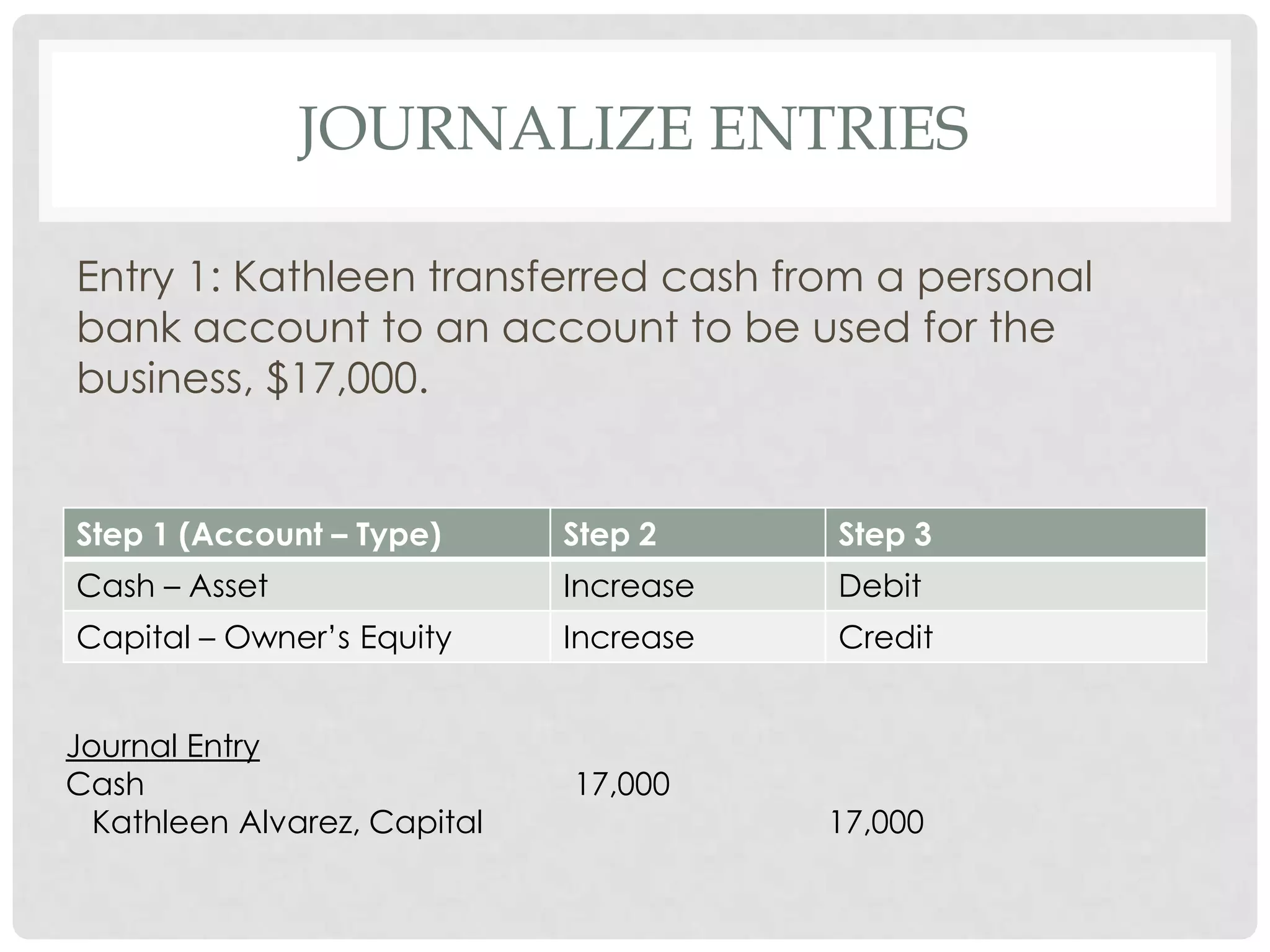

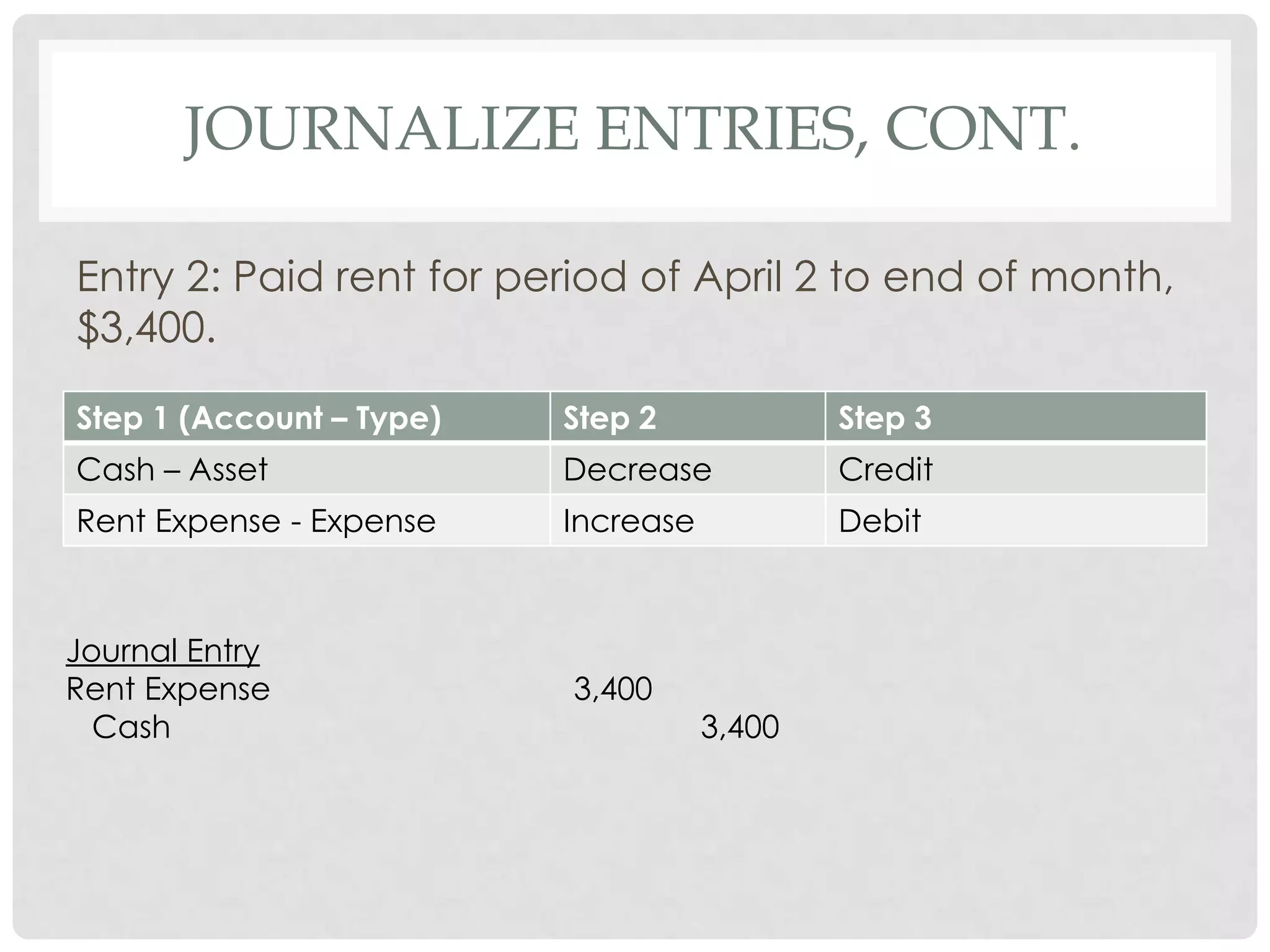

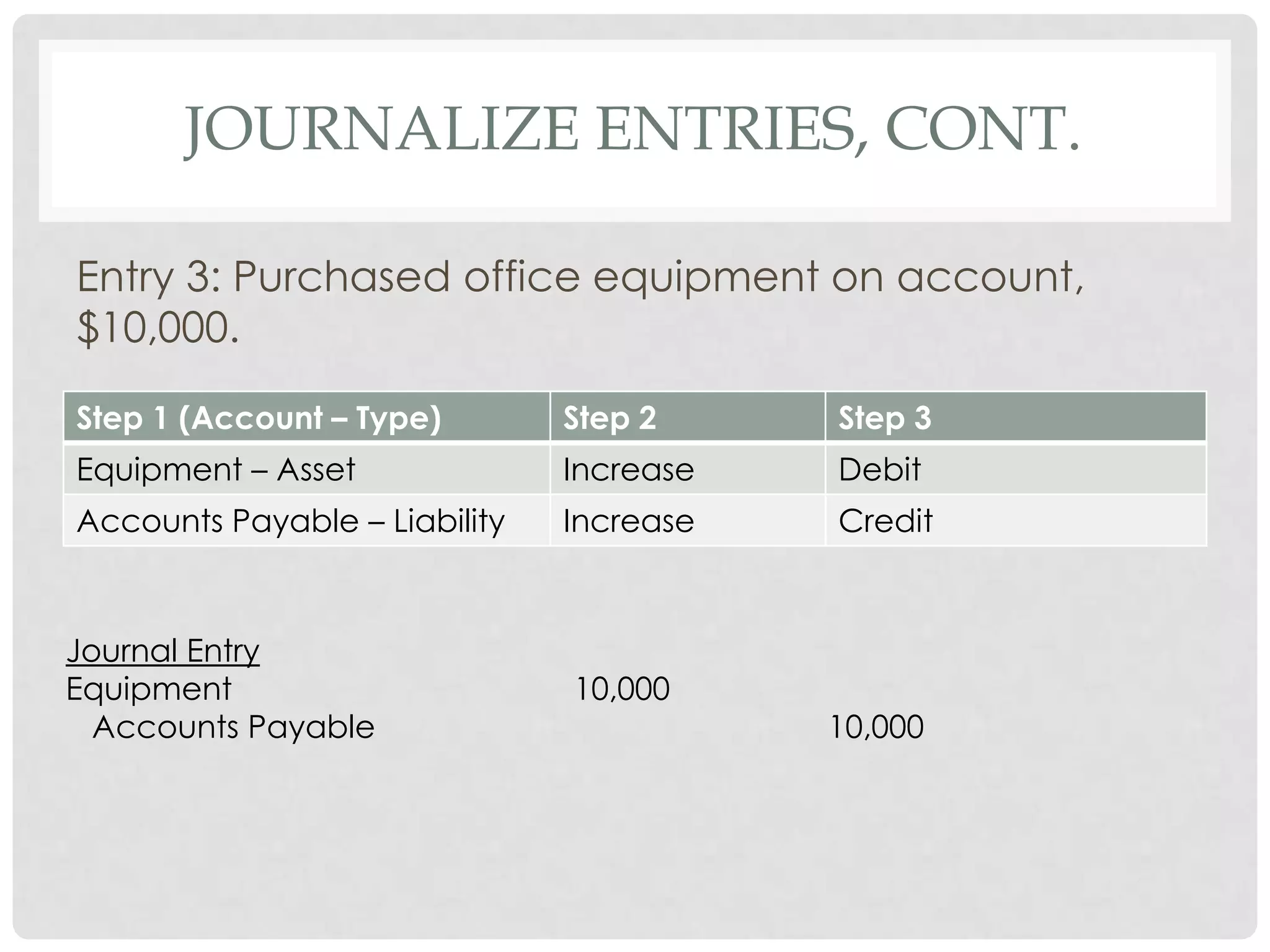

