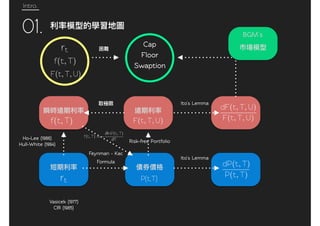

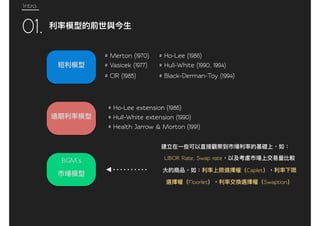

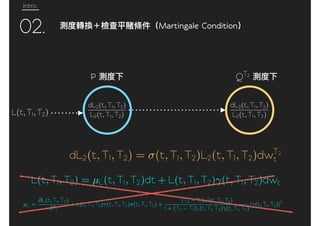

This document discusses the LIBOR Market Model (LMM) for pricing interest rate derivatives. It covers:

1. The HJM framework and finite number of time periods with lognormal LIBOR rates. This is the Brace-Gatarek-Musiela (BGM) model which is also known as the LMM or LFM.

2. Assumptions of the BGM model including positive, continuous LIBOR rates that follow a lognormal process.

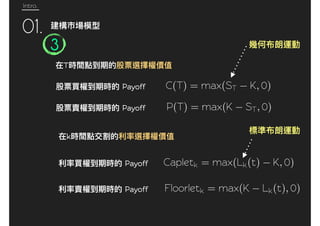

3. Pricing of interest rate derivatives like caplets, floorlets, caps and floors using the Black formula under the risk-neutral measure. Caplets and floorlets are priced individually and then summed to obtain prices for caps

![Model

02.

B A

A B $1 A

P(t, T1)

P(t, T1)-

$1 [1 + (T2 T1)L(t, T1, T2)]

t T1 T2

$1 $1 [1 + (T2 T1)L(t, T1, T2)]

1 + (T2 T1)L(t, T1, T2)

[1 + (T2 T1)L(t, T1, T2)]P(t, T2)+

+

$1- [1 + (T2 T1)L(t, T1, T2)]

LIBOR Forward Ra0e

P(t, T2)](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-8-320.jpg)

![Model

02. LIBOR Forward Ra0e

P(t, T1) = P(t, T2)[1 + (T2 T1)L(t, T1, T2)]

P(t, T2)L(t, T1, T) =

P(t, T1) P(t, T2)

(T1, T2)

1 + (T2 T1)L(t, T1, T) =

P(t, T1)

P(t, T2)

1 + x LIBOR Ra0e =[ ]= exp[

T2

T1

r(t, u)du]

HJM f](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-9-320.jpg)

![Model

02.

N(d1) S KN(d2)[ ]C = SN(d1) Ke rt

N(d2)

Portfolio

+

1

(T1, T2) P(t, T1)

1

(T1, T2) P(t, T2)

Price of tradable Asset

P(t, T2)L(t, T1, T2) =

P(t, T1) P(t, T2)

(T1, T2)

LIBOR Forward Ra0e](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-10-320.jpg)

![Model

02.

= E(Xn|Xn 1) = g(Xn 1)

= E(Xn|Xn 1, Xn 2, ..., X1)

E(Xn|Fn 1)

&

E(Xn|Fn 1) = Xn 1

Spot

Forward

Other Risk-Adjus0ed

measure

measure

measure

QT

Q

Qs

[ ]Bt

P(t, T)

S](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-11-320.jpg)

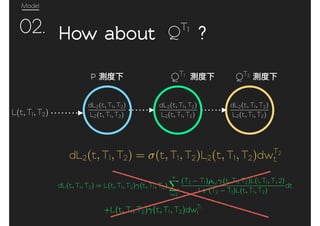

![Model

02.

