Life insurance company and management

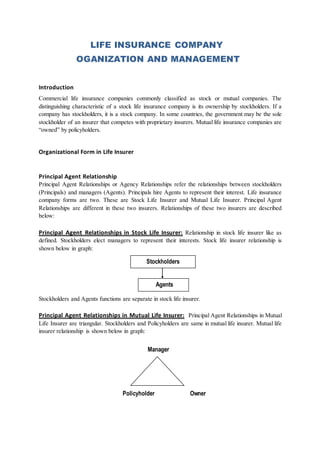

- 1. LIFE INSURANCE COMPANY OGANIZATION AND MANAGEMENT Introduction Commercial life insurance companies commonly classified as stock or mutual companies. The distinguishing characteristic of a stock life insurance company is its ownership by stockholders. If a company has stockholders, it is a stock company. In some countries, the government may be the sole stockholder of an insurer that competes with proprietary insurers. Mutual life insurance companies are “owned” by policyholders. Organizational Form in Life Insurer Principal Agent Relationship Principal Agent Relationships or Agency Relationships refer the relationships between stockholders (Principals) and managers (Agents). Principals hire Agents to represent their interest. Life insurance company forms are two. These are Stock Life Insurer and Mutual Life Insurer. Principal Agent Relationships are different in these two insurers. Relationships of these two insurers are described below: Principal Agent Relationships in Stock Life Insurer: Relationship in stock life insurer like as defined. Stockholders elect managers to represent their interests. Stock life insurer relationship is shown below in graph: Stockholders and Agents functions are separate in stock life insurer. Principal Agent Relationships in Mutual Life Insurer: Principal Agent Relationships in Mutual Life Insurer are triangular. Stockholders and Policyholders are same in mutual life insurer. Mutual life insurer relationship is shown below in graph: Manager Policyholder Owner Stockholders Stockholders Agents

- 2. Mutual policy owners have the right to vote to elect directors and to share in the value of the company if it is liquidated or demutualized. Principal Agent Conflict Principal Agent Conflict arises when goals are contradictory of principal and agent. The operation of the life insurance industry involves three primary parties: Stockholders, Managers and Policyholders. Agency theory applied to insurance has focused on the incentive conflicts among the three parties and the manner in which these conflicts can be controlled. The separation of the managerial and ownership functions in the stock company means that the managers of such a company do not bear personally the full financial effects of their decisions. Managers logically make decisions and take actions to maximize their own utility (actions that increase their power, prestige, or income) that may be inconsistent with the best interests of the stockholders. The separation of the managerial and ownership functions also creates incentive conflicts. Stockholders have incentives to increase the value of their claims at the expense of the policyholders after policies are sold. In mutual company, the ownership function is merged policyholders’ function of minimizing the incentive conflicts between owners and policyholders. The rights of mutual policyholders (as owners) are more restricted than the rights of common stockholders. Mutual policy owners have the right to vote to elect directors (the rights of policyholders cannot be accumulated) and to share in the value of the company if it is liquidated or demutualized. These rights expire with the policy. Upon termination of a policy, the policyholder usually has no rights to capital (except for cash values in life insurance products). The elimination of the stockholder group reduces potential costs imposed on mutual policyholders from decisions relating to dividends, financing, and investment over the lives of their policies. Agency cost and control mechanism to reduce agency cost or to solve agency problem Agency cost refers the cost incur from conflict between stockholders and agents. To solve agency problem or to reduce agency cost, two steps can be taken. These are: Managerial compensation: Management will frequently have a significant economic incentive to increase share value for two reasons. First, managerial compensation, particularly at the top, is usually tied to financial performance in general and oftentimes to share value in particular. Second, managers have relates to job prospects. Managers who are able to pursue goal of stockholders will tend to get promoted. To gain those benefits managers will act in the stockholders interests. Control of the firm: Control of the firm ultimately rests with stockholders. They elect the board of directors, who, in turn, hire and fire management. The mechanism by which unhappy stockholders can act to replace existing management is called a proxy fight. To avoid the threat of replacing management managers will act in the stockholders interests.

