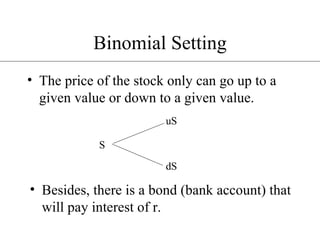

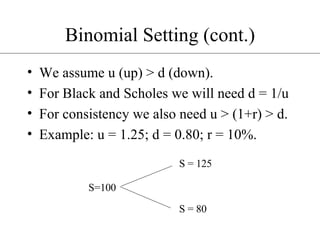

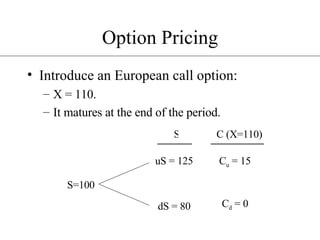

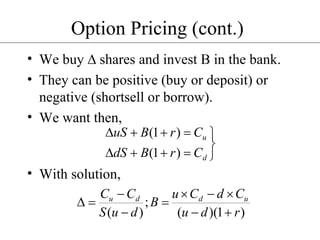

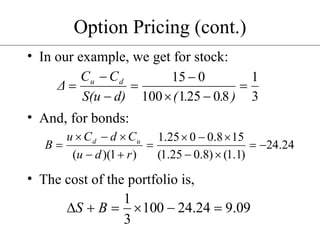

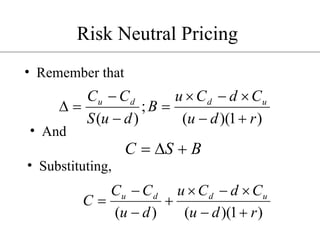

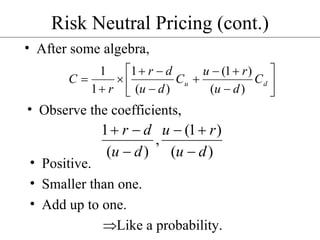

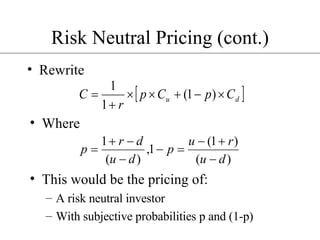

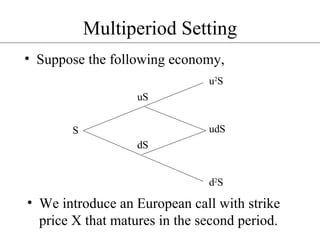

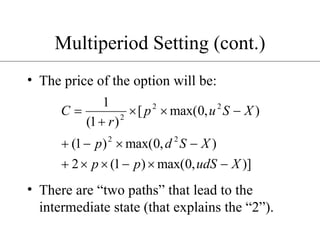

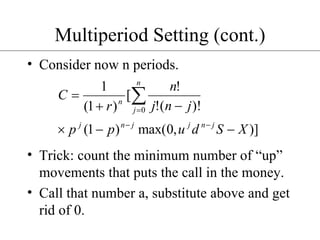

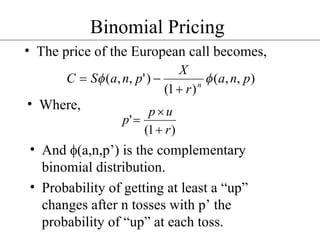

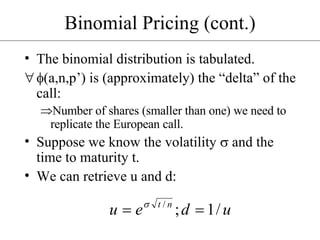

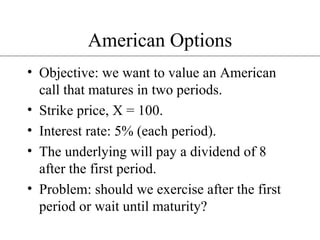

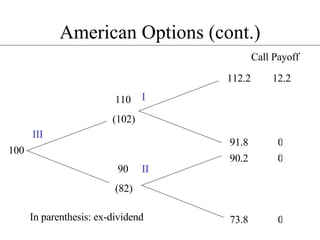

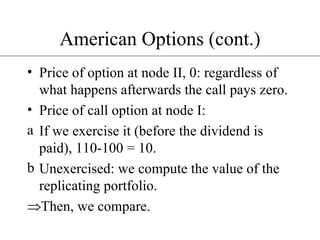

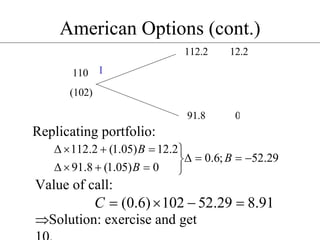

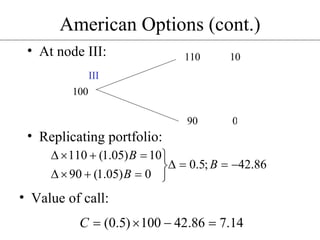

The document discusses binomial pricing models for pricing American options. It introduces a binomial model where the underlying asset price can move up or down between time periods. It shows how to price a European call option in this framework by constructing a replicating portfolio. The price of the option is set so that this portfolio replicates the payoffs. It then extends this to multiple time periods and discusses how to price early exercise features of American options.