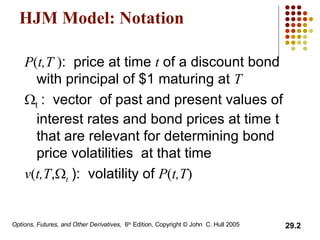

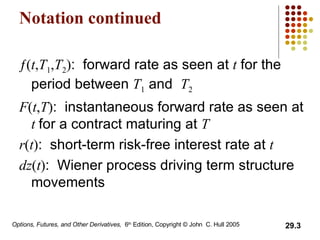

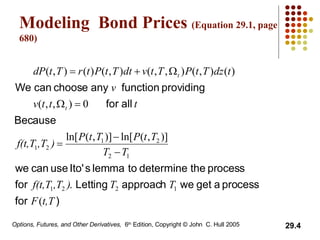

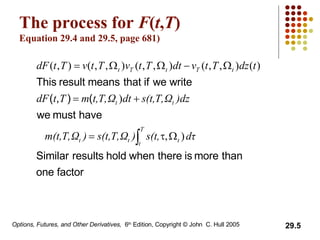

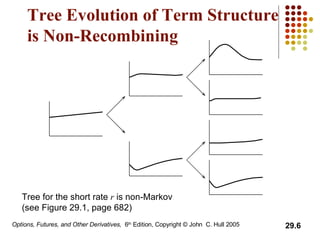

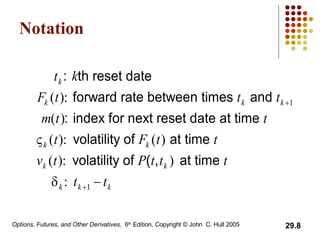

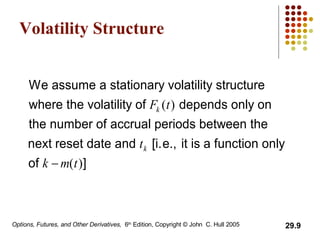

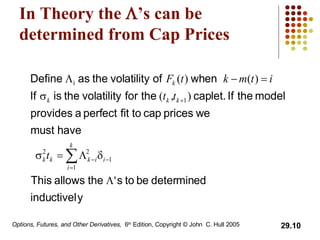

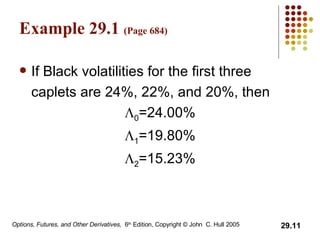

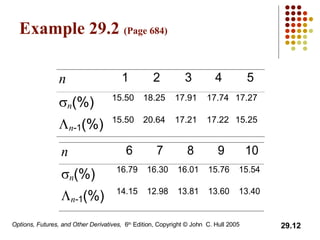

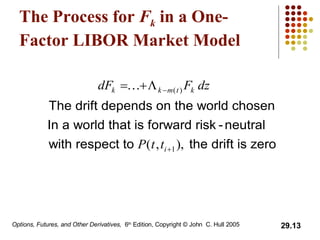

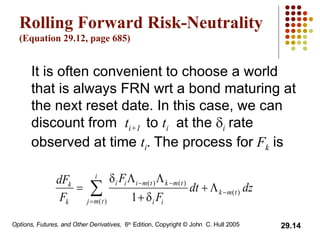

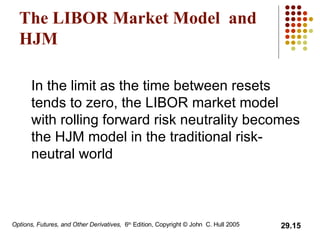

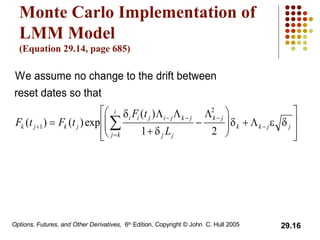

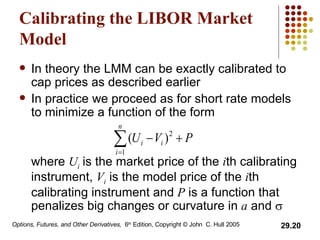

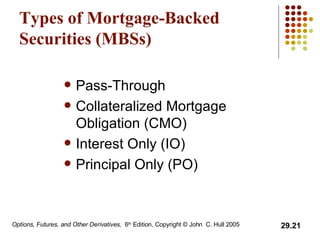

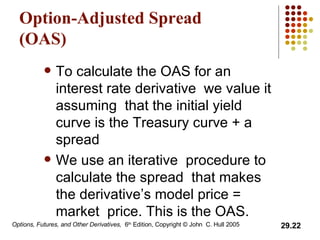

The document discusses interest rate derivative models, including the HJM and LIBOR Market Models (LMM). It introduces the notation, modeling, and implementation of these models. The HJM model models the term structure of interest rates as a non-recombining tree. The LMM models forward rates and can be calibrated to caplet prices. It becomes the HJM model as the time between resets approaches zero. The document also briefly discusses types of mortgage-backed securities and calculating the option-adjusted spread.