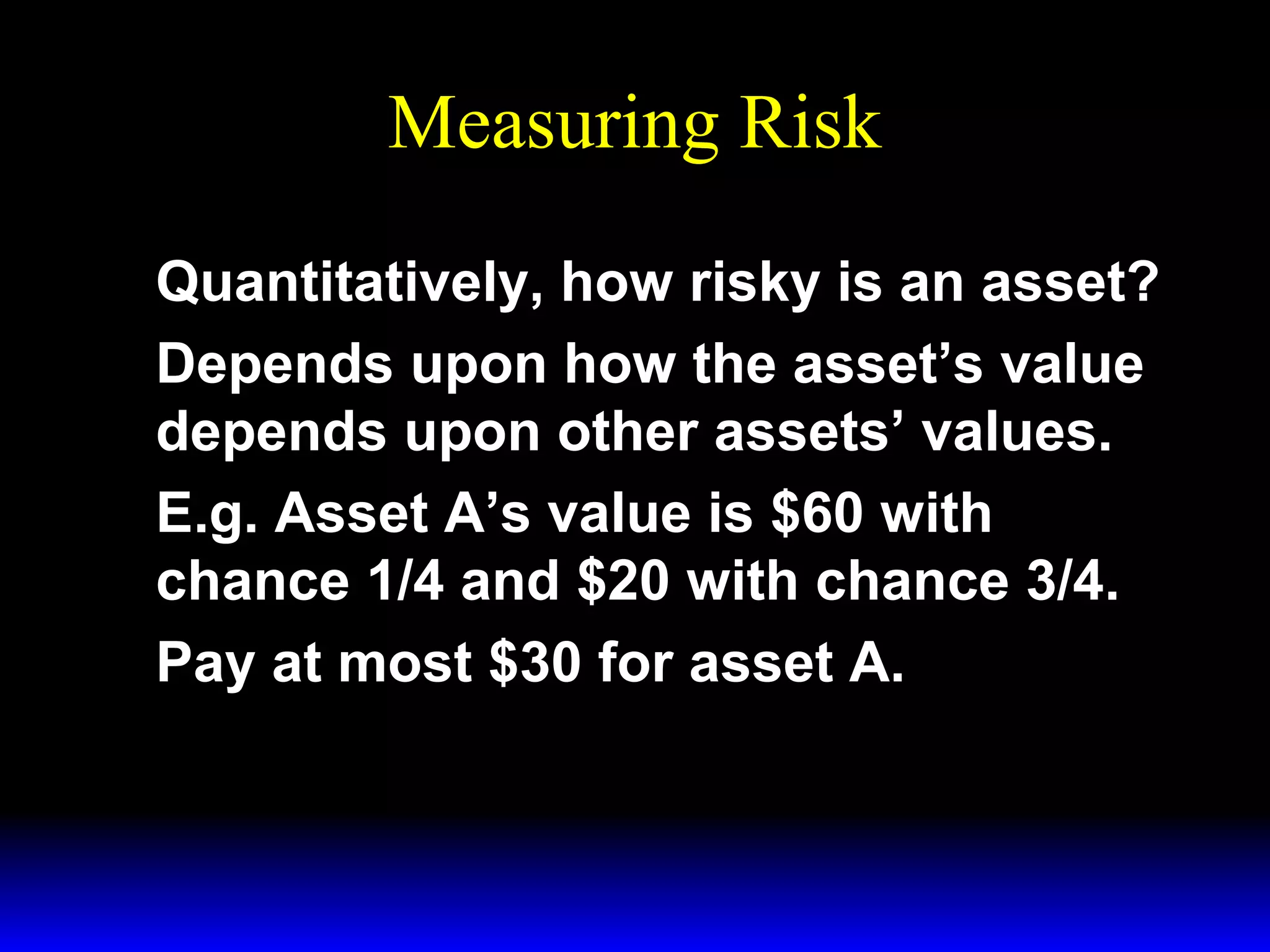

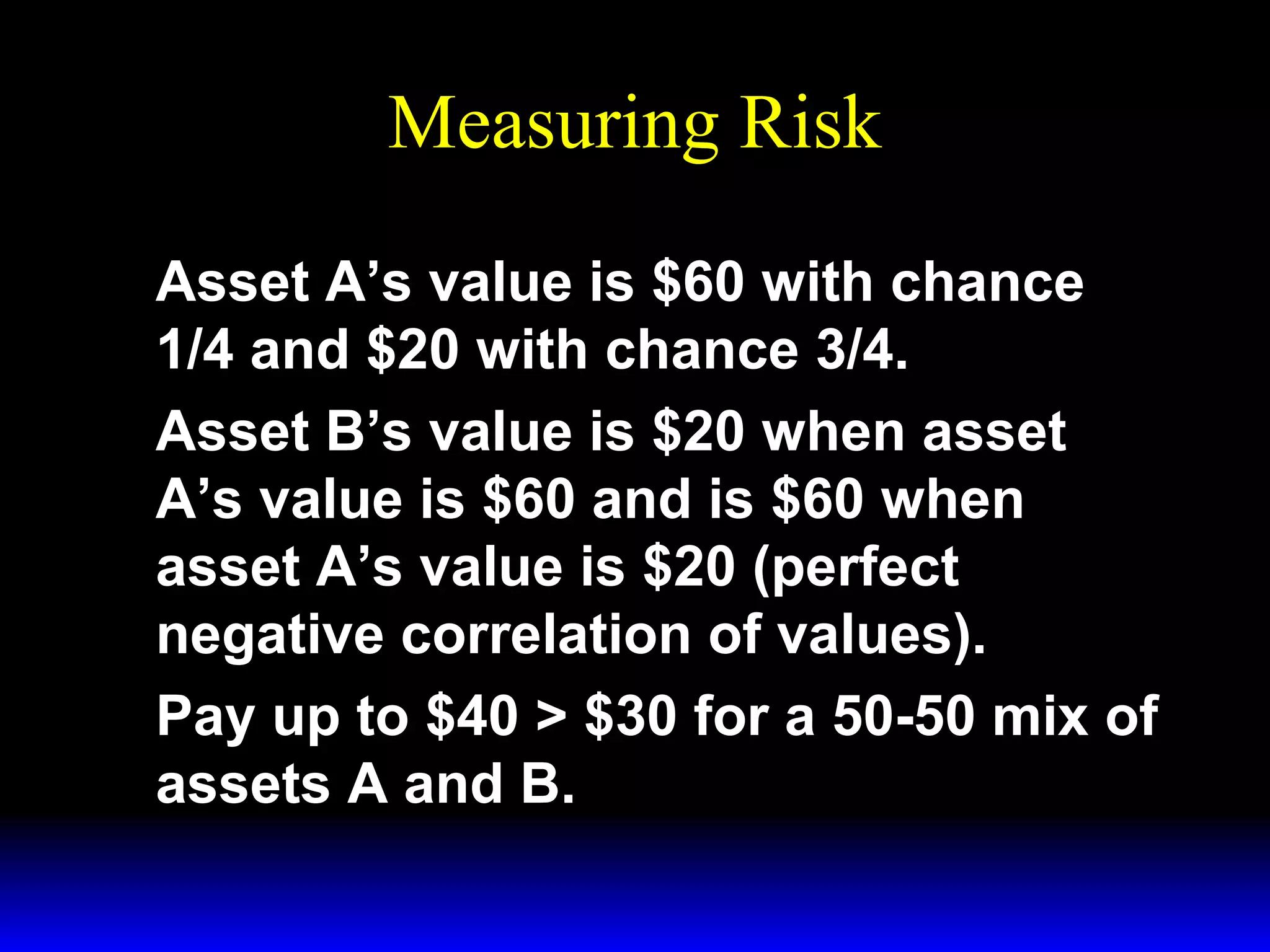

This document provides an overview of key concepts related to risky assets and portfolio choice including:

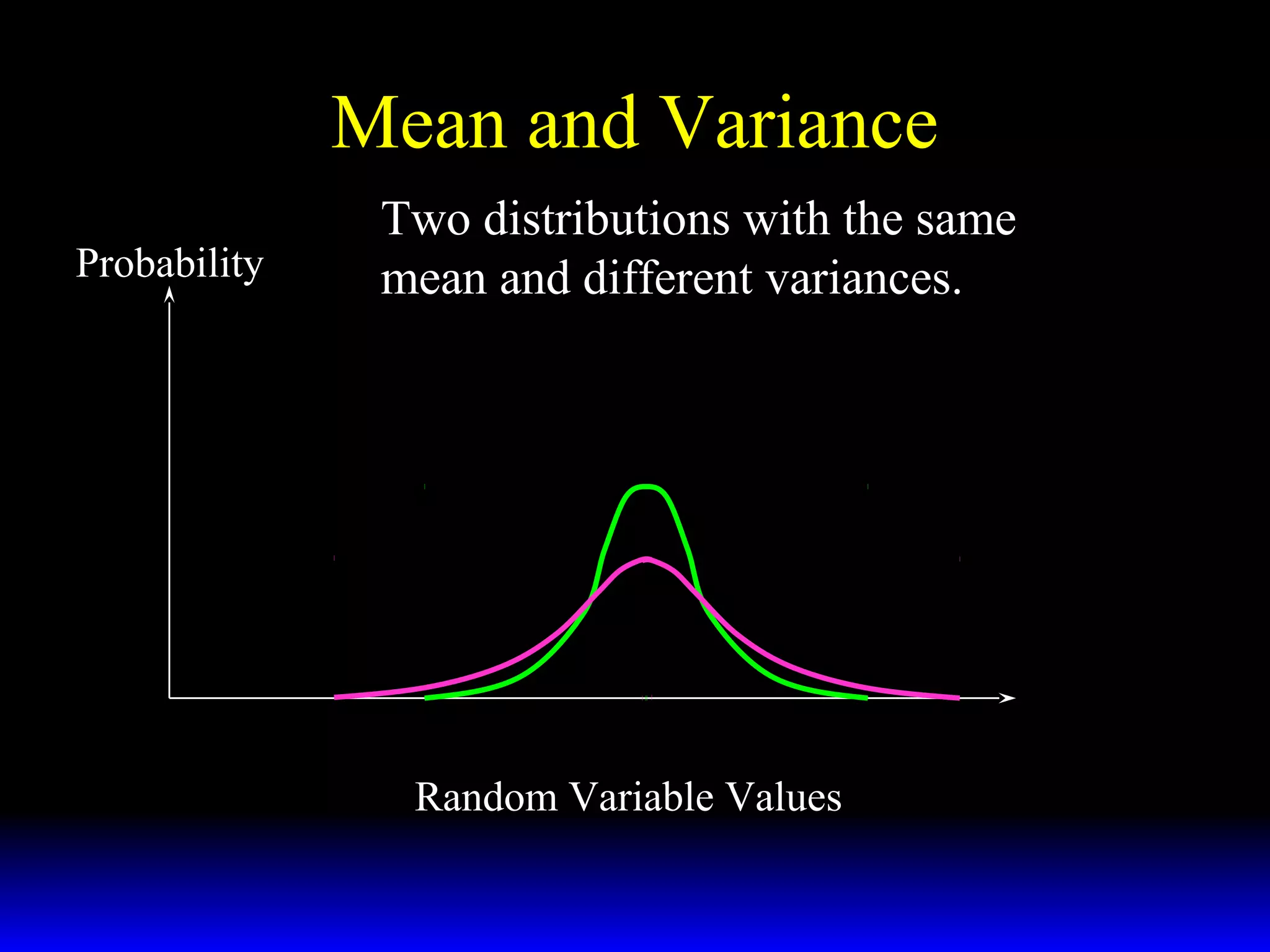

- The mean and variance of distributions and how they measure the expected value and variation of random variables.