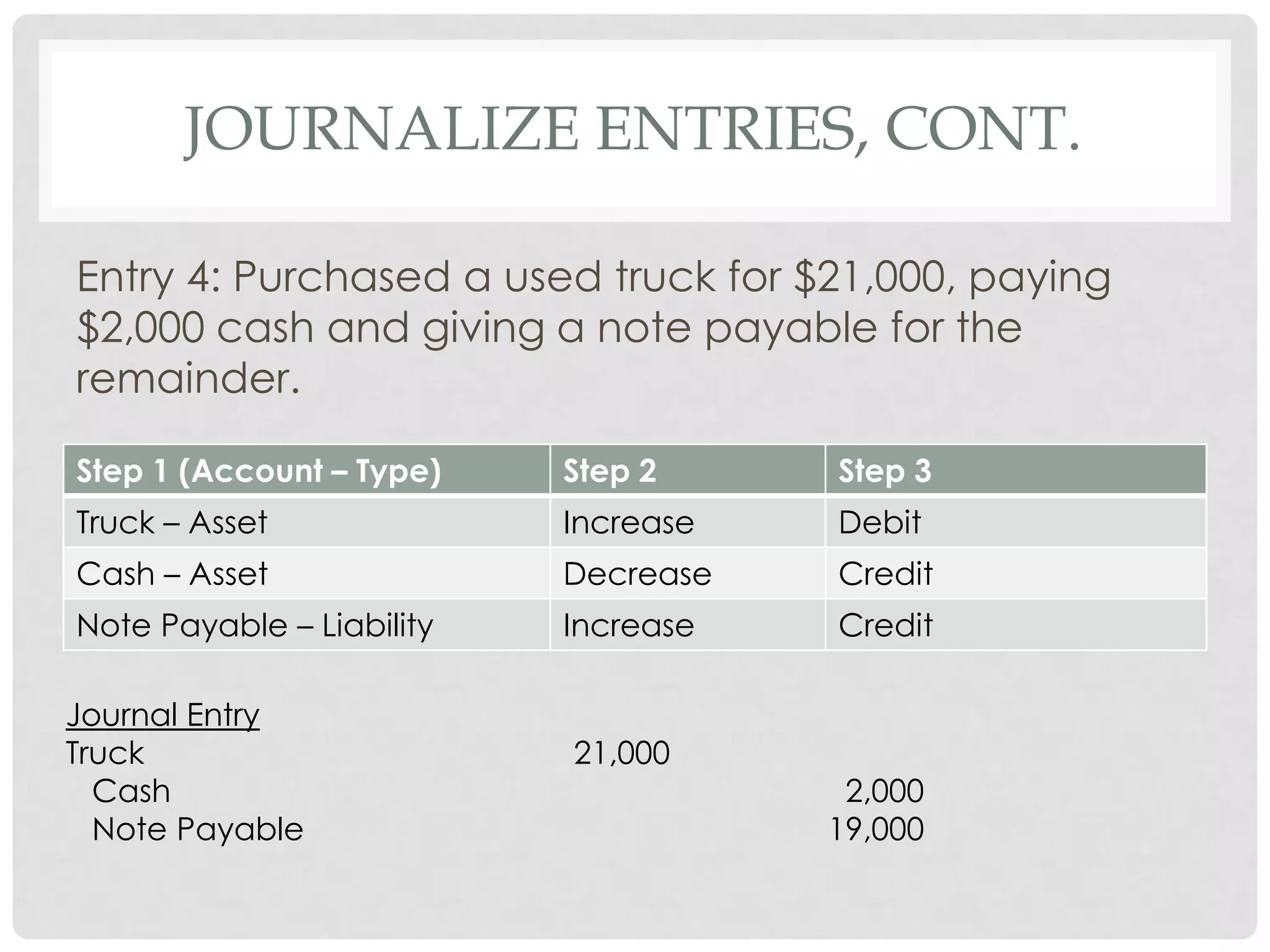

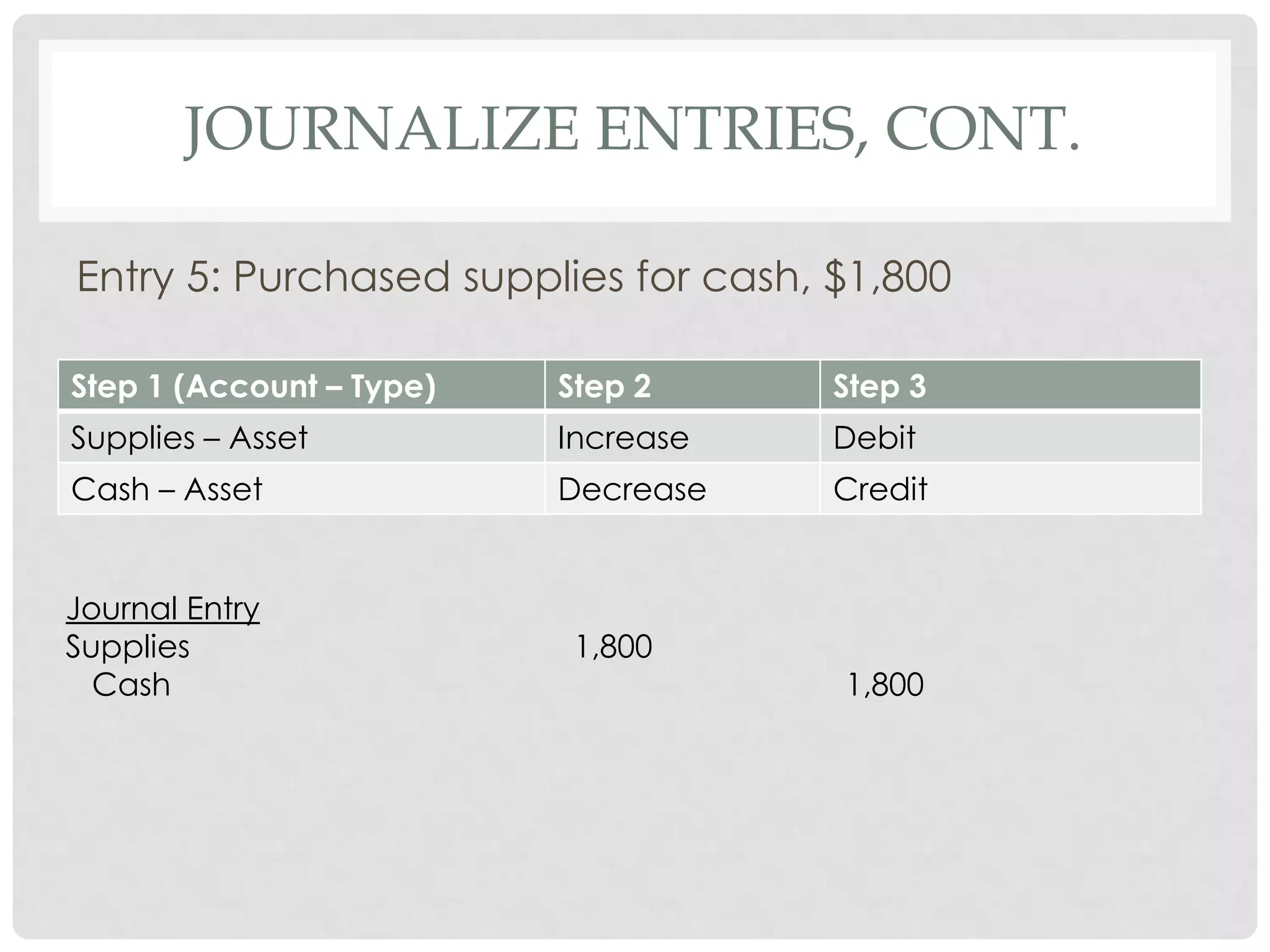