- 3. Another way that management can be replaced is by takeover. Those firms that are poorly managed are more attractive as acquisitions than well managed firms because greater profit potential exists. Thus, avoiding a takeover is another incentive to act in the stockholders interests. Life Insurance Company Formation In developed countries, there are two types of Life Insurance Company. These are Stock Life Insurance Company and Mutual Life Insurance Company. Description of these two companies is given below: Stock Life Insurers Stock Life Insurer is a company that organized for the purpose of maximizing value of its stockholders. Stock Life Insurer conducts its operation according to company act. It forms as like a company. Mutual Life Insurers Mutual Life Insurer is also a corporation, but it usually has no capital stock and no stockholders. Policyholder in a mutual company is both a customer and an owner. Mutual Life Insurers have to follow the rules and regulations like a company. Technically, the assets and income of a mutual company are owned by the company. The policyholders usually are considered to be contractual creditors with the right to vote for directors as provided for by law. The insurer is administrated and its assets are held for the benefit and protection of the policyholders as reserves, surplus, or they are distributed them as dividend to the extent that board of directors (trustees) deems such action warranted. Thus, in a mutual insurer, the policyholder pays a typically fixed premium stated in his or her policy, but the actual or net cost to the policyholder will depend on the dividends or other credits allocated to his or her policy each year by the board of directors. Organizational Structure Holding Companies Holding companies are financial corporations that own or control one or more insurers, broker-dealer organizations, investment companies, consumer finance companies, and other financial service corporations. There are two types holding company. First is upstream holding company and second is downstream holding company. Upstream holding company refers a holding company formed by one or more stock companies. Downstream holding company is usually formed by a mutual insurance company and sits in the middle of the inter corporate structure. It is owned wholly or in part by the mutual that sits at the top, and its own subsidiaries. Affiliations and Outsourcing

- 4. The rapidly changing financial services business has enhanced insurer interest in corporate restructuring and affiliations. The purpose of such activities is to increase efficiency and profitability and to survive the challenges of new competitors entering into traditional insurance areas. Such transactions include acquisitions, demutualization, holding company formation, and mergers. Although acquisition and merger activity has increased steadily as consolidation has taken place in the industry, strategic alliances have long been a key element in insurer strategy. Through such alliances, a life insurer can gain access to resources of other firms but still remain independent. In the drive to focus on their core competencies, improve customer service, and reduce operating expenses, outsourcing has become an important strategic tool for many life insurers. Insurers have brand labeled another insurer’s product with claims handled by a third-party administrator. Also, investment management can be provided by an investment banking firm or other asset management organization, and data processing and network management can be handled by a service bureau. Corporate Governance Corporate governance refers the mechanism by which corporations are controlled and directed. It includes disclosing information to stockholders; standing audit, compensation and nominating committees; director attendance meetings; settlement of election etc. Corporate Reorganization Corporate reorganization refers the system of mutualization and demutualization. Mutualization and Demutualization are described below: Mutualization Mutualization refers a procedure through which stock insurers convert from stock form into mutual form. It involves the retirement of the capital stock of the insurer, coupled with the transfer of control of the insurer from the stockholders to the policyholders. Demutualization Demutualization refers a procedure through which mutual insurers convert from mutual form into stock form. Some benefits of demutualization are given below: 1. It provides financial flexibility. Insurer can issue stock, debt and hybrid securities and it can get back credit facilities. It provides maximum access to capital to finance future growth. 2. Span of control will be wide. 3. Talented employees can be attracted and retained by offering stock options. 4. Productivity will increase; absenteeism and turnover will be lower. 5. Overall organization efficiency will increase. Motives for Conversion Motives for Conversion are discussed below: 1. The first motive is to increase capital and to enhance margin of solvency through influx of new capital 2. To expand the business and to enhance the margin of solvency through an influx of new capital. 3. Increasing the ability to adapt changes of financial system.

- 5. 4. Enhancing corporate structure flexibility. A basic structural advantage of the stock life insurer form is that it permits formation of an upstream holding company. Life Insurance Company Formation In terms of formation of Life Insurance Company Formation the Company Act 1994 and Insurance Company will be followed. Both two acts will suggest how to form as well as control of insurance company. After formation the Insurance Development and Regulatory Authority (IDRA) will direct the life insurance company. Life insurance business to be undertaken by both an individual or by a partnership. The formation should be one that provides both performance and high degree of security and payment. A company have to meet all legal requirements under our country’s existing laws and regulation. It is formed by two ways: Stock Life Insurer Mutual Life Insurer Stock Life Insurer A stock life insurance company is one that is organized for the purpose of making profits for its shareholders. That means it will be followed all systems which existed in a company. Policymakers of this type of life insurer all time seek to maximize the shareholders profit. The life insurance business is highly specialized and is subject in every country to special laws. Under these laws, a company must have a minimum amount of capital and surplus before it can secure a certificate of authority to operate as a life insurance company. For instance, MetLife Alico, Pragoti Life Insurance Co. and all other Life insurance company have to maintain an amount as capital and paid-in initial surplus under the Existing laws in our country. These capital are divided into different names. Such as, Authorize capital, Issued capital, Paid up capital, called in capital and so on. Mutual Life Insurer A mutual life insurance company also is a company, but it usually has no capital stock and no stockholders.The policyownerinamutual companyiscustomerand ina limitedsense,an owner of the insurer, in contrast to the policy owner in a stock company, who usually is a customer only.

