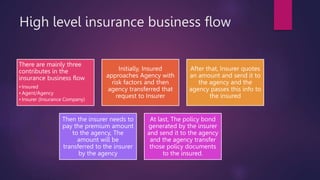

Insurance allows individuals to manage risk by paying premiums to an insurance company in exchange for financial protection from losses. The insurance company collects premiums from many policyholders to create a risk pool that pays out to those who experience losses. There are different types of insurance like health, home, auto, and life that protect against risks such as illness, accidents, property damage, and death. The amount of risk determines the cost of insurance, with higher risks factors resulting in higher premiums.