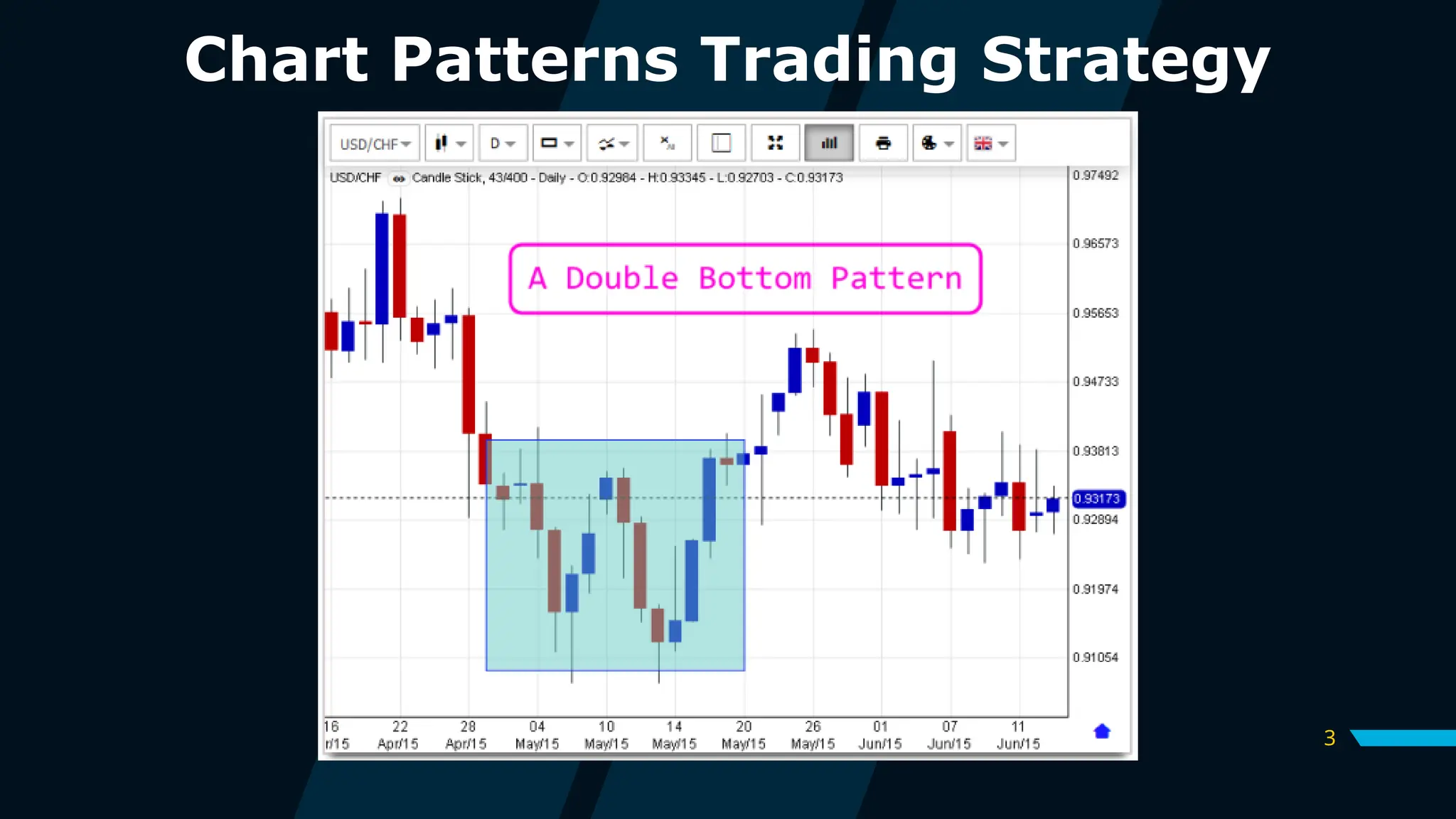

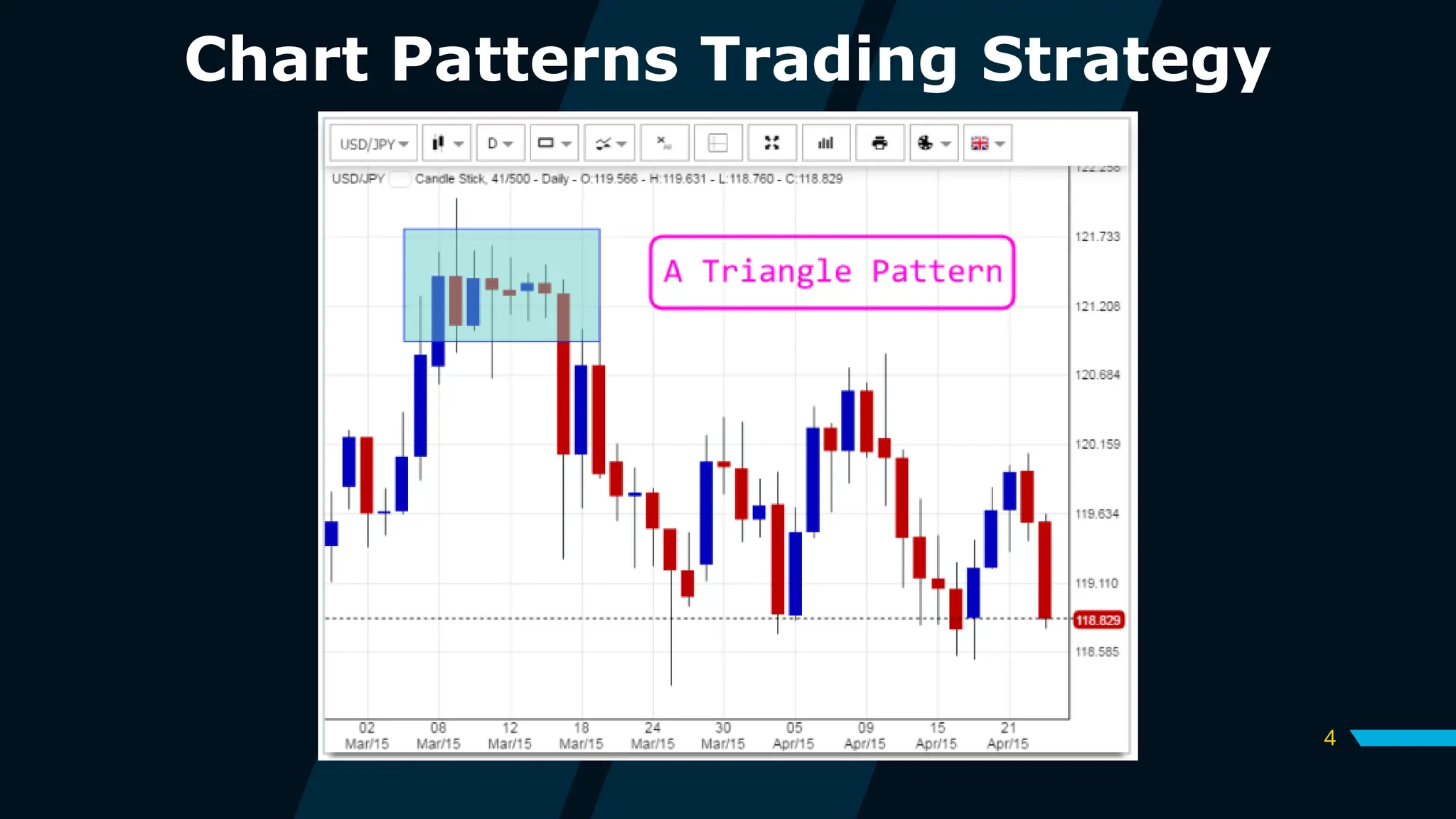

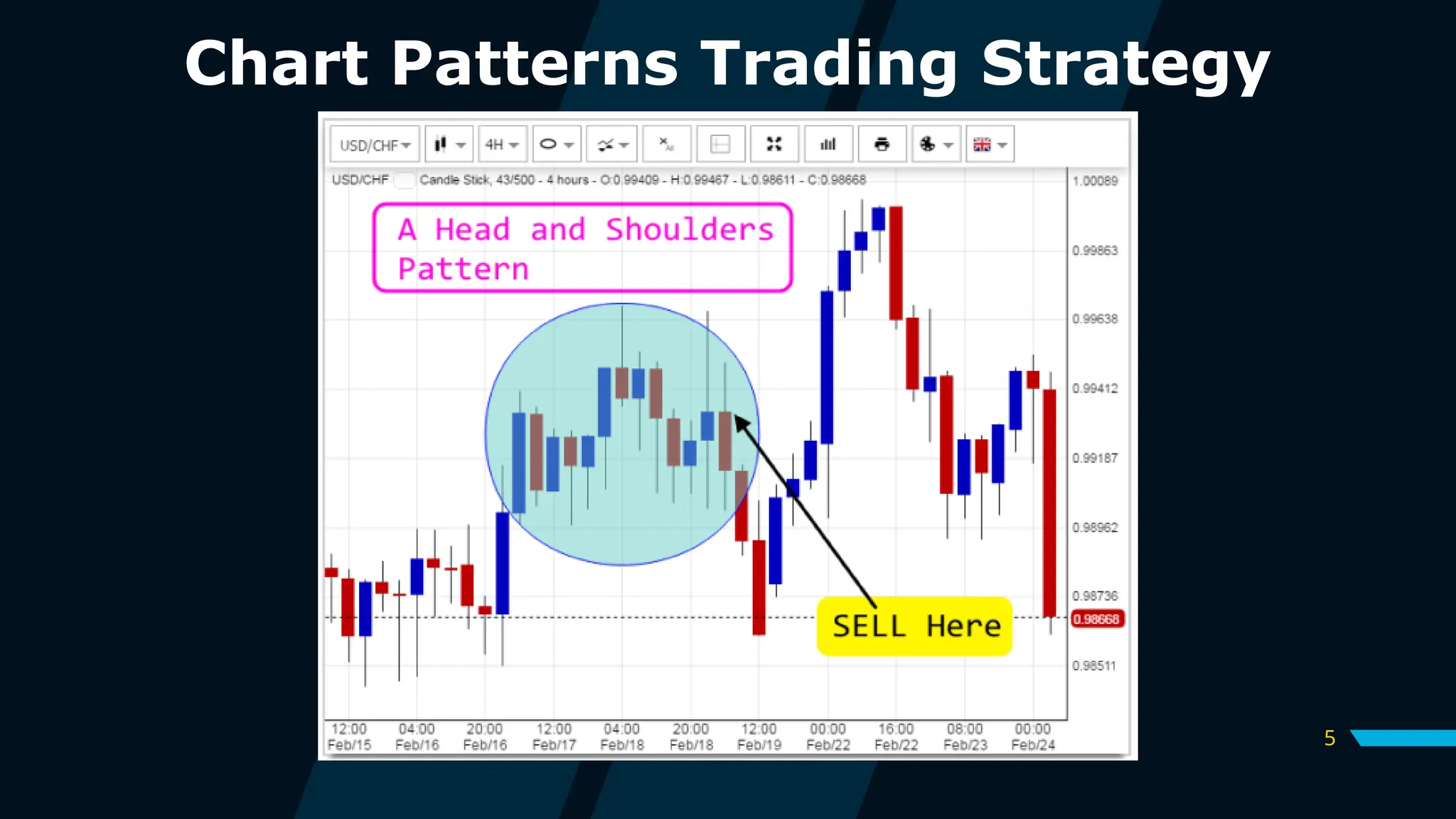

