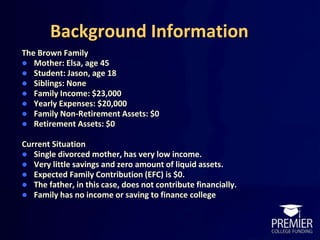

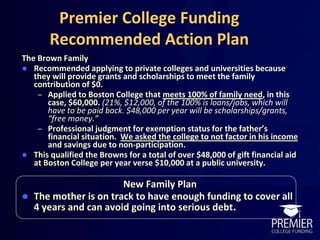

The Brown family's financial situation is precarious, with a low income and no savings, which affects their ability to finance college for Jason. They initially planned to apply to public universities but discovered insufficient financial aid for their needs. Premier College Funding recommended applying to private colleges, resulting in significant financial aid opportunities, potentially covering all four years without incurring debt.