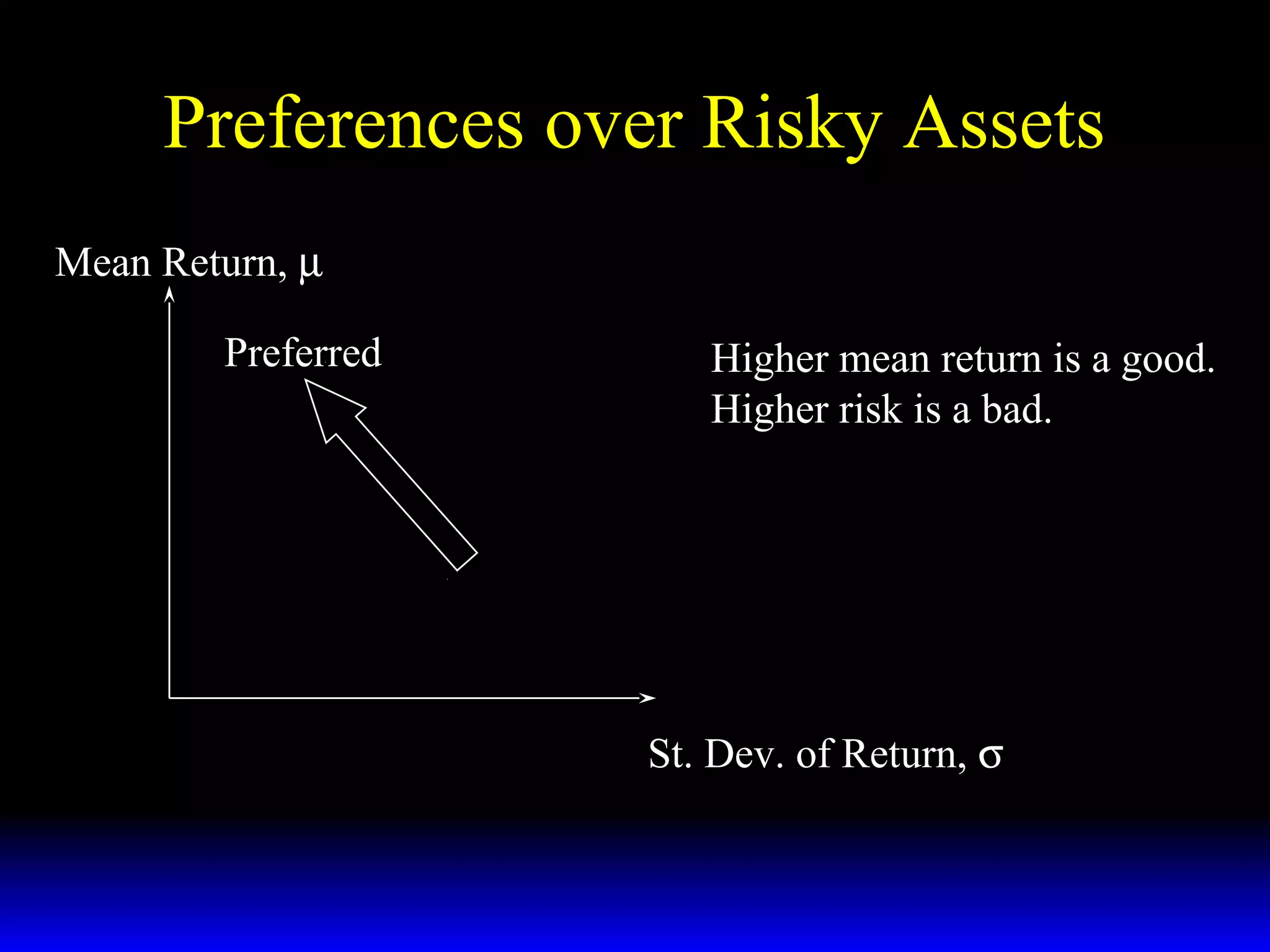

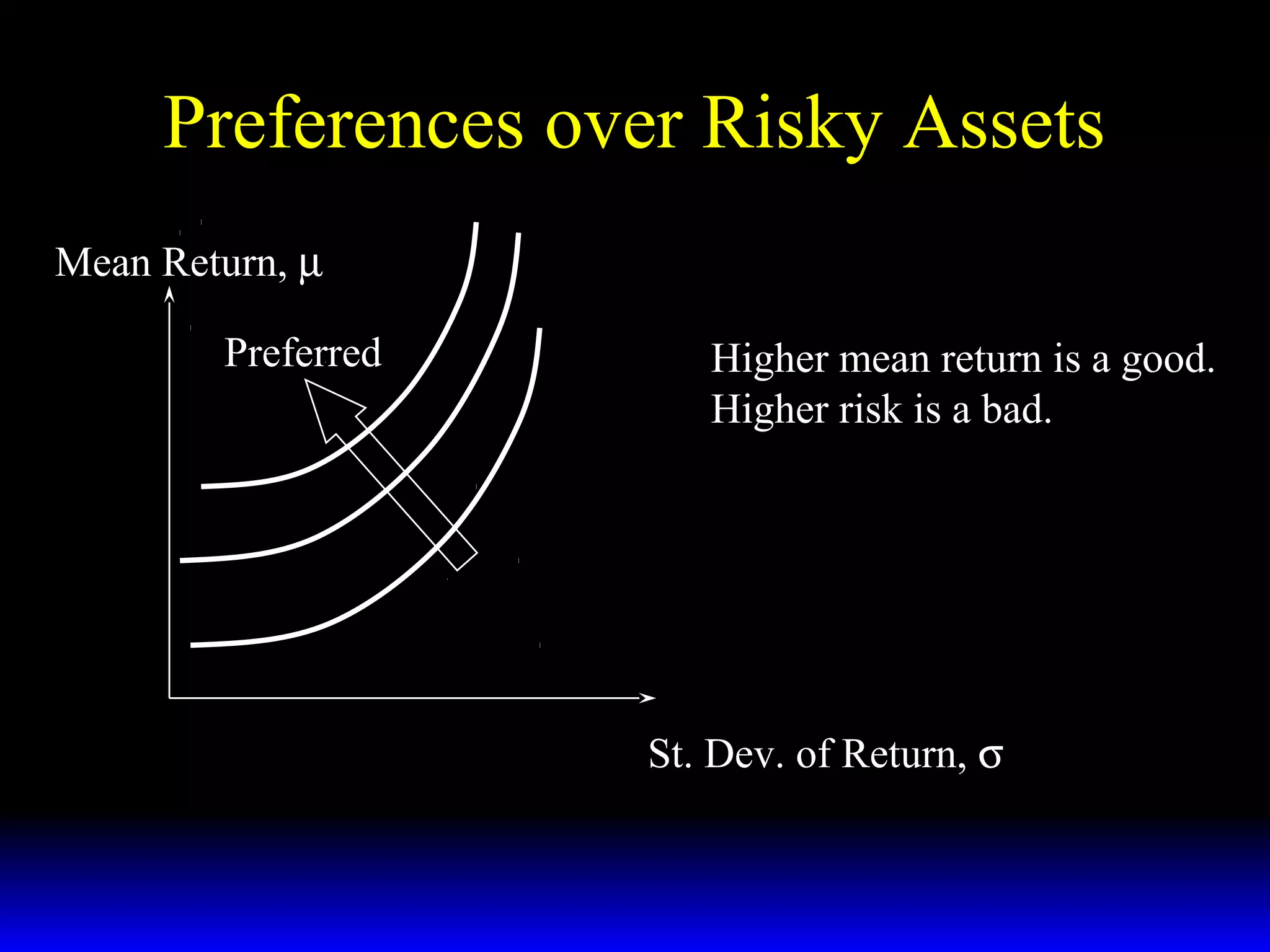

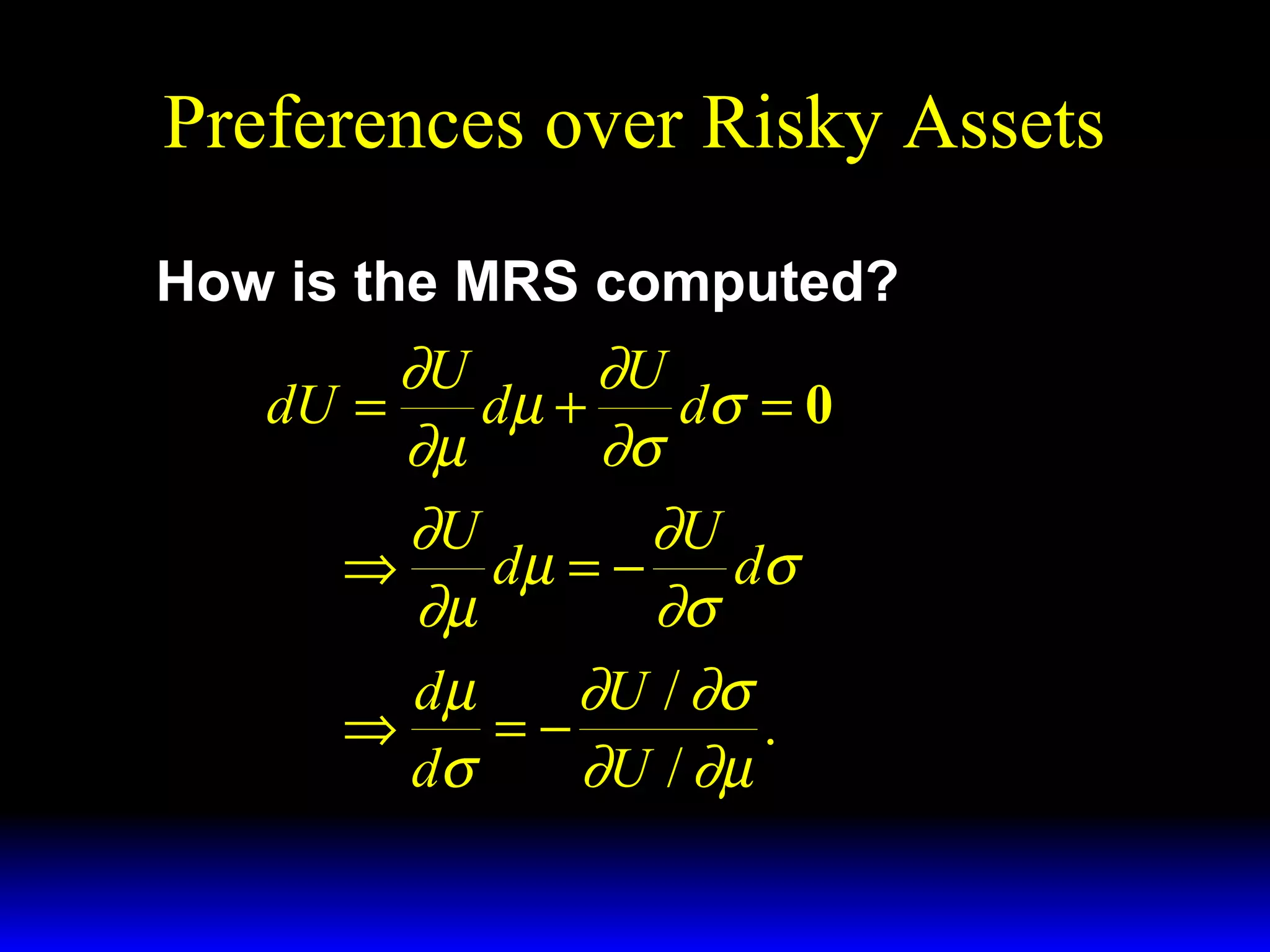

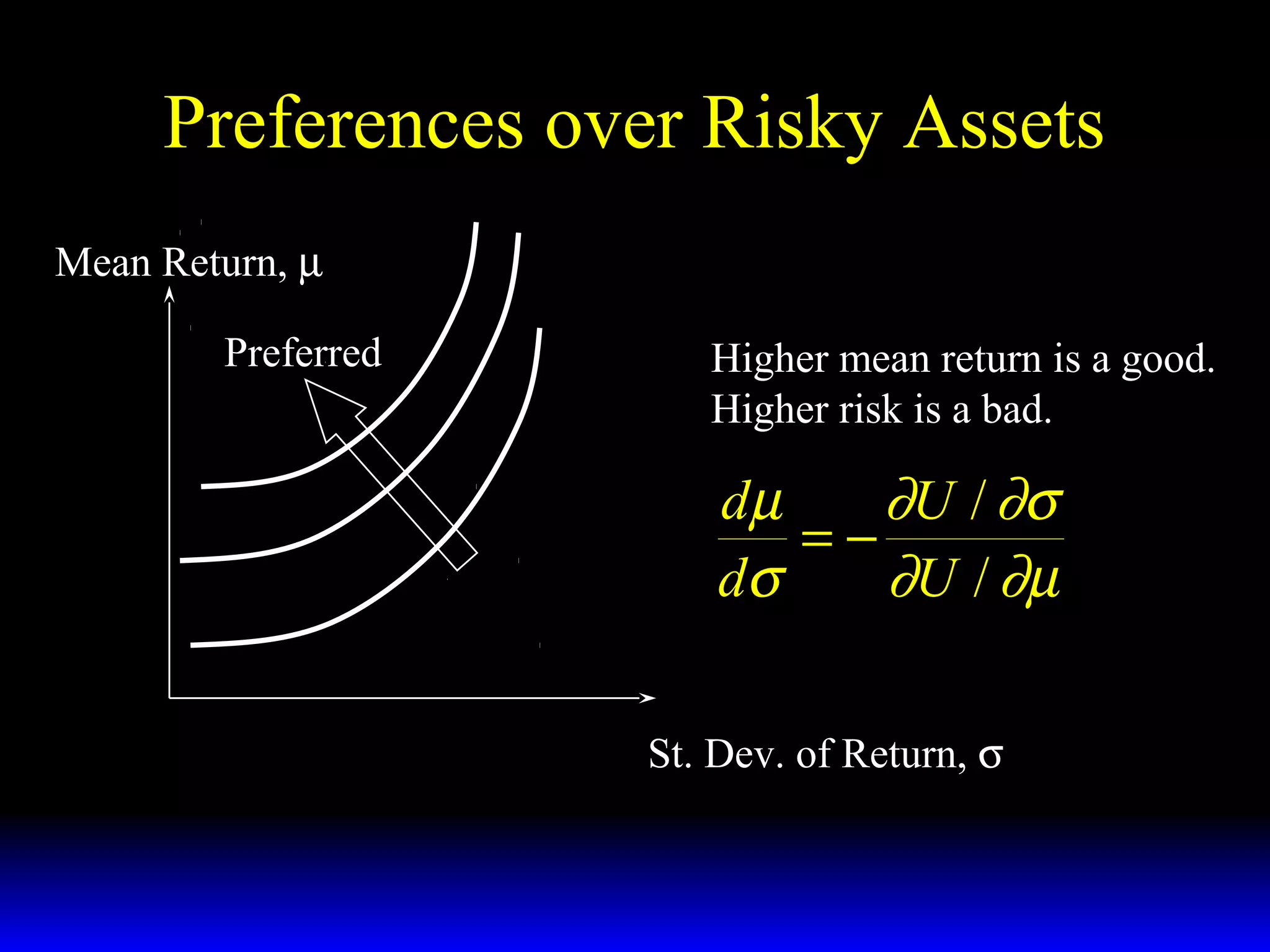

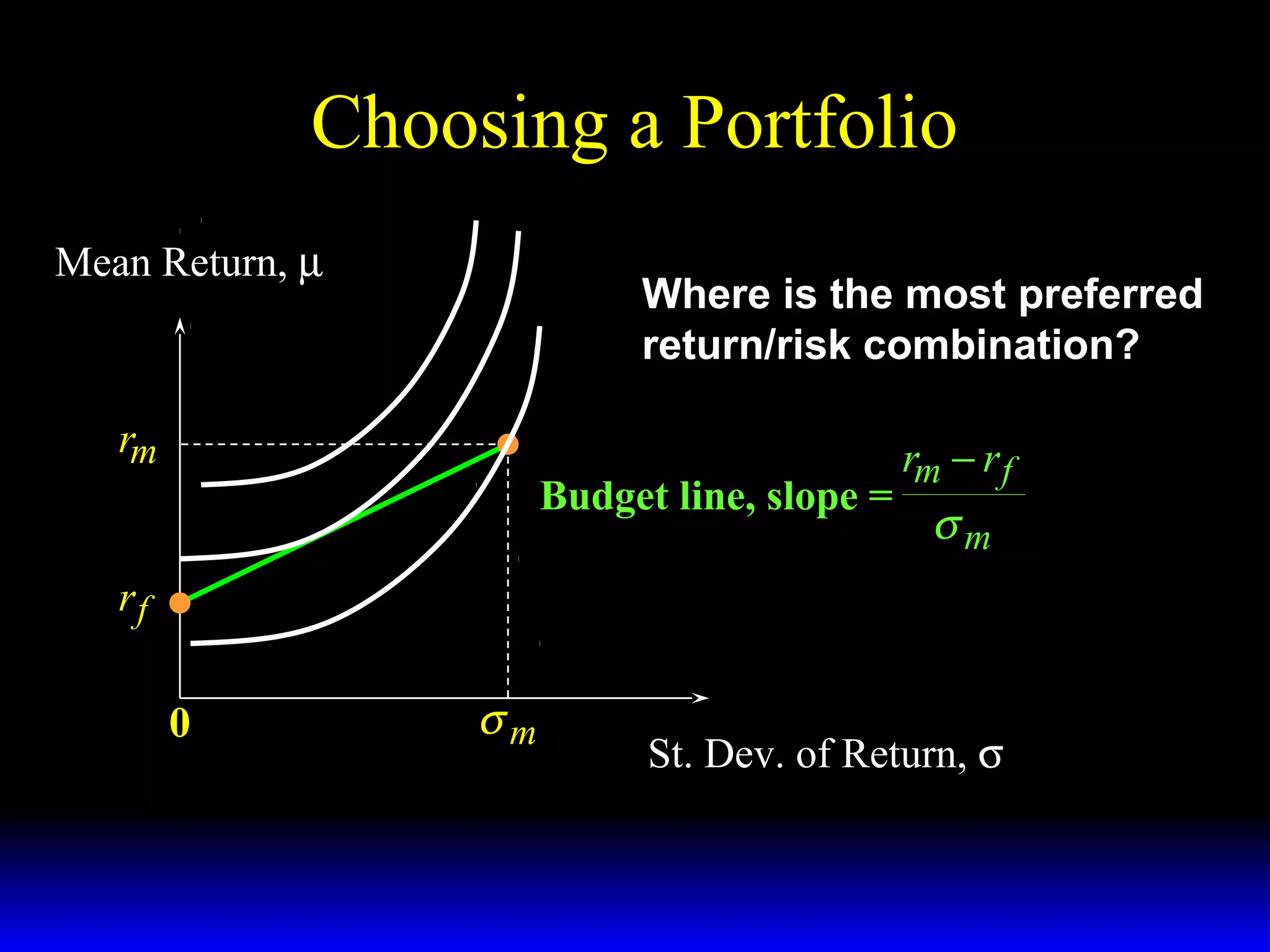

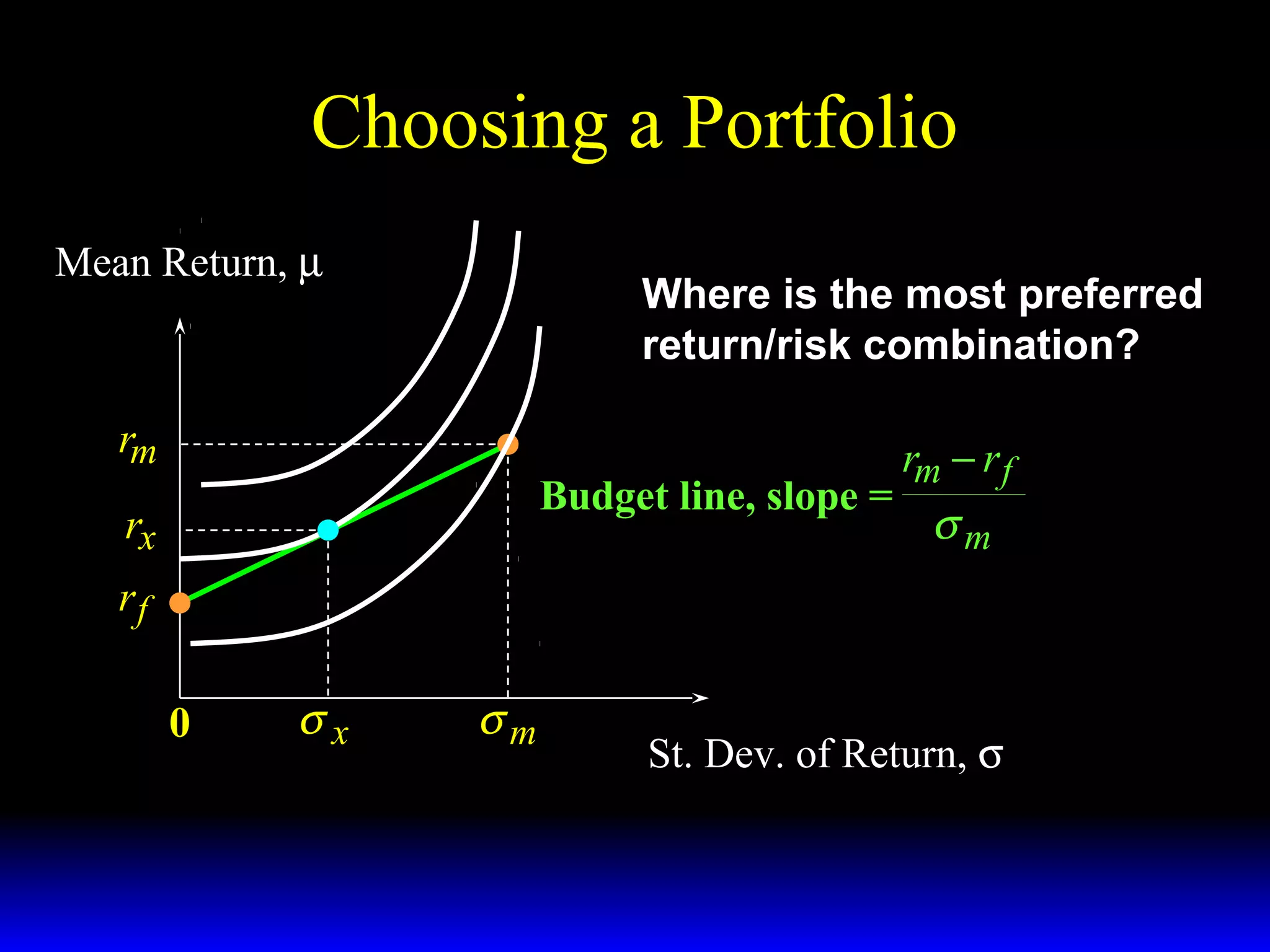

- How investors prefer higher returns but less risk, represented by a utility function.