- 6. Technically,te assetsandincome of amutual insurerare ownedbythe company. The policy owners usually are considered to be contractual creditors with the right to vote for the benefit and protectionof the policyownersandbeneficiariesas reserves, surplus, or contingency funds or they are distributedtothemasdividends to the extent that the board of directors (trustee) deems such action warranted. Mutual insurersmostlyissueparticipatingpolicies.The organization of new mutual insure presents some seriouspractical problemslike asanew stock companyface.Afterithas beenfullyestablished and has attained adequate financial stability, a stock insurer can be converted into a mutual company. Office Organization and Administration The life insurance company follows the pattern of other company that are concerned with collection, investment and disbursement of fund. Organization in general three main elements: 1) Levels of authority 2) Departmentalization 3) Functionalization Levels of Authority Levels of authority refers how and what extent the authority belongs to the managers, shareholders and other parties. There usually four levels of authority in life insurance. Top Level-Board of directors Executive Level-CEO and senior officers Managerial Level-Each Vice presidents Functional Level-Line managers All of the four levels are briefly described below: Board of directors have high level of authority than all managers and members in a company. They direct, control and supervise their subordinate. CEO and other senior officers execute and implement the all policies which are created and developed by Board of Directors. Vice presidents work with line managers. They work with specific department. They works with the directions are made by executive level managers. Line managers are lower level managers in a company. They are work with non-managerial employees. They have direct authority to supervise all employees.

- 7. Departmentalization The life insurance companies are involve with three basic functions. These three functions are smoothly operated by seven individual functions. These are: i. Actuarial ii. Marketing iii. Accounting and Audit iv. Investment v. Legal vi. Underwriting vii. Administration These are briefly describing below: Actuarial Department The Actuarial department establishes the insurer’s premium rates, establishes reserve liabilities and no forfeiture values and generally handles all the mathematical operation of the insurer. This department also is responsible for analyzing earning and furnishing the data from which annual dividend scales and excess interest and other credit are established. Marketing Department The marketing department is responsible for the sale of new business, the conversion of existing business and certain types of service of policy makers. Accounting & Auditing Department The accounting and auditing department are responsible for establishing and supervising the insurer’s accounting and control procedure, and supervised checked for audit purpose. Investment Department Follows the direction of vice president. Investment on these policies which will ensure to the company’s maximum profit. Legal Department The legal department is charged with the responsibility of handling all the company’s legal matters. Underwriting Department

- 8. It is responsible for establishing standards of selection and passing judgment on applicants of insurance. Administration Department It is responsible for providing home office services to the company’s agents and policy makers. Administration departments also are responsible for human resources, home office planning, and other staff functions. The secretary of the company has charge of the insurer correspondence, the minutes of the board of directors, and various committees and the company’s records. Functionalization The life insurance companies involve three basic functions. These are: 1. To sell 2. To service 3. To invest These are briefly describing bellow: To Sell The company wants to sell their products more and more. This is most basic function of a company. On this selling time the product should be diversified. Otherwise products will not be accepted by the customer. To Service Company just not give focus only the sell of product. Customer also need before and after sell service such as maintaining good relationship with the customers and so on. To Invest This functions only deals with investment on profitable policies. People are more diversified. They wants new products even paying high. This functions seek this type of customer to maximize the company’s ultimate profit. Corporate Reorganization Mutualization of Stock Insurers When stock insurers have been converted from stock form into mutual form through a procedure called mutualization, which involves the retirement of the outstanding capital stock of insurer, coupled with the transfer of control of the insurer from the stockholders to the policyholders. The officer of the insurer usually initiate mutualization proceeding by submitting a proposal to the board of directors. The key factors is the price to be paid for each share of stock and the manner of payment. The price must be attractive enough from the viewpoint of the stockholders to induce them to relinquish their rights of ownership and control. On the other hand, from an insurer’s viewpoint, the price must be limited practically by the fact that the remaining surplus, after mutualization, must be

