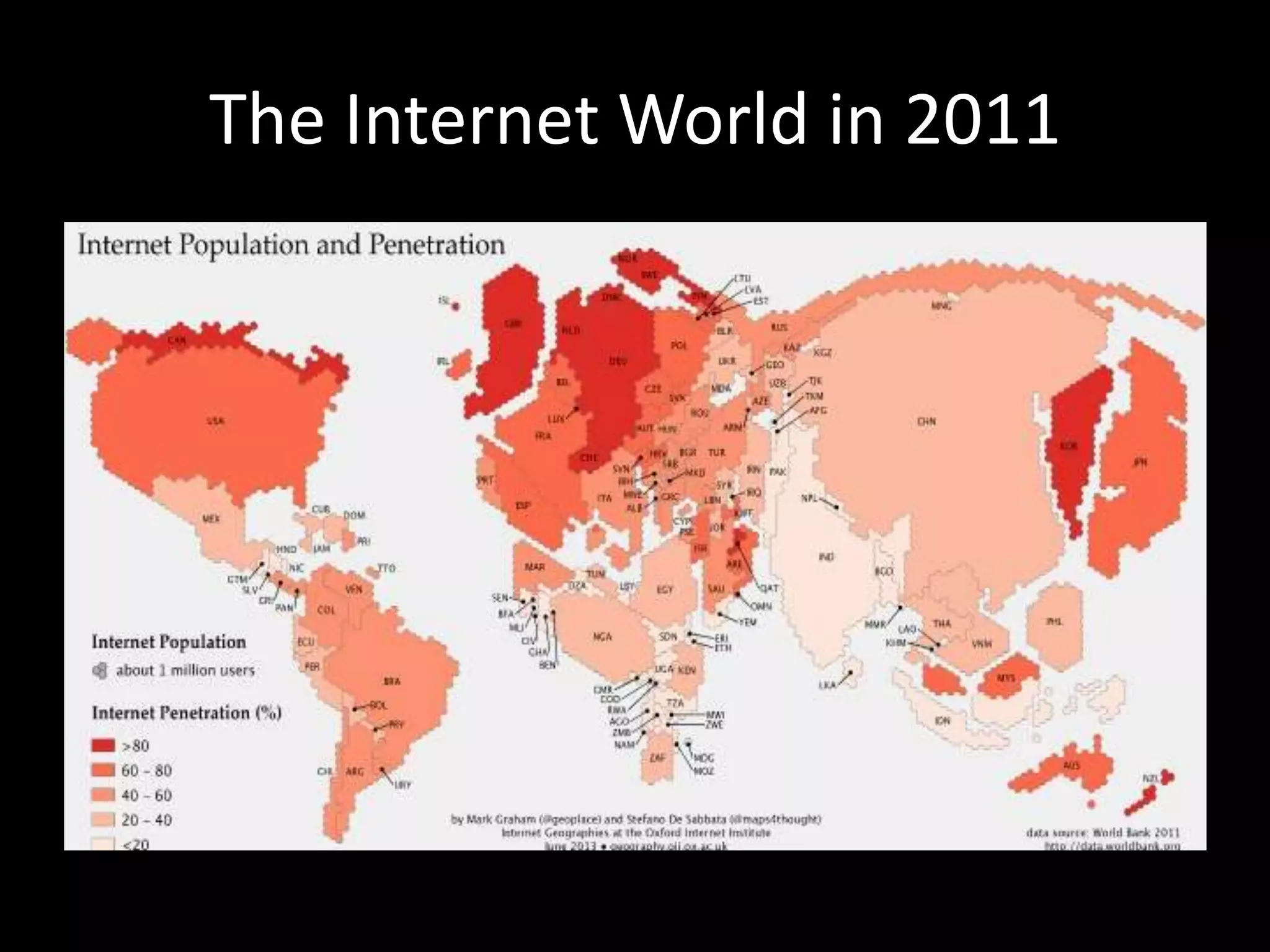

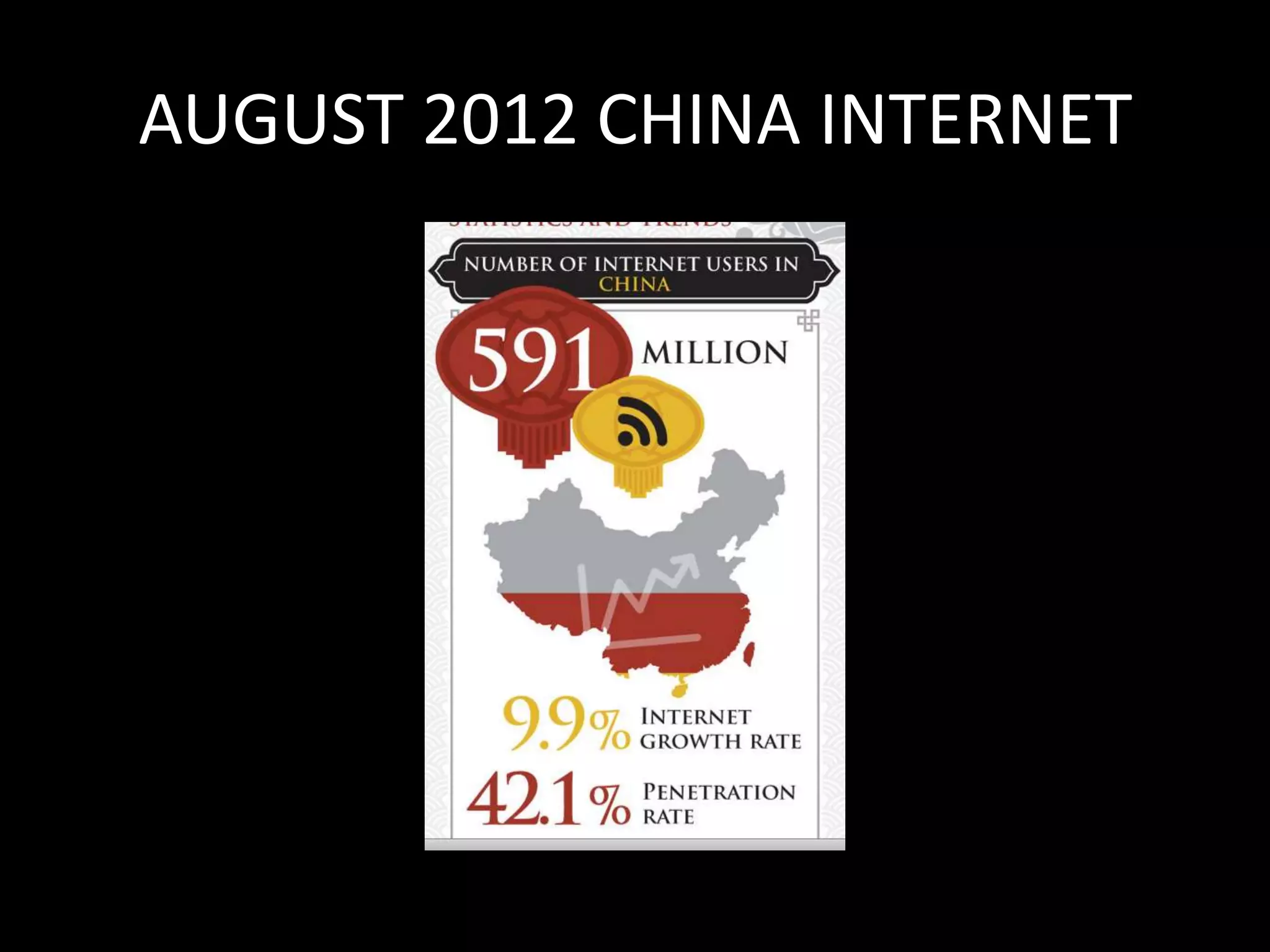

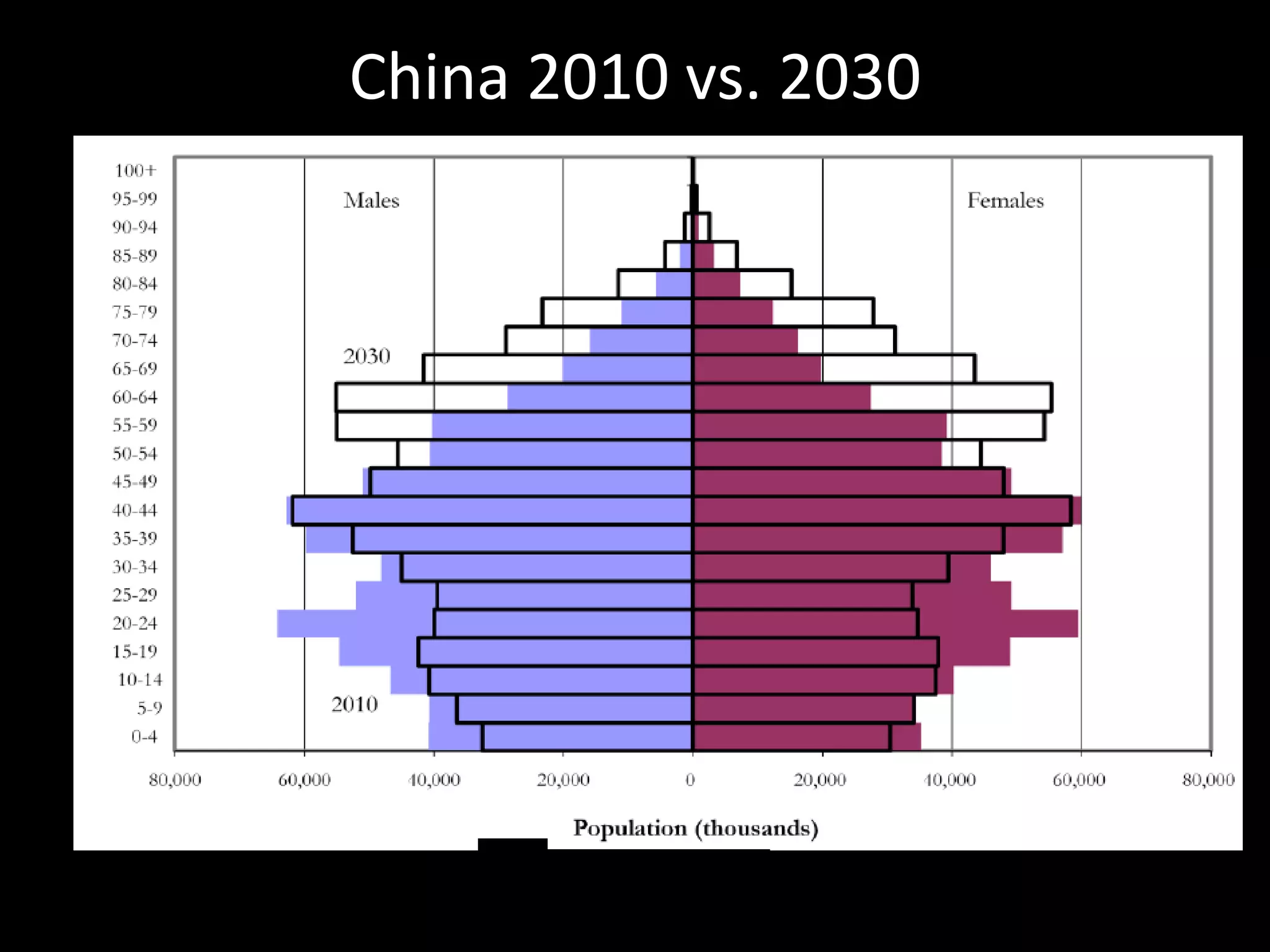