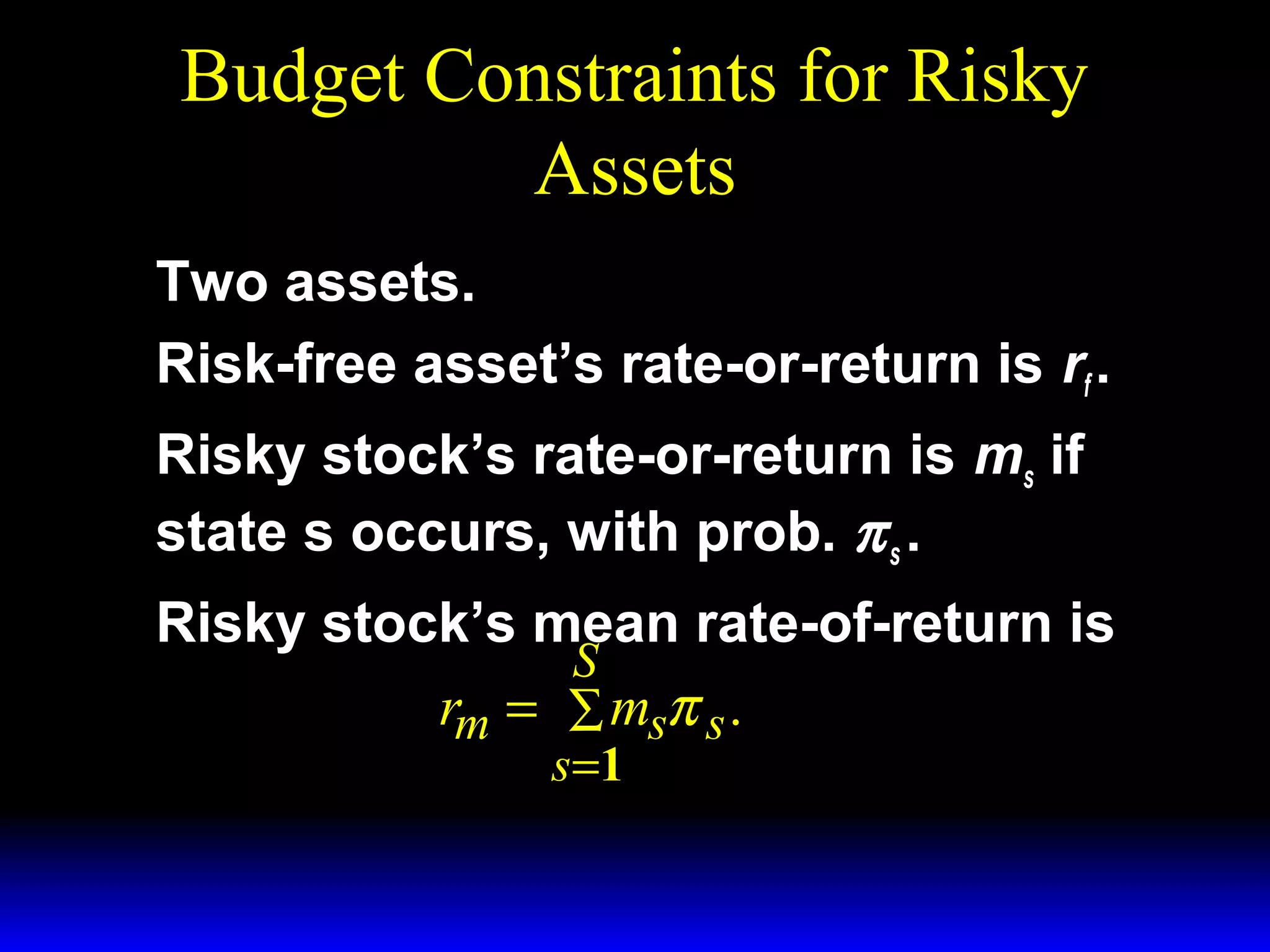

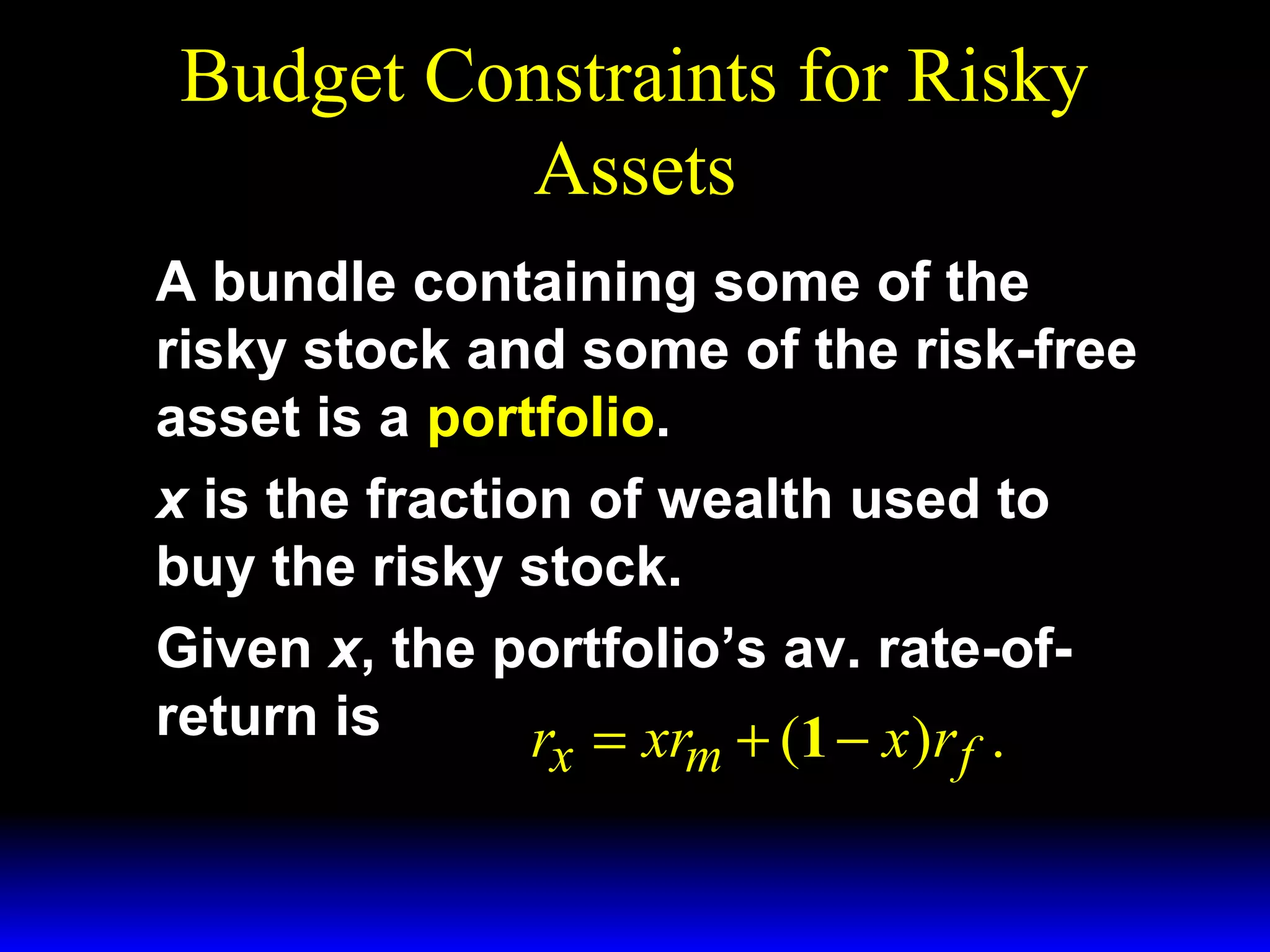

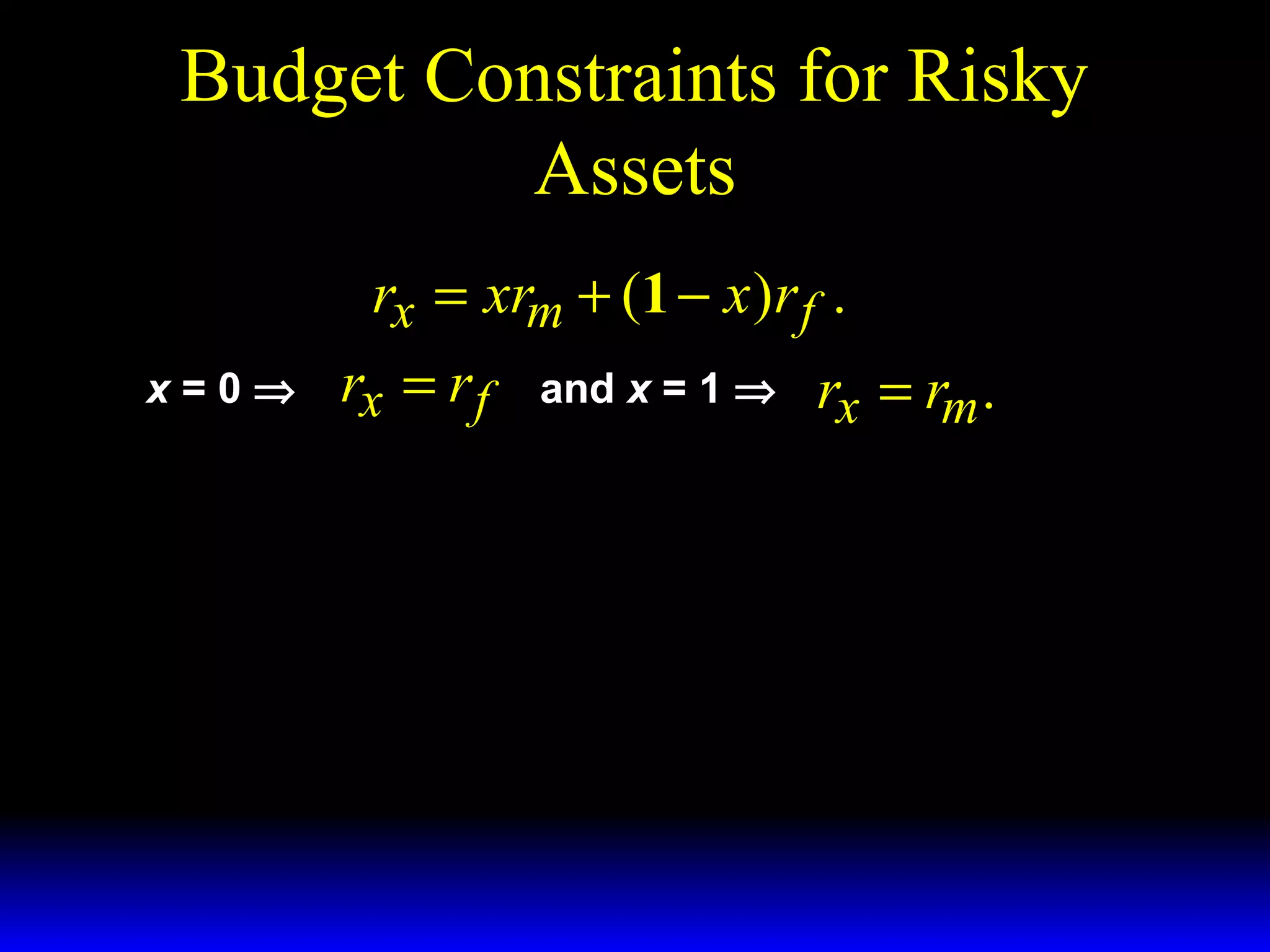

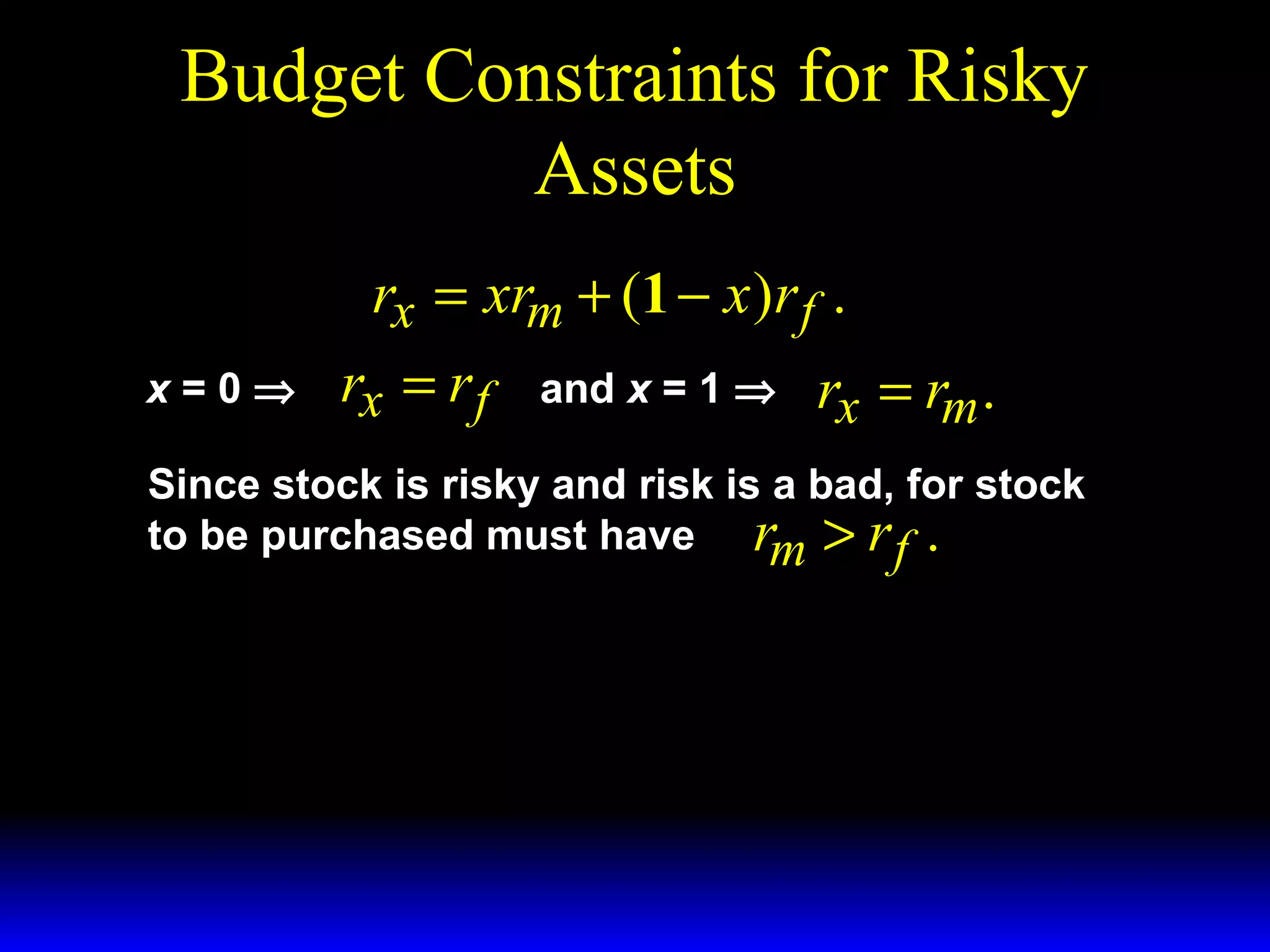

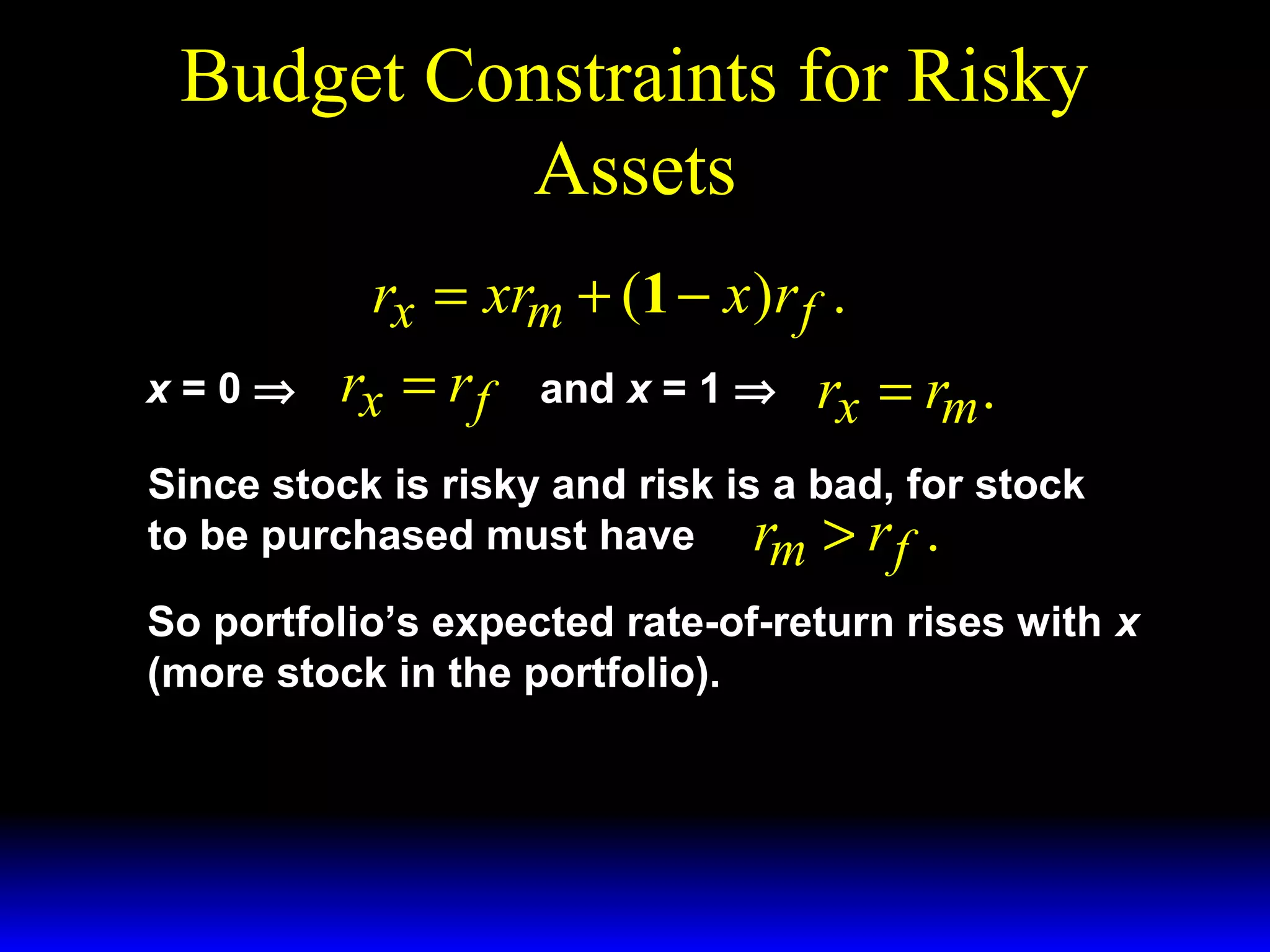

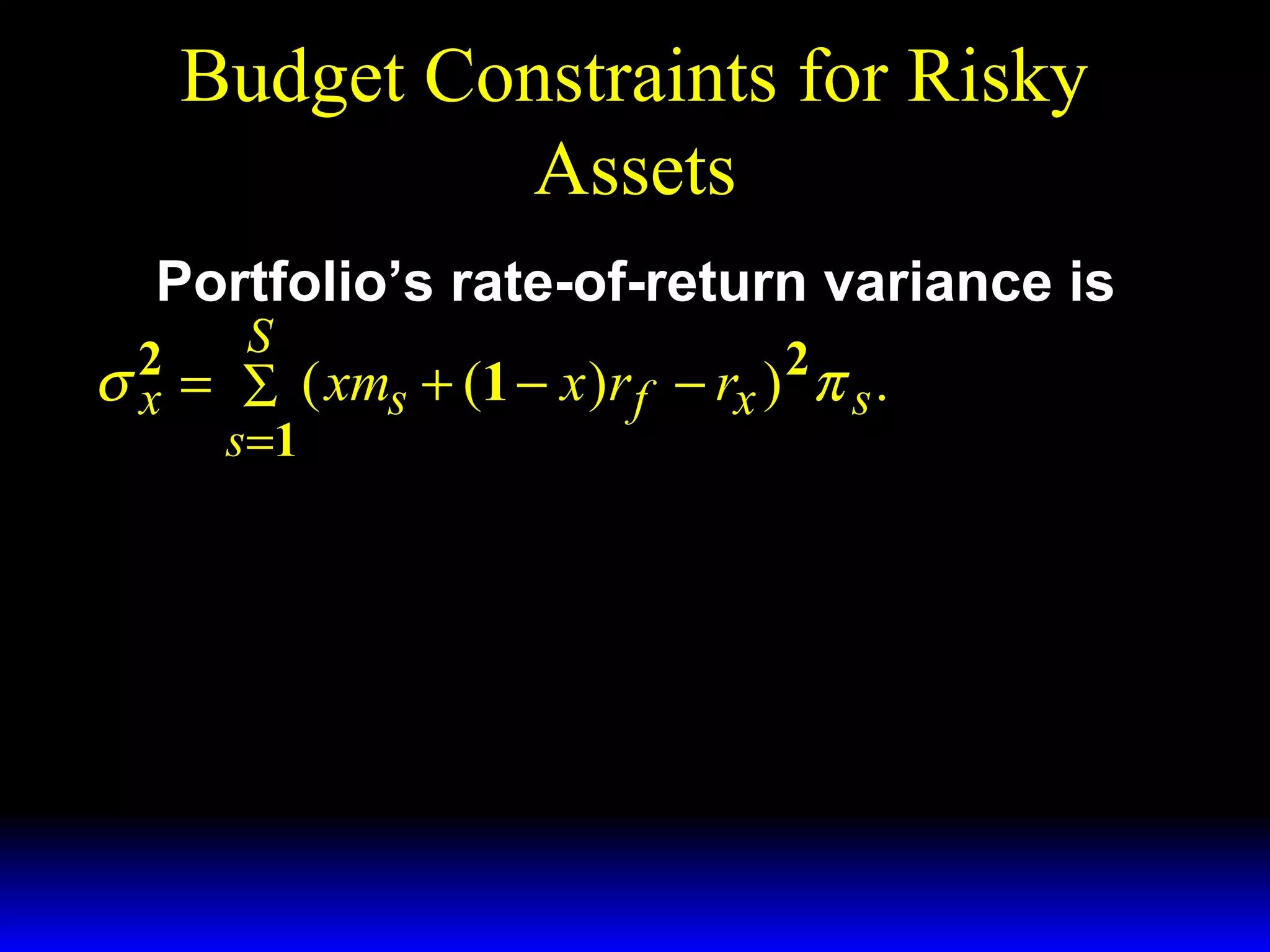

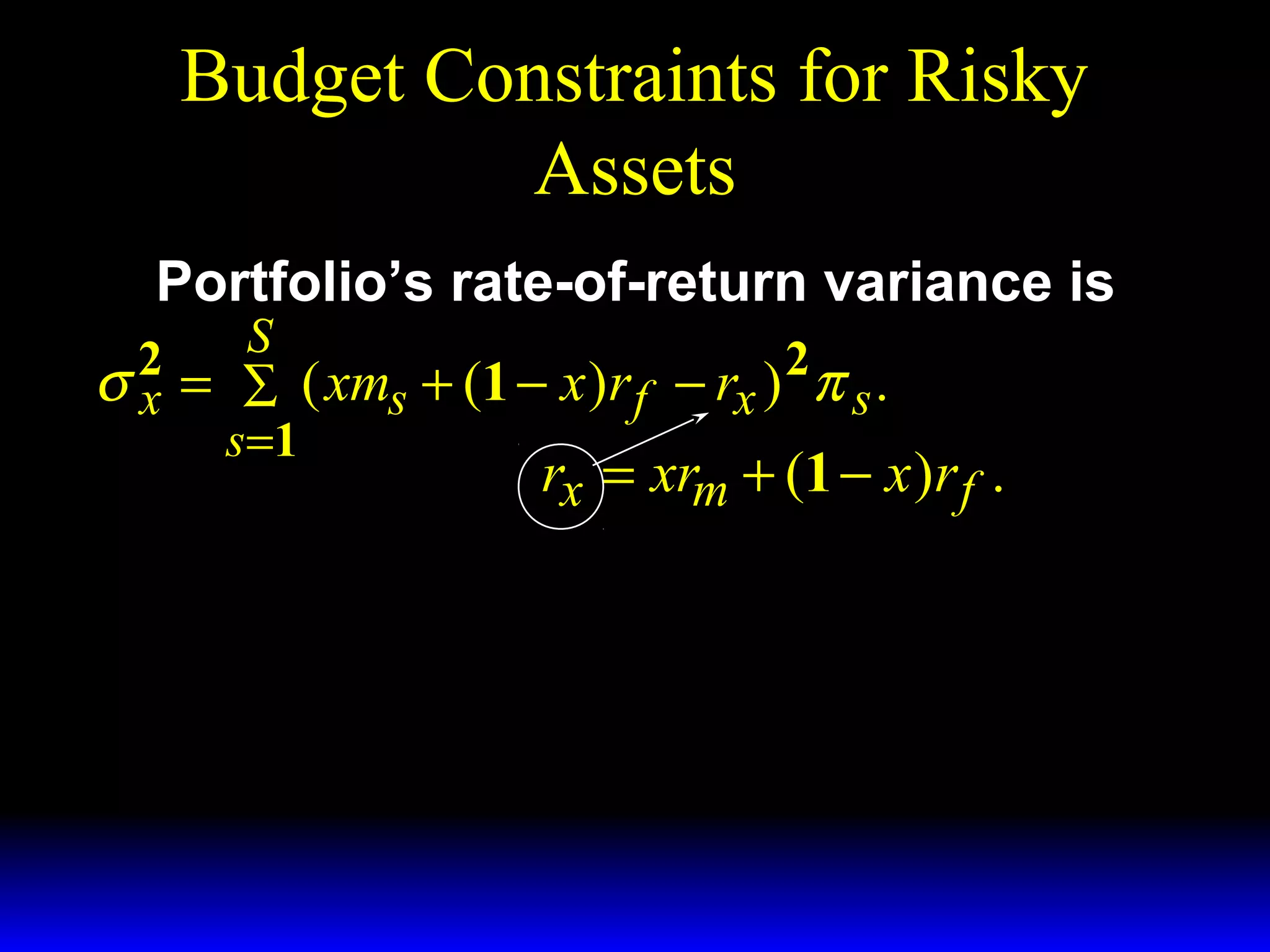