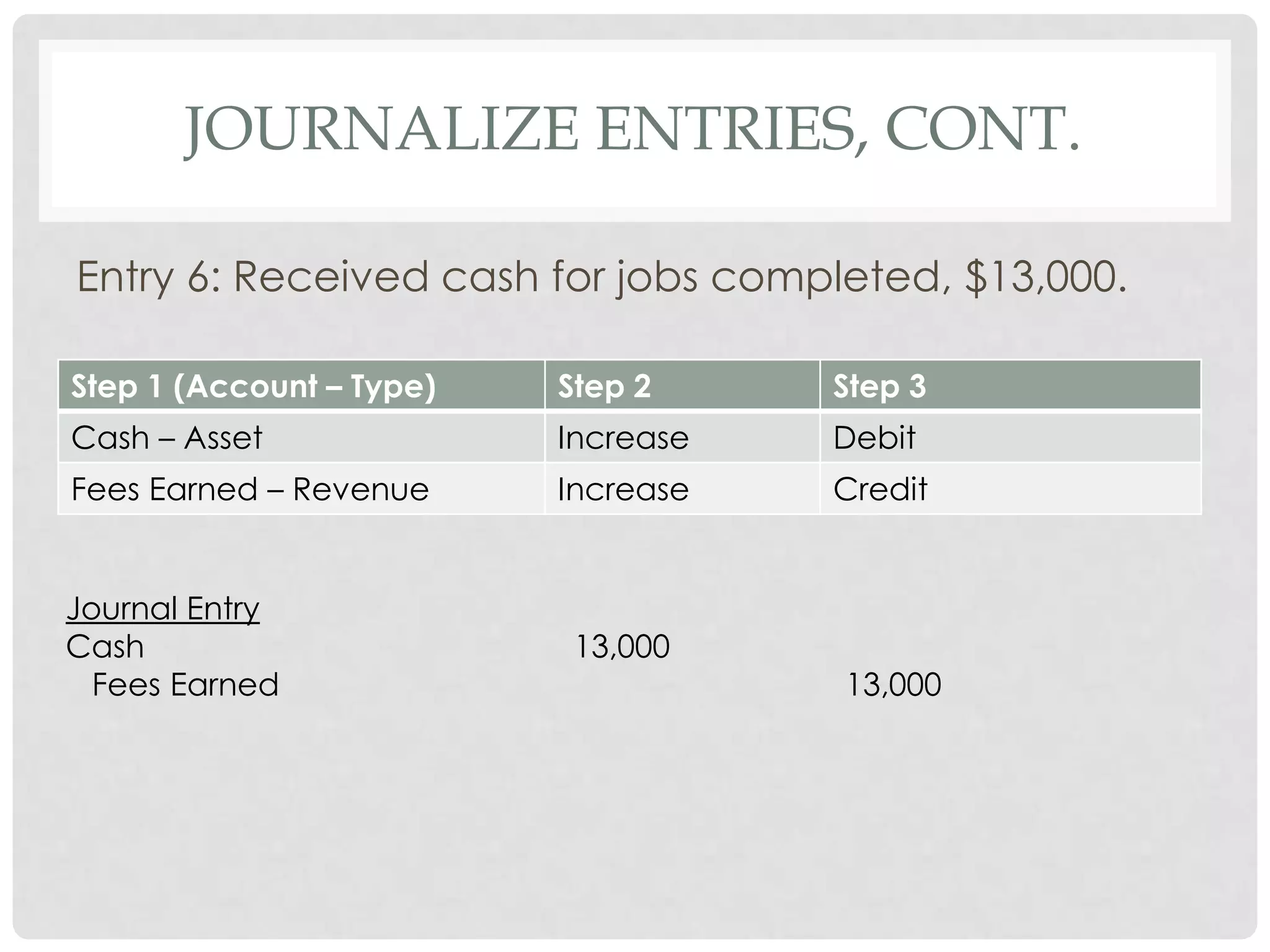

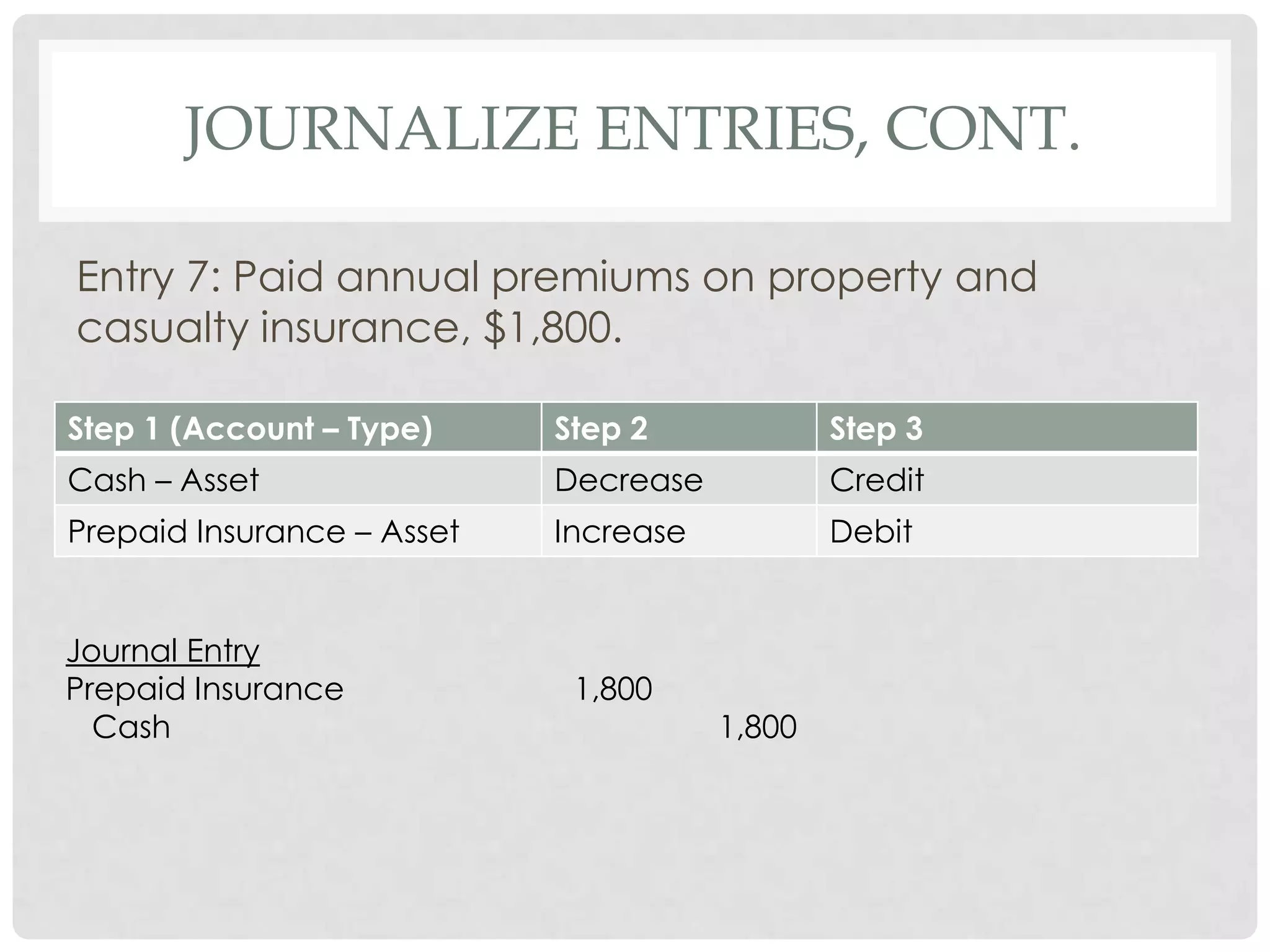

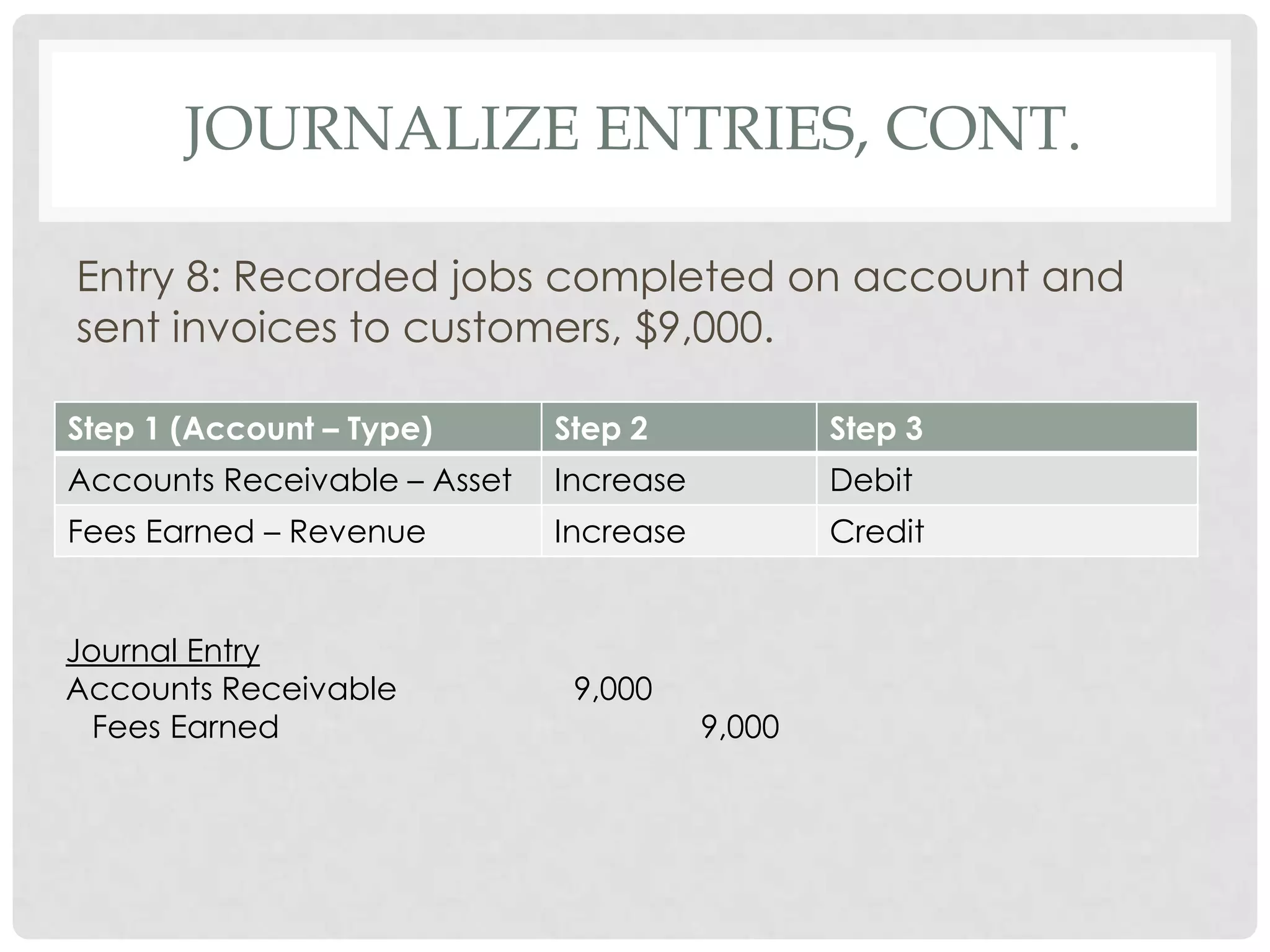