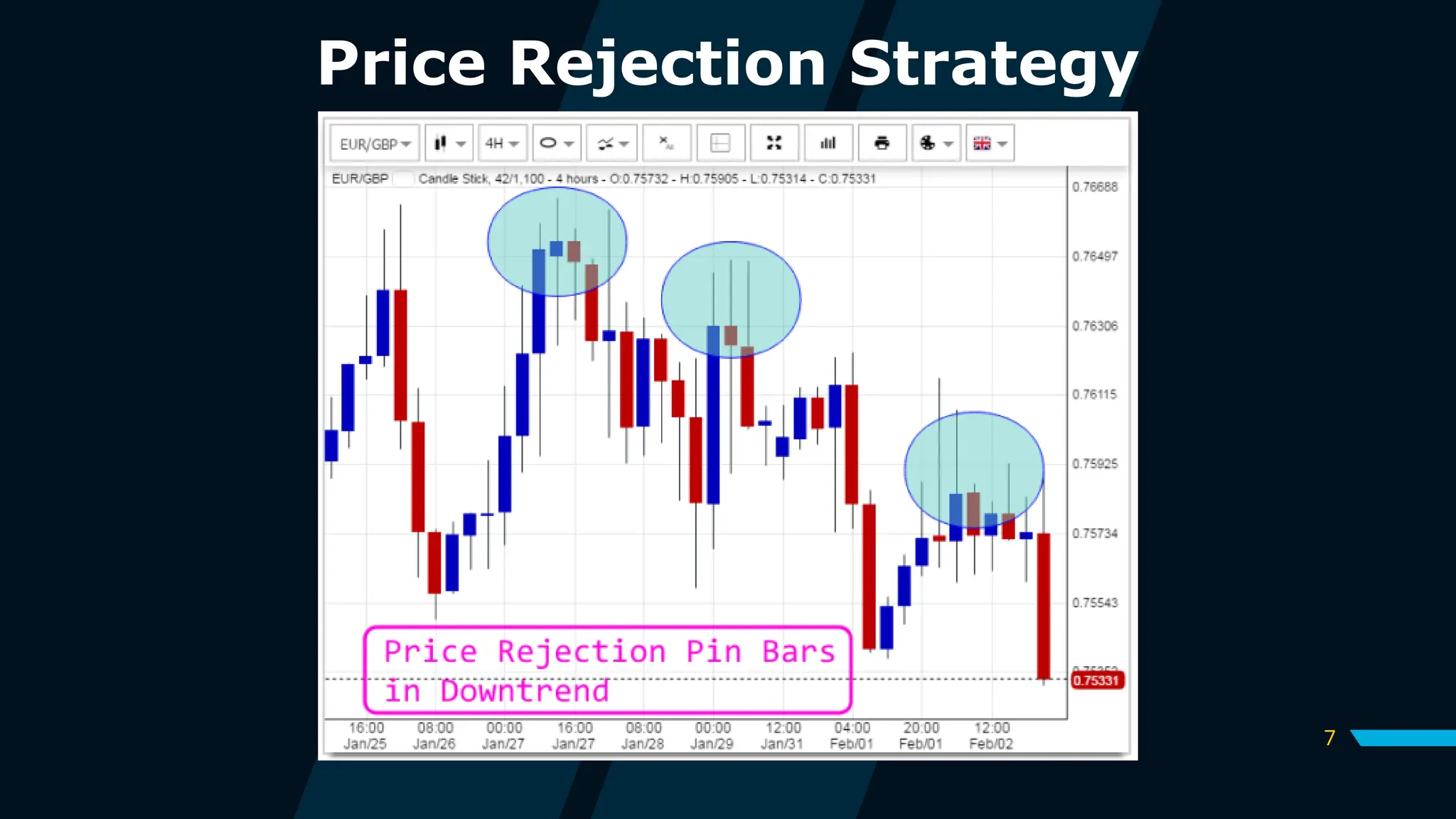

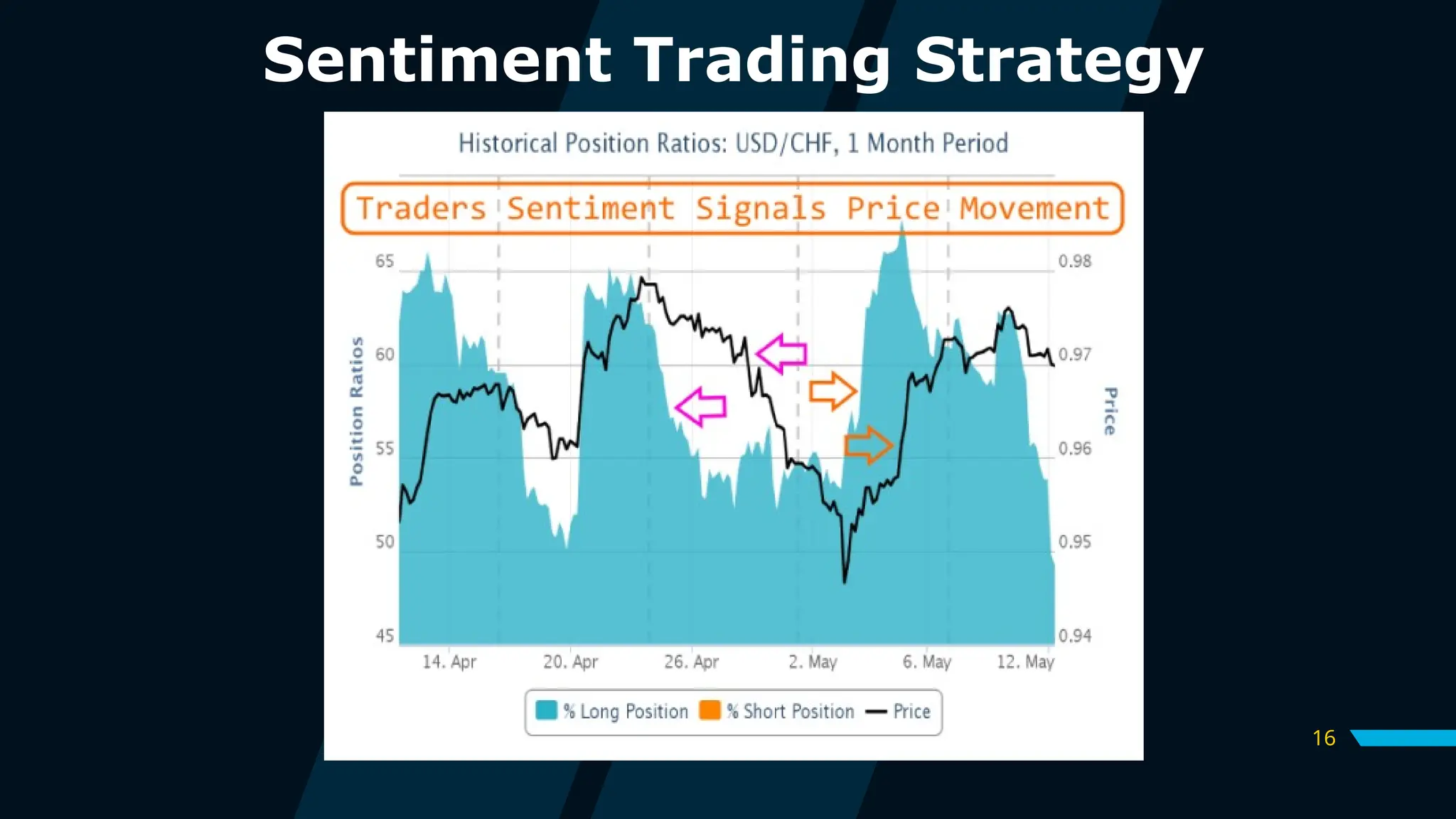