- 9. adequate to permit sound operation. Sometimes it is quite important that the payment for the shares be spread over a long period of time so as to avoid an undue burden on current surplus. If the plan is approved by the board of directors, it usually must be submitted to the insurance regulatory authorities for approval. Upon approval, the plan is then submitted to the policy-owners and stockholders in accordance with the applicable insurance law. Demutualization of Mutual Insurers When mutual insurers have been converted from mutual form into stock form through a procedure called demutualization. Demutualization is the process by which a mutual insurance company converts to a stock insurer. Demutualization is a complex and expensive process which takes a long period of time to consummate. A demutualization can also be used as an acquisition device whereby the acquiring company purchases all of the stock of the converting company at the time of the demutualization. The two companies, the acquirer and the demutualizing company, then enter into a conversion and acquisition agreement which sets forth all of the terms and conditions of the demutualization along with the normal provisions found in an acquisition agreement. The task force concentrated on three aspects of demutualization: 1. Maintenance of reasonable policy owner dividend expectations. 2. The aggregate amount of compensation to policy owners in exchange their membership rights, and 3. The allocation of this aggregate amount of compensation among participating policy- owners. Four life insurance companies have now completed the process of demutualization: 1. Canada Life Insurance Company. 2. Manufacturers Life Insurance Company. 3. Sun Life Assurance Company of Canada. 4. Clarica Life Insurance Company (formerly The Mutual Life Assurance Company of Canada) Motives for Conversion The primary reason why a mutual life insurance company would consider demutualization is to obtain to access to equity capital and related financing alternatives such convertible debentures warrants, and preferred stock. The reason is becoming increasingly important. As the integration of the financial services industry accelerates, the requirements for capital growth and capital investment

- 10. multiply. Besides a possible desire to enhance the firm’s margin of solvency through an influx of new capital, there is also the need to make major capital investments in: 1. Computer systems, equipment, facilities 2. The growth of sales and distribution capabilities, and 3. Acquisitions that broaden product offerings, increase scale, bring access to new customers and new markets and so on. For mutual and stock life insurance companies, the main source of equity capital has been and will continue to be retained earnings from their insurance operations. Stock companies have available the full range of public market financing options. Mutual companies can obtain capital funds through debt but have only limited access to equity capital. For some mutual insurer, this limited access may not be sufficient. A second interest in demutualization could stem from the enhance corporate structure flexibility in would permit. A structural advantage of the life stock life insurance company form is that it permits formation of an upstream holding company. Through this mechanism the company can 1. Limit the impact of insurance regulatory controls and restrictions on non-insurance operations, and 2. Permit acquisitions to be made without diminution of statutory surplus. There are two key reasons for a mutual company to consider demutualization. Income tax law for life insurance companies includes for mutual life insurance companies an add-on tax element that can constitute a major share of the company’s total tax. Demutualization changes the relationships and incentive conflict among owners, policy owners, and management. The typical conversion statute does not recognize management and employees. Management has no incentive to demutualize and dilute its corporate control by creating a group of shareholders who could be expected to be less docile than mutual company policy owners. Employees have no means to participate in the conversion asides from their positions policy-owners. The Conversion Process In a tradition conversion, the mutual life insurance company literally is transformed into a shareholder-owned enterprise through a process in which policy owner membership rights are exchanged for valuable consideration such cash, premium credits, additional benefits, or possibly common stock in the resulting stock company. If the company wishes to raise new equity capital, which is one of the principal reasons for conversion, that step may be taken at the time of conversion or at some later date. If new capital raised on the conversion date, ownership of the insurer will be shared between the policy owners and the new shareholders. If no new capital is raised, the policy owners initially may own all of the share of the company. In some cases, the conversion may be taken so that the converted mutual insurer may be acquired by another company, a so-called sponsored demutualization. In this case, the consideration to policy owners usually will be in the form of cash or additional benefits. The converting mutual company may wish to go through restructuring in which an upstream holding company is created. The parent holding company would own all of the shares of the

