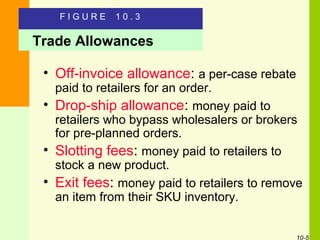

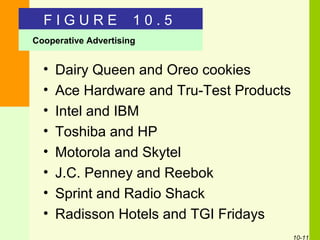

This document discusses trade promotions, which include incentives used by manufacturers and retailers to push goods through distribution channels. Approximately 50% of total promotional spending is on trade promotions. The document outlines different types of trade promotions like trade allowances, incentives, and shows. It also discusses objectives of trade promotions like obtaining distribution and inventory levels. Potential concerns with overreliance on trade promotions are also noted.