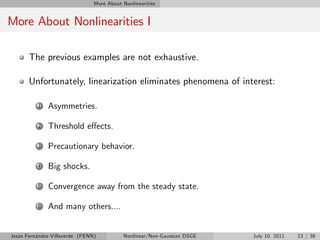

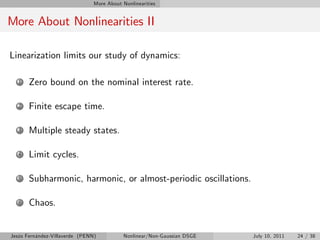

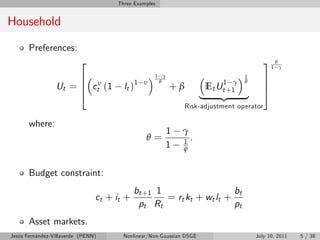

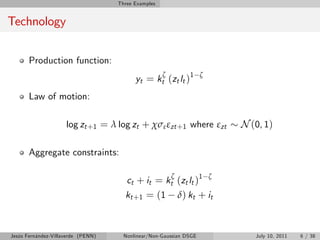

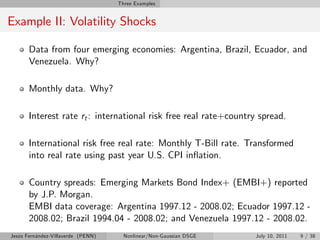

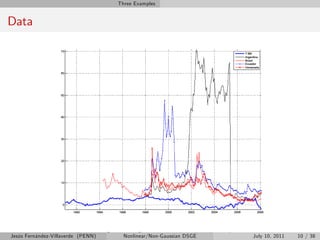

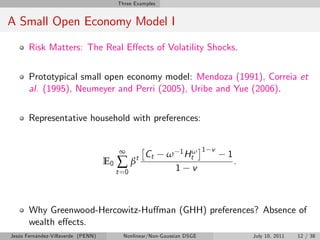

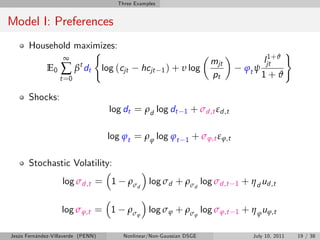

The document discusses three examples of nonlinear and non-Gaussian DSGE models. The first example features Epstein-Zin preferences to allow for a separation between risk aversion and the intertemporal elasticity of substitution. The second example models volatility shocks using time-varying variances. The third example aims to distinguish between the effects of stochastic volatility ("fortune") versus parameter drifting ("virtue") in explaining time-varying volatility in macroeconomic variables. The document outlines the motivation, structure, and solution methods for these three nonlinear DSGE models.

![Three Examples

Model II: Constraints

Budget constraint:

Z

mjt bjt +1

cjt + xjt + + + qjt +1,t ajt +1 d ω j ,t +1,t =

pt pt

mjt 1 bjt

wjt ljt + rt ujt µt 1 Φ [ujt ] kjt 1 + + Rt 1 + ajt + Tt + zt

pt pt

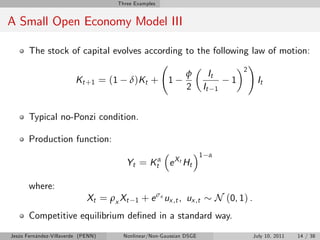

The capital evolves:

xjt

kjt = (1 δ) kjt 1 + µt 1 V xjt

xjt 1

Investment-speci…c productivity µt follows a random walk in logs:

log µt = Λµ + log µt 1 + σµ,t εµ,t

Stochastic Volatility:

log σµ,t = 1 ρσµ log σ + ρ

µ σµ log σµ,t 1 + η µ uµ,t

Jesús Fernández-Villaverde (PENN) Nonlinear/Non-Gaussian DSGE July 10, 2011 20 / 38](https://image.slidesharecdn.com/chapter1nonlinear-110825092234-phpapp02/85/Chapter-1-nonlinear-20-320.jpg)