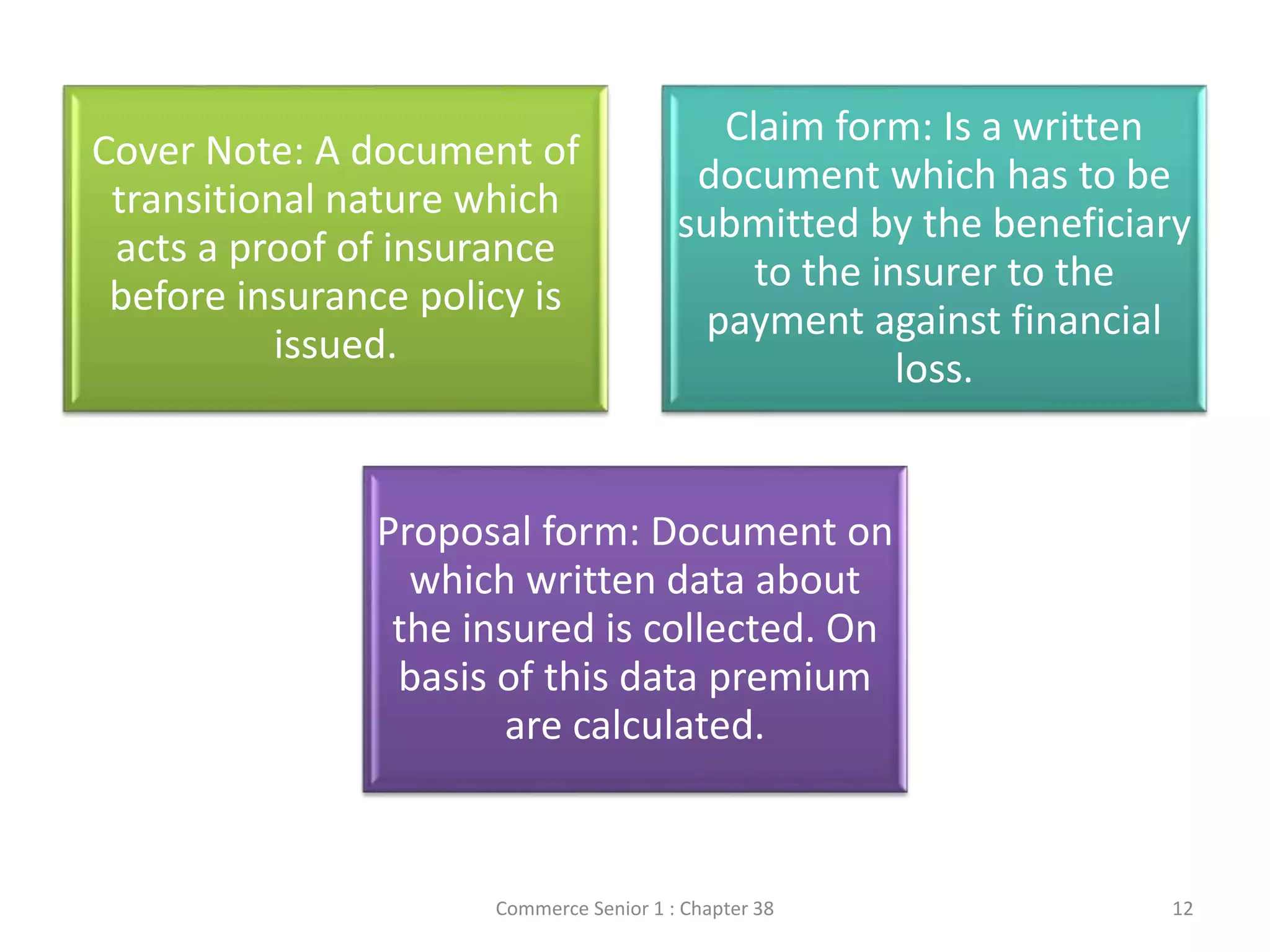

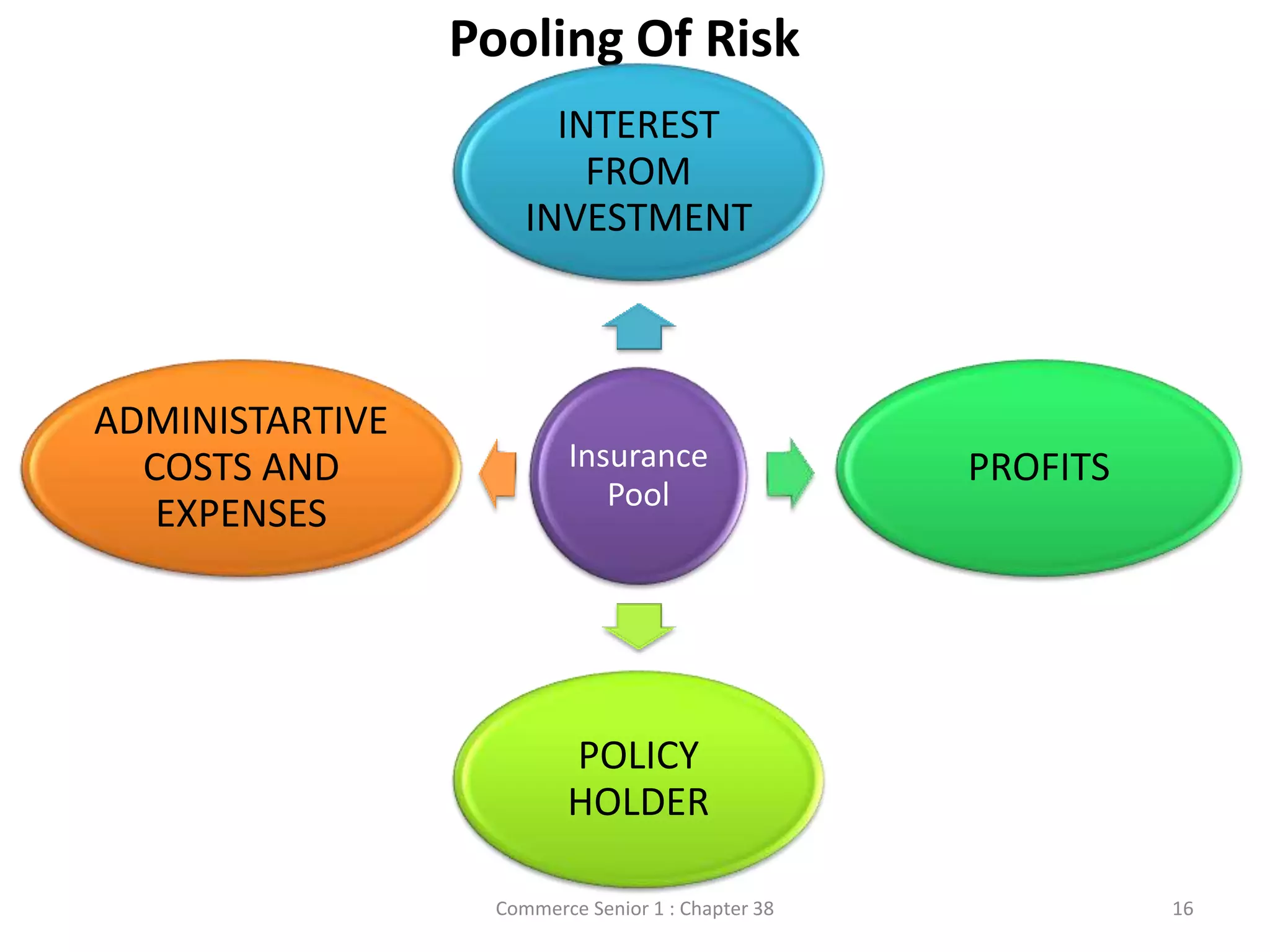

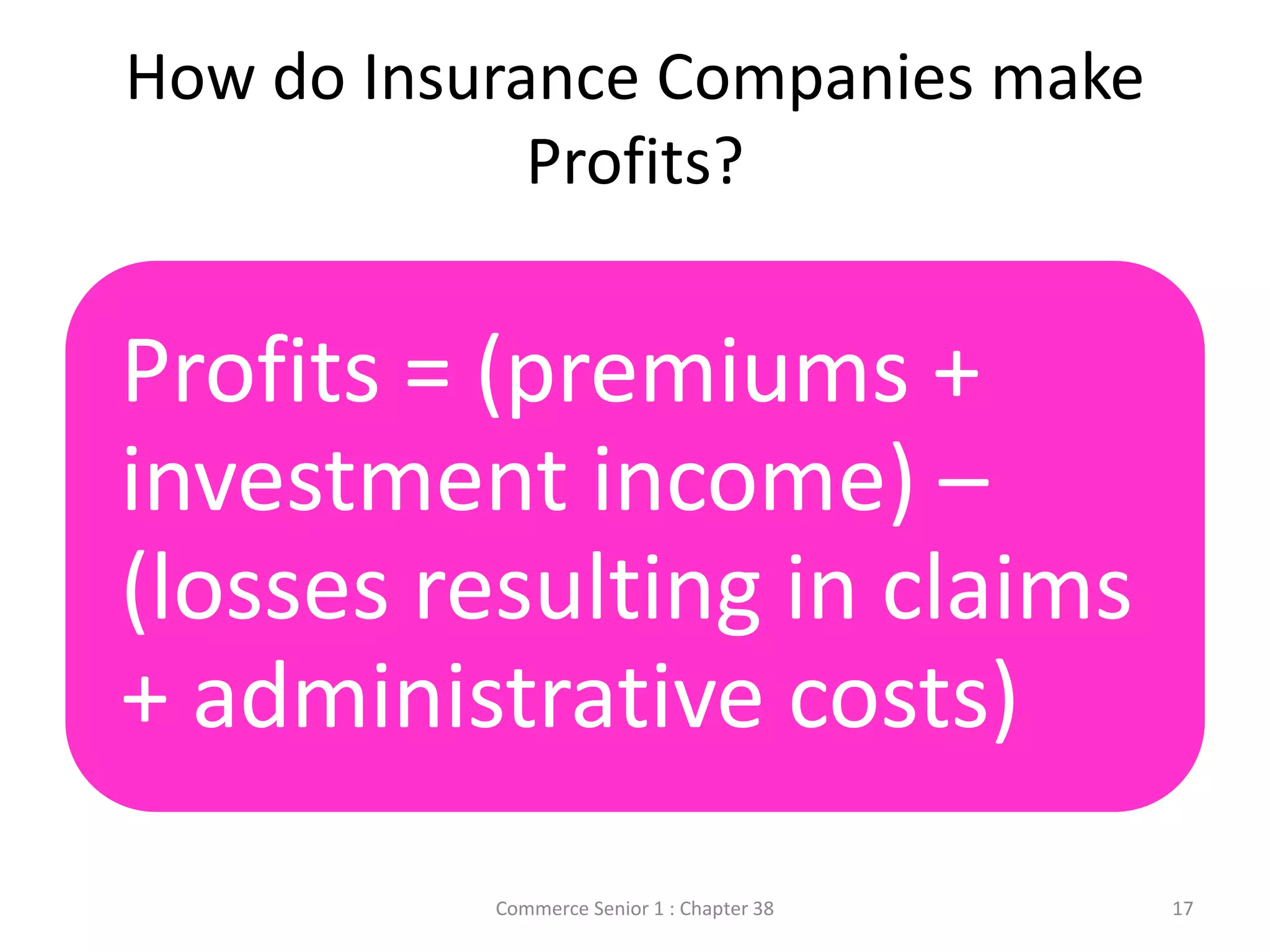

This document discusses the purpose of insurance. It begins by defining insurance as a way to spread losses among a large number of people who contribute to a common fund. Insurance transfers risk from the insured to one or more insurers. It provides financial protection and compensation in the event of a claim. The importance of pooling risk is that it allows risks to be spread evenly among a large number of contributors, making it easier for insurance companies to bear losses than individuals. Insurance companies make profits based on the difference between premiums and investment income collected, and losses from claims paid out plus administrative costs.