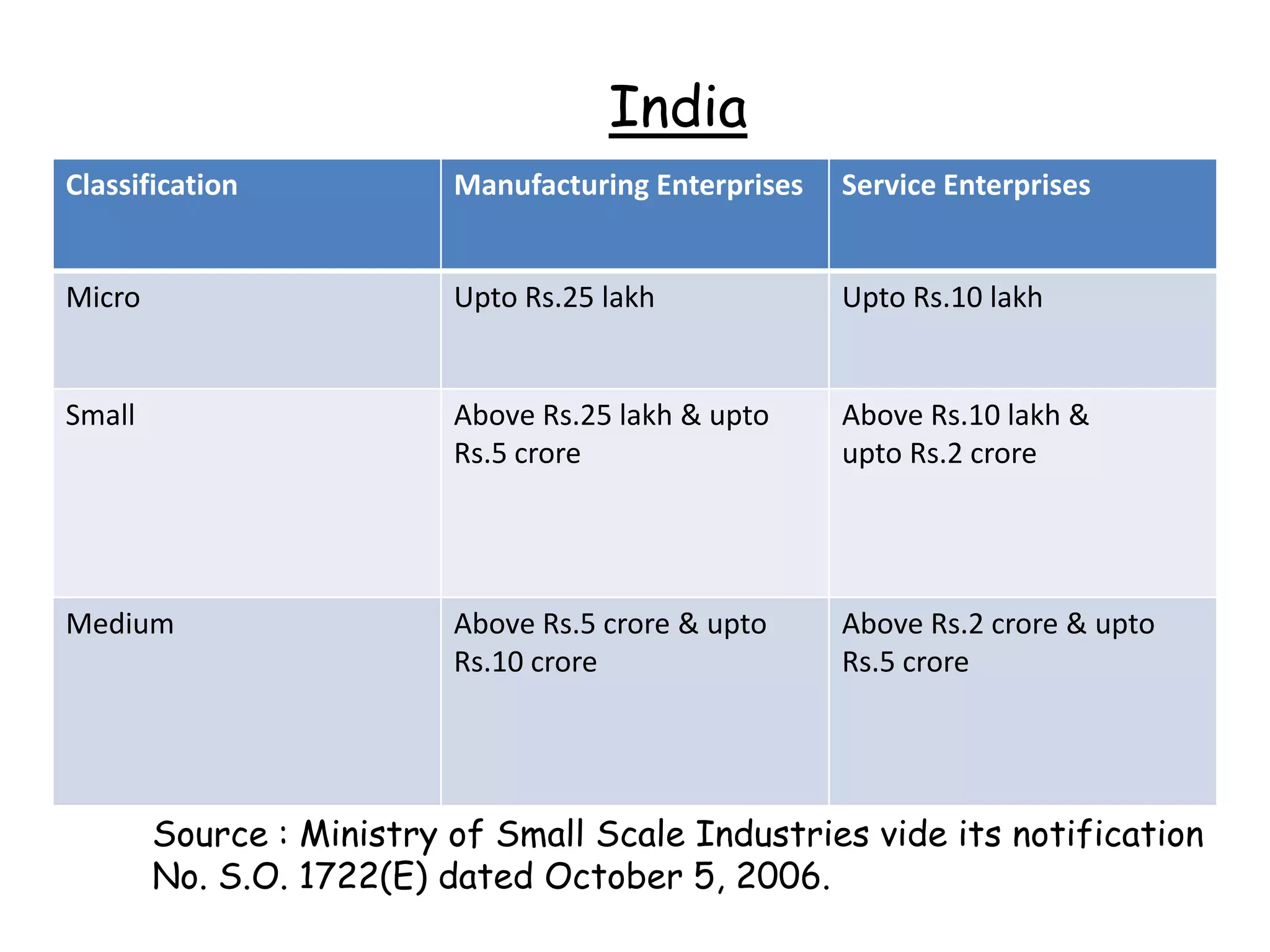

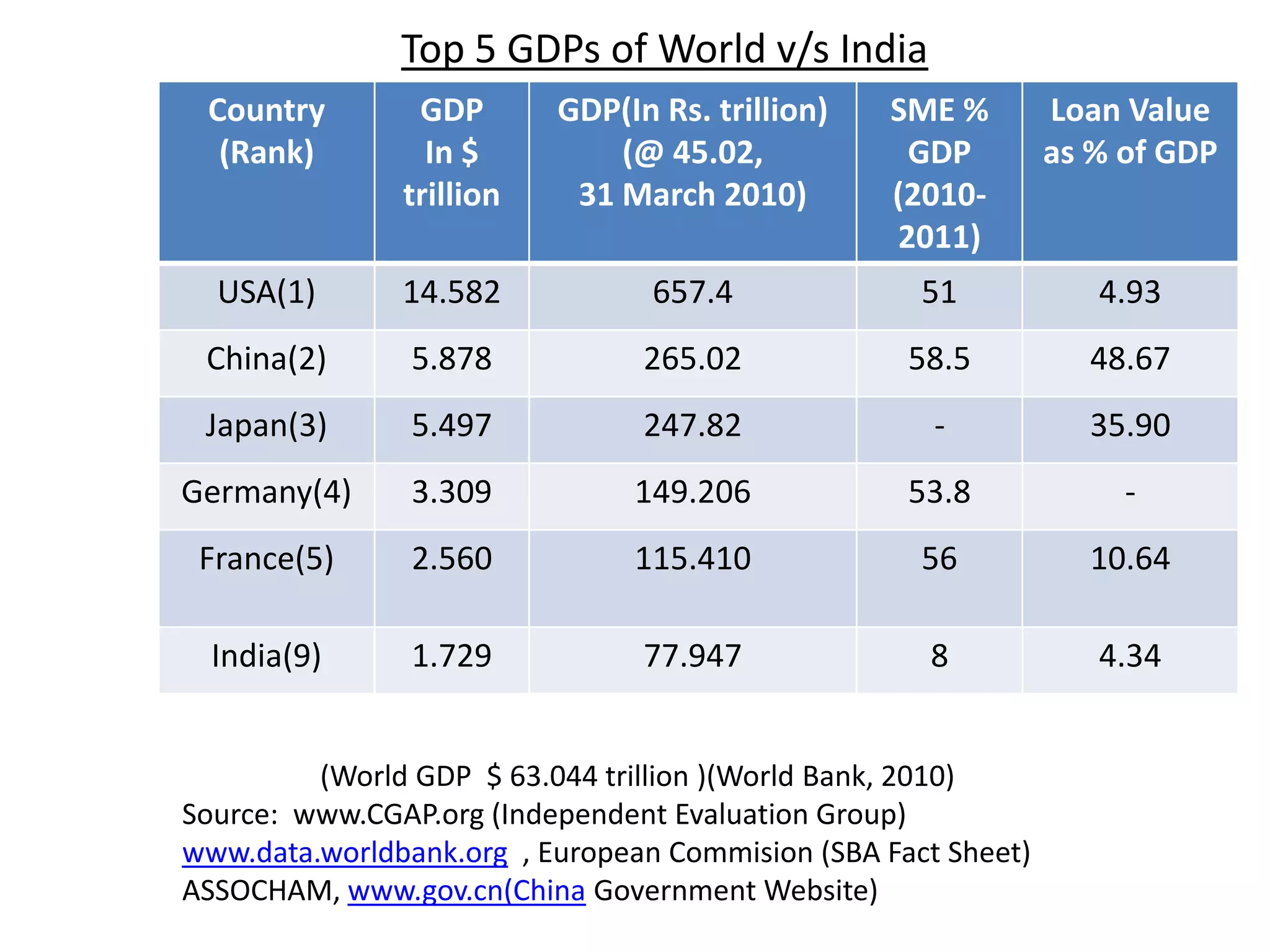

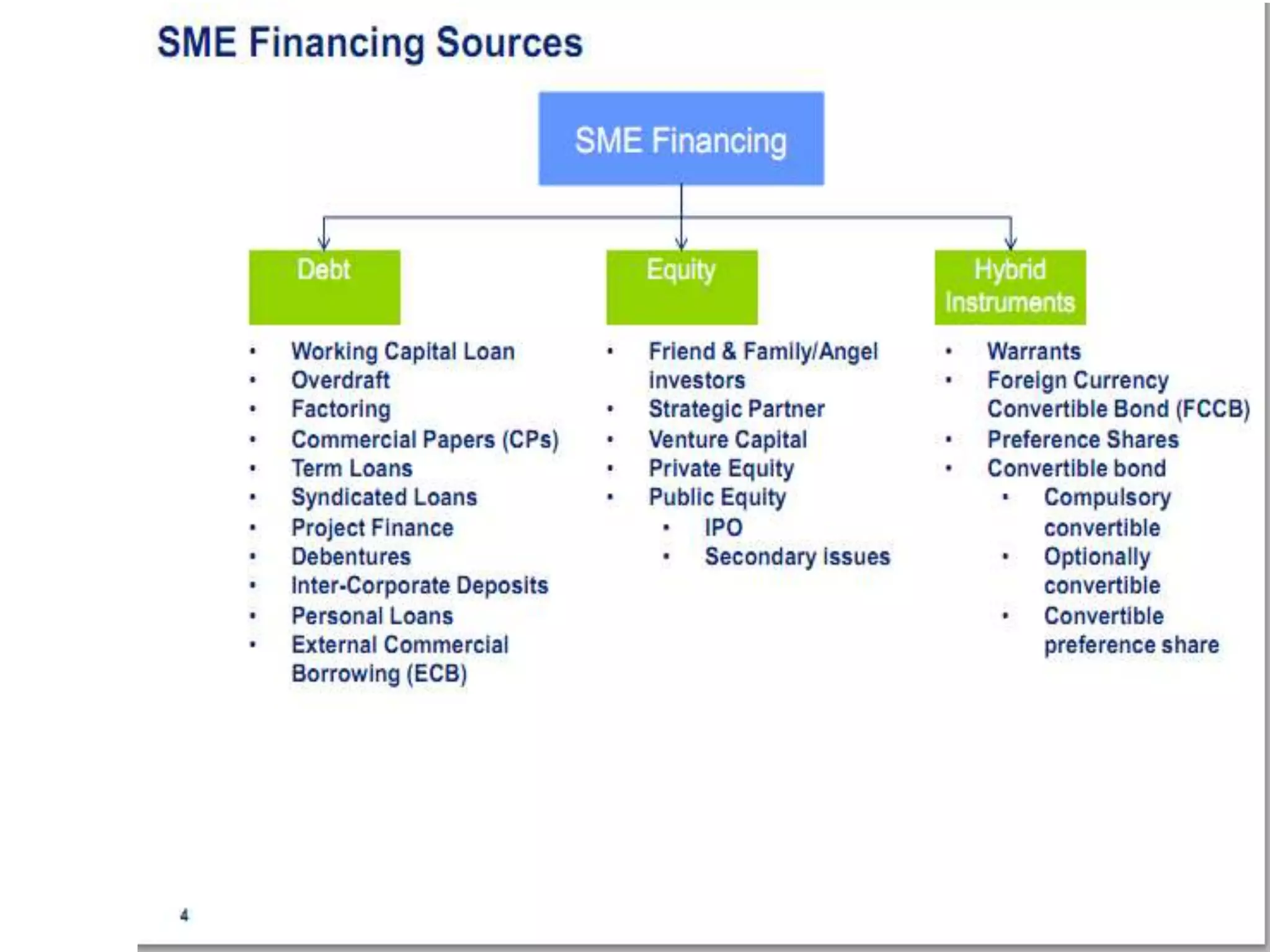

