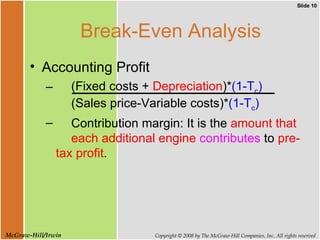

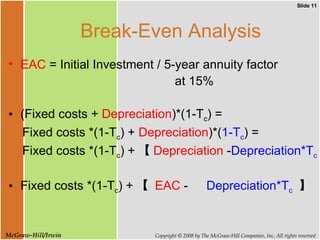

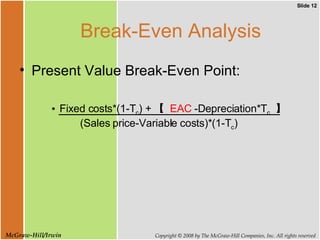

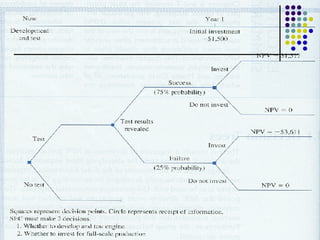

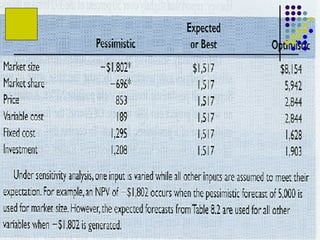

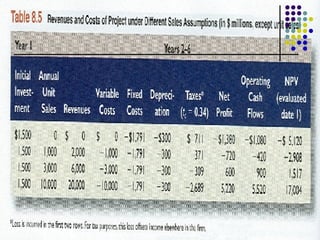

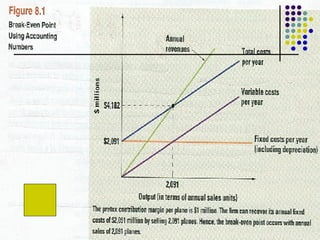

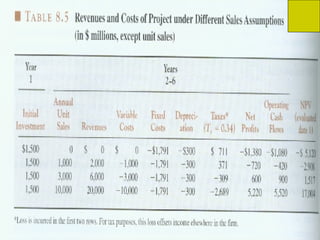

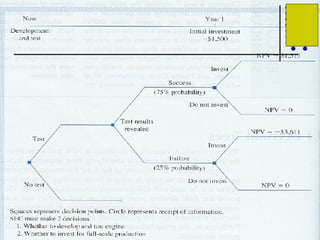

The document discusses several capital budgeting techniques: sensitivity analysis, which examines how changes in assumptions impact NPV; scenario analysis, which considers multiple forecasts simultaneously; and break-even analysis, which determines the sales needed to cover costs. It also discusses real options, noting that NPV underestimates a project's value since managers can adjust in response to changes. Decision trees are presented as a tool to analyze projects with uncertain outcomes.