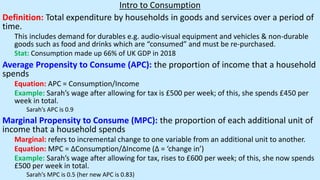

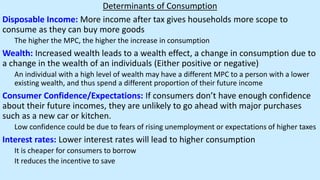

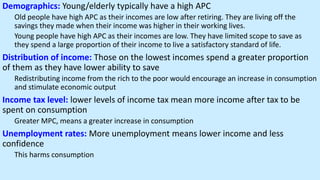

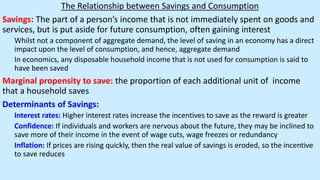

The document discusses consumption as total household expenditure on goods and services, which constituted 66% of UK GDP in 2018. It defines key concepts such as average propensity to consume (APC) and marginal propensity to consume (MPC), along with their determinants like disposable income, wealth, consumer confidence, interest rates, and demographic factors. Additionally, it examines the relationship between savings and consumption, explaining how various factors influence saving behaviors.