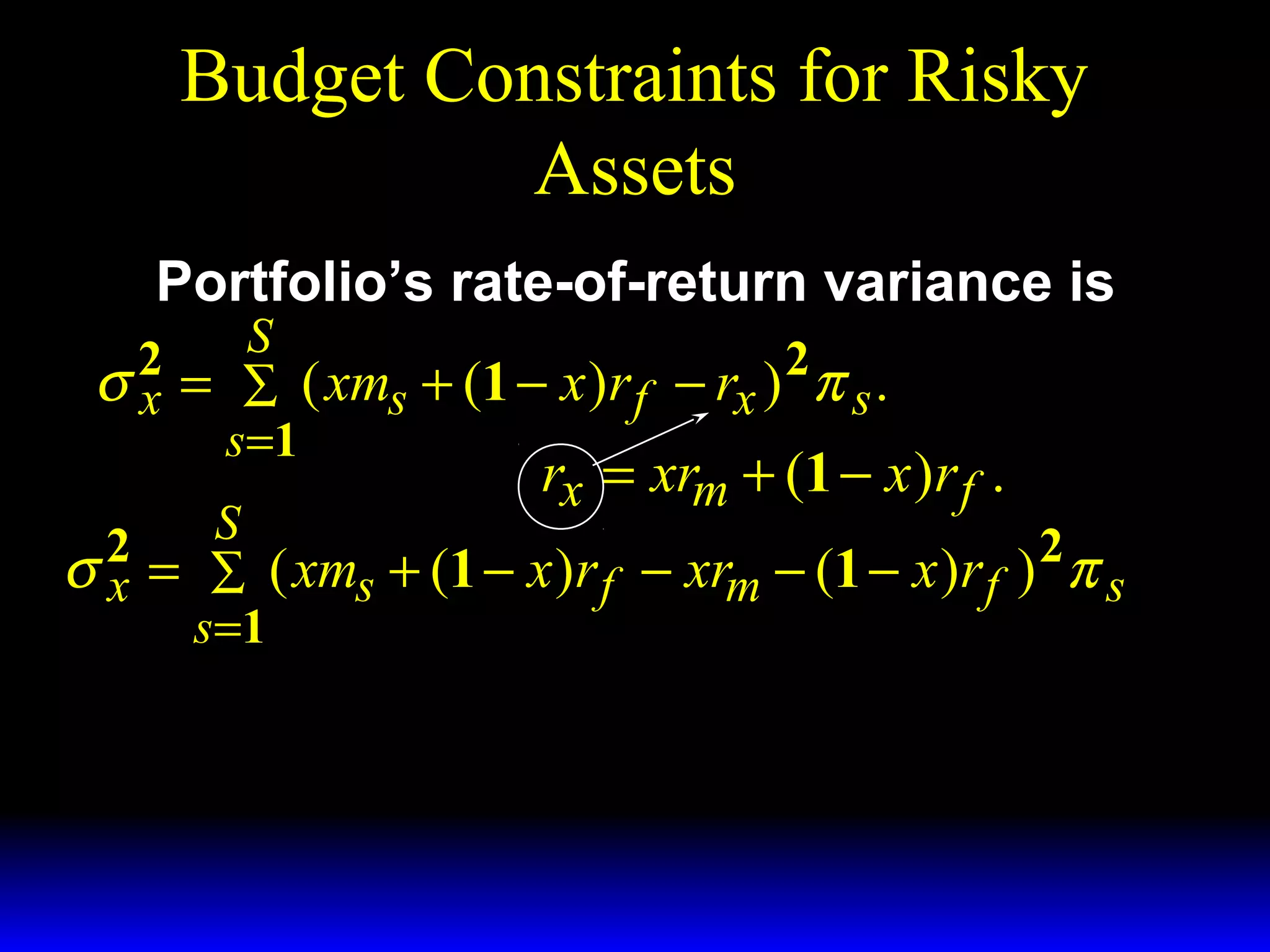

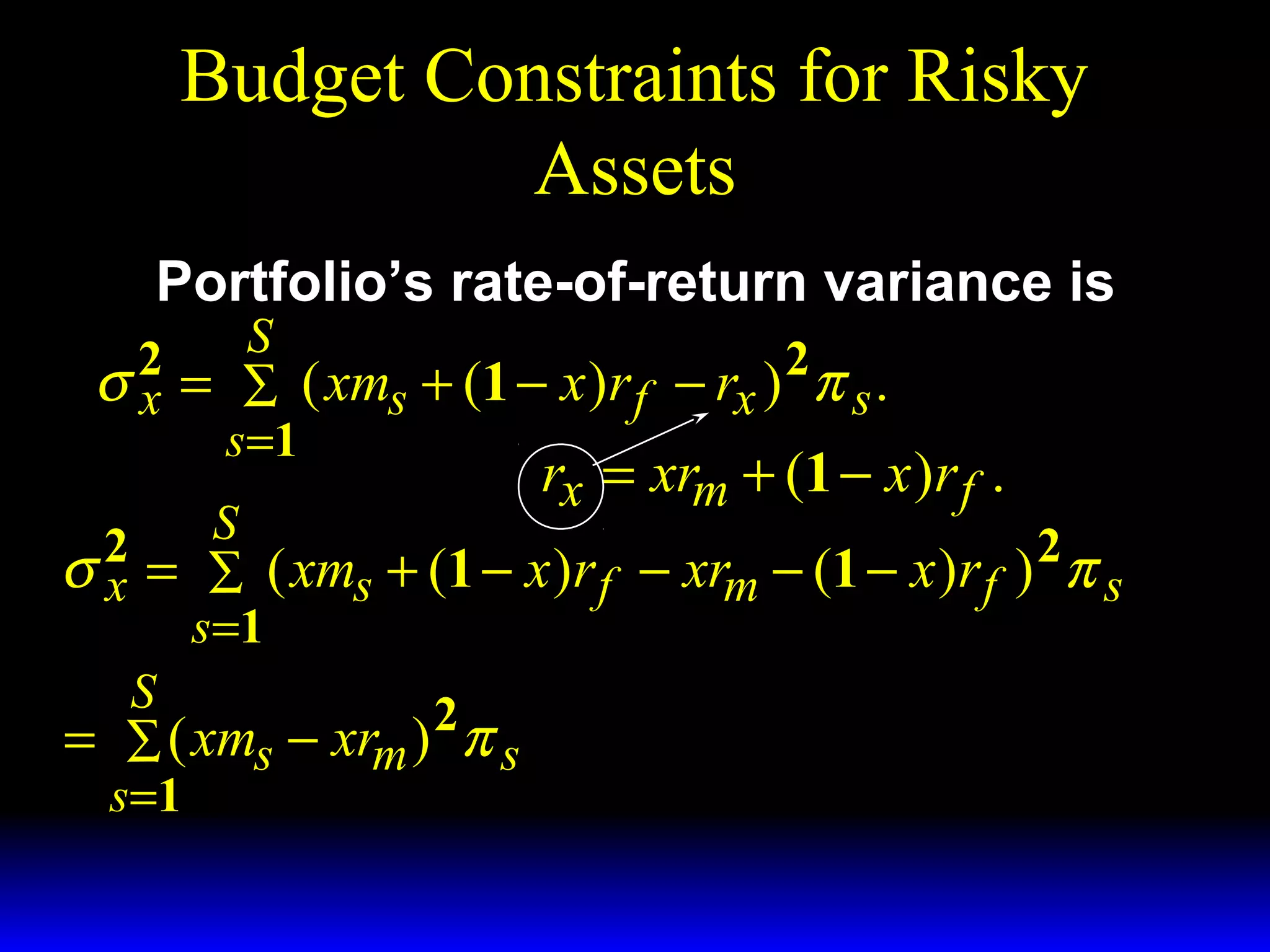

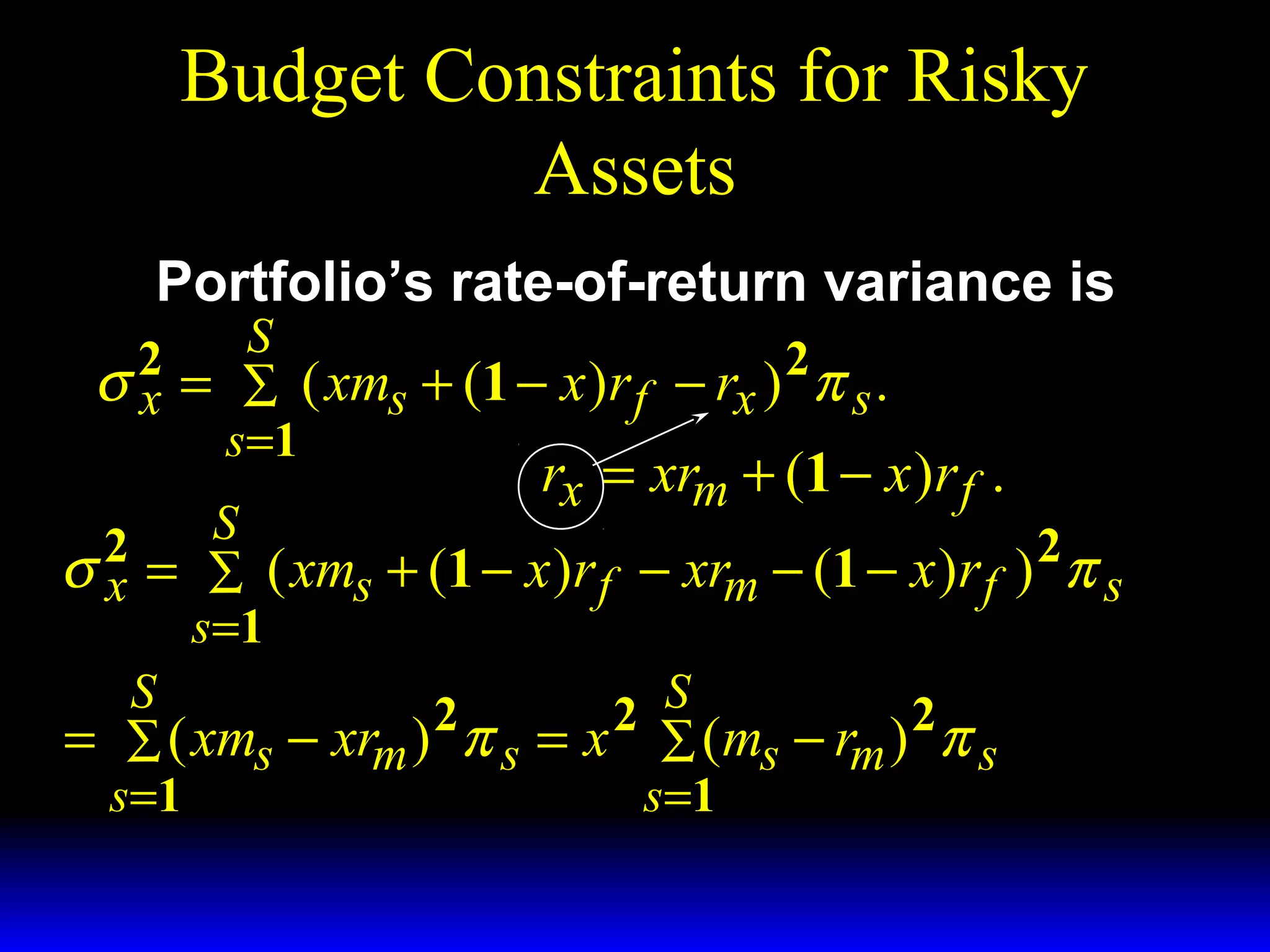

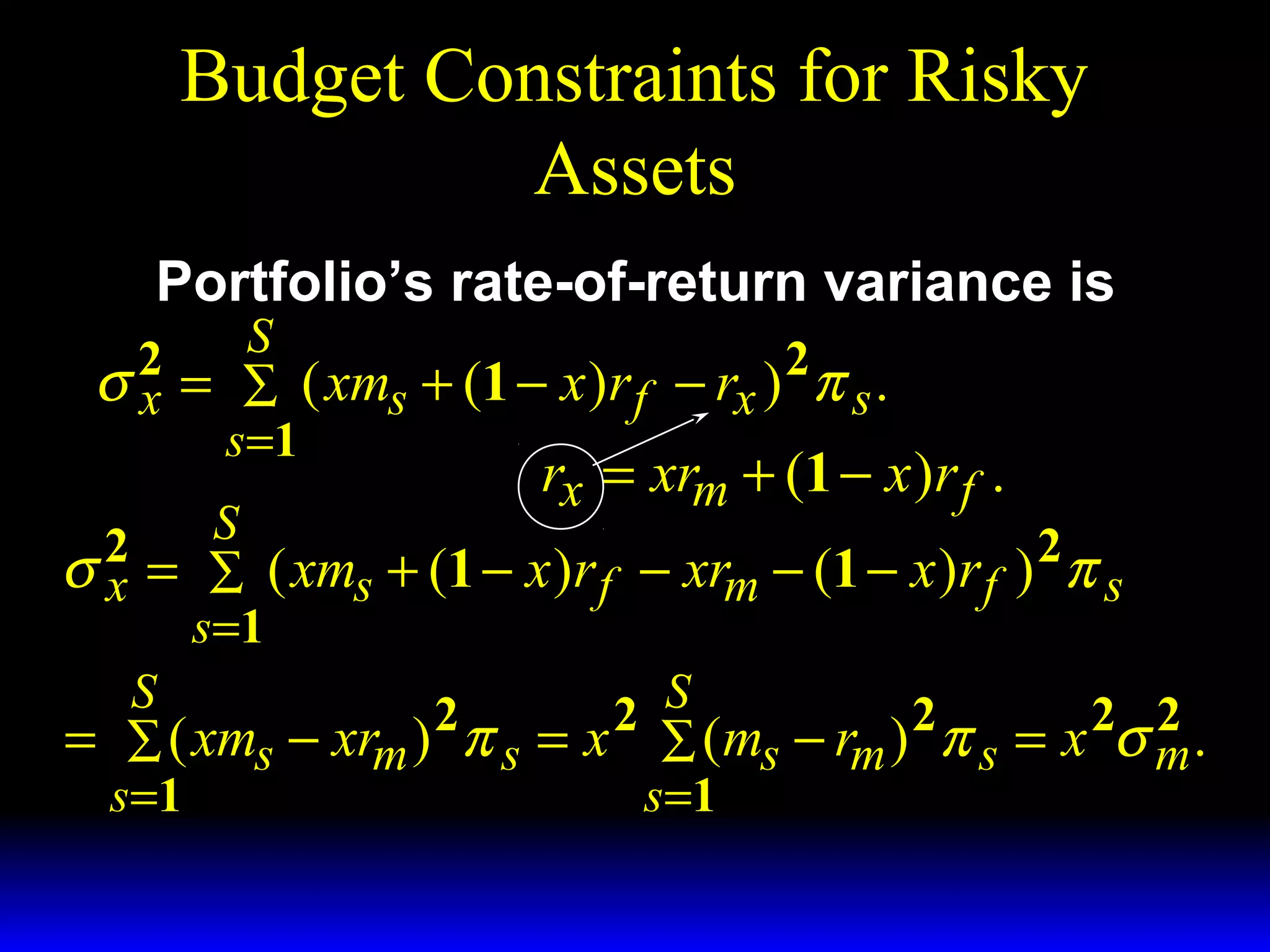

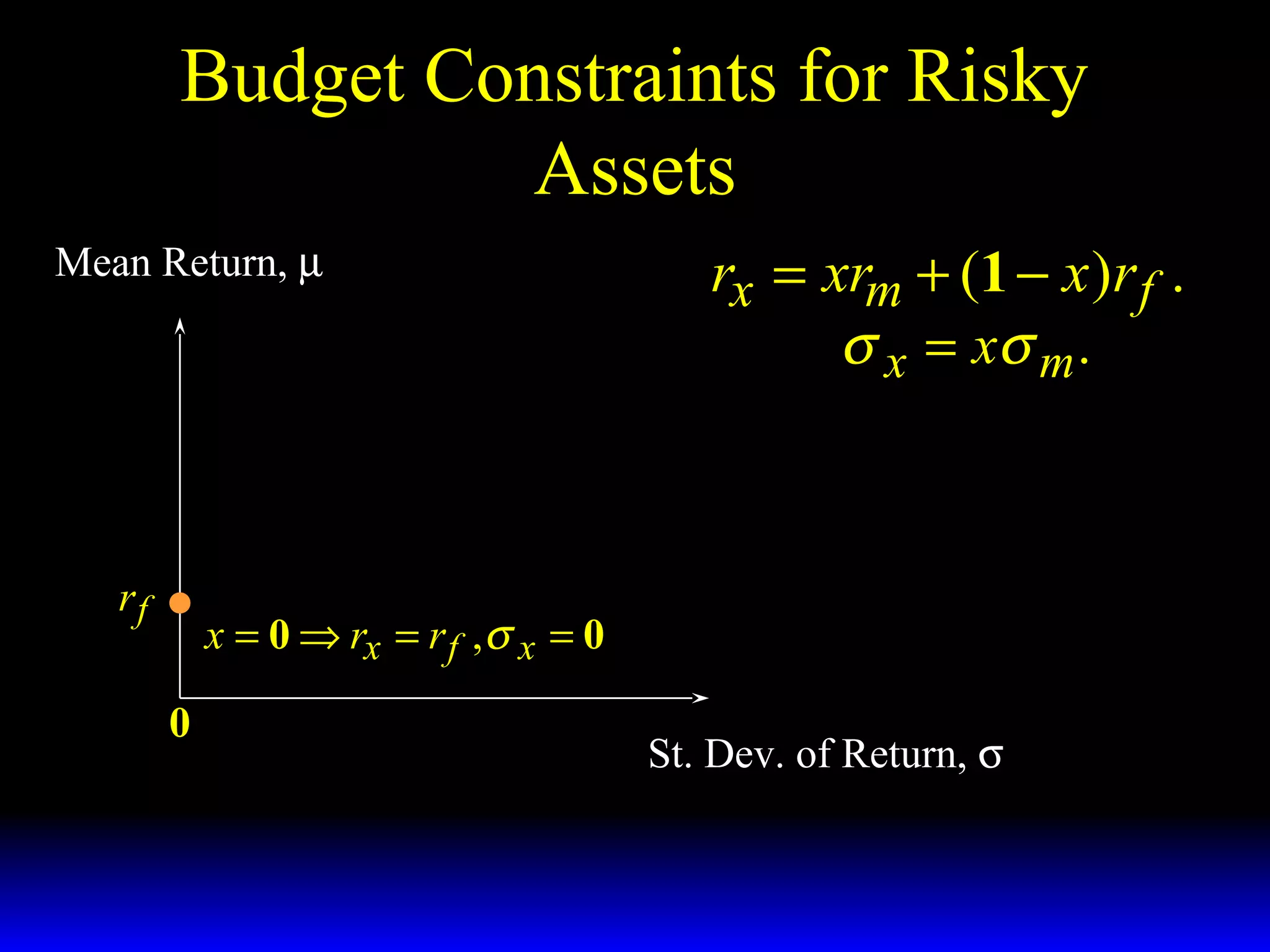

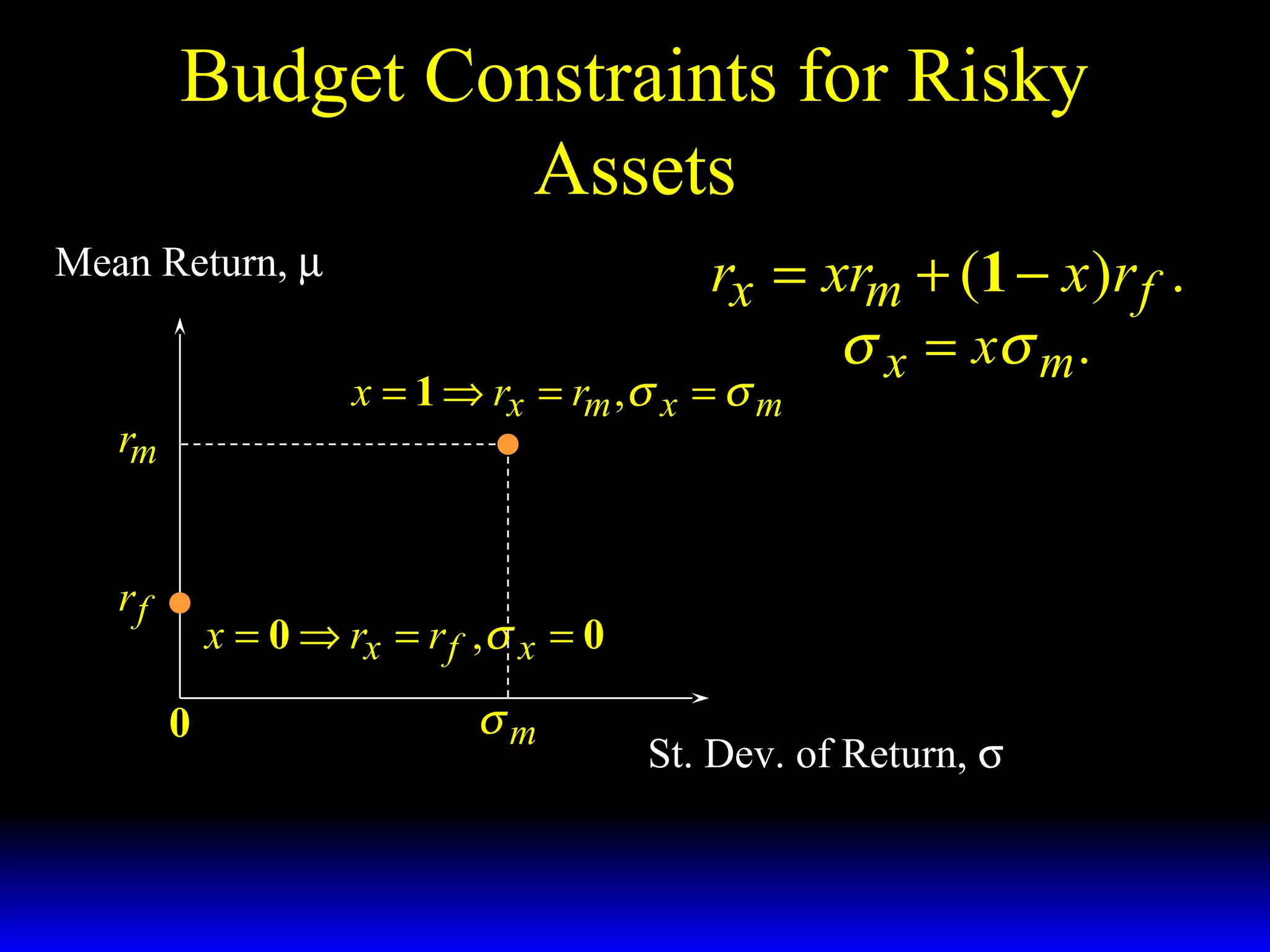

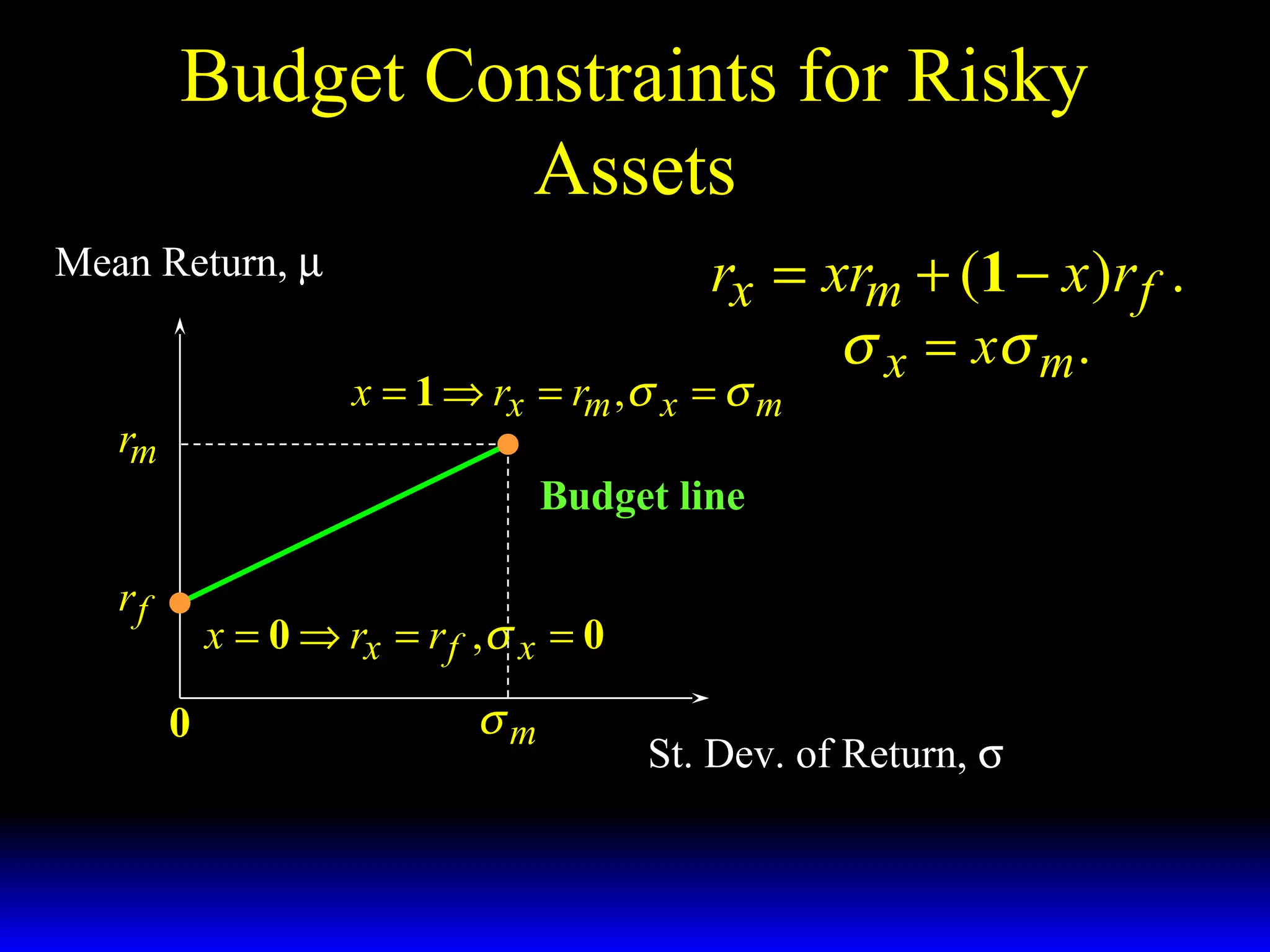

