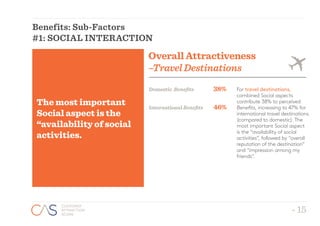

The document discusses findings from research on the Customer Attraction Score (CAS), which measures the overall attractiveness of shopping and travel destinations. The research was based on an online survey of over 1600 Australian shoppers and travellers. It found that the benefits of a destination have a much greater influence on its attractiveness than the costs. For both shopping and travel destinations, the strongest benefit factor is social interaction. Marketing efforts should focus on promoting these experiential benefits rather than reduced costs alone.