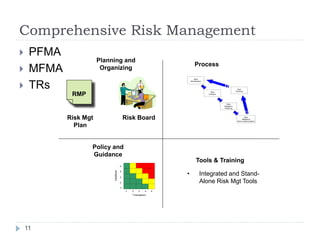

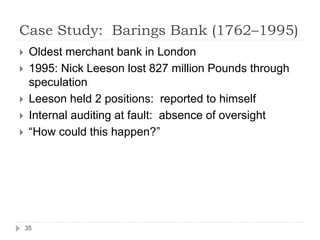

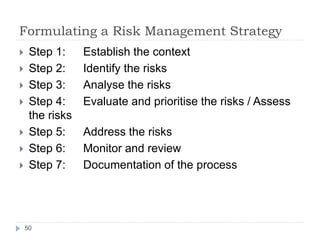

This document discusses enterprise risk management and contains activities and content related to risk management. It defines key risk management terms and concepts, outlines the risk management process, and discusses the benefits and relevance of risk management. It also addresses regulatory frameworks, legislative requirements, and key risks associated with ineffective risk management.