Bauer Industries is evaluating a proposal to build a new truck manufacturing plant and has prepared cash flow projections over 10 years showing revenues of $100 million annually, manufacturing and marketing expenses totaling $45 million, and depreciation of $15 million, resulting in estimated annual EBIT of $40 million and unlevered net income of $26 million. Bauer plans to use a 12% cost of capital to evaluate the project's net present value and determine if the project should be accepted.

![TUTORIAL 7 – Discounted Cash Flow Valuation I

TUTORIAL 7 – Discounted Cash Flow Valuation I

{Ross chapter 5: Critical thinking 1; Questions 4, 5, 7}

Critical Thinking

Question 5.1 – Annuity Period

As you increase the length of time involved, what happen to the present value of an annuity? What

happens to the future value?

–duration increase, present value decrease (indirect relationship)

–duration increase future value increase (direct relationship)

–Assuming positive cash flow and a positive interest rate, both the present and the future value will

rise.

Questions and Problems

Question 4 – Calculating Annuity Present Values

An investment offers $8,500 per year for 15 years, with the first payment occurring 1 year from

now. If the required return is 9 per cent, what is ... Show more content on Helpwriting.net ...

Question 16 – Calculating Future Values

What is the future value of $1,560 in 13 year assuming an interest rate of 9percent compounded

semi–annually?

For this problem, it simply needs to find the FV of a lump sum using the equation:

FV= PV (1+r) t

It is important to note that the compounding occurs semi–annually. To account for this, it will divide

the interest rate by two (the number of compounding periods in a year), and multiply the number of

periods by two. Doing so, it may get:

FV= PV {[1+ (k/m)] nm} = $1560 {[1+ (0.09/2)] 13x2} =$4899.46

TUTORIAL 9 – Bond Valuation and the Structure of Interest Rates

{Parrino Chapter 8: Critical thinking: 6 & 9 (E–reading);

Question & problems: 6, 14 & 16 (E–reading)}

Critical Thinking

Question 8.6

Explain why bond prices and interest rates are negatively related? What is the role of the coupon

rate and the term to maturity in this relation?

Bond prices are included market interest rate, coupon rate, and term to maturity.

(i) The market interest rate is a compound varies always. On the other hand, the coupon for the bond

remains fixing until maturity. Therefore, any change in market interest rate does not affect the

coupon, but it affects the price of the bond. When the market interests go up, bonds go down and](https://image.slidesharecdn.com/capital-231113193837-aa26d0c5/85/Capital-37-320.jpg)

![The Practical Application of Discounted Cash-Flow Based...

Title: THE PRACTICAL APPLICATION OF DISCOUNTED CASH–FLOW BASED

VALUATION METHODS Publication: Studia Universitatis Babes Bolyai – Oeconomica, LII,

2/2007 Author Name: Takács, András; Language: English Subject: Economy Issue: 2/2007 Page

Range: 13–28 Summary: Valuation methods based on Discounted Cash–Flow (DCF) play a major

role in the field of company valuation. The current literature contains a reasonably deep and detailed

theoretical basis for DCFbased valuation, although, when starting to apply the techniques to

evaluate a real company, some practical problems may appear. This study summarizes the most

important practical difficulties which may hinder the valuation process and proposes different ways

of solving these. Beyond the ... Show more content on Helpwriting.net ...

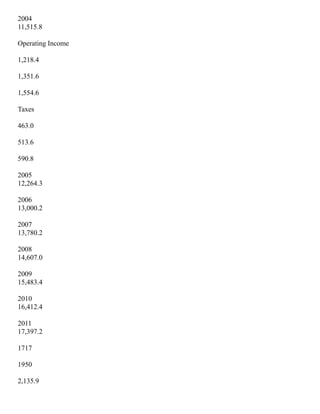

The calculation of FCF can be done according to the formula shown by Figure 1 (based on

[Copeland, Murrin and Koller, 2000], [Fernandez, 2002] and [Agar, 2005]). Initially, we need to

determine Earnings Before Interest and Tax (EBIT), which represents hypothetical earnings before

tax which ignores the effect of interests paid on debt. It can be calculated as the reported earnings

before tax plus the interest expense stated in the income statement [Bodie, Kane and Marcus, 2004].

The EBIT should then be reduced by the hypothetical tax (computed as EBIT * tax rate) in order to

obtain Earnings After Tax without the effect of debt financing. This number shows the accounting

profit which would have been realized had the firm used no debt to finance its operation. 1

According to [Fernandez, 2002], the most important types of cash–flow are the Free cashflow

(cash–flow available to satisfy both the shareholders' and creditors' return requirements), the Equity

Cash–flow (cash–flow available for shareholders) and the Debt Cash–flow (cash–flow available for

creditors). 14 Earnings Before Interest and Tax (EBIT) – Tax on EBIT (EBIT * Tax rate)

Accounting earnings = Earnings After Tax without debt + Depreciation expense – Increase in gross

fixed assets – Increase in Working Capital Adjusting items = FREE CASH FLOW (FCF)

... Get more on HelpWriting.net ...](https://image.slidesharecdn.com/capital-231113193837-aa26d0c5/85/Capital-49-320.jpg)