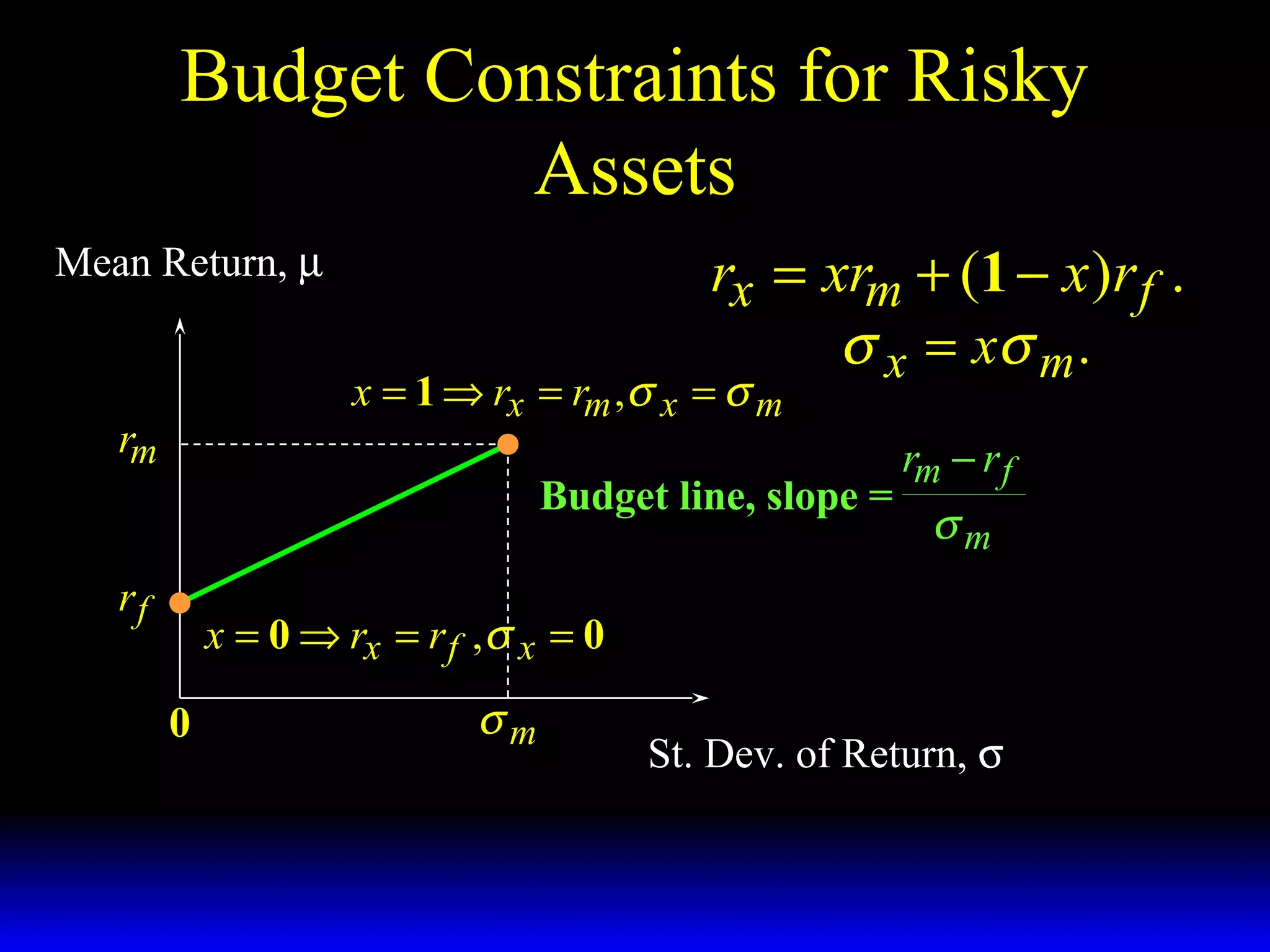

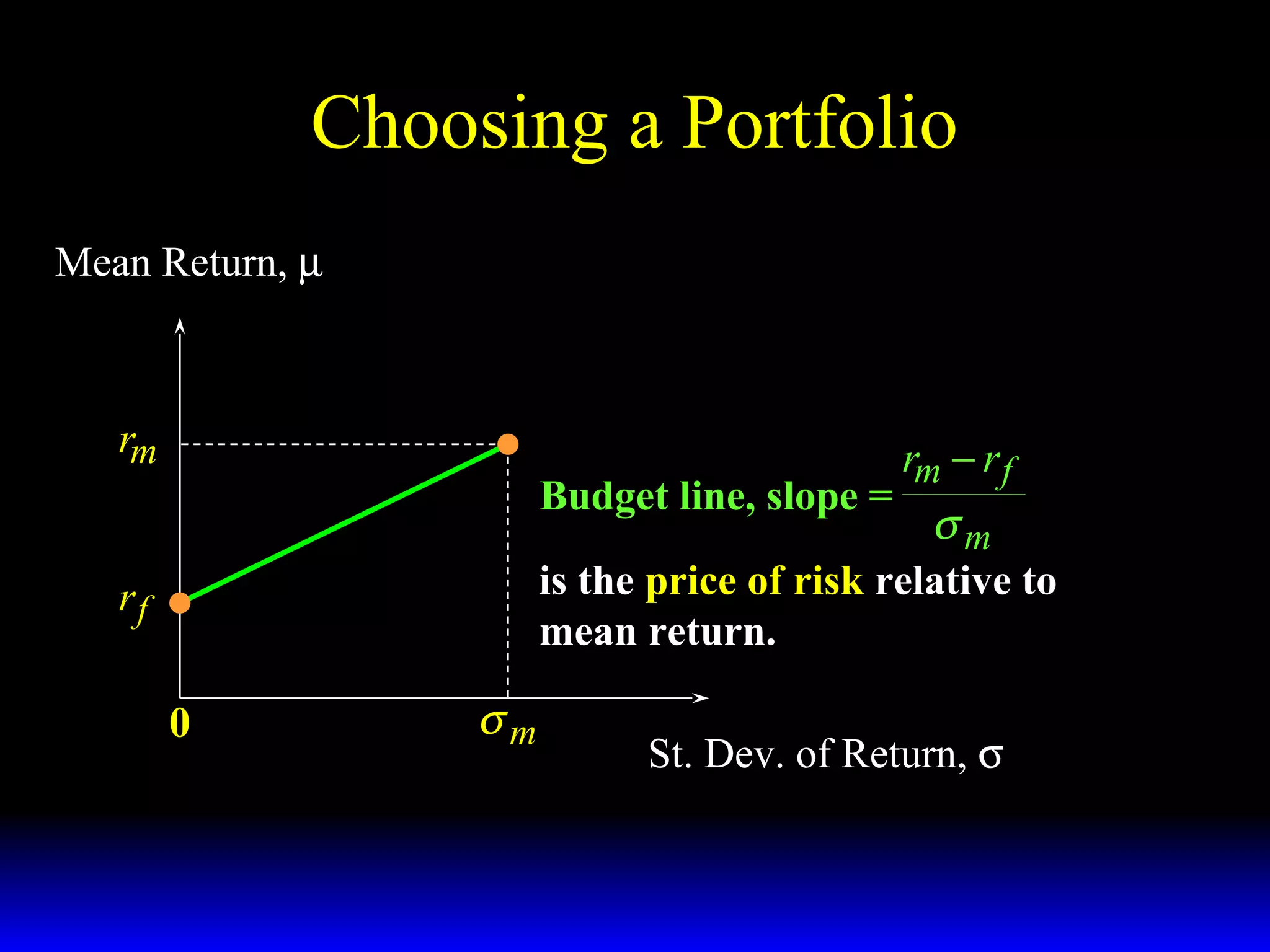

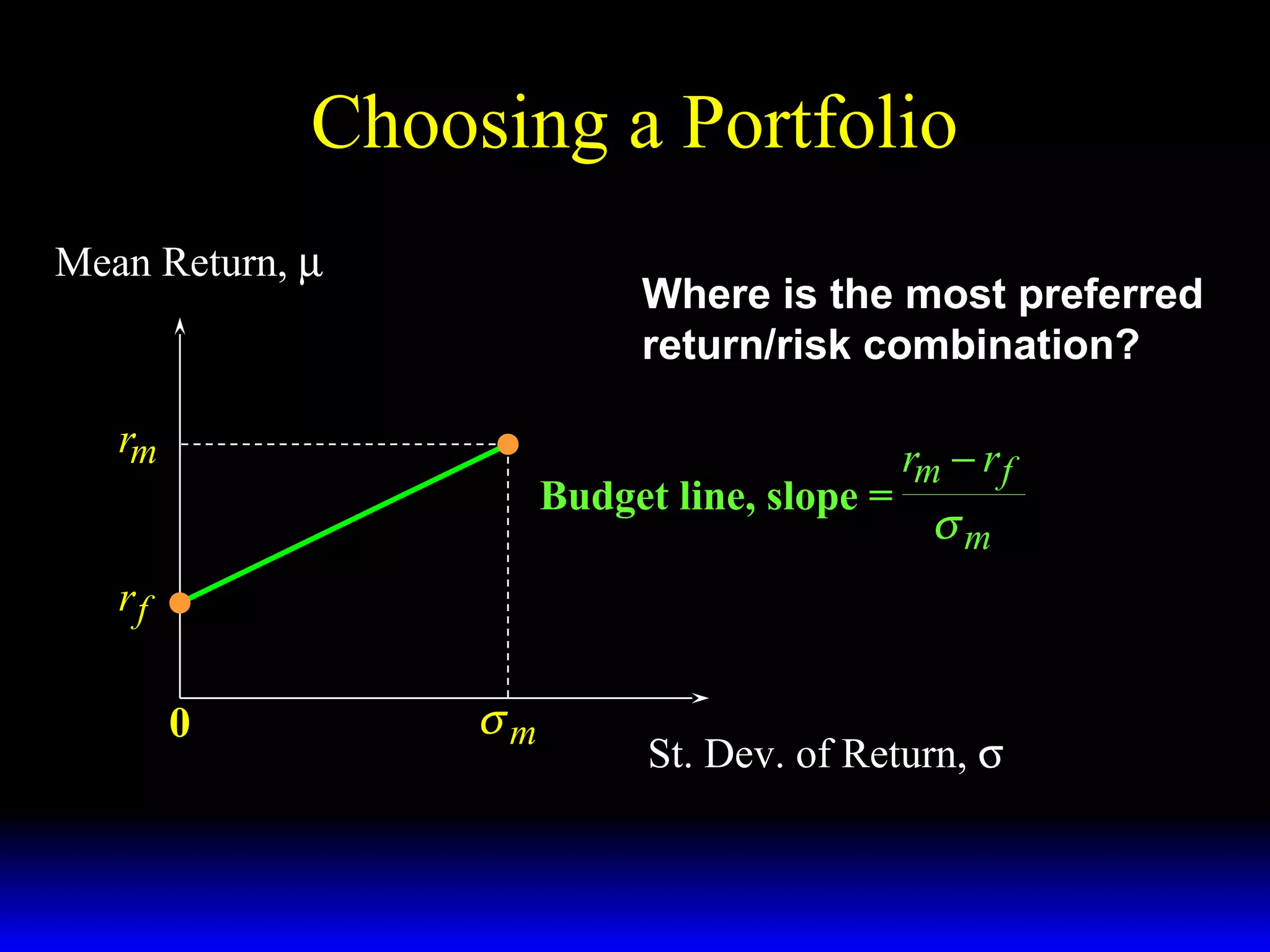

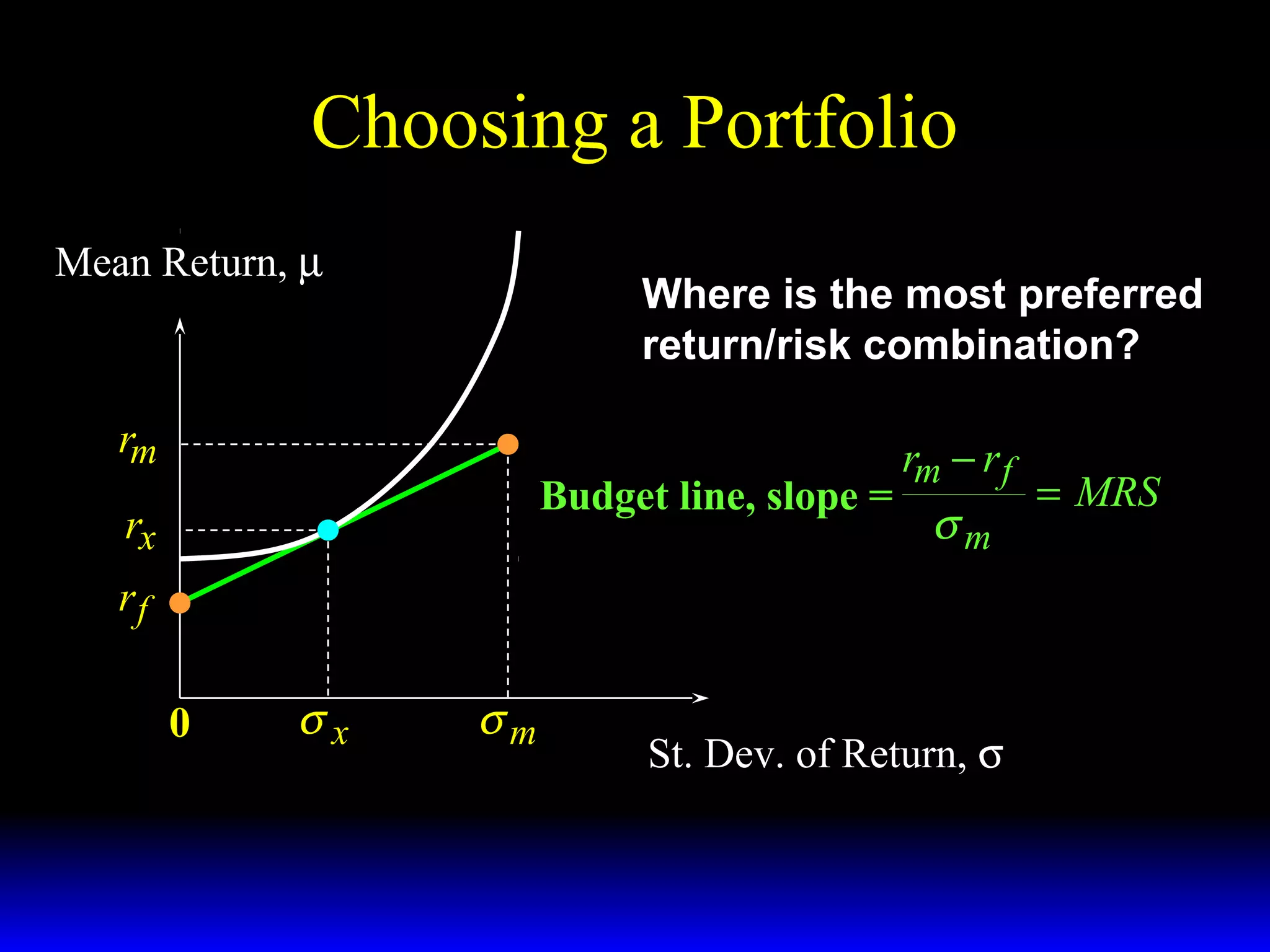

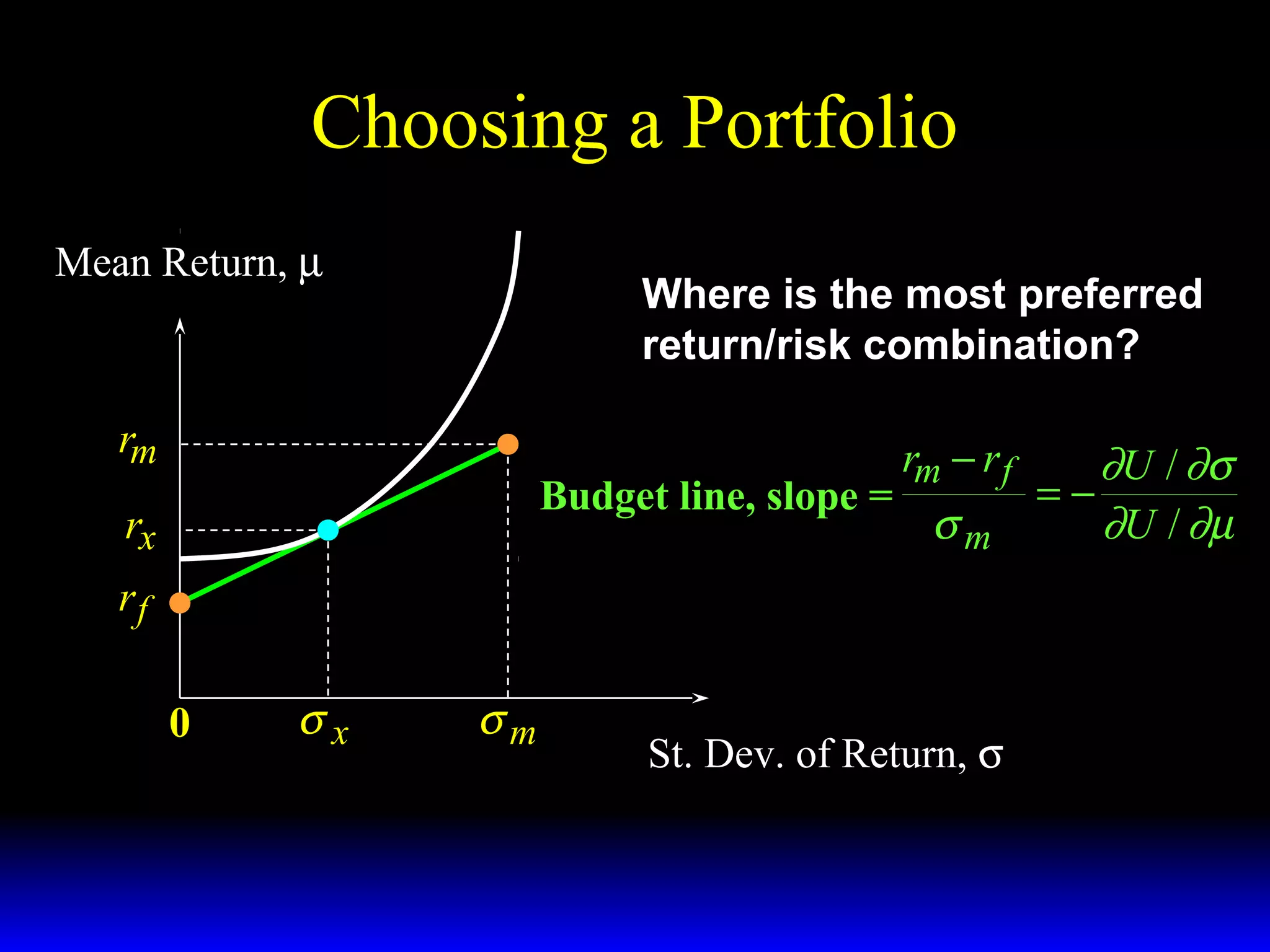

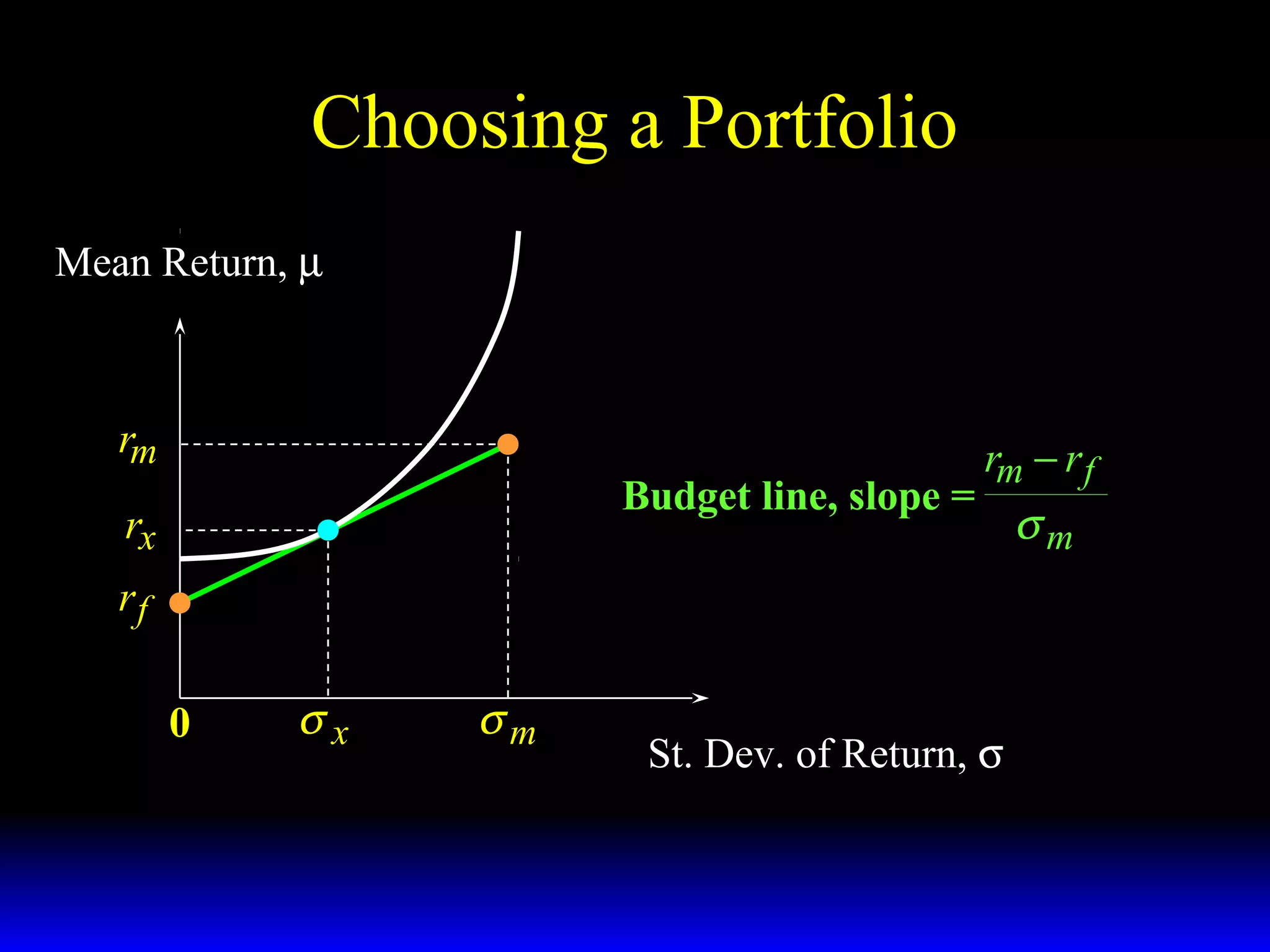

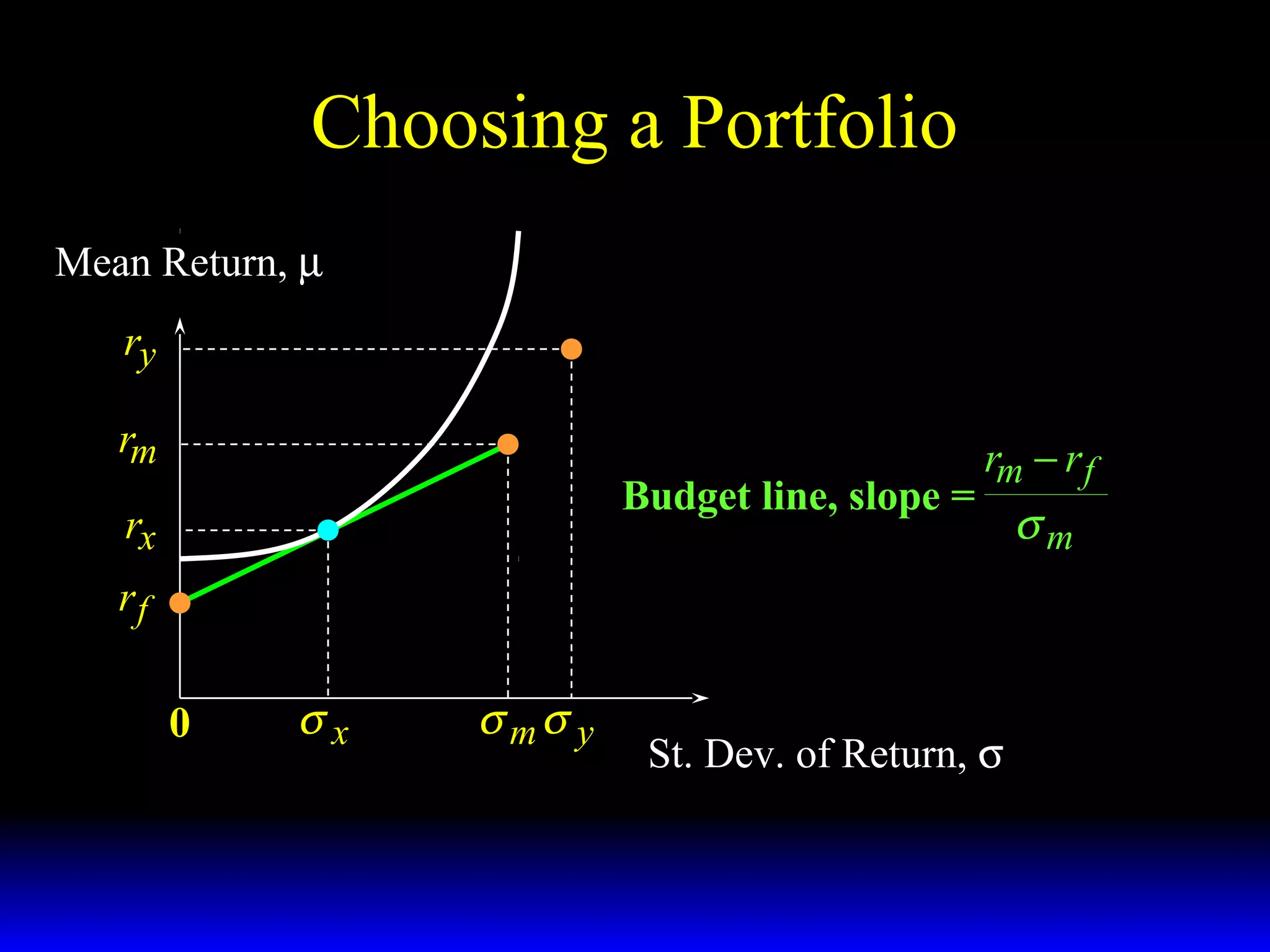