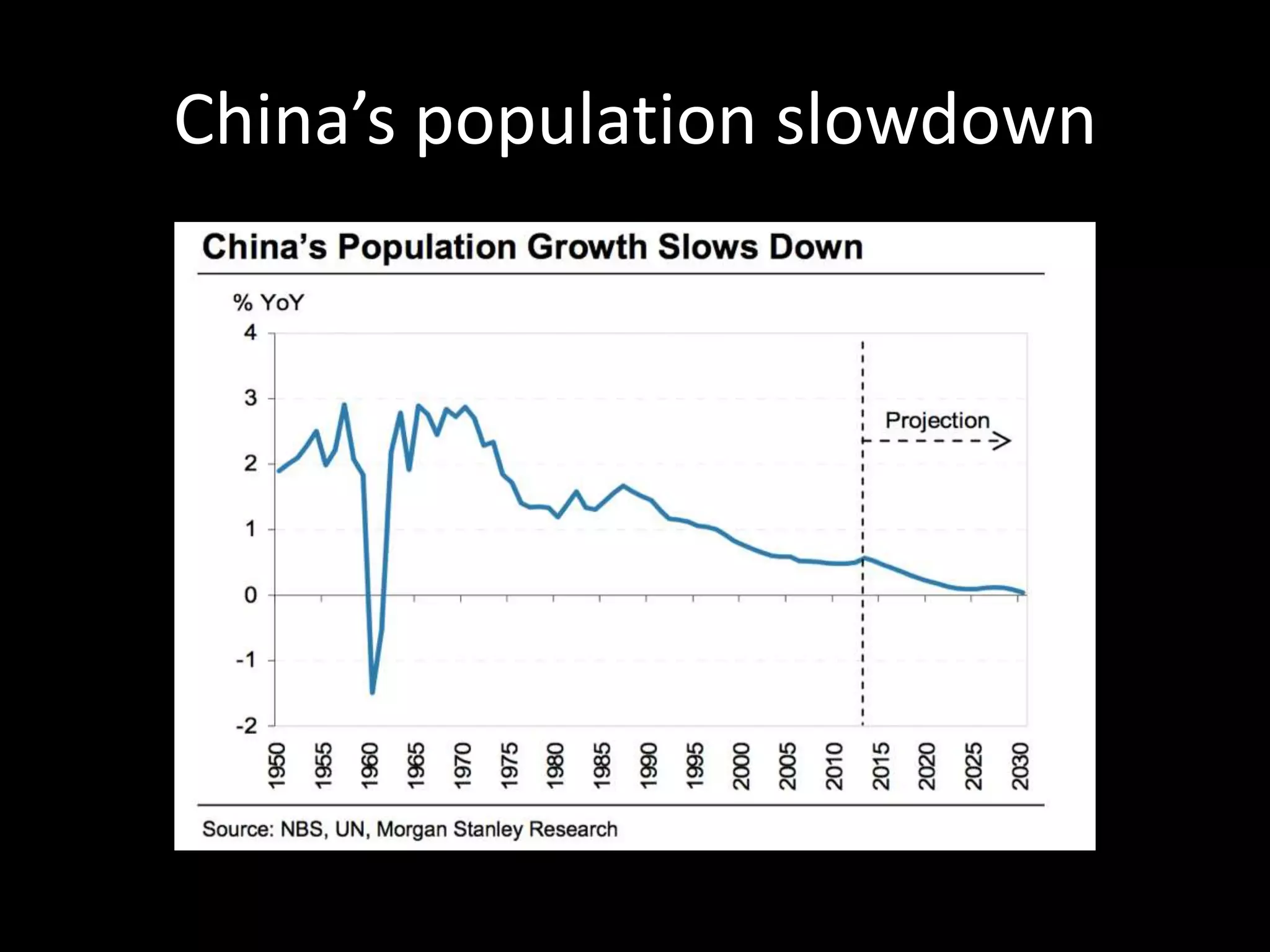

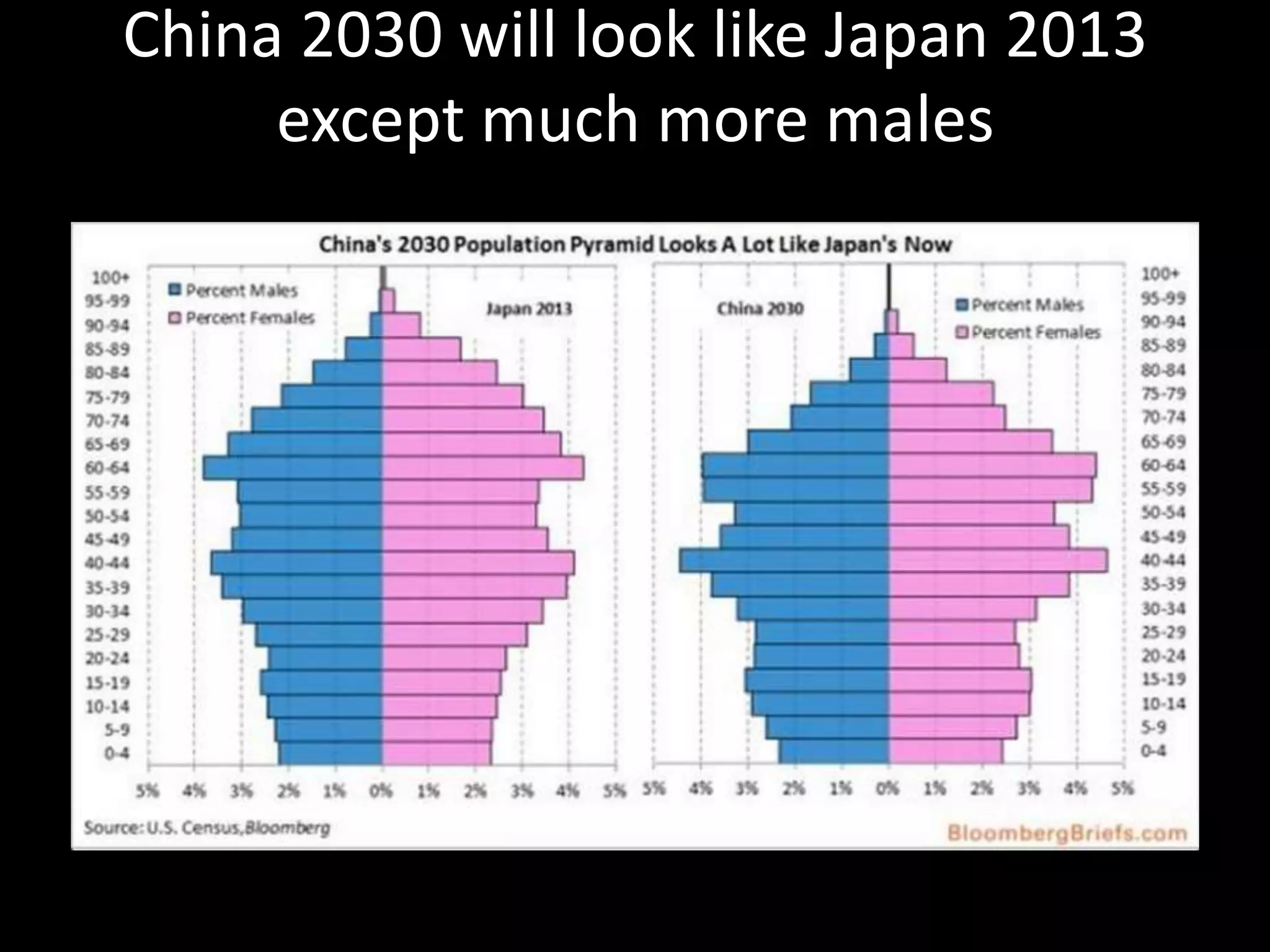

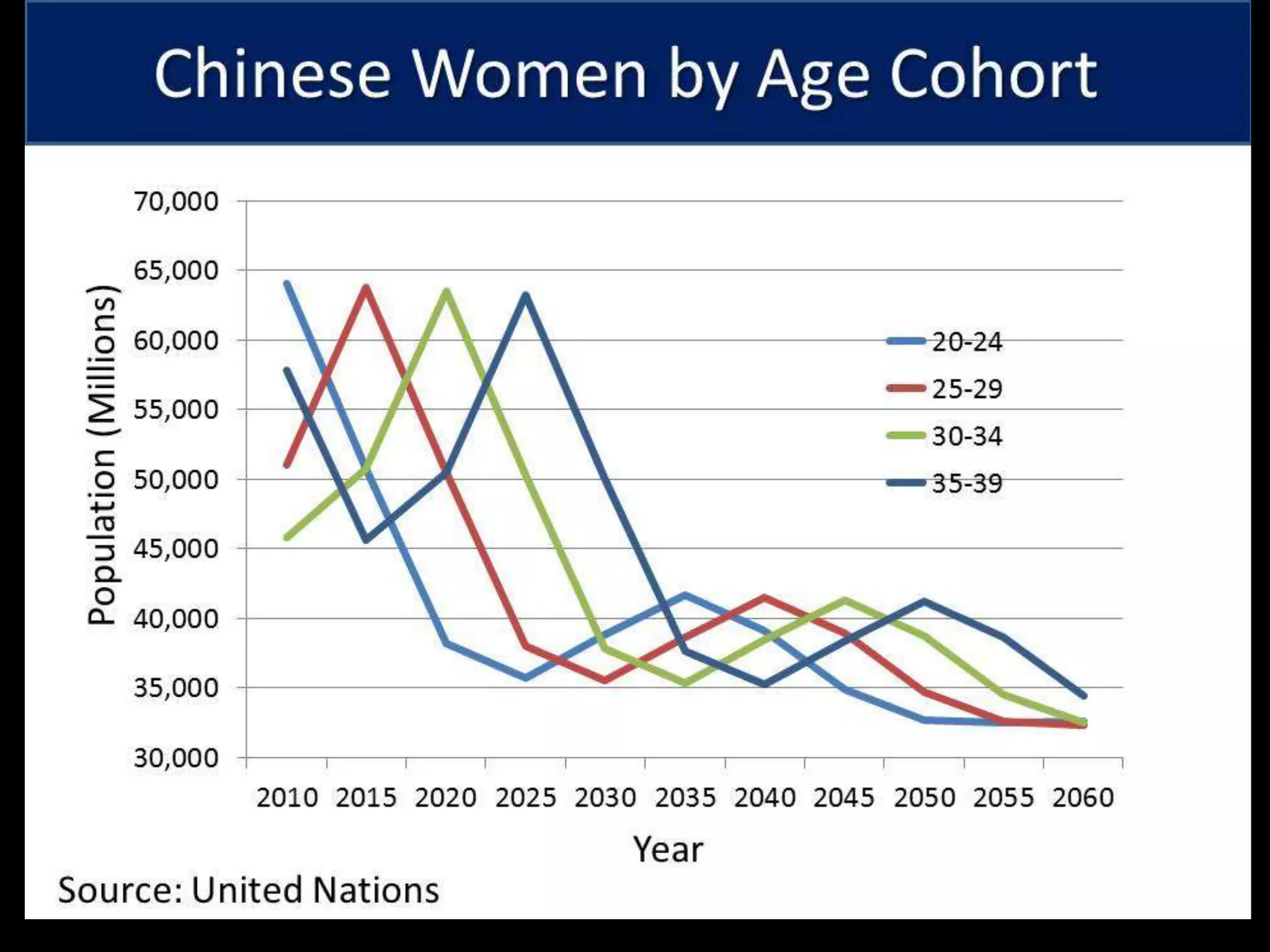

