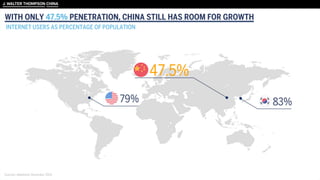

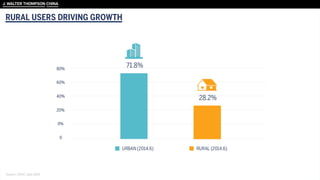

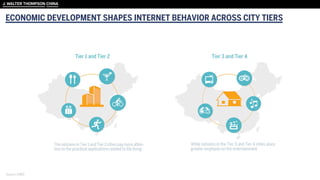

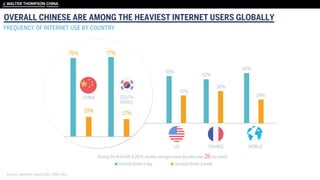

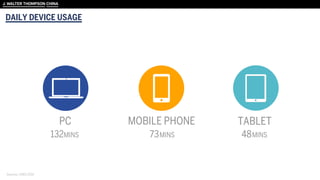

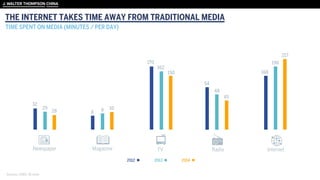

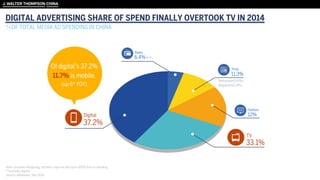

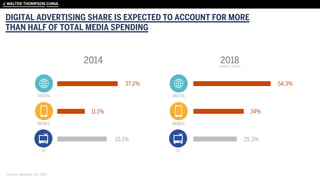

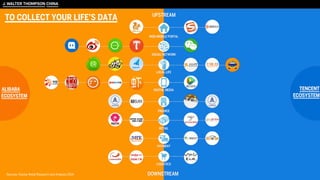

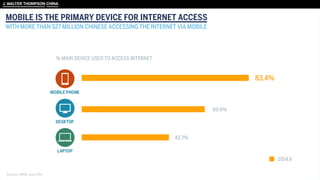

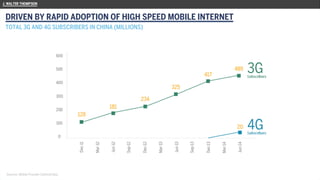

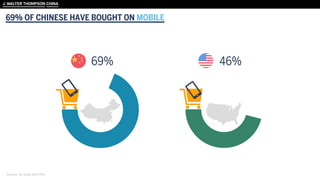

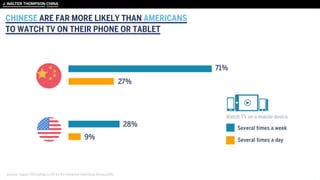

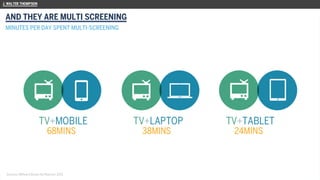

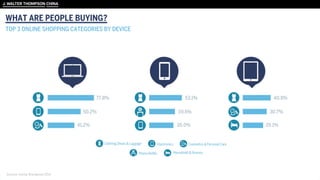

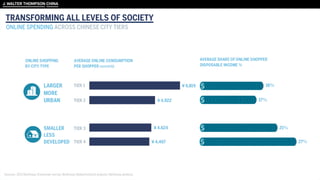

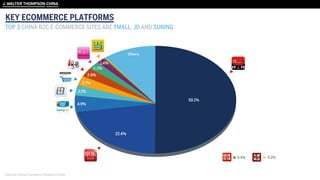

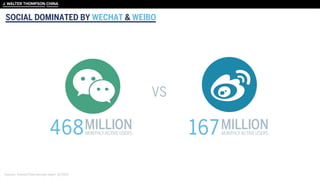

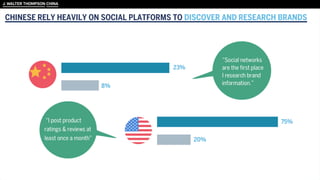

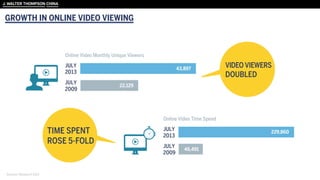

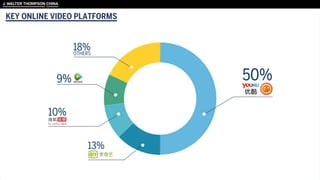

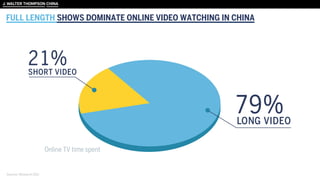

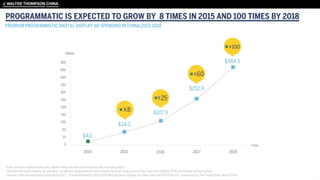

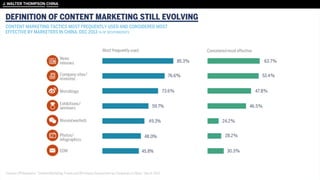

The document discusses the digital landscape of China in 2015, highlighting internet penetration rates, the influence of mobile devices, and the rise of e-commerce among Chinese consumers. It emphasizes that digital advertising has overtaken traditional TV advertising, with significant growth forecasted in various sectors including programmatic advertising and social media engagement. Key players in the market, such as WeChat, Alibaba, and Tencent, are pivotal in shaping consumer behavior and advertising strategies.