The document summarizes the concepts of international arbitrage and interest rate parity. It defines different types of arbitrage opportunities including locational, triangular, and covered interest arbitrage. It also derives the formula for interest rate parity and shows how it ensures arbitrage profits are not possible. The document notes that while interest rate parity generally holds, deviations may exist due to transaction costs, political risk, and tax differences across countries. It concludes by discussing how arbitrage forces can impact the valuation of multinational companies.

![Derivation of IRP

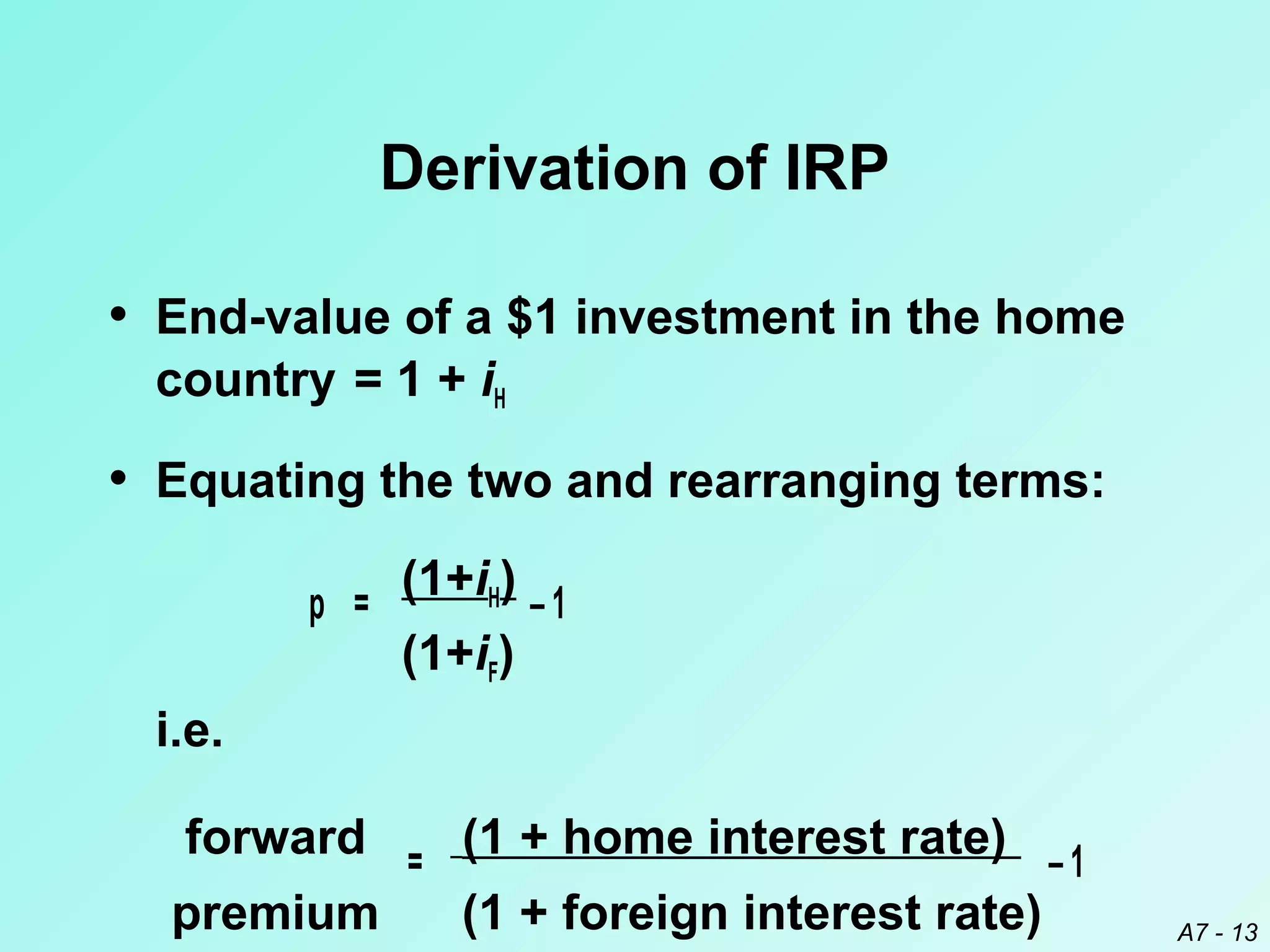

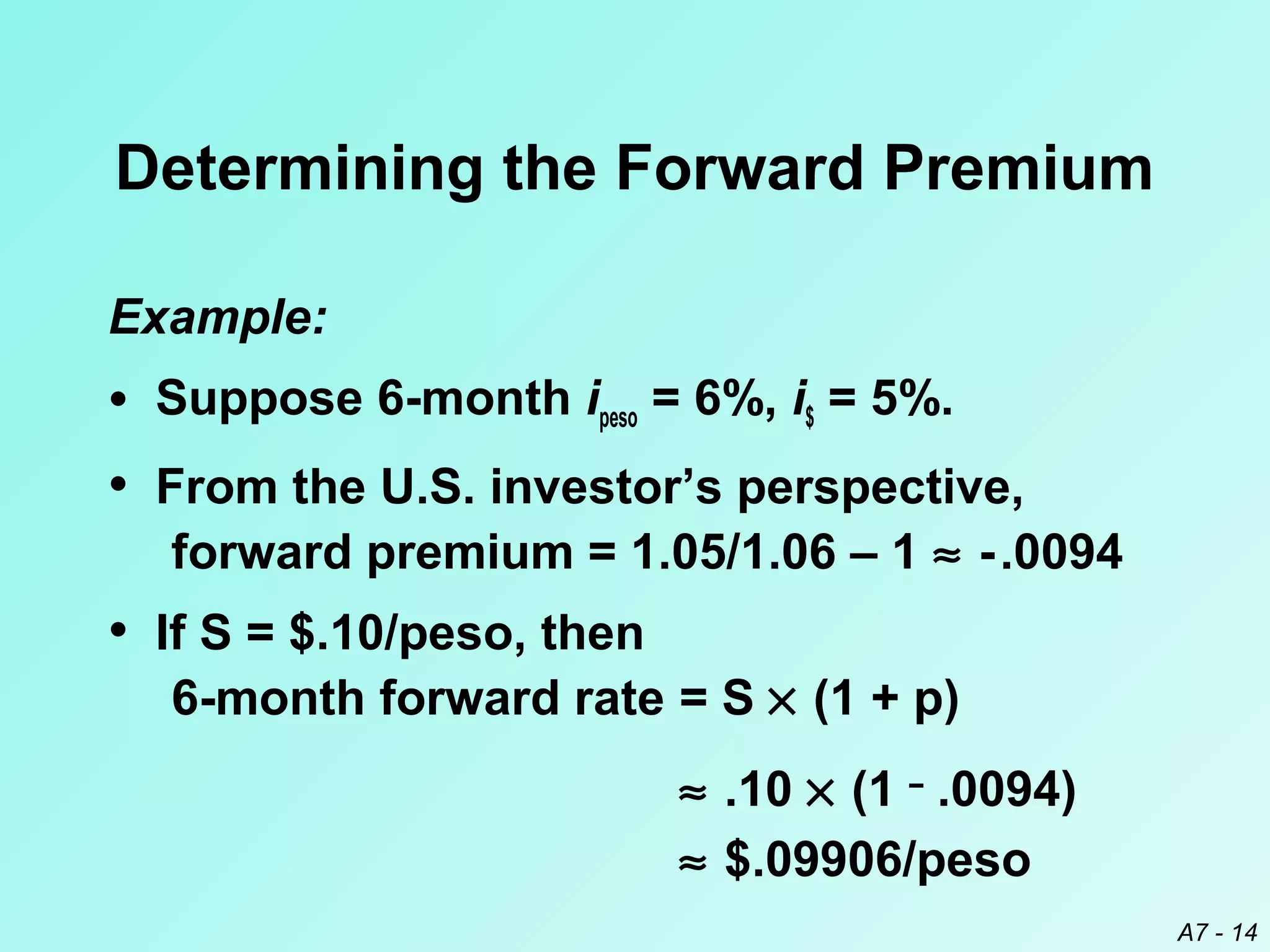

• When IRP exists, the rate of return

achieved from covered interest arbitrage

should equal the rate of return available in

the home country.

• End-value of a $1 investment in covered

interest arbitrage = (1/S) × (1+iF) × F

= (1/S) × (1+iF) × [S × (1+p)]

= (1+iF) × (1+p)

where p is the forward premium.

A7 - 12](https://image.slidesharecdn.com/basic07-140127113806-phpapp02/75/Basic07-12-2048.jpg)

![Impact of Arbitrage on an MNC’s Value

Forces of Arbitrage

m

E ( CFj , t ) × E (ER j , t )

n ∑

j =1

Value = ∑

(1 + k ) t

t =1

[

]

E (CFj,t )

=

expected cash flows in

currency j to be received by the U.S. parent at the

end of period t

E (ERj,t )

=

expected exchange rate at

which currency j can be converted to dollars at

the end of period t

A7 - 22](https://image.slidesharecdn.com/basic07-140127113806-phpapp02/75/Basic07-22-2048.jpg)