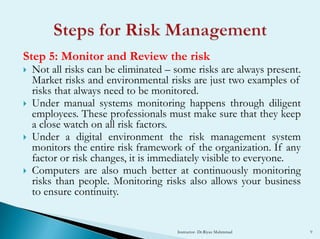

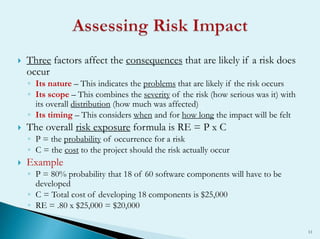

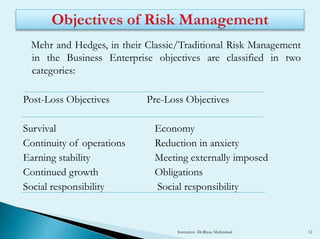

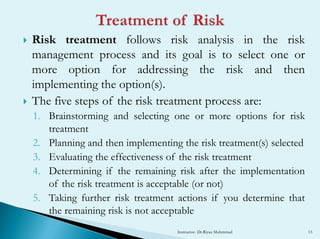

The document discusses the risk management process, which consists of 5 steps: 1) identifying risks, 2) analyzing risks, 3) prioritizing risks, 4) treating risks, and 5) monitoring risks. It provides details on each step, such as how to identify potential risks, analyze their scope and severity, rank their priority, implement solutions to address risks, and continuously monitor risks. The goal of the risk management process is to reduce threats to an organization's capital and earnings through a systematic, scientific approach.