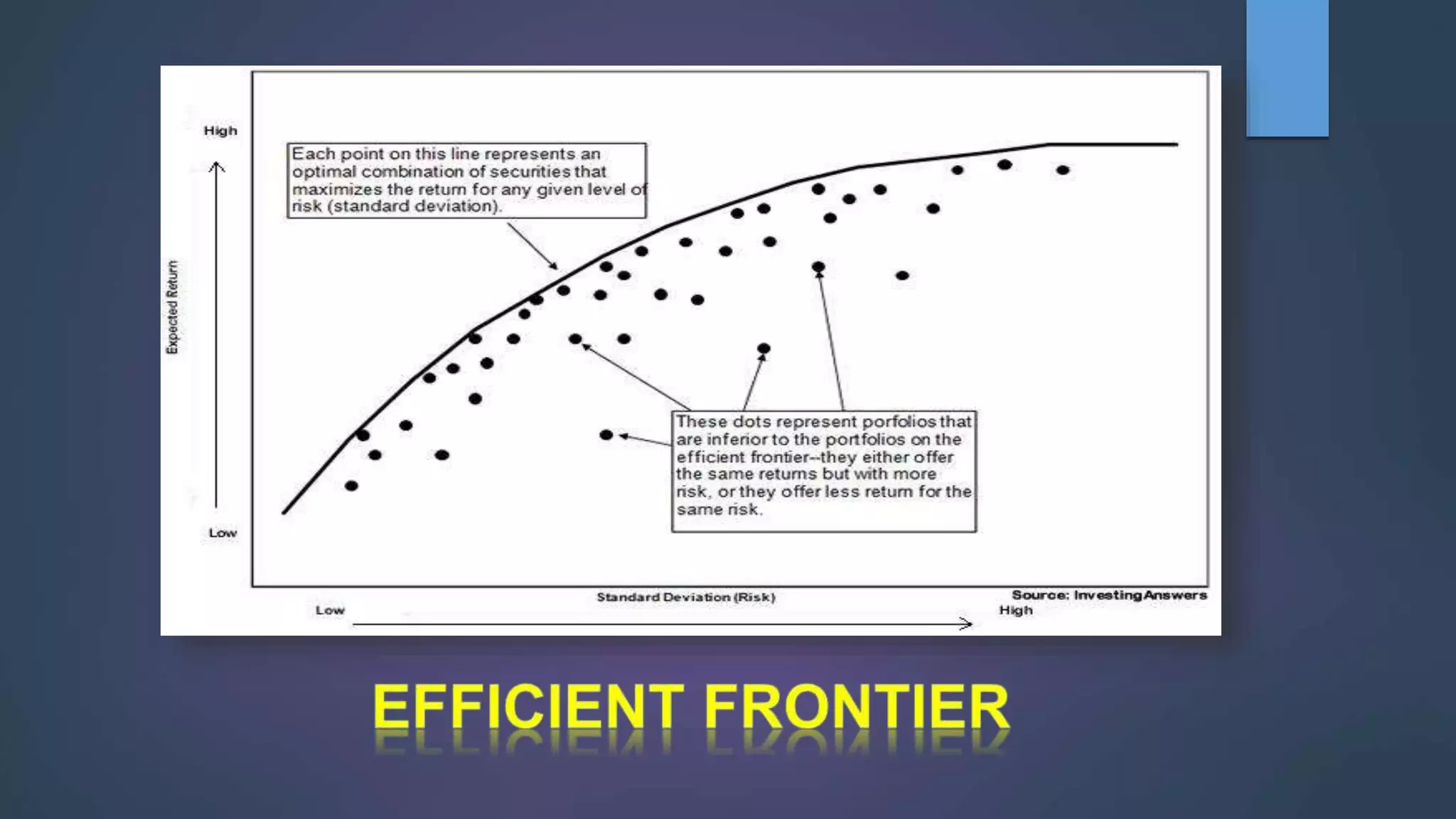

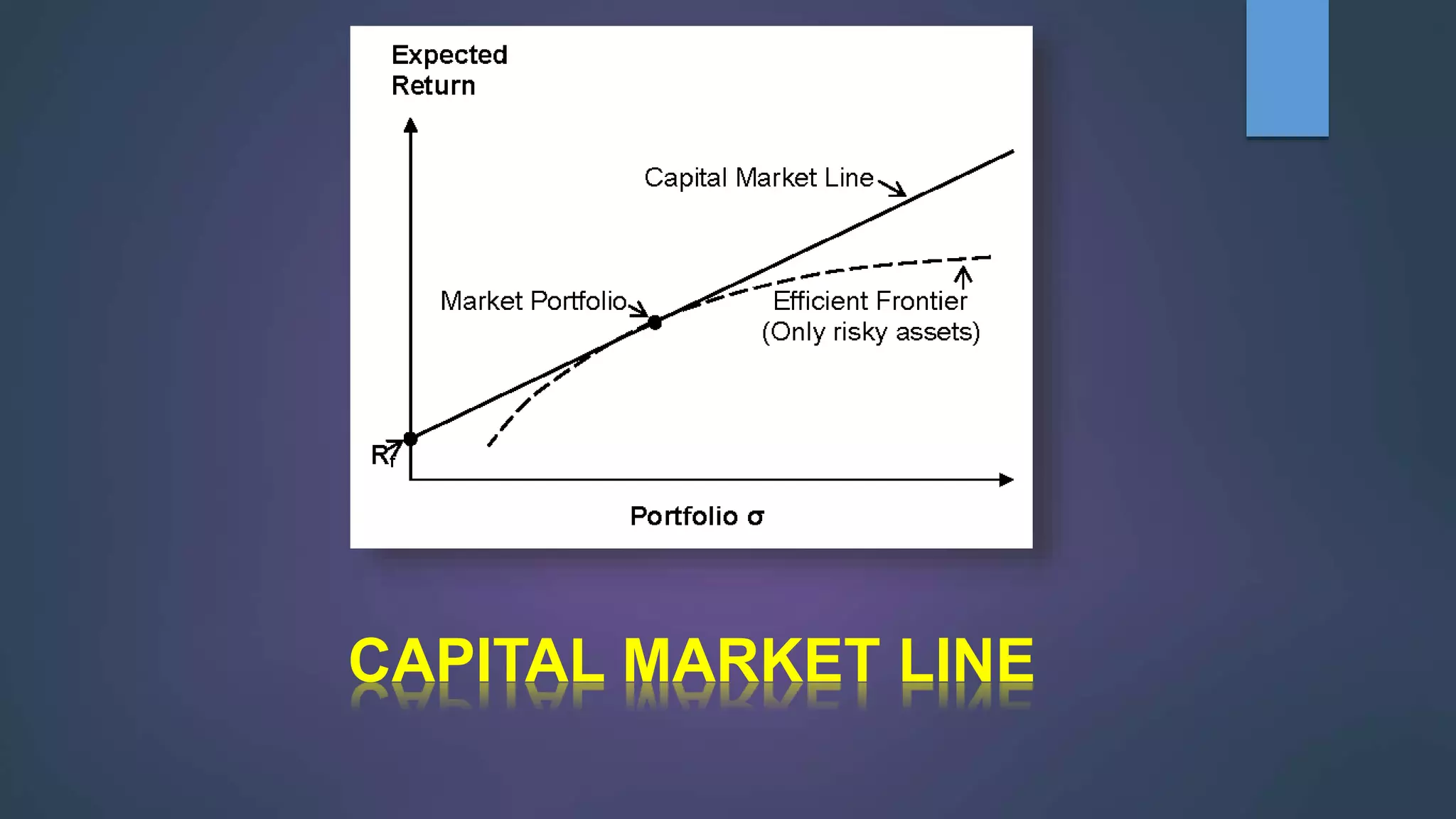

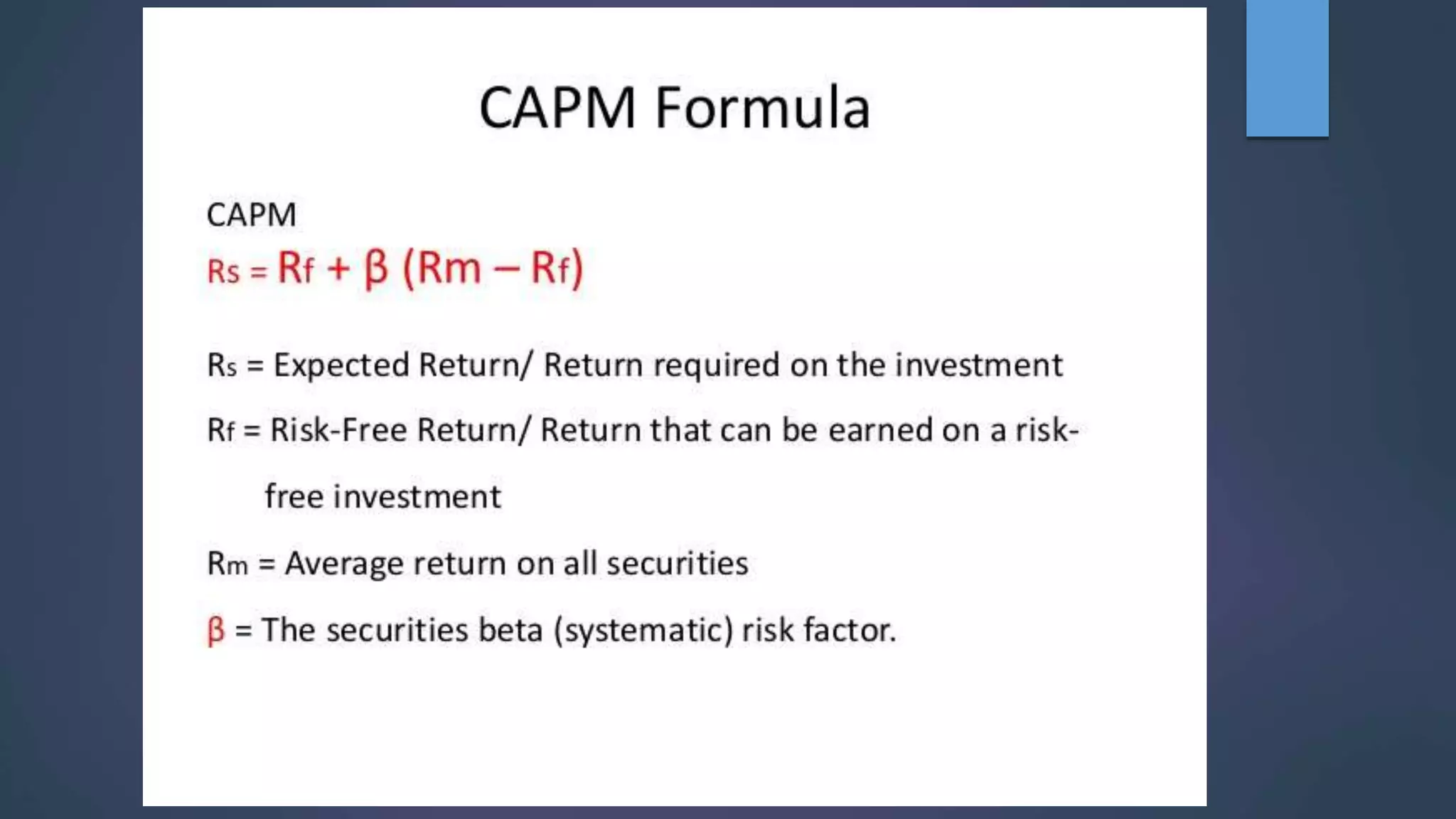