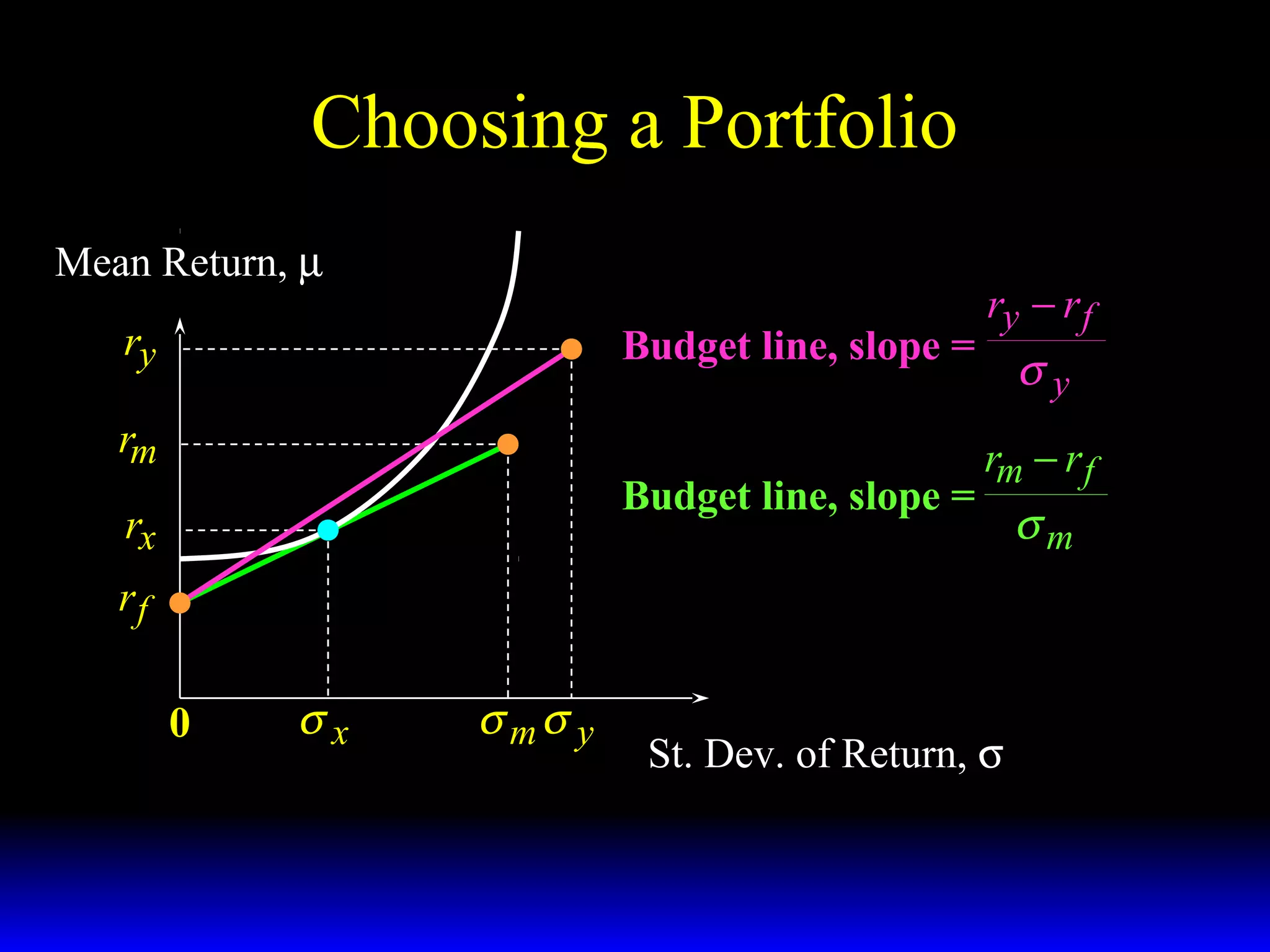

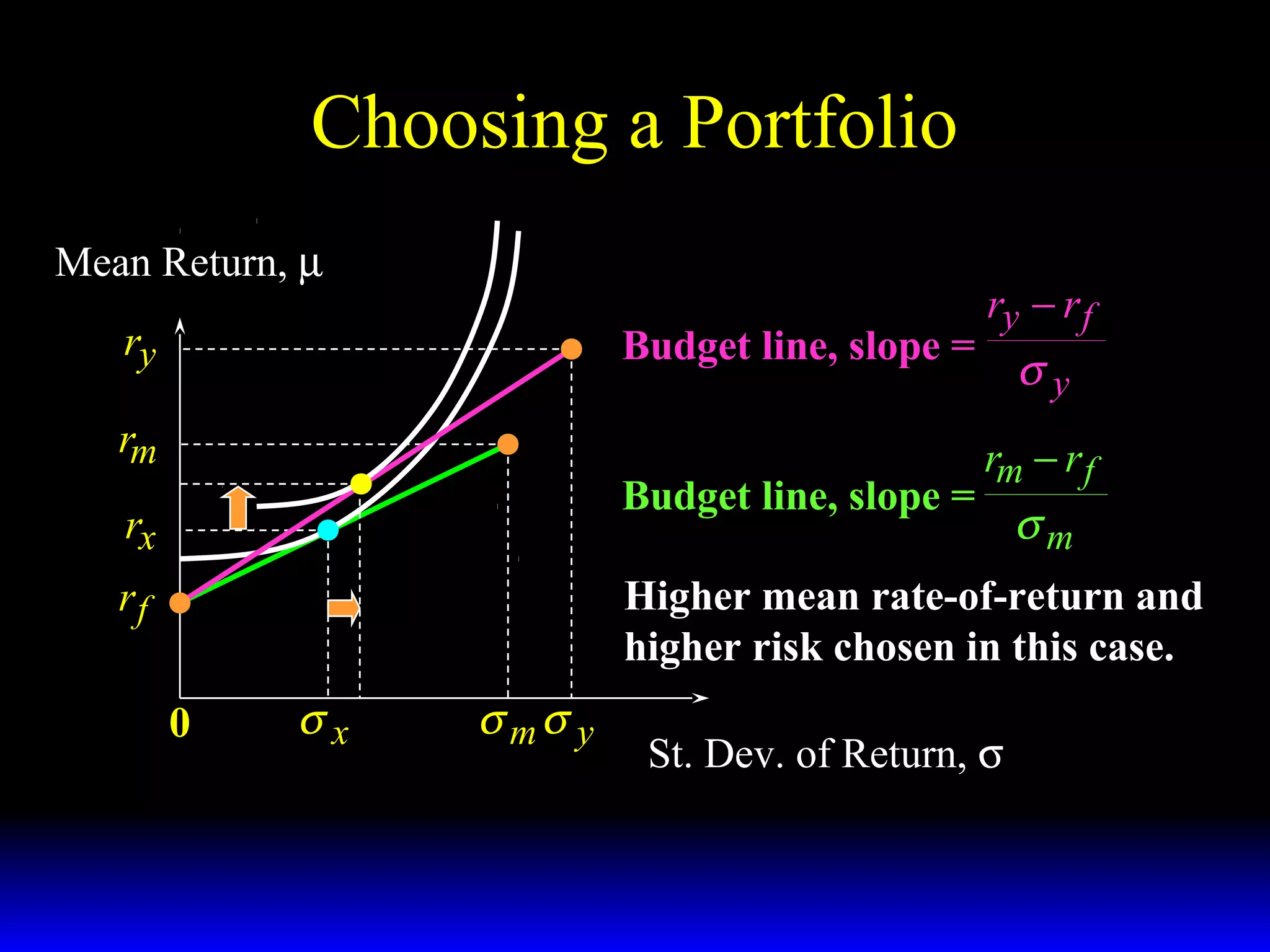

- The budget constraint for risky assets showing the tradeoff between expected return and risk of different portfolios.

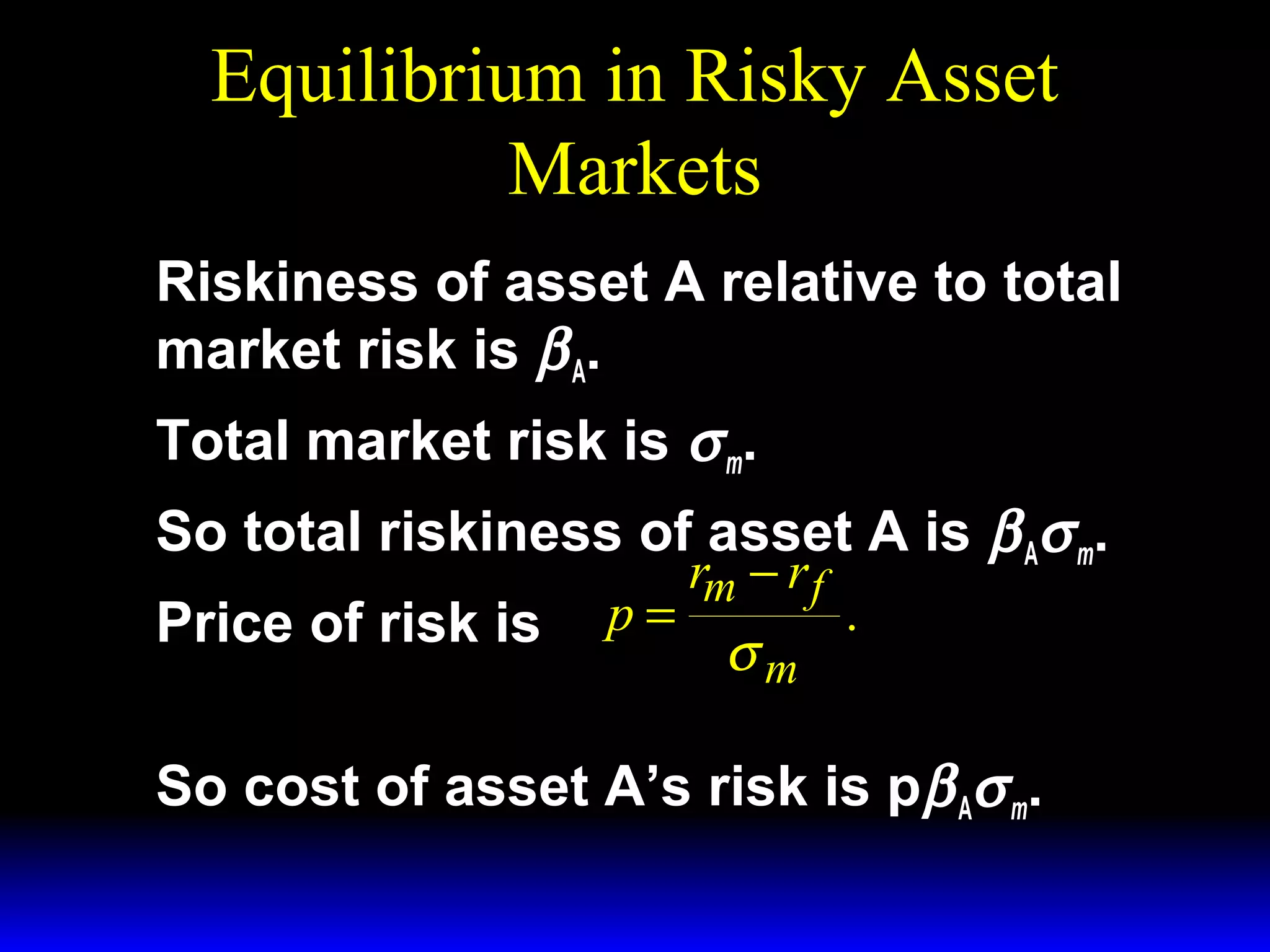

- How the slope of the budget constraint line