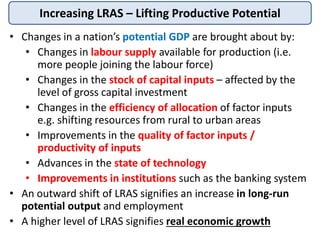

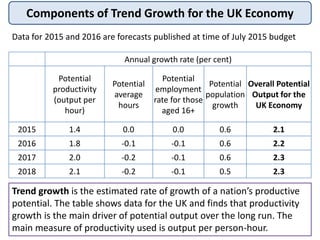

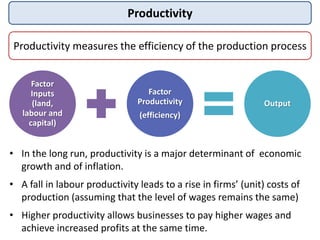

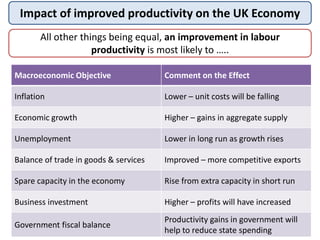

Long run aggregate supply is determined by factors that affect an economy's potential output over the long run, including: labor supply and quality, capital investment, productivity, technology advances, and institutions. An outward shift of the LRAS curve represents an increase in potential output and real economic growth. Productivity, defined as output per hour worked, is the main driver of the UK's potential output growth in the long run according to forecasts.