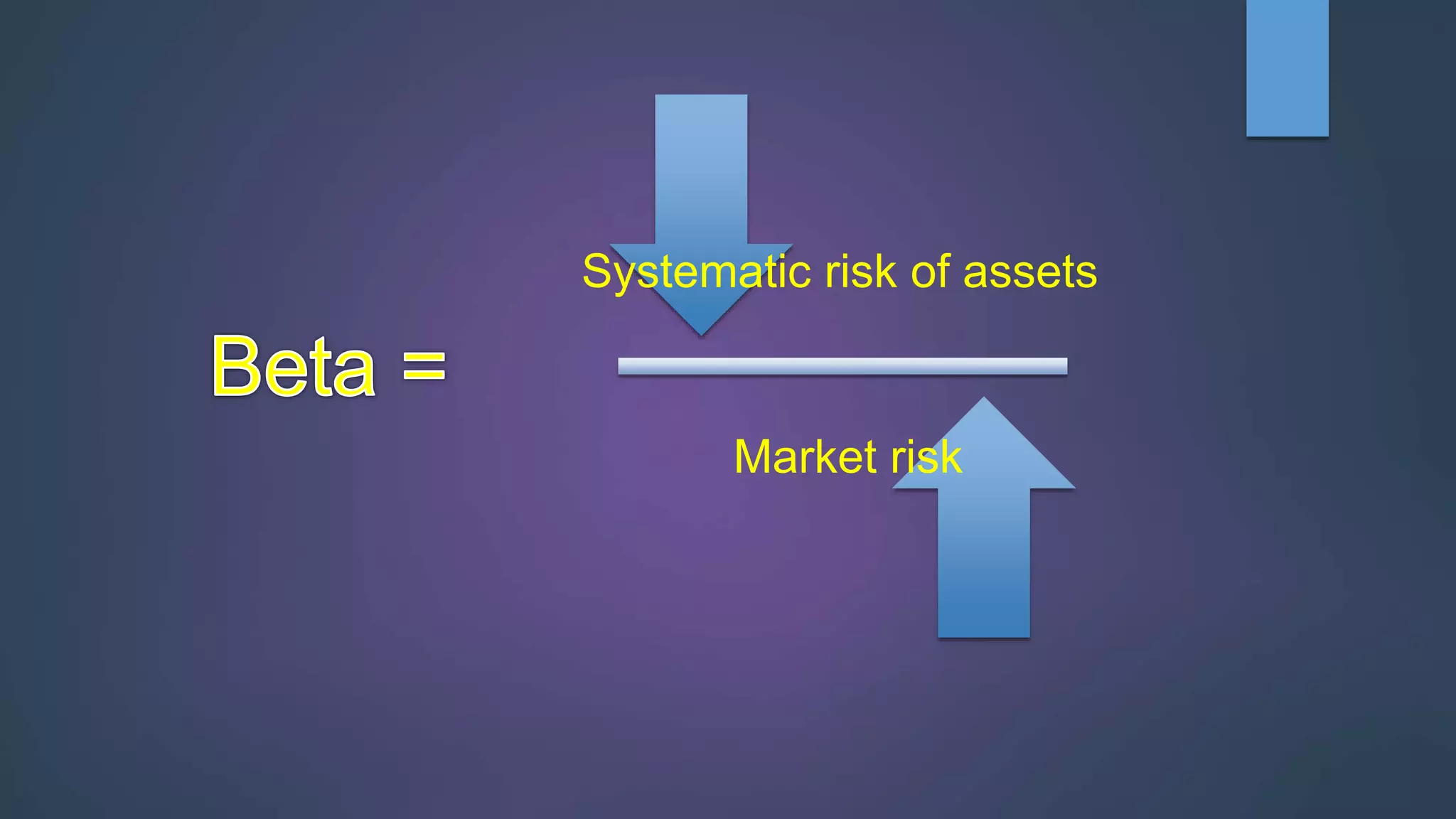

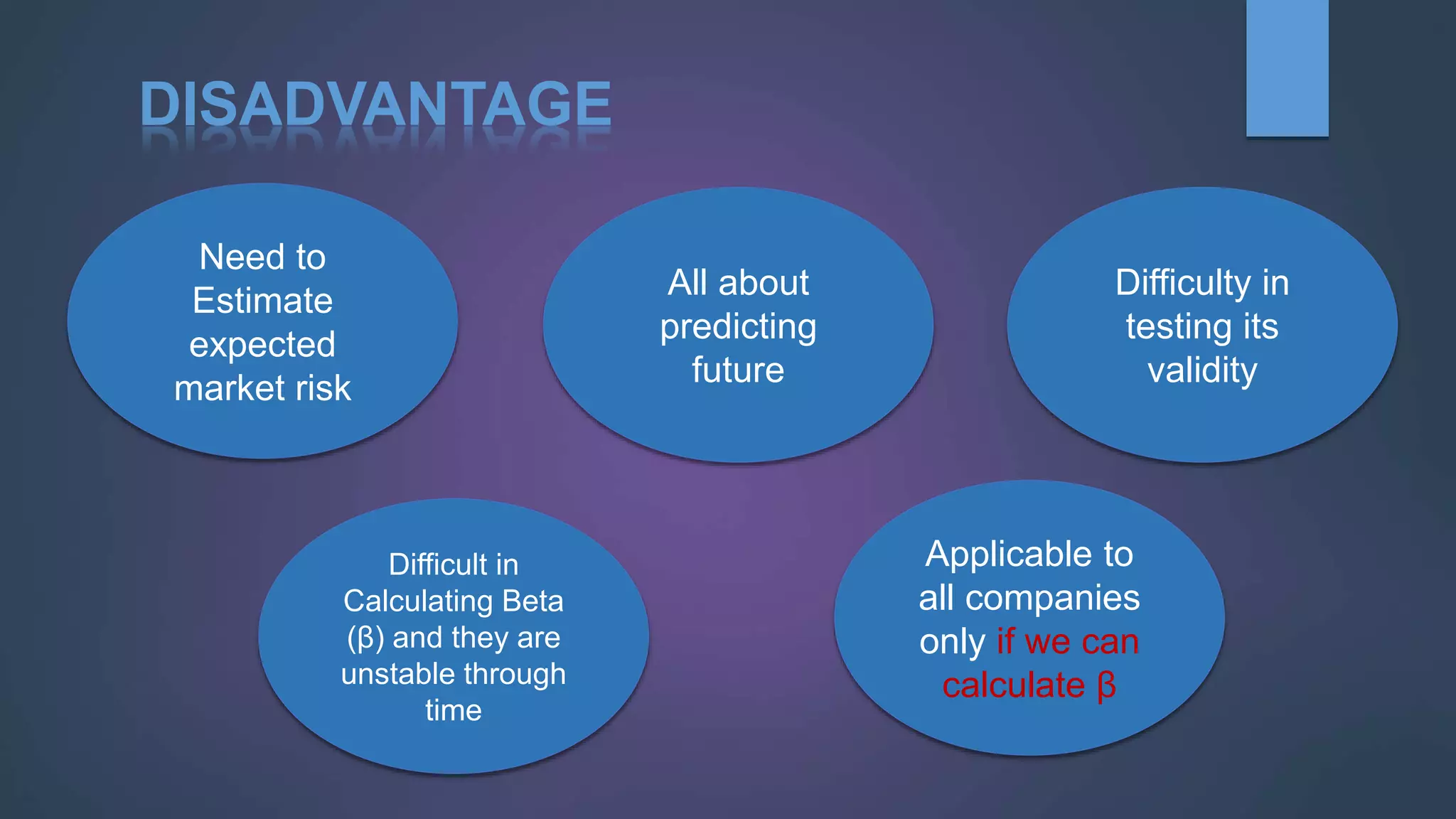

This document discusses the relationship between risk and return in investments. It introduces concepts like the capital market line, security market line, systematic and unsystematic risk, beta, and the Capital Asset Pricing Model (CAPM). CAPM holds that the expected return of an asset is determined by its sensitivity to non-diversifiable risk (beta) rather than its total risk. The model describes the tradeoff between risk and return and how risk is compensated through higher expected returns.