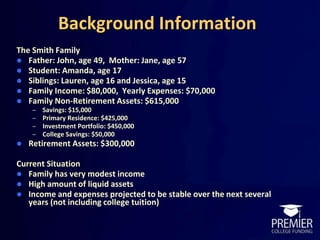

The Smith family, with an annual income of $80,000 and significant assets, initially faced a projected college aid of $0 for their three children. After consulting with Premier College Funding, they implemented a phased asset protection plan, qualifying them for over $70,000 in financial aid per year, sufficient to cover tuition for seven years while maintaining $350,000 in savings. The document also includes a disclaimer about the informational purpose of its contents and the forward-looking nature of financial statements.