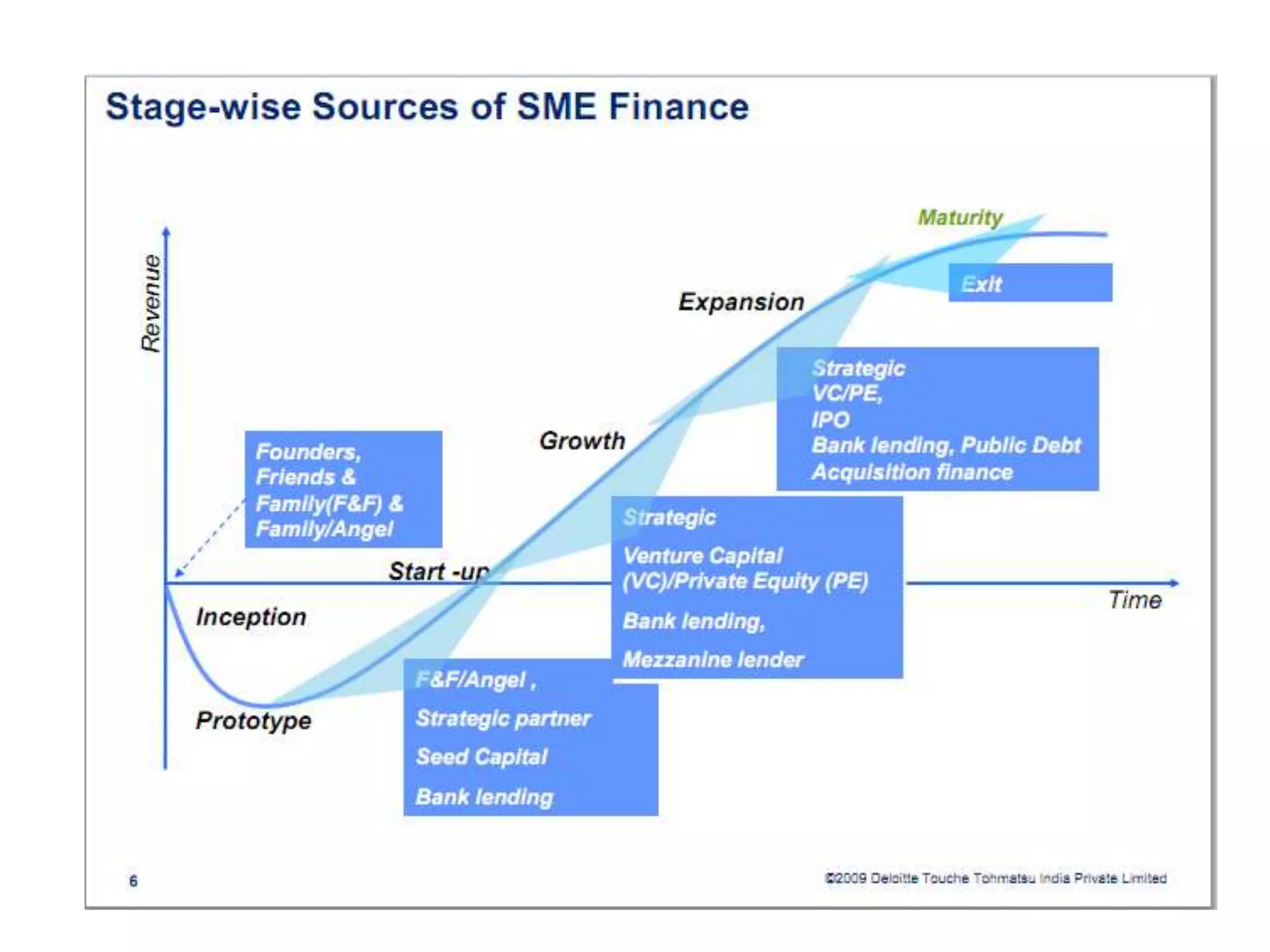

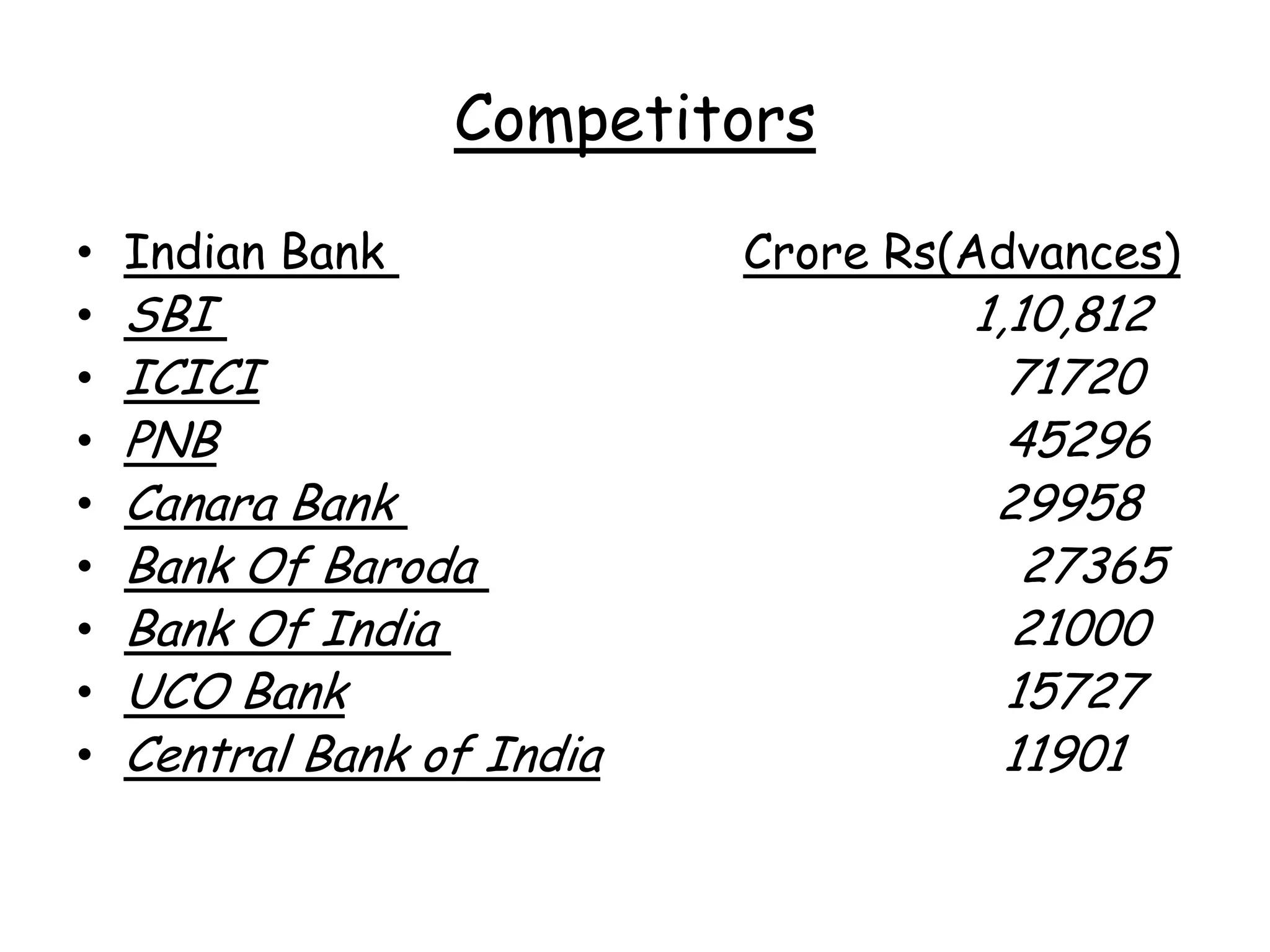

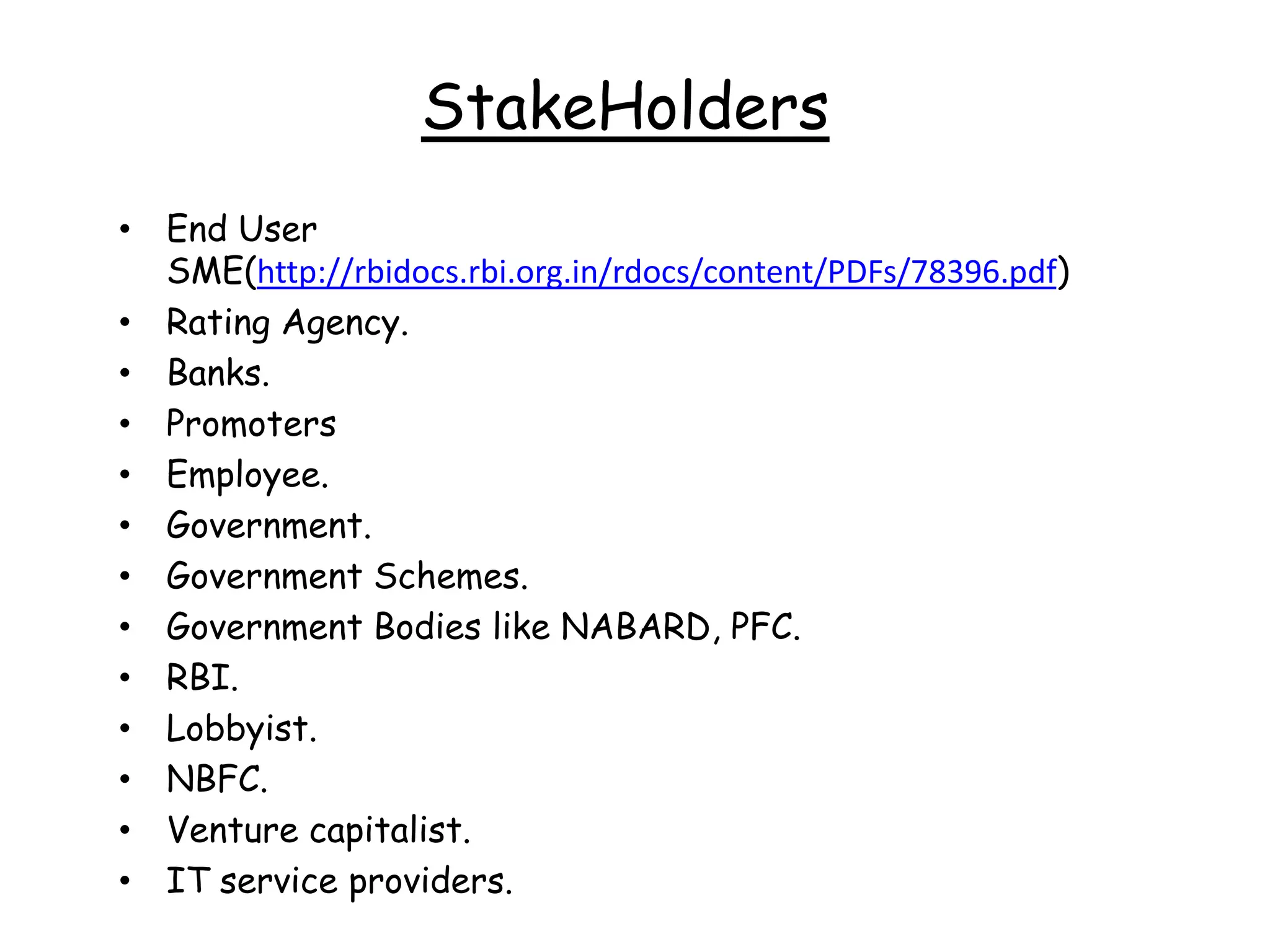

