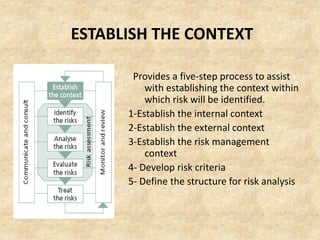

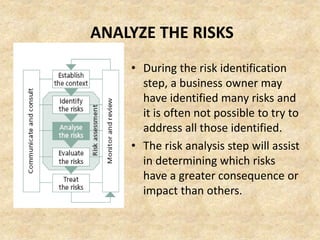

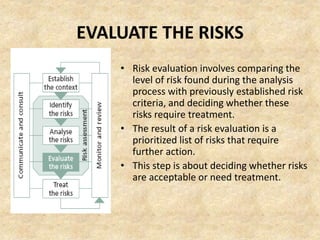

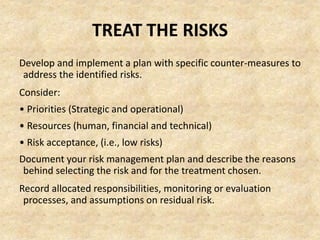

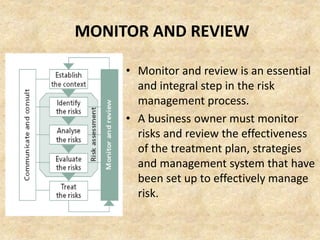

Risk management is the process of identifying, analyzing, and mitigating risks. It involves establishing the context, identifying risks, analyzing their potential impact, evaluating them against risk criteria, treating risks by developing plans to address high priority risks, and then monitoring risks over time as circumstances change. The goal is to balance risks with potential rewards and manage uncertainty. Risk management is widely used in both public and private sectors across finance, insurance, healthcare, government, and other industries and organizations to help achieve objectives and dreams despite risks.