represents the price of risk and most preferred portfolios lie along the line where the marginal rate of substitution equals this price.

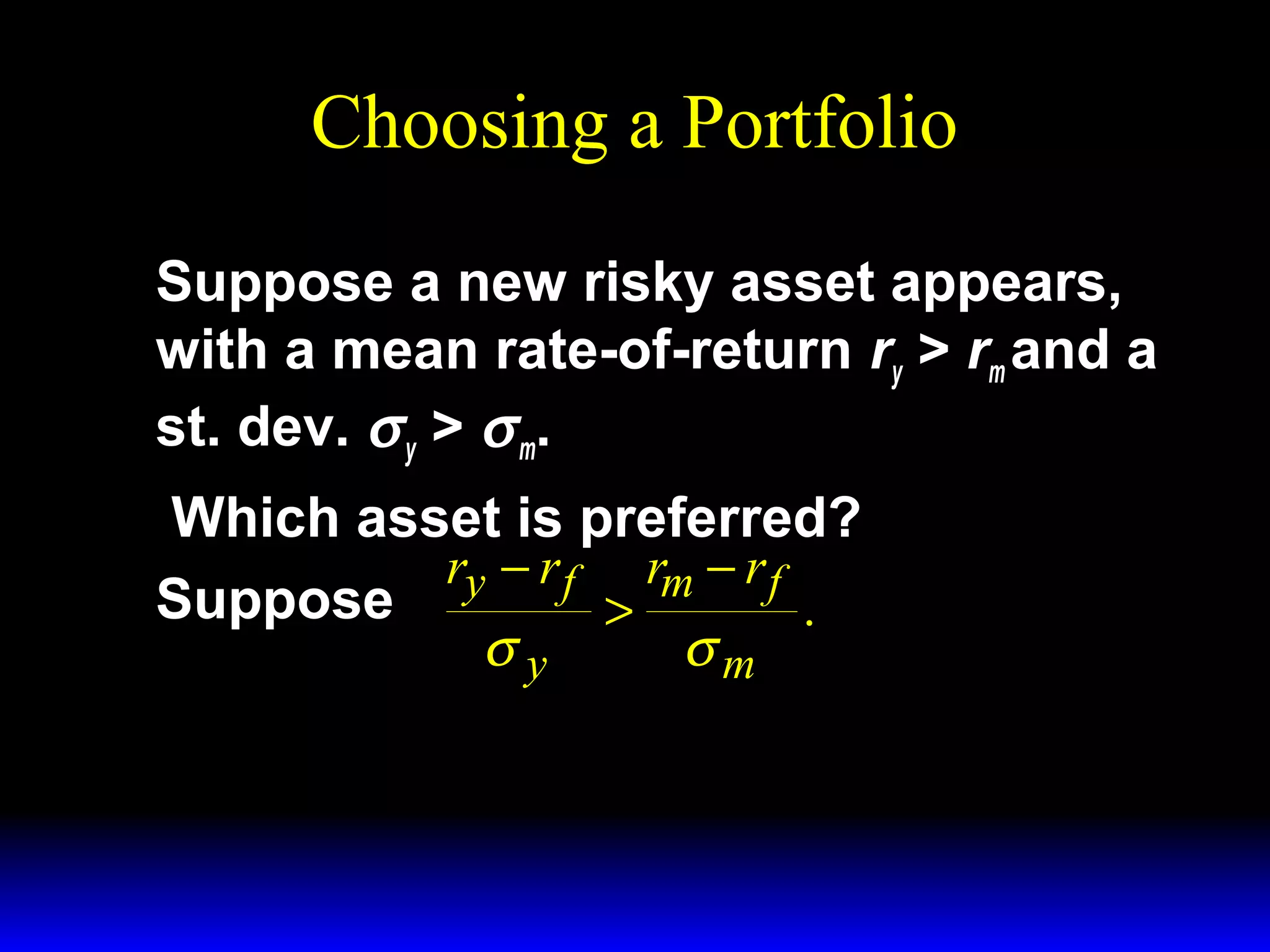

- Factors that influence choice between risky assets like their expected returns, risks, and risk-adjusted returns.

