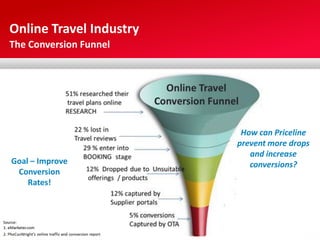

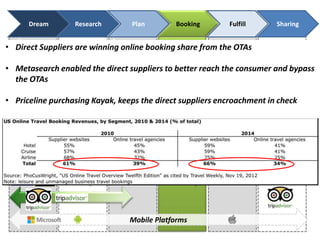

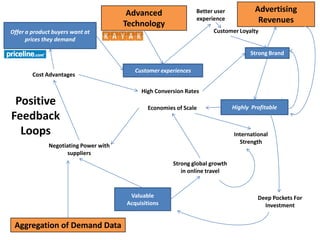

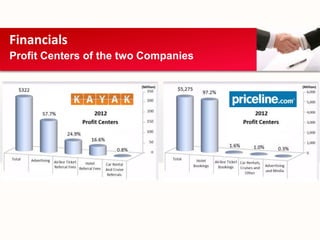

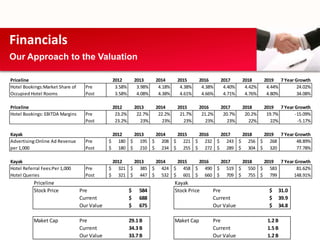

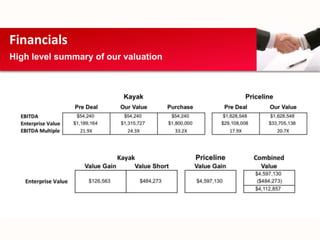

Priceline acquired Kayak for $1.8 billion in a deal announced in late 2012. This was Priceline's largest acquisition to date and aimed to capture more of the online travel consumer market. The acquisition allowed Priceline to eliminate a potential competitor, expand its role in the travel value chain, and increase conversion rates from travel searches to bookings. A financial analysis valued Kayak at $1.2 billion based on projections for its advertising revenues and hotel booking referral fees through 2019.