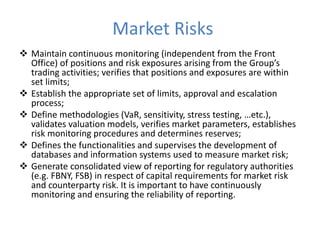