- 11. converted insurance company, the policy owners would receive shares of the holding company, and the shares sold to the public also would be shares of the holding company. Current Developments As the need for capital has grown, alternative approaches to demutualization have been developing. In 1995, Illinois adopted a statute that facilitates the process by using subscription rights to balance the interests of all stockholder including management and employees. All stockholders are required to execute subscription contracts and remit funds for the amount of shares they wish to purchase. The money is placed in escrow and the total number of shares subscribed is then calculated. Under the statute, there are restrictions on the rights available to each group to assure an equitable distribution of the subscription rights. If there is an oversubscription, the shares are allocated on a fair and equitable basis among all eligible subscribers who elected to purchase. The estimated market value of the converted stock company is established by a qualified in dependent party, usually a securities underwriter. The entire process must be approved by the insurance regulator. The net effect is to convert the insurer into a stock with an influx of capital from the purchased shares, Having legislation on the books is one thing; deciding to demutualize is quite another. The determination as to whether an insurer should seek to convert will be an individual insurer decision based on the insurer’s position in the market, its business goals, its capital position and needs, and the likelihood and ability to achieve these goals without understanding the wrenching course of demutualization. The analysis required for such a decision is burdensome and ordinarily will not be undertaken necessary. These considerations will undoubtedly lead to considerable interest in holding company concepts underlying the low and Illinois approaches to facilitating mutual company access to the capital markets. Box 23-5 lists US. Jurisdictions that allow mutual conversions as of 1999. As competition has tightened in the financial services marketplace, margins have declined and demand for capital has increased; mutual life insurance companies will be required to consider seriously whether conversion represents a necessary strategic action. The globalization of financial services and investment also will be a significant consideration. Life Insurance Management Planning along with decision making is a primary function of management. The first step in providing a foundation for guiding decision making and goal settings is for senior management and the board of directors to define an overall corporate mission. Strategic Management The strategic planning process involves a systematic approach to analyzing the environment, assessing the organization's strengths and weaknesses, and identifying opportunities in which the organization could have a competitive advantage. Strategic planning is intended to allow managers to

- 12. forecast the future and to develop courses of action that will result in maximizing the chance of a successful future for a company. The first step in strategic planning is for management and the board of directors to define the overall objectives of the company-—its mission. A mission is the fundamental, unique purpose that sets a business apart from other firms of its type and identifies the scope of its operations in product and market terms. Once the mission statement has been crafted, the next step in the strategic planning. Process is to establish long-term objectives that collectively appear to assure accomplishment of the company’s mission. The primary objective ordinarily would be the maximization of shareholder value in a stock insurer and policy owner value in a mutual company. Strategic planning can be contrasted with operational planning designed to guide an organization's day-to-day activities. Operational planning is tactical; it describes methods to be used at various levels in the organization to achieve lower-level objectives and ultimately to accomplish major corporate objectives. If an organization produced only a single product or service, managers could develop a single strategic plan that covered everything it did, but most financial services organization are in diverse lines of business. Therefore, an organization needs corporate-level strategy (determines the roles that a business unit in the organization will play), business level strategy (each division will have its own strategy that defines the products or services it will offer and the markets it wants to target), and functional-level strategy (support the business-level strategy). Planning and Control Cycle All well-managed companies utilize a planning and control cycle made up of four stages: (1) strategic planning, (2) tactical planning, (3) performance monitoring, and (4) control and readjustments. These stage describe a management process without any particular time frame. The strategic planning stage defines the target markets, products and services, and distribution systems that are coordinated to achieve the company’s profitability and solvency objectives in light of the established overall corporate mission. These objectives must be achieved within solvency constraints defined by management in regard to cash flow and capital adequacy.