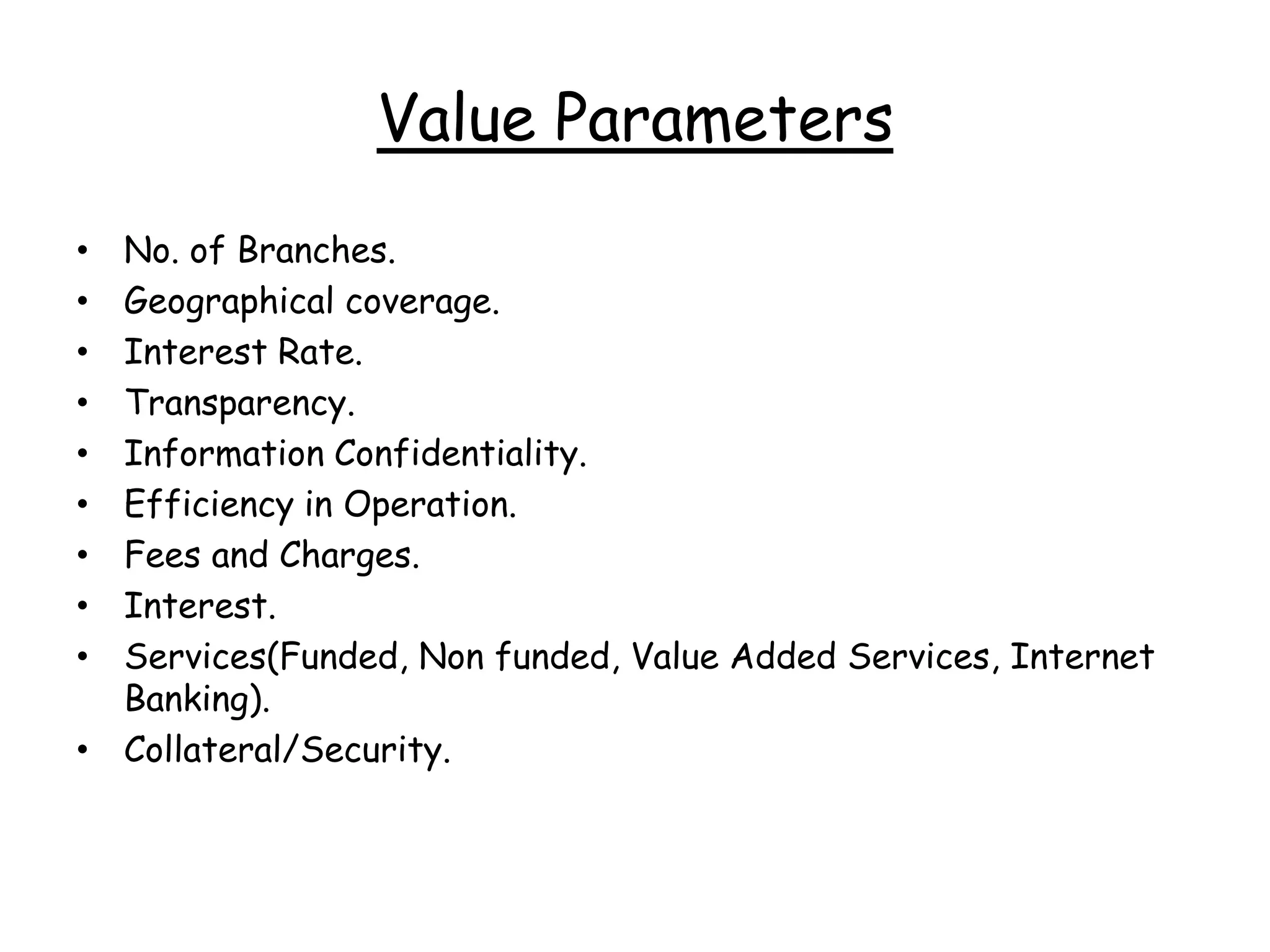

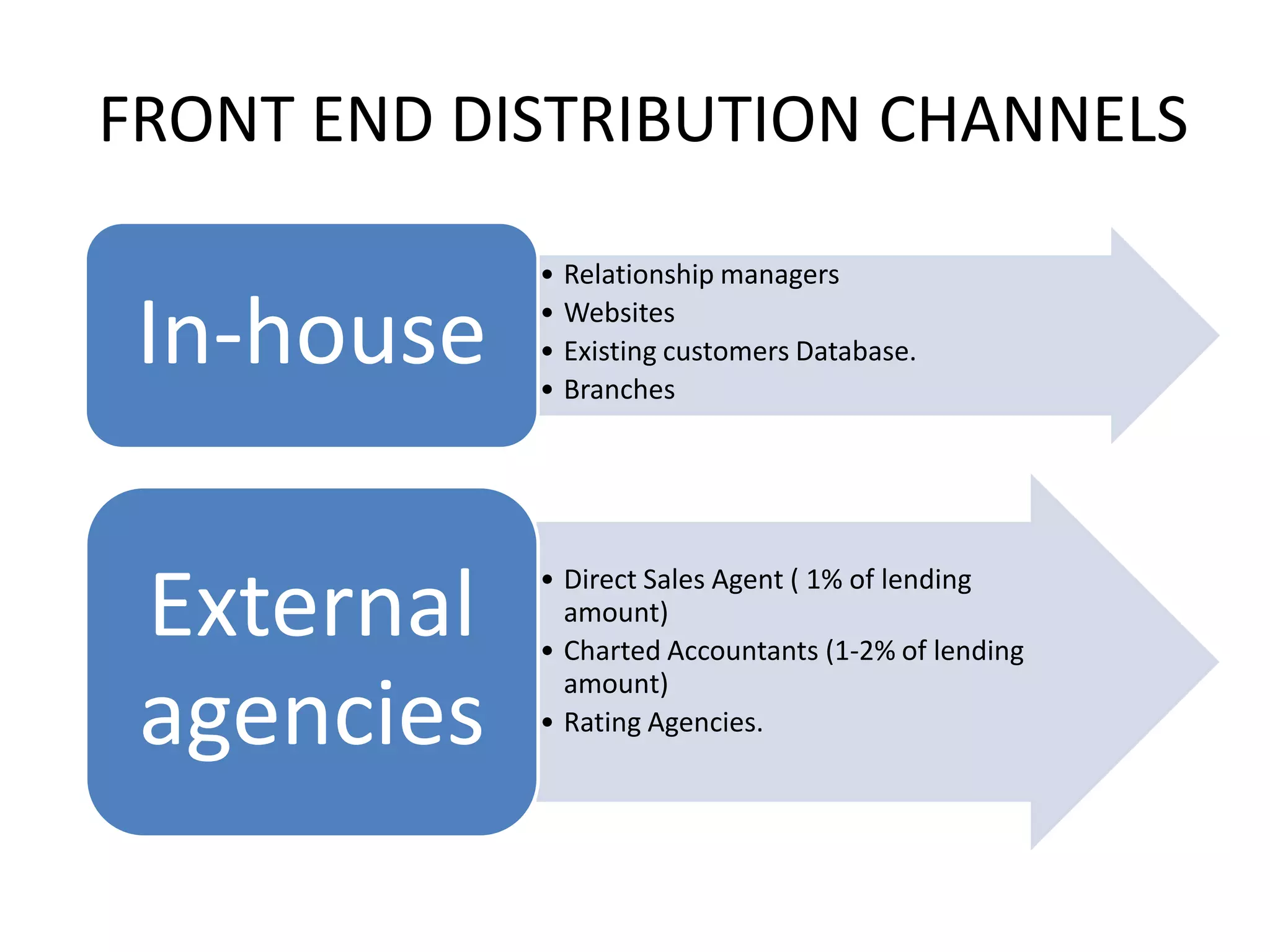

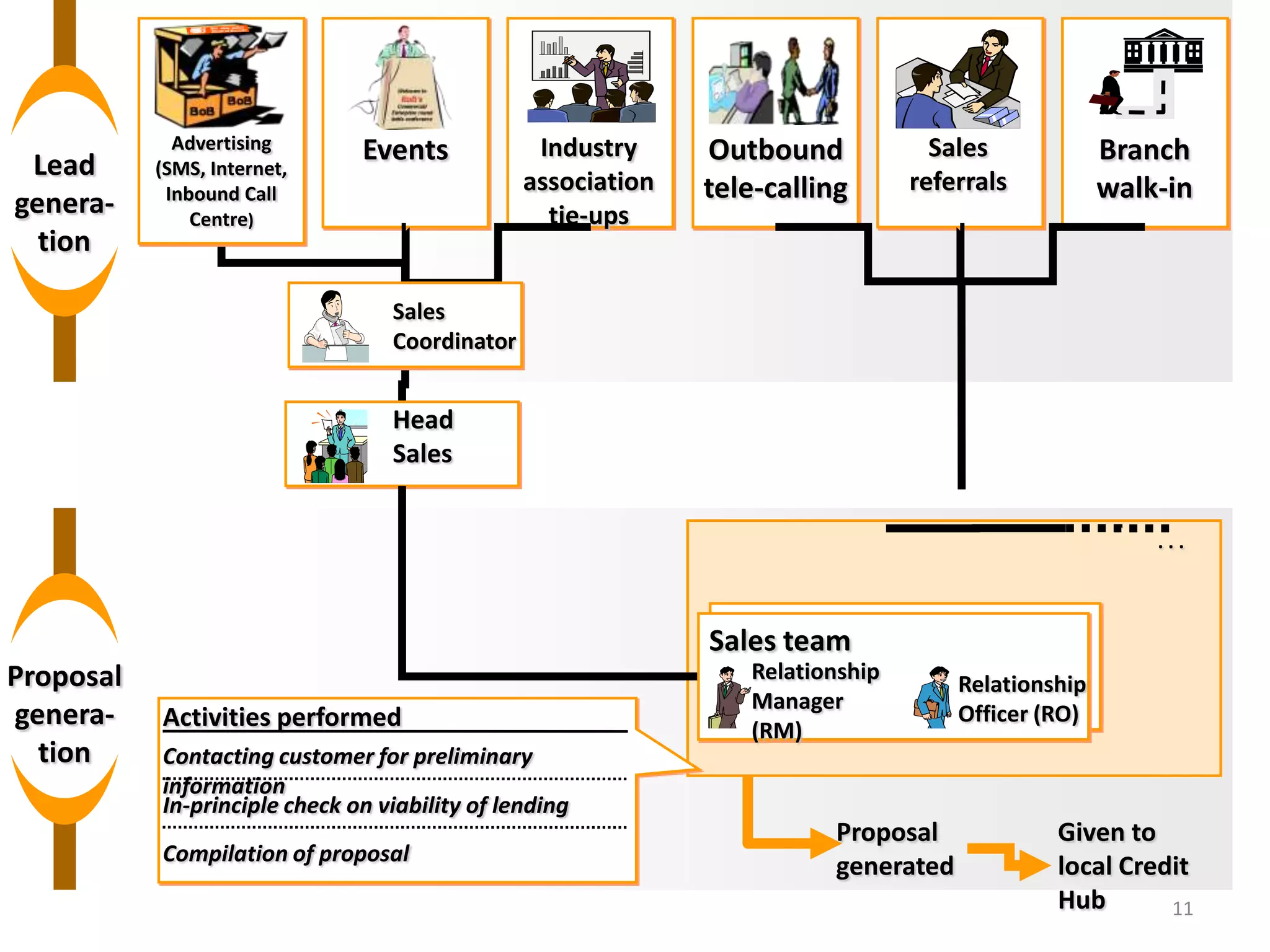