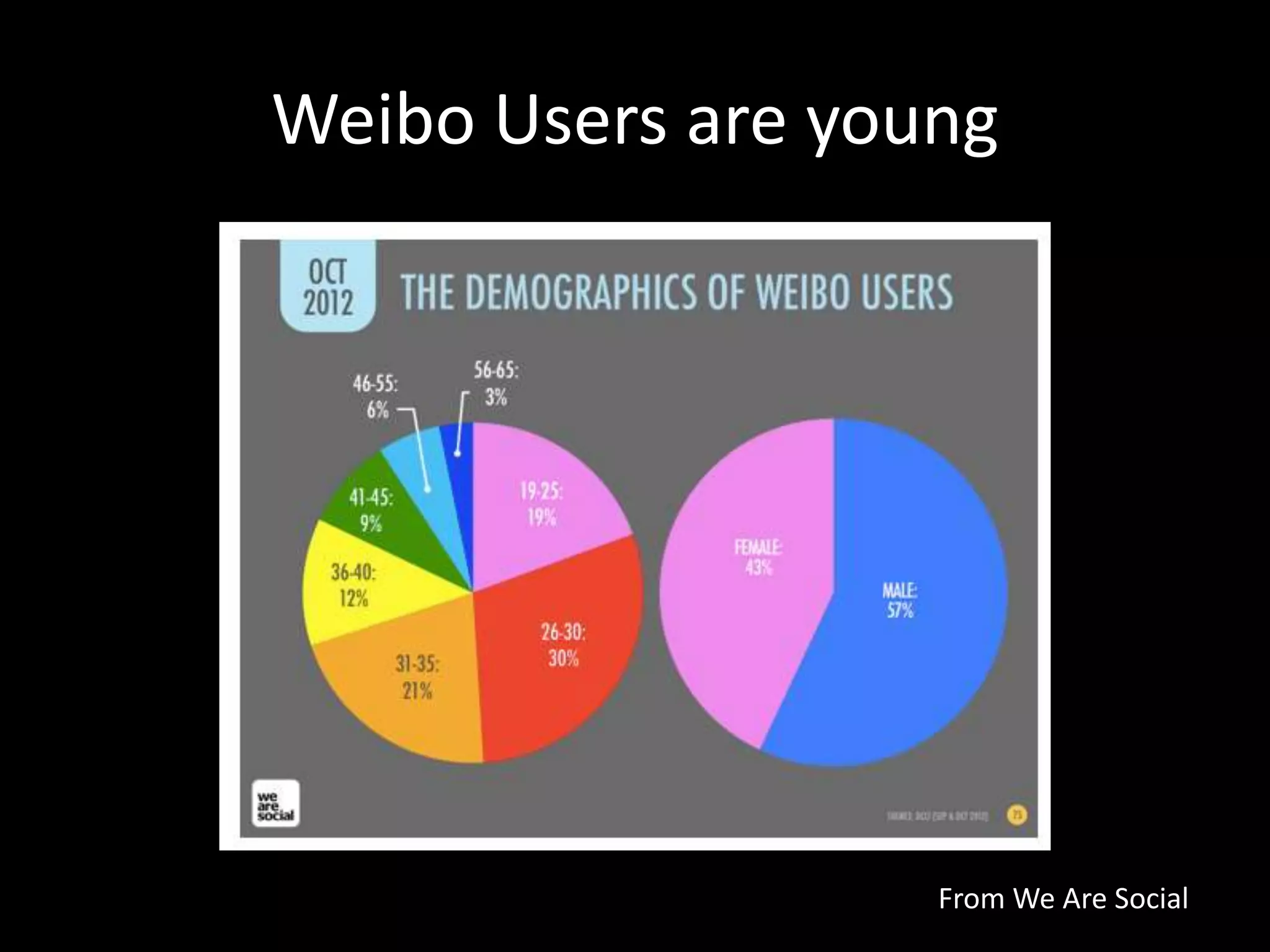

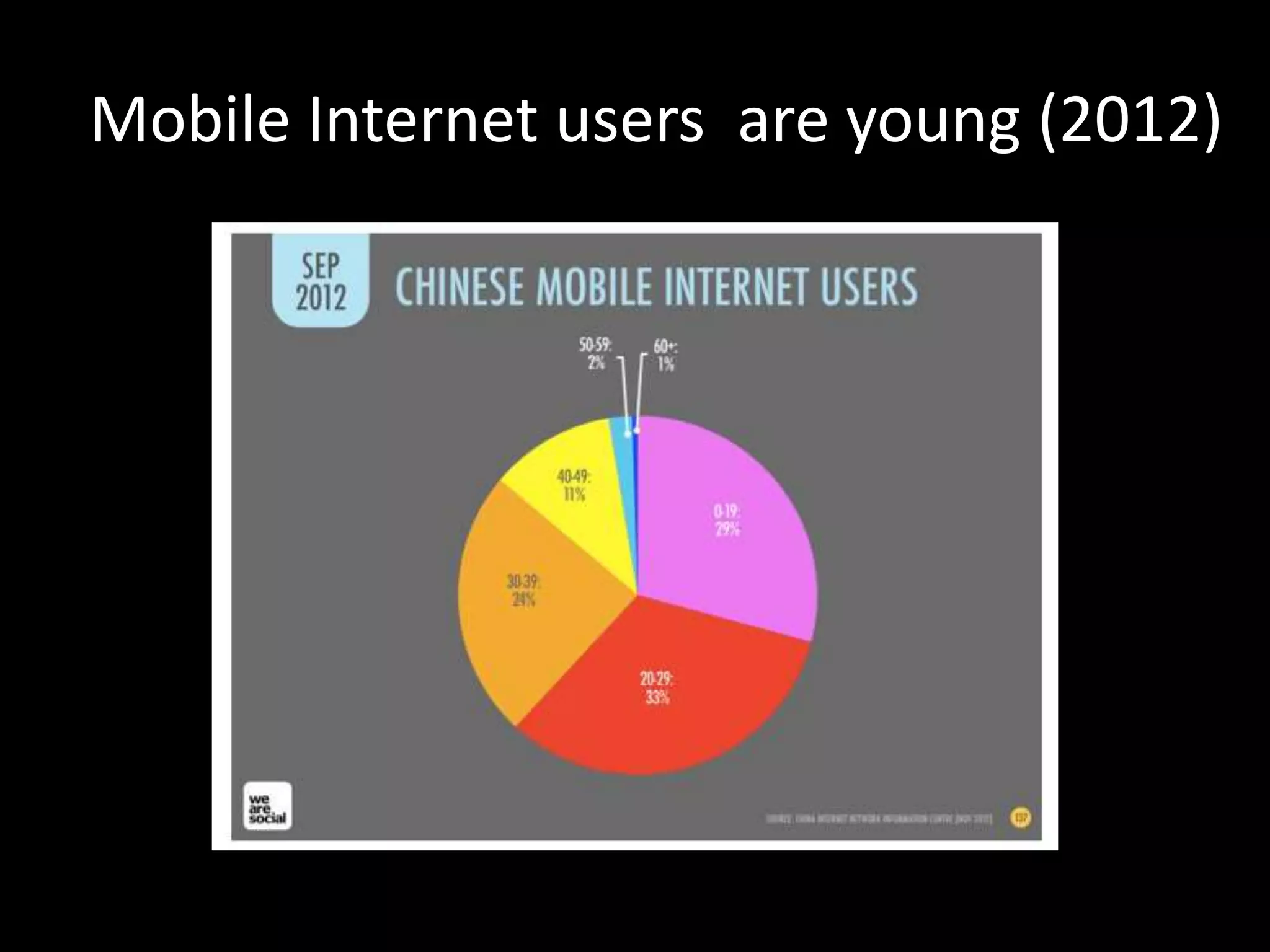

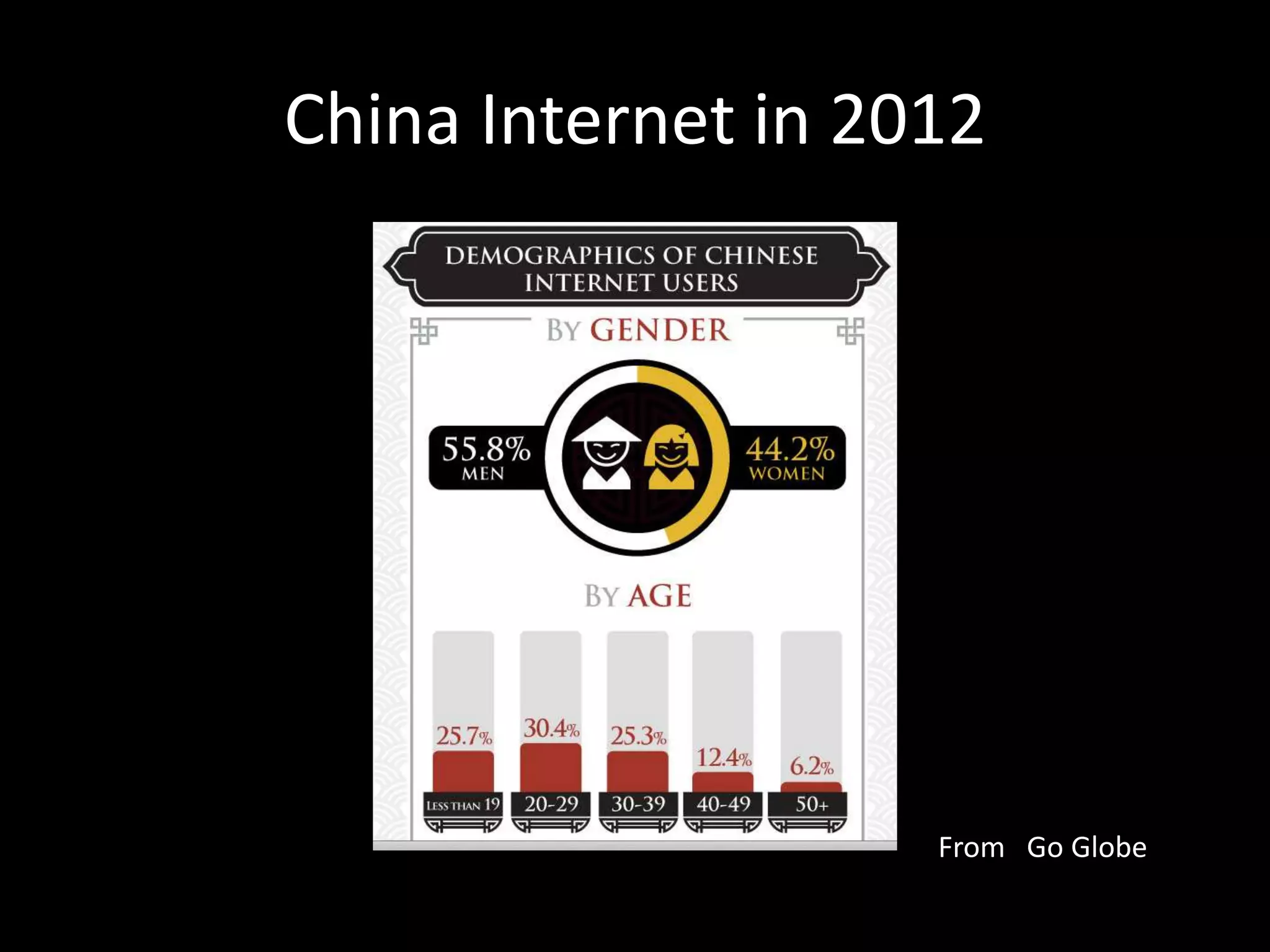

This document summarizes trends in China's changing internet demographics and how they will impact companies. It notes that China's population is aging and internet usage is dominated by younger users. As the population of young users declines, companies will need to monetize customer lifetime value. Major internet companies like Tencent, Alibaba, and Baidu are poised to leverage their brands and traffic to move into new offline industries like retail, finance, healthcare, and automobiles. The mobile internet has also caused a major shift, making casual gaming and mobile apps the new focus.