1

P(t, T2)

P(t, T1) P(t, T2)

(T1, T2) QT2

P(t, T2)L(t, T1, T2)

P(t, T2) QT2

P(t, T2)L(t, T1, T2) =

P(t, T1) P(t, T2)

(T1, T2)

LIBOR Ra0e

dL2(t, T1, T2) = (t, T1, T2)L2(t, T1, T2)dwT2

t

dLk(t, Tk 1, Tk) = (t, Tk 1, Tk)Lk(t, Tk 1, Tk)dwk

t( )

[ ]

LIBOR Forward Ra0e](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-12-320.jpg)

![Pricing

03.

Model for LIBOR (London In0er-Bank Offer Ra0e)

-HJM framework

-Fini0e number, N of time periods

-LIBOR over each period lognormal

- Black’s Formula for caplets satisfied.

BGM model = LMM = LFM

Brace Ga0arek Musiela (1997)

Assumption

- L > 0

- L continuous time

- L follows a lognormal process with de0erministic vol.

Thus, dL(t, Tk 1, Tk) = k(t, Tk 1, Tk)dwk

t

t [0, Ti], i = 1, ...N wk

t : is brownian motion under Qk](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-17-320.jpg)

![Pricing

03.

Caplet

Cpl(t, T1, T2, N, K) = N P(t, T2) (T1, T2)Blackc(K, L(t, T1, T2), )

=

T1

t

2(u, T1, T2)du Blackc(K, F, ) = F (

ln(F/K) + 2

) K (

ln(F/K) 2

)

pf:

Cpl = N P(t, T2) (T1, T2) EQ

[

e

T2

t

rudu

P(t, T2)

(L(t, T1, T2) K)+

|Ft]

N P(t, T2) (T1, T2) EQT2

[(L(t, T1, T2) K)+

|Ft]=

MartigaleQT2

dQT2

dQ](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-19-320.jpg)

![Pricing

03.

EQT2

[(L(t, T1, T2) K)I{L(t,T1,T2)>K}|Ft]

1 2

2 EQT2

[I{L(t,T1,T2)>K}|Ft] = PrT2

(L(t, T1, T2) > K|Ft)

= EQT2

[L(t, T1, T2)I{L(t,T1,T2)>K}|Ft] KEQT2

[I{L(t,T1,T2)>K}|Ft]

= PrT2

(lnL(t, T1, T2) > lnK|Ft)

= PrT2

(z < d2,k) = (d2,k)

= ...](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-20-320.jpg)

![Pricing

03.

1 EQT2

[L(t, T1, T2)I{L(t,T1,T2)>K}|Ft]

= EQT2

[L2(t)e

1

2

T1

t

2

T2

(u)du+ T1

t T2

(u)dwT2 (u))

I{L(t,T1,T2)>K}|Ft]

dwR

(t) = dwT2

(t) T2 (t)dt

= L2(t, T1, T2)ER

[I{L(t,T1,T2)>K}|Ft]

= L2(t, T1, T2)PrR

(L(t, T1, T2) > K|Ft)

= L2(t, T1, T2)PrR

(lnL(t, T1, T2) > lnK|Ft)

= L2(t, T1, T2) (d1, k)](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-21-320.jpg)

![Pricing

03.

EQT2

[(L(t, T1, T2) K)I{L(t,T1,T2)>K}|Ft]

= EQT2

[L(t, T1, T2)I{L(t,T1,T2)>K}|Ft]

1 2

KEQT2

[I{L(t,T1,T2)>K}|Ft]

21= +

= L2(t, T1, T2) (d1,k) K (d2,k)](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-22-320.jpg)

![Pricing

03.

Cap

pf: Trivial ! Caplet Cap

Portfolio

Cap = 𝞢 Caplet

Cap(t, T, N, K) =

i= +1

N P(t, Ti)EQ

[

e

Ti

t

rudu

P(t, Ti 1)

(Ti 1, Ti)(L(t, Ti 1, Ti) K)+

|Ft]

= N

i= +1

P(t, Ti) (Ti 1, Ti)Blackc(K, L(t, T1, T2),

Ti 1

t

2

i (u)du)](https://image.slidesharecdn.com/lmm-151225114914/85/LIBOR-Market-Model-Presentation-23-320.jpg)