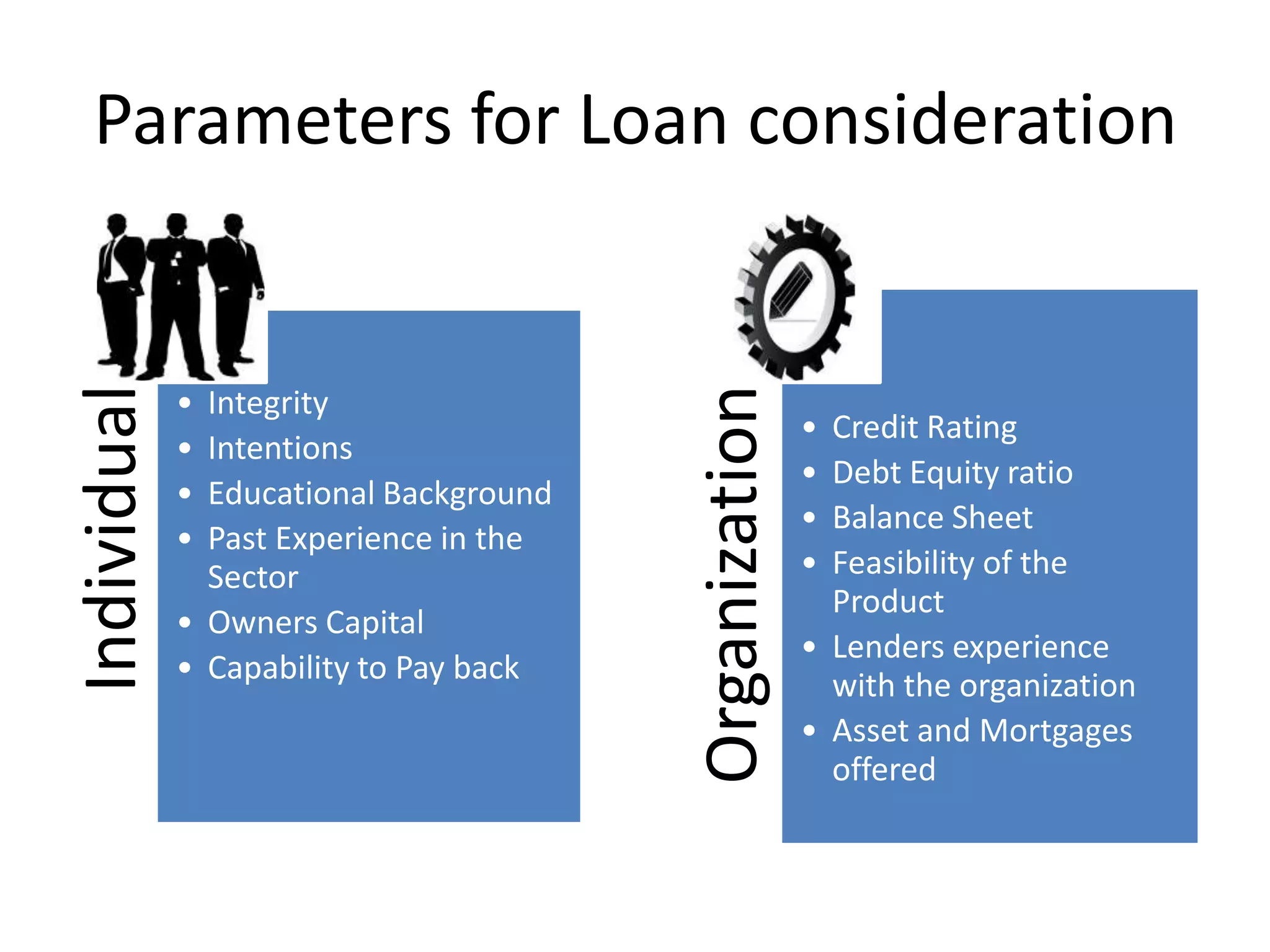

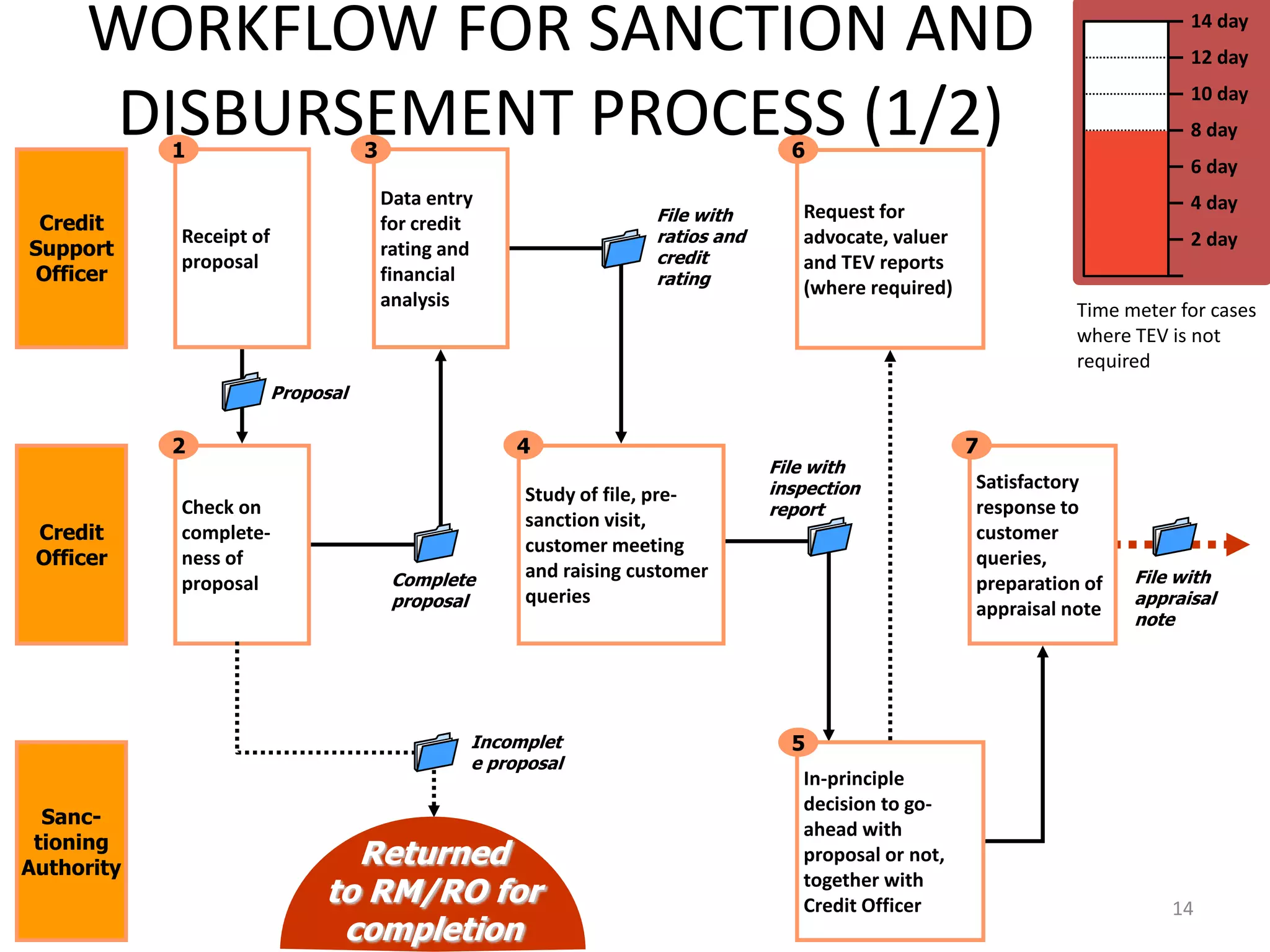

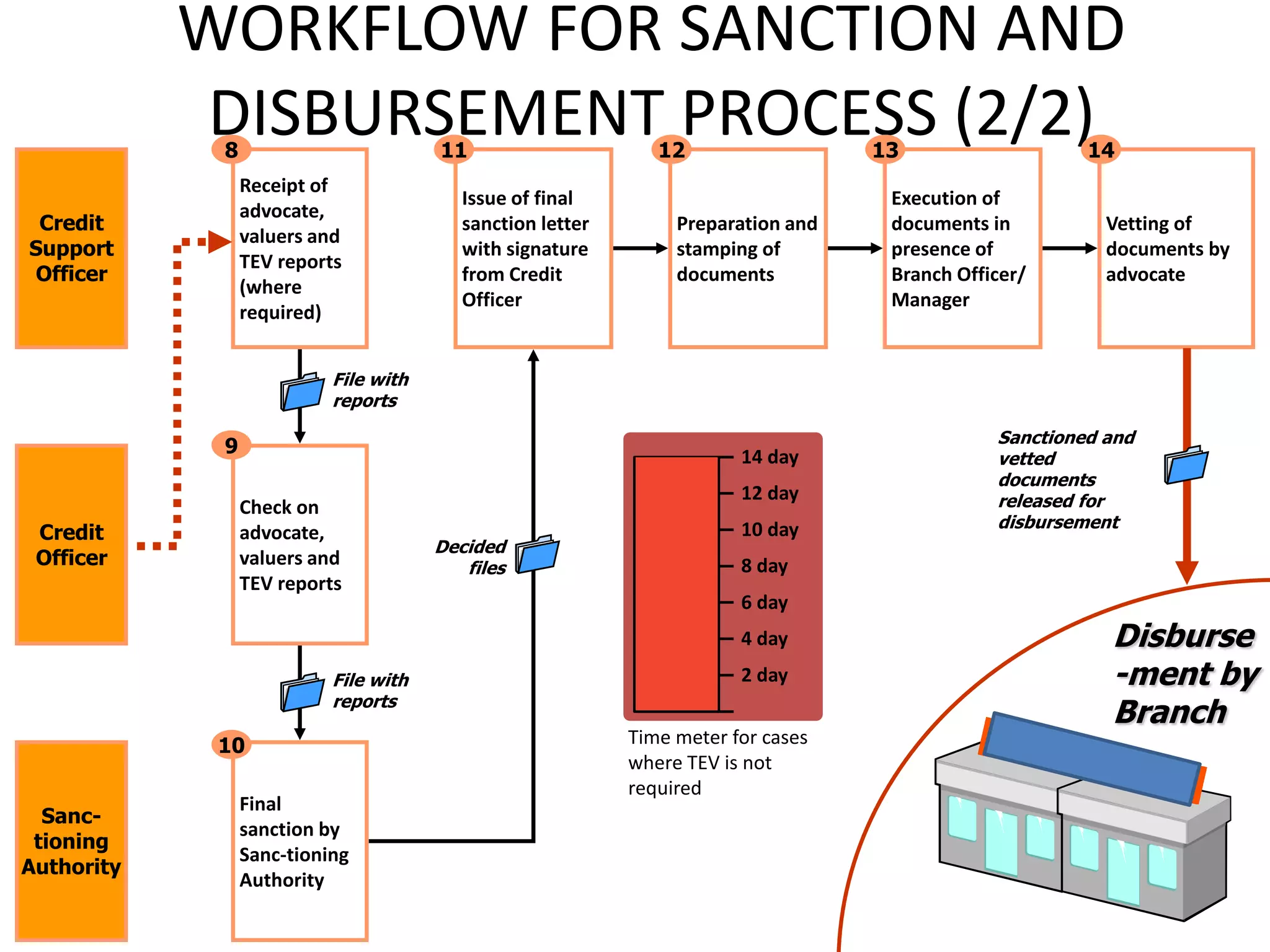

The document discusses SME lending in India. It notes that SMEs contribute significantly to the Indian economy, providing over 40% of exports and employing over 60 million people. However, SME lending as a percentage of GDP in India is lower than other major countries. The document then provides details on the classification of SMEs, key stakeholders in SME lending like banks and government bodies, the loan approval workflow, and value parameters from the perspective of both lenders and borrowers.