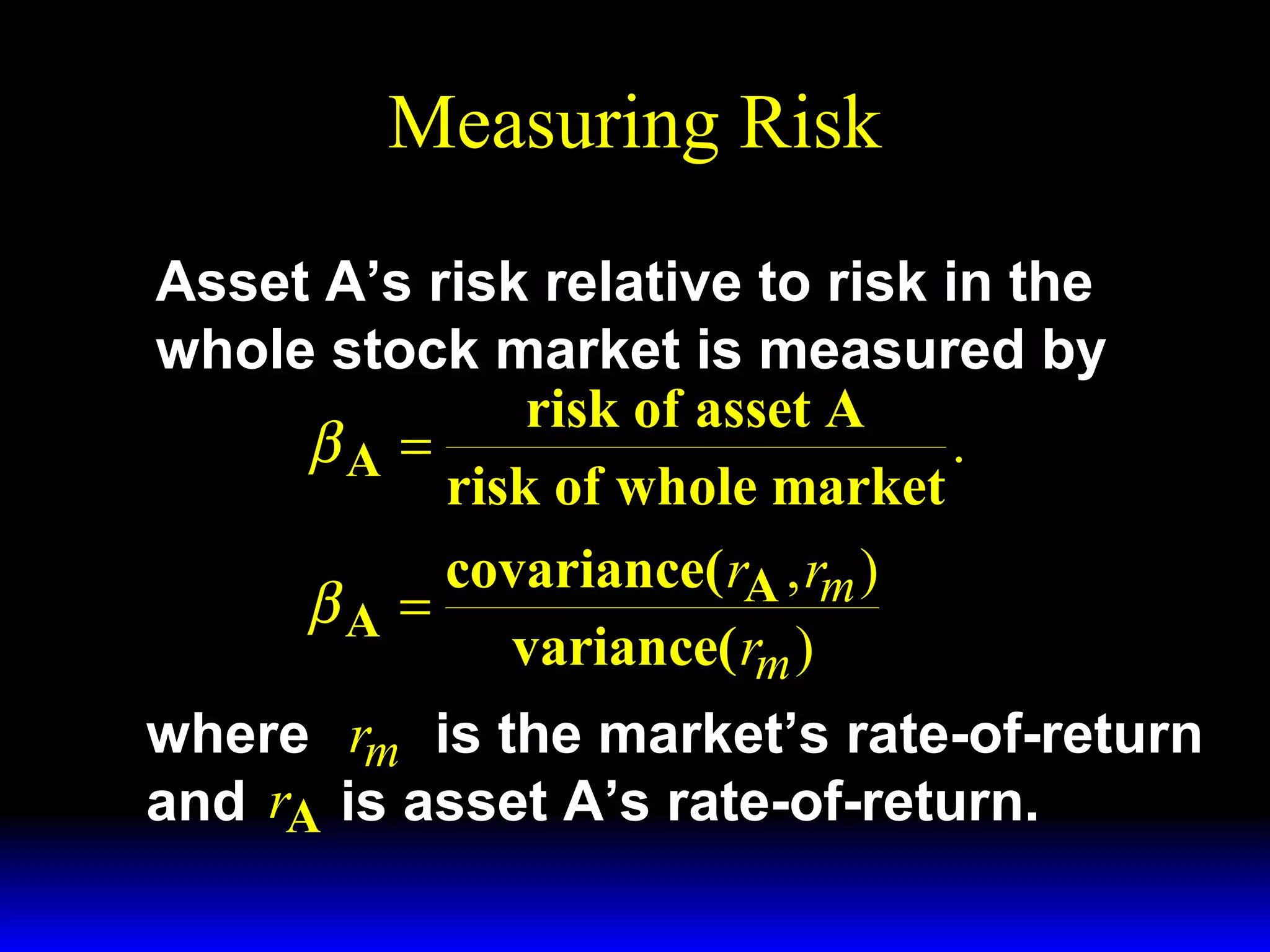

- Beta and how it measures the risk of individual

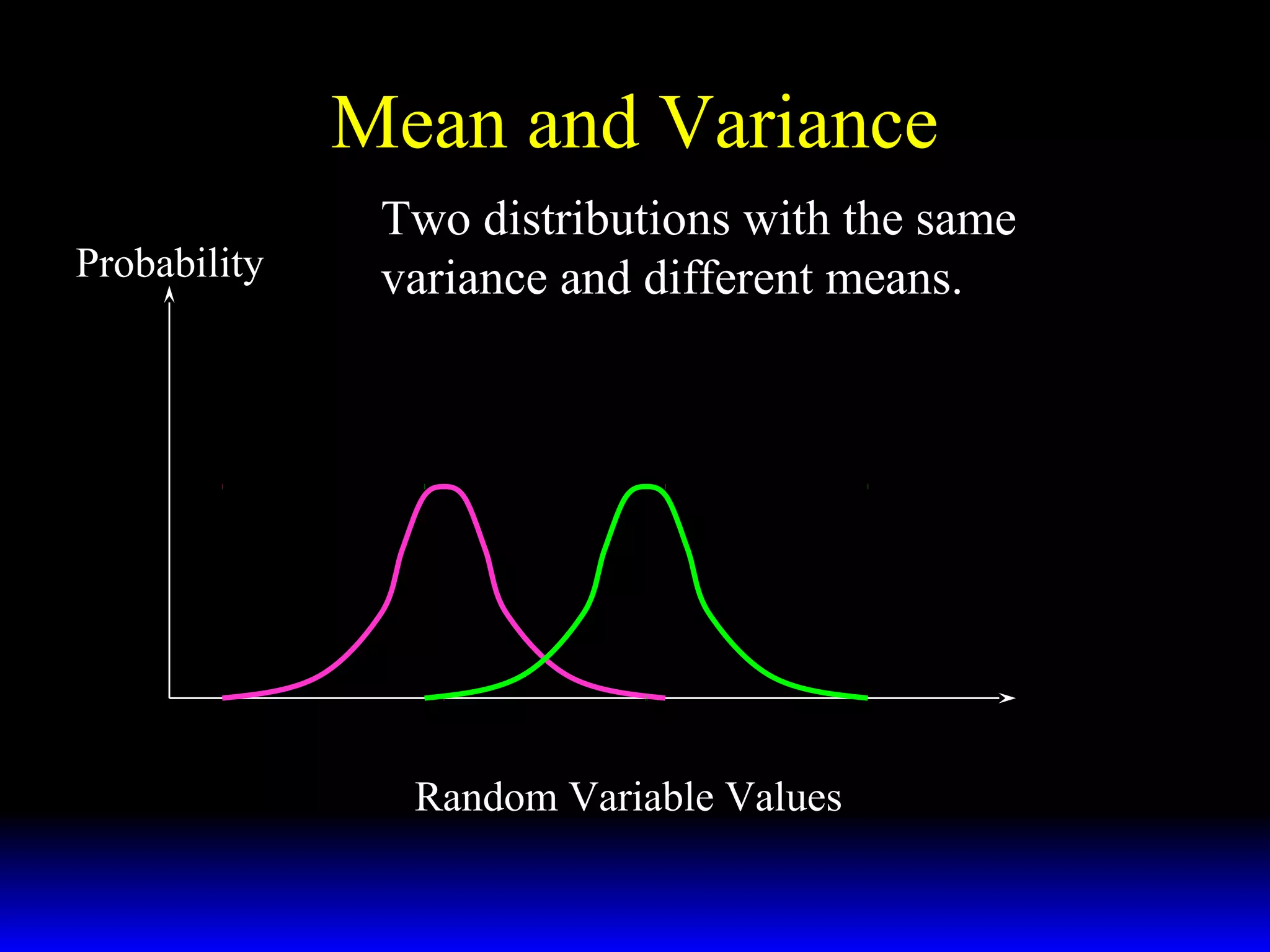

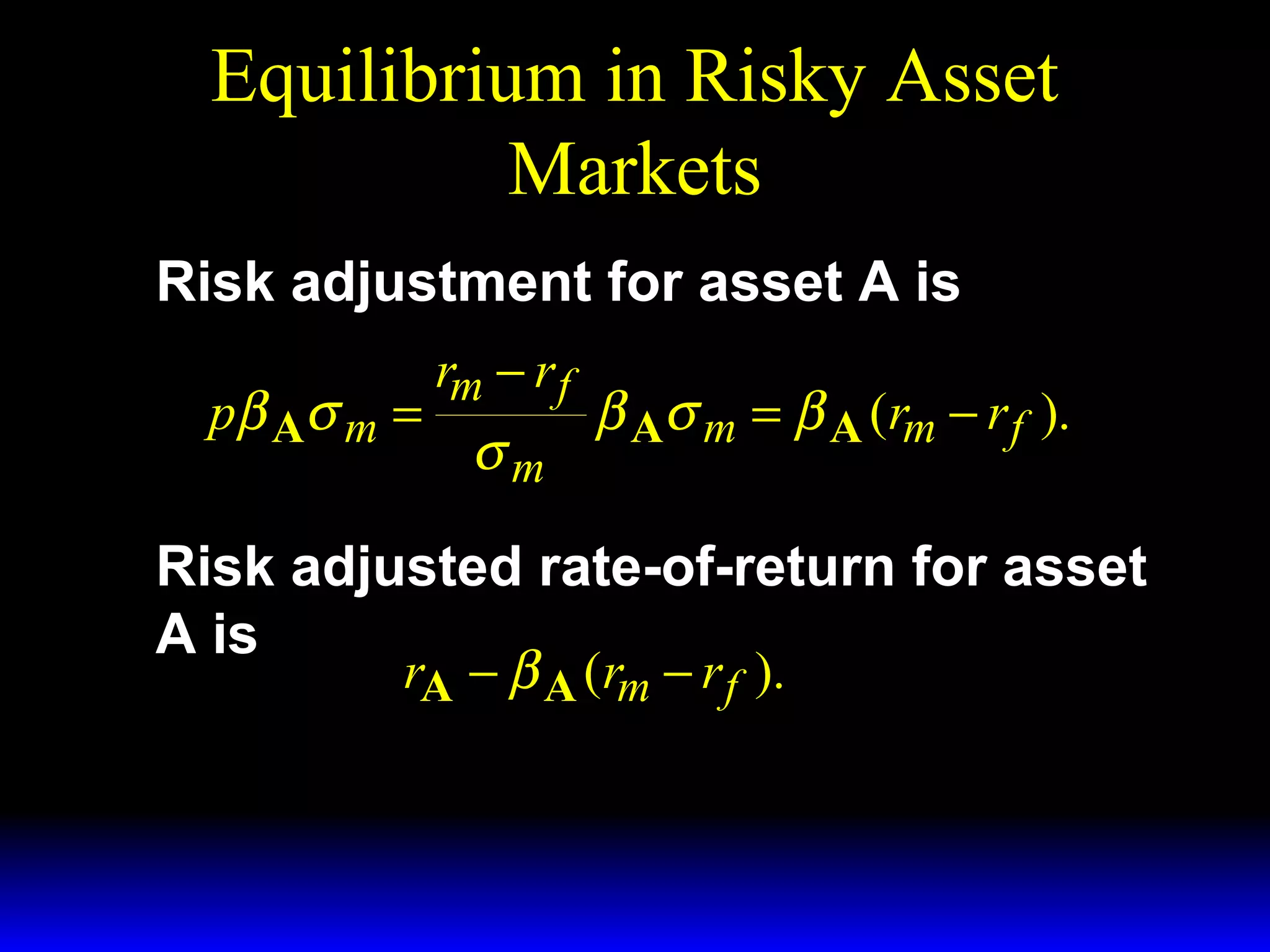

![Mean of a Distribution

A random variable (r.v.) w takes

values w1,…,wS with probabilities

π 1,...,π S (π 1 + · · · + π S = 1).

The mean (expected value) of the

distribution is the av. value of the

r.v.;

S

E[ w] = µ w = ∑ wsπ s .

s =1](https://image.slidesharecdn.com/ch13-140131134437-phpapp01/75/Ch13-2-2048.jpg)

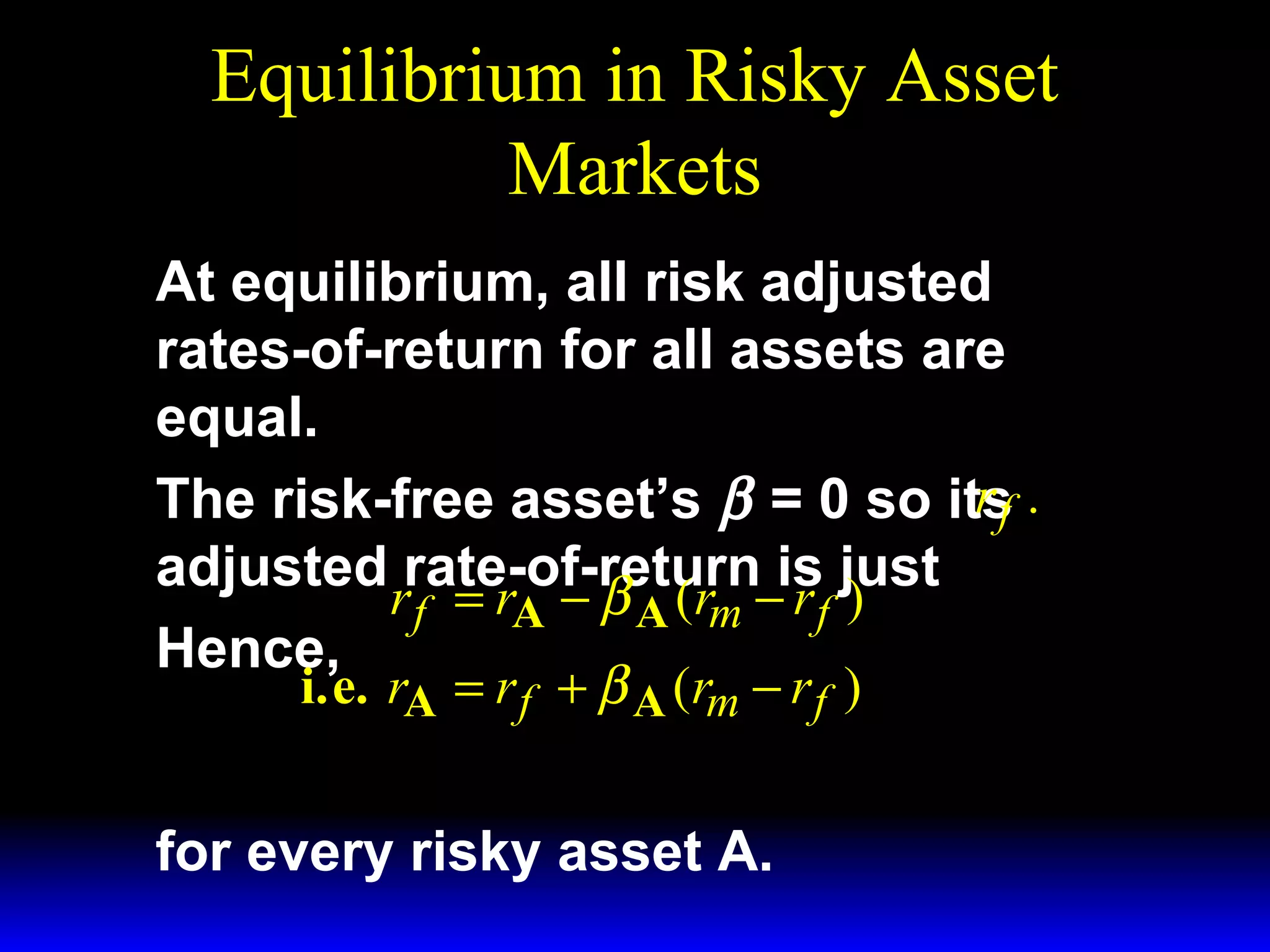

![Variance of a Distribution

The distribution’s variance is the

r.v.’s av. squared deviation from the

mean;

S

2

2

var[ w] = σ w = ∑ ( ws − µ w ) π s .

s =1

Variance measures the r.v.’s

variation.](https://image.slidesharecdn.com/ch13-140131134437-phpapp01/75/Ch13-3-2048.jpg)

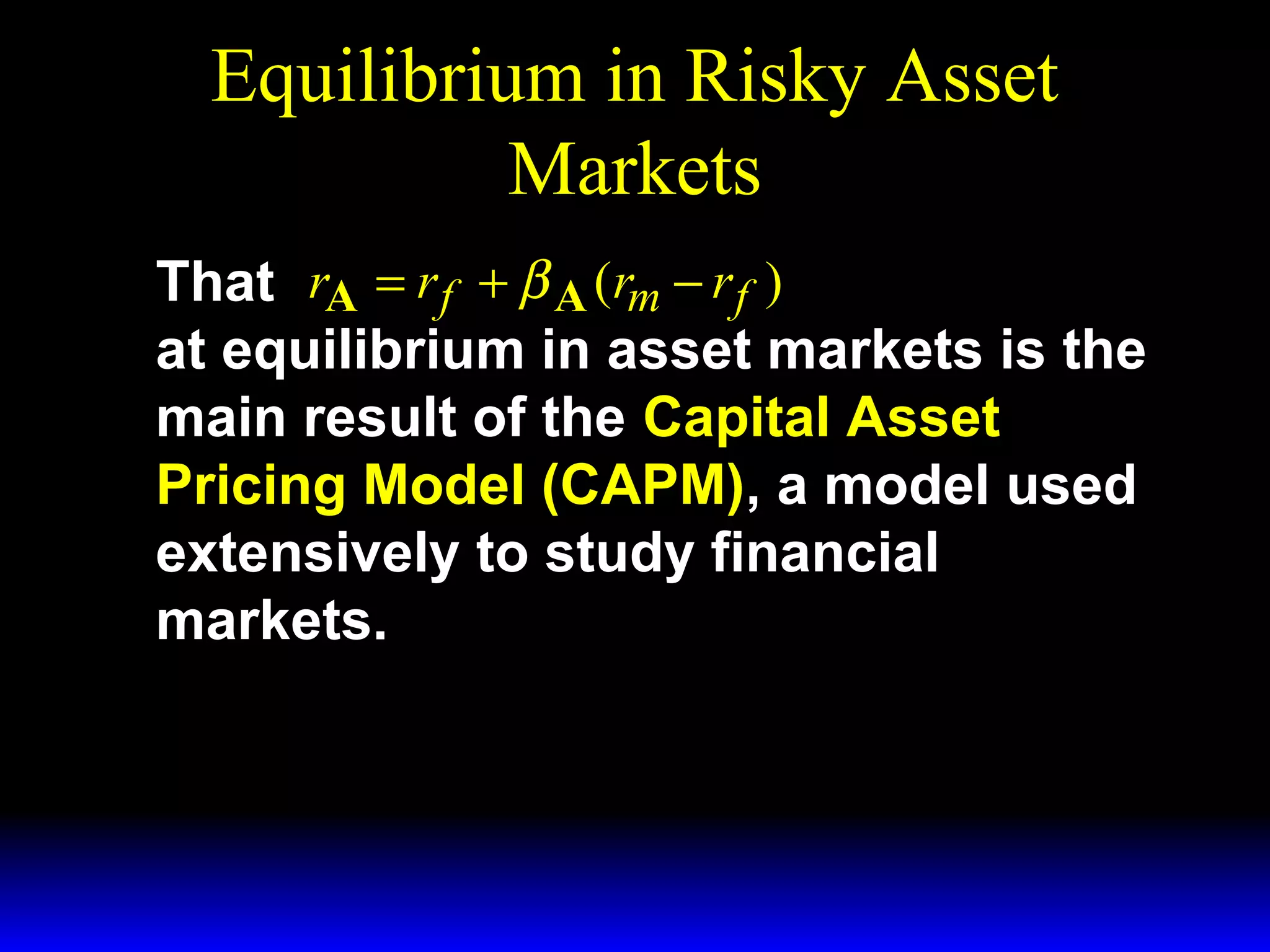

![Standard Deviation of a

Distribution

The distribution’s standard deviation

is the square root of its variance;

2

st. dev[ w] = σ w = σ w =

S

2

∑ ( ws − µ w ) π s .

s =1

St. deviation also measures the r.v.’s

variability.](https://image.slidesharecdn.com/ch13-140131134437-phpapp01/75/Ch13-4-2048.jpg)