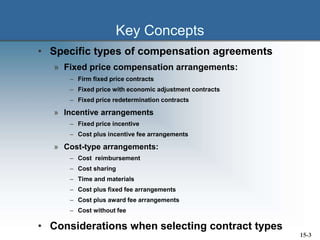

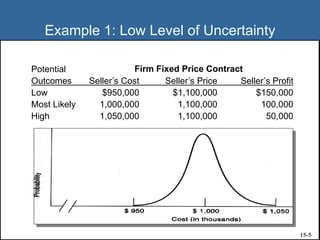

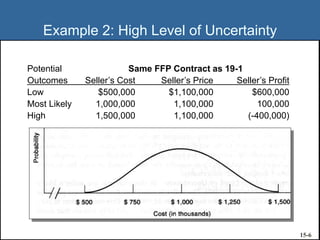

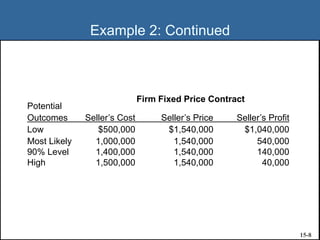

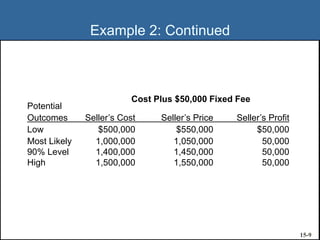

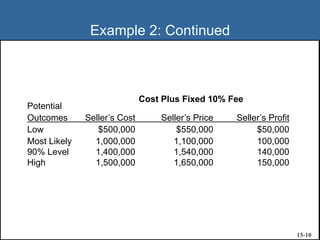

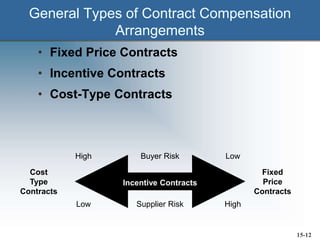

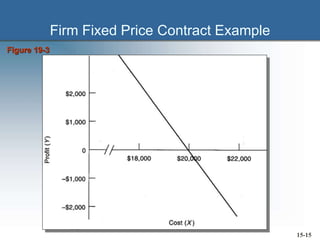

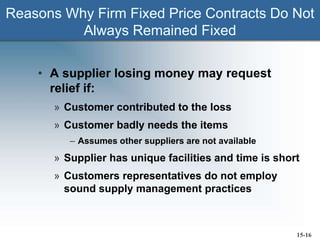

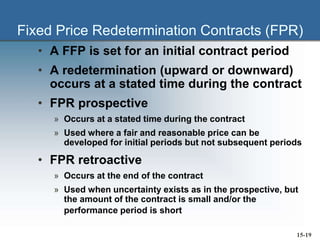

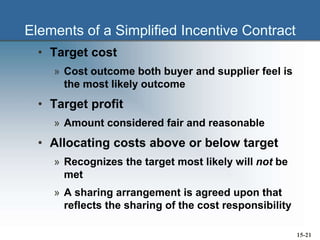

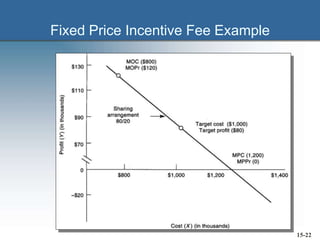

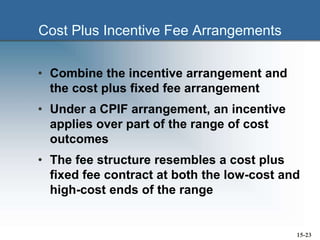

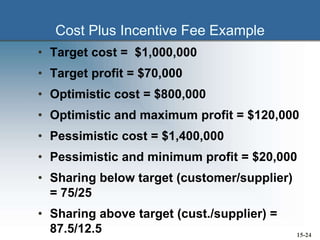

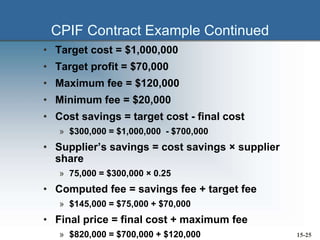

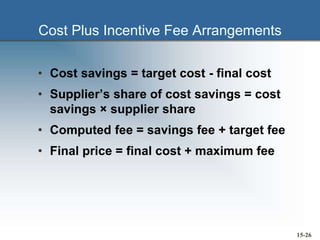

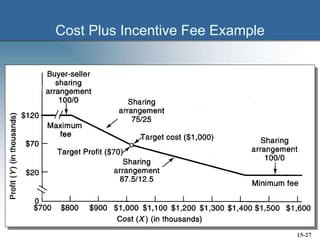

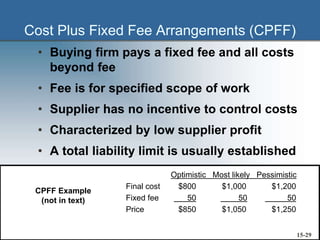

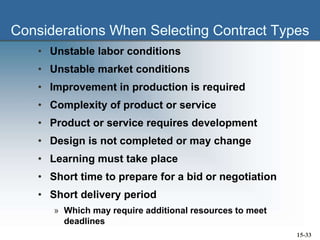

The document outlines various compensation agreements used in contracts, focusing on fixed price, incentive, and cost-type arrangements. It discusses the implications of different compensation structures on cost responsibility, profit margins, and supplier motivation in the context of risk appraisal. Examples illustrate how these contracts function under varying levels of uncertainty and the factors involved in choosing appropriate contract types.