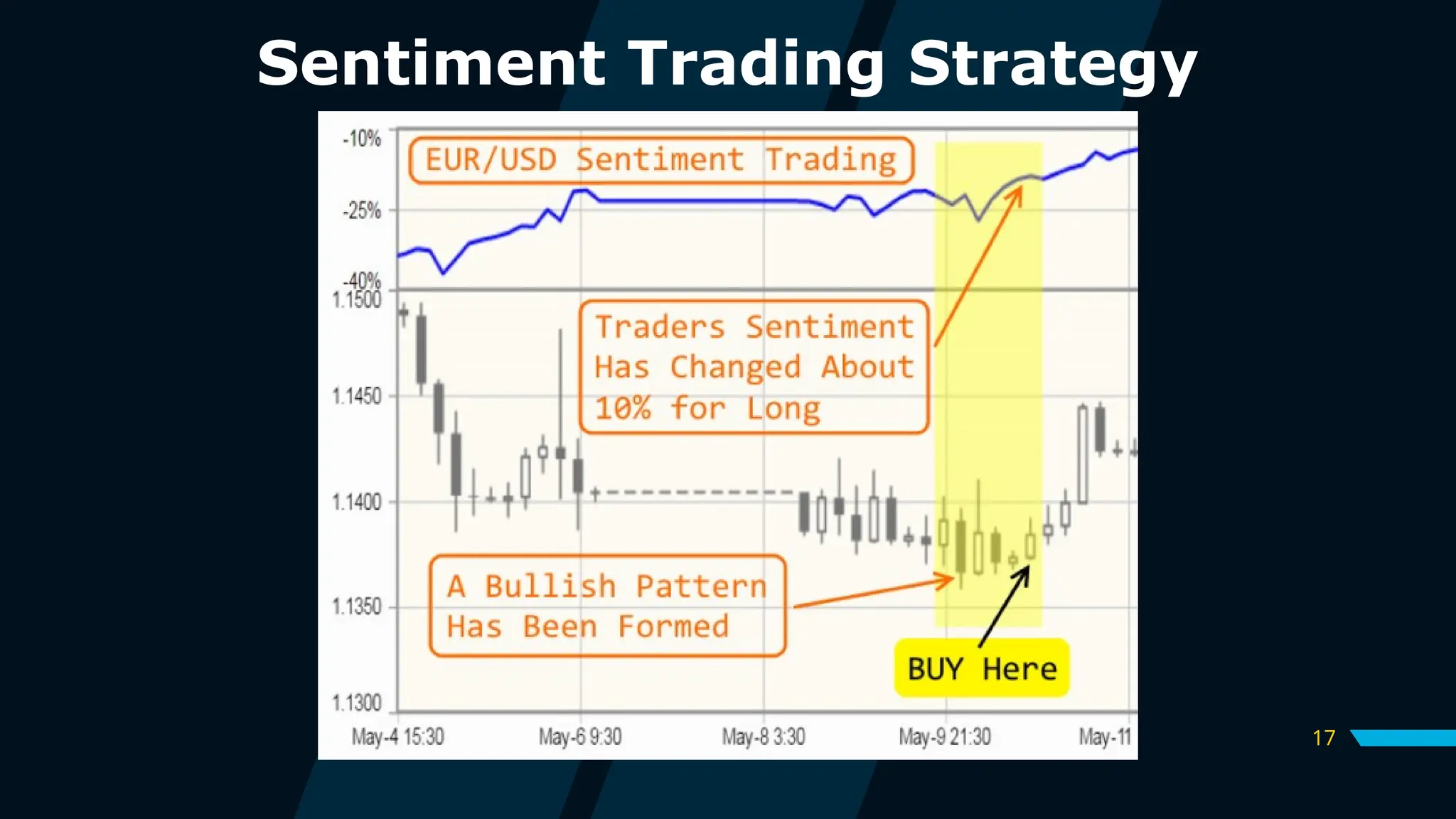

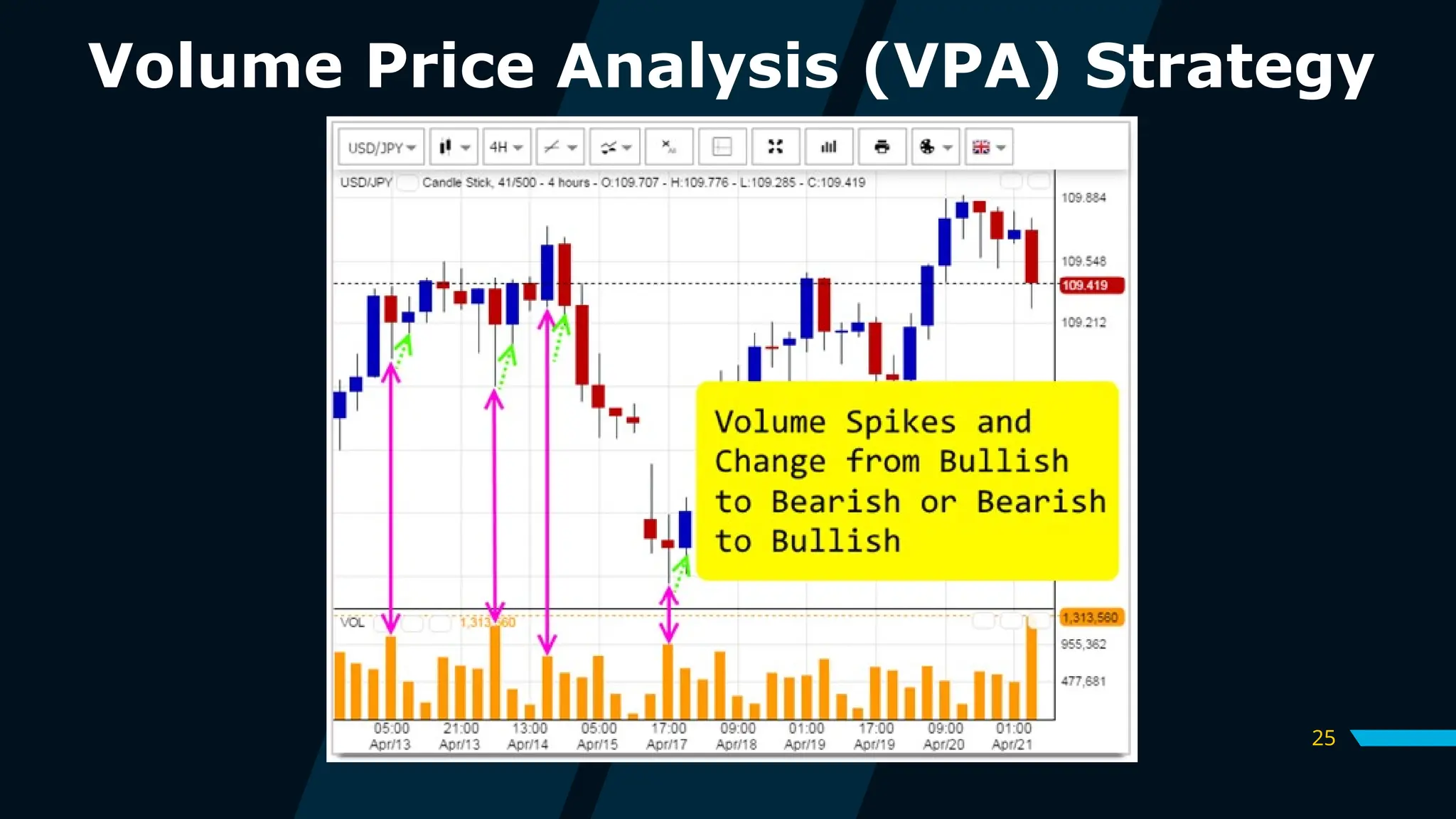

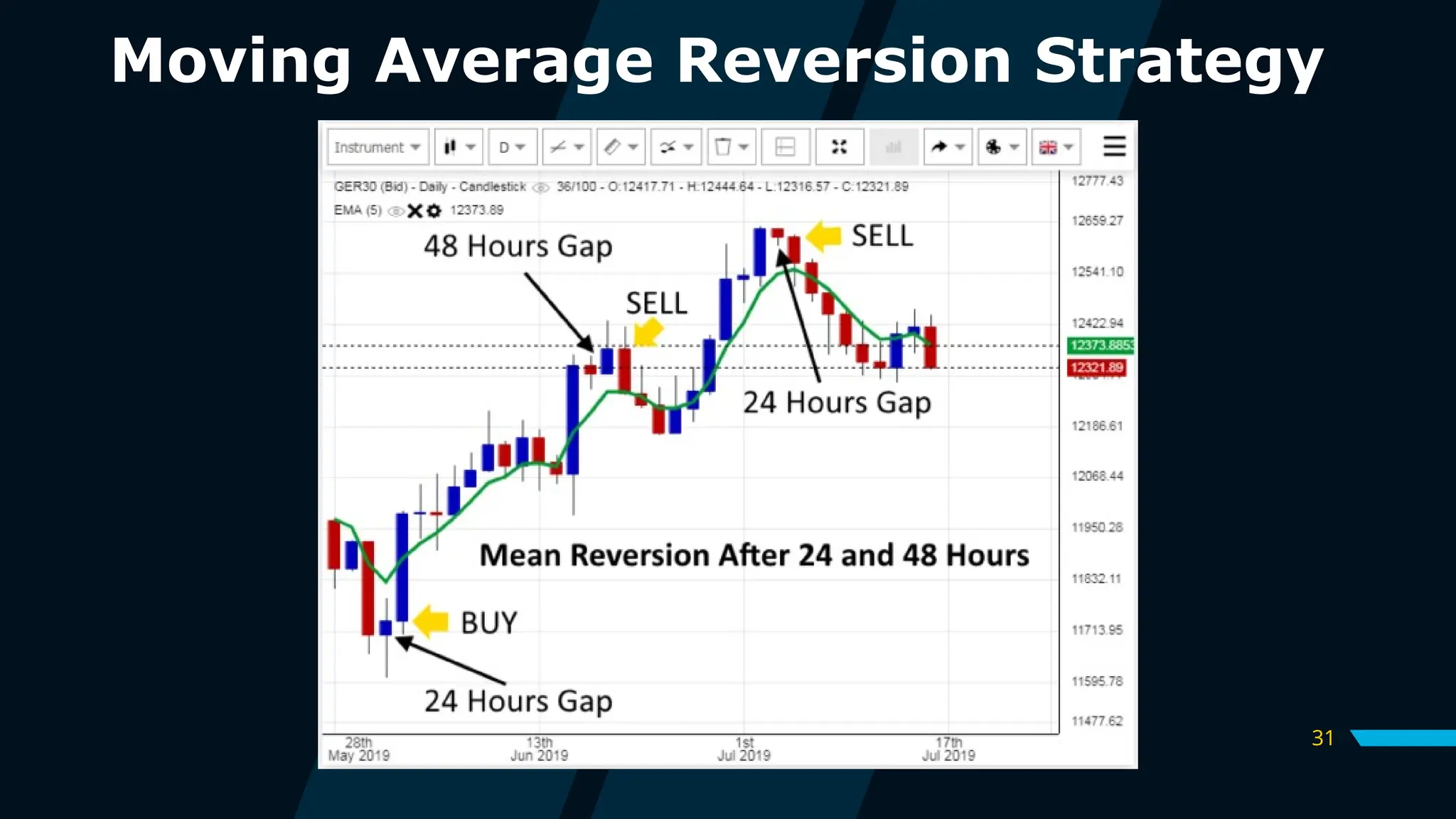

The document outlines the top 10 proven trading strategies, including chart patterns, price rejection, long-term trading, news trading, sentiment analysis, correlation trading, multiple time frame strategies, volume price analysis, inter-market trading, and moving average reversion. Each strategy is designed to improve trading performance by analyzing patterns, market sentiment, and trading volume. The document encourages traders to master these strategies for better profitability in various market conditions.