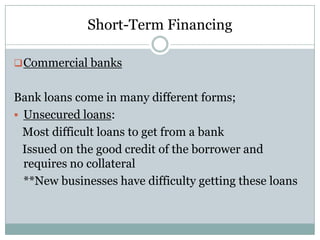

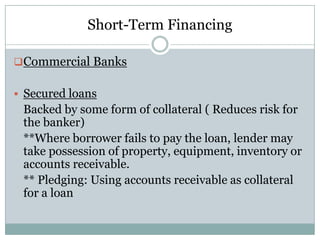

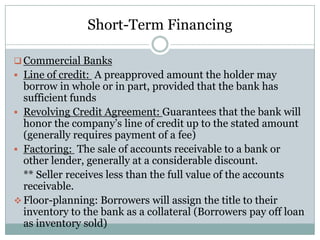

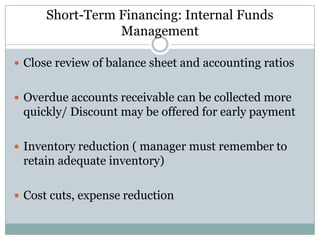

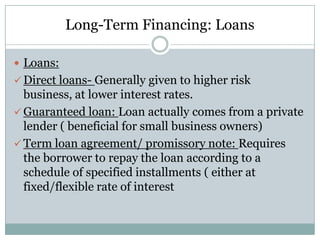

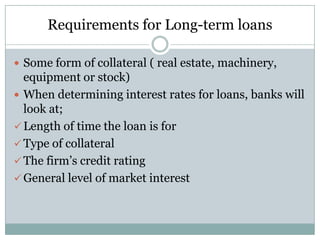

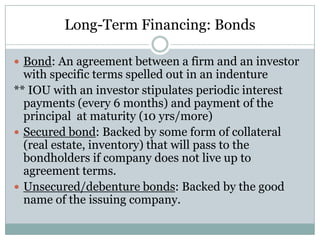

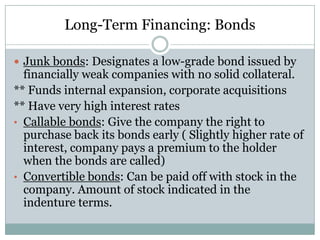

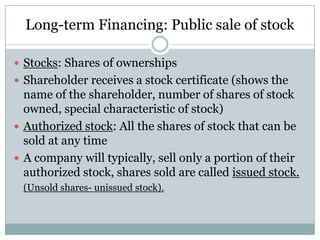

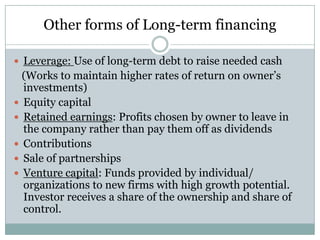

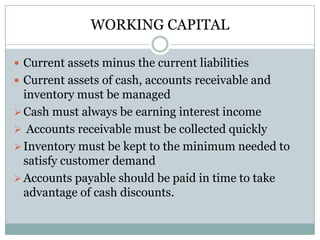

This document summarizes short-term and long-term financing options for businesses. It discusses sources of short-term debt like trade credit, bank loans, and internal funds management. Long-term debt options include bank loans, bonds, and public stock sales. It also covers managing finances through working capital, capital budgets, and financial controls. The overall purpose is to provide an overview of the major categories of funds sources for businesses and how financial managers can utilize different financing strategies and tools.