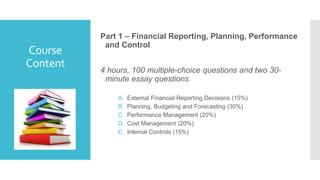

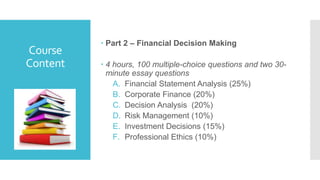

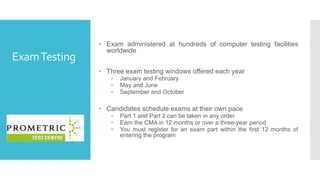

This document provides information about the Certified Management Accountant (CMA) program. The CMA certification validates mastery of critical skills for financial planning, analysis, control, and decision-making needed for strategic business roles. The CMA exams are computer-based and administered globally, including in major Indian cities. The two-part exam covers topics like financial reporting, planning, performance management, cost management, financial statement analysis, and corporate finance. Earning a CMA can expand career opportunities and earning potential in fields like accounting, auditing, and financial analysis. It provides exemptions for other certifications like ICWA in India and ACCA in the UK.