- 13. Everything in the management of a life insurer affects everything else. The effective manager must be able to see the logical interrelationships among micro decisions as they affect each other and the company's macro performance. In a financial context, a life insurer can be viewed as an aggregate of individual products and associated cash flows. The financial criteria employed to measure profitability can vary, but return on equity and value added are two widely used measures. These profitability criteria are often measured for strategic business units for purposes of determining relative performance, investment strategies, resource allocations, and incentive compensation. Capital adequacy (both short and long term) is an important consideration in individual product design and the portfolio of products offered by a life insurance company. If required surplus is impaired, the insurer will face regulatory intervention. Rating services also pay close attention to surplus levels. Thus, cash flow and surplus management are important financial considerations, often serving as constraints on product design. Once the target markets, distribution systems, and product mix meet the profitability and capital (surplus) criteria, the next stage of the planning cycle. Tactical planning, can begin to provide the implementation of the strategic plan. The tactical plan involves the development and maintenance of all of the managerial and distribution components required to carry out the strategic plan within the timetables and cost constraints assumed in the product profitability and solvency models. Timely, efficient implementation is as important as good strategic planning. Realistic, achievable tactical plans must be developed for the product portfolio selected. The third stage of the planning and control cycle is performance monitoring. The purpose of course, is to determine if the insurer's strategic and tactical plans are being carried out so as to meet profitability and solvency objectives. Effective performance monitoring systems involve a limited number of meaningful reports generated for each strategic business unit and for the company as a whole. The timing of the reports and the amount of detail depend upon the use to which the reports are put. Senior management reports are likely to take a summary form to facilitate management by exception, enabling executives to concentrate on correcting variances from planned objectives. Obviously, the quality and integrity of the data are critically important. Effective performance monitoring permits control and readjustment, the fourth stage of the planning and control cycle. Performance monitoring will lead to control and readjustment of tactics to achieve a given strategic plan, or readjustment of the strategic plan itself if it appears to be unattainable even after feasible adjustments have been made. This completes the cycle, in which strategic plans involving products, markets, and distribution systems are modified as experience unfolds and ideas for new products and Strategies evolve as a natural part of the management process.

- 14. It is important to remember that creativity and imagination are critical to successful life insurance company management. There are always a number of ways to attack a problem strategically and tactically. The effective executive-manager will examine a number of alternative approaches, applying the technical tools at his or her disposal and at times even inventing new ones. Management is a dynamic process in which creativity is a critically important resource. Value Based Planning The management of a life insurer’s capital resource is central to the successful fulfillment of its mission. Key questions that every company faces include: How will corporate capital be allocated among many possible applications? What market segments and products represent the most attractive opportunities for investing in the company’s future? What constitutes an adequate rate of return for the company’s investments? How will management performance be evaluated? Value based planning is increasingly used in the life insurance industry as a tool for analyzing these issues and establishing long range strategy. Value based planning, also called embedded value analysis, focuses on the economic net worth of a company and its relative increase from planning period to planning period. The value of company comprises three elements: 1. Current capital and surplus together with non-benefit contingency reserves, 2. The value of expected future net cash flows from existing business, 3. Expected future net cash flows from future business. These values are defined as the present value of future cash flows discounted at a specified hurdle rate of return for alternative investments with similar risk characteristics. The discount rate is determined by reference to the company’s cost of capital in the capital markets and it may be adjusted to reflect the different risks associated with different products or ventures. A product or business venture creates values if discounted cash flows exceed the initial investment. Four broad strategies are generally available to management with respect to existing product lines and business. A. The product or venture can be discontinued and market share surrendered. B. Additional investments can be discontinued and market share harvested as it declines. C. Sufficient investment can be made to maintain existing market share. D. Significant investment can be made to build market share. To determine whether value is created by adoption of these strategies, the cash flows associated with the investments required for each strategy are discounted at the selected rate. The investment required for each strategy is the sum of the value that might be received through divesting the product or venture by sale or reinsurance agreement and the additional capital required to adopt the strategy. When discounted cash flows exceed the required investment. Value is created and adoption of the strategy is indicated. New products, ventures and acquisitions can be tested similarly foe value

- 15. creation. Aggregate value added during any planning or measurement period is the difference in beginning and ending values, adjusted for surplus paid out in dividends and paid in through capital injections during the period. Value based planning is a standard for strategic and capital allocation decision making. It serves as a rational basis for establishing the critical long term policies that guide successful pursuit of the corporate mission. These include: Establishing a long term financial strategy that satisfies the requirements of the various constituencies that management serves. Determining a capital structure that is consistent with corporate policies regarding operational and financial leverage. Allocating capital to ventures, products, and acquisitions that will create future value for policy owners and stockholders. Identifying performance standards by which the success or failure of management action may be evaluated. In competitive business, the financial results depend ultimately on the success of the company in achieving a unique or predominant position in the segments of the market that it chooses to serve. This position may stem from a low-cost structure, a unique sales operation, a special underwriting or investment skill, and so on; each of these elements is important in enhancing profit. The key to the success for the company is to assure that these unique positions continue and that changes in other elements of the cost or pricing structure do not negate these positions. In all areas of organization there are no simple answers, only different choices, each with its own advantages and disadvantages. The choice will often depend more on the company’s history, its current circumstances, or sometimes on the easy availability of information than on the merits one can determine on balance of a particular approach. Trends in life insurer Organization Life insurer organization structures are changing in response to technological developments, the need for profitability, & the increasing demand for better customer service. In effect, the traditional hierarchical organization is evolving into a network organization. This new organizational concept that is emerging, although not entirely eliminating hierarchy, emphasizes task accomplishment, making use of network of relationships involving employees & outside resources. This includes the use of strategic alliances & outsourcing communication systems that extend beyond the traditional corporate structure. Network organizations by definition are learning organizations in which employees continuously upgrade their knowledge bases & skill sets as part of their ongoing responsibilities to each other. Characteristics reflecting the network organization include: * Fewer layers of management. * Wider spans of control. * Organization of small work groups & work teams.