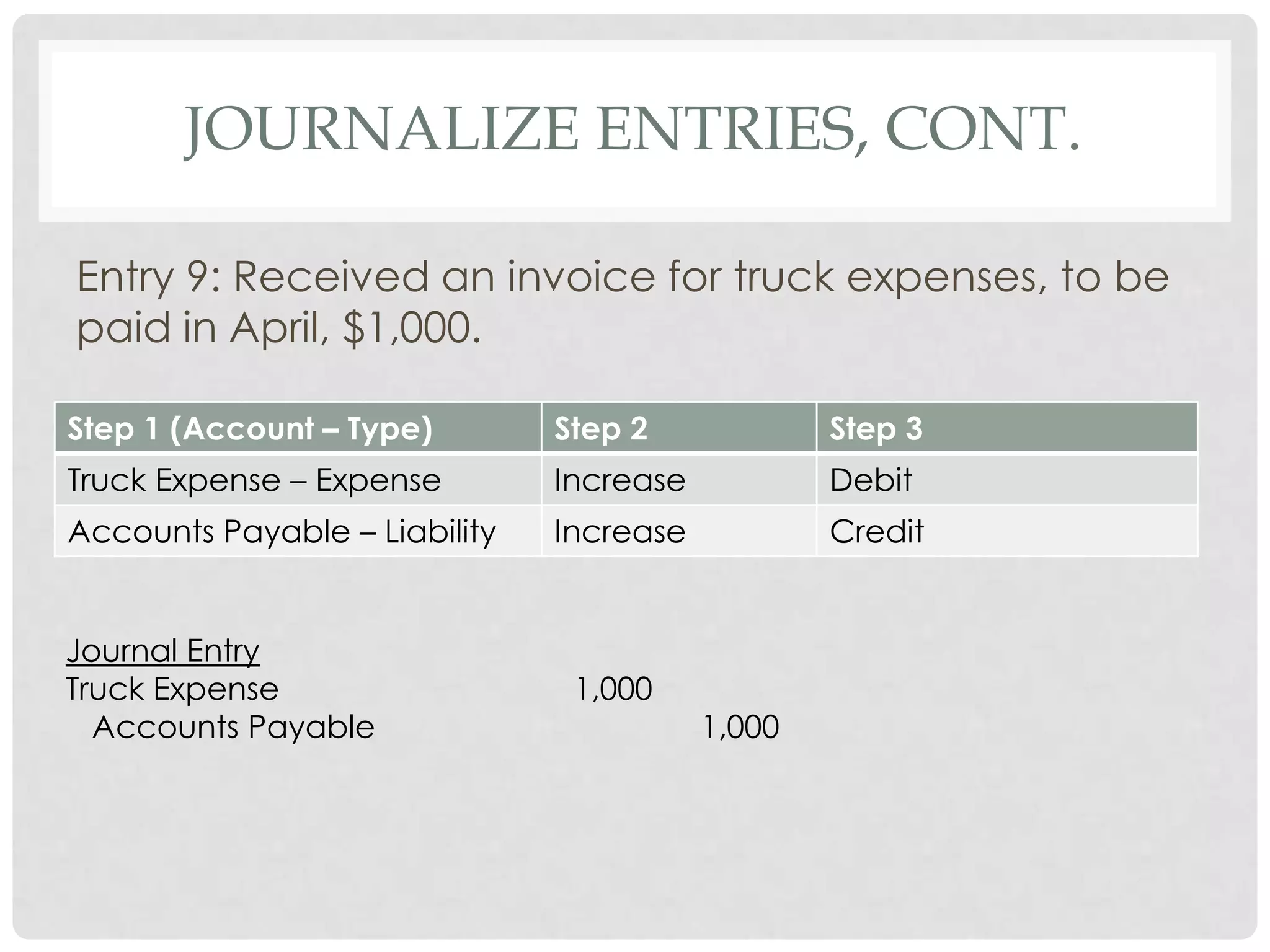

The document contains 9 journal entries to record various transactions for a new business. The entries include: contributions of cash from the owner, payment of rent and expenses, purchases of equipment, a truck, and supplies both with cash and accounts payable, recognition of revenue for jobs completed with both cash and accounts receivable, and prepayment of insurance. The entries are to be posted to general ledger accounts and an unadjusted trial balance prepared grouping accounts by type.