- 16. * Reliance upon outsourcing, strategic alliances, & external communication systems in business operations. Fewer layers of management: It's common for senior & middle managers to over manage & mismanage the activities of their subordinates. One author suggests that age, prosperity, & size contribute to over layered organizations. Mergers, acquisitions, & diversification into a new business also can lead to over layering. Planning staffs frequently overlap line management, resulting in slow decision making as well as excess overhead. Today technological developments are leading to a reduction in the number of layers of management. This is so because: *Accountability & responsibility can now be downloaded because the information needed for decision making is on the employee’s computer. * Computers are doing the work of organizing, assembling, & analyzing data once done by middle managers. * Computer allow errors to be corrected at source, reducing the need for data checks by management. * Widespread use of management-by-exception reporting on the computer decreases the amount of time that managers need to spend reviewing the work of their subordinates. Fewer layers management can result in * Elimination of redundant functions and responsibilities. * An increased individual sense of self-esteem as employers are given more knowledge & freedom to make decisions. * More timely responses to customers. * Enhanced responsiveness to changing market & product needs. Wider span of control: The ability of the life insurance manager to obtain computerized information regarding the work subordinates has permitted the expansion of spans of control. This reduces the need for meetings between supervisor & individual employees. Wide spans of control also give employees a greater feeling of independence because they have less direct supervision. This organizational environment permits managers to focus on strategic issues & improving operations rather than on tactical matters because these are now part of everyone's knowledge base on the computer. Wider spans of control will not automatically result in increased productivity. To gain improved productivity, managers in such an environment must be able to handle the significantly increased

- 17. responsibilities arising from their increased reliance upon technology to obtain management information. Managing greater numbers of employees requires managers to enhance their leadership & participative management skills. Work groups & Work teams In the network organization responsibility & accountability are delegated lower in the organization through creating strategic business units & small work groups that are responsible for specific products markets, customers or distribution systems. Many insurers have created separate businesses to provide investment & information system services in competition with outside suppliers. Work teams are frequently found in such areas as new business processing, customer service, & claims payments. The formation of smaller work teams & business units improves responsiveness to customer service needs, helps clarify accountability, & facilitates tracking results through performance measurement & capital management systems & the development of appropriate incentive compensation plans. They also facilitate the allocation of capital resources to meet return on capital objectives & product line-specific asset-liability management. Perhaps most important, work teams & smaller business units help attract, develop & retain capable individuals by giving them assignments with wide range of responsibility, autonomy, & accountability. Strategic Alliances, Outsourcing, & external communications network: Strategic alliances may be formed with customers, suppliers, & competitors to help each party attain its objectives. Common alliances in the life insurance industry include: *Domestic & foreign insurers (e.g. to enter foreign markets) *Life insurers & banks (e.g. marketing insurance & annuity products) *Life insurers & technological firms (e.g. software development) *Life insurance & health care organizations (e.g. HMOs) Outsourcing to business can control costs, allow management to concentrate on its core competencies, & facilitate an organizational restructuring, a merger, or an acquisition. External communications network such as the Internet are becoming important management tools in gaining competitive intelligence & marketing insurance products. Life insurers are in various stages of using this additional management tools in delayering their organizations, increasing managements' spans of control, & generally facilitating organizational change. Reference: 1) Text book- Life & health insurance by Kenneth Black Jr. & Skipper Jr. 9th edition. 2) www.idra.org.bd 3) www.Wikipedia.org 4) www.scribd.com 5) en.banglapedia.org 6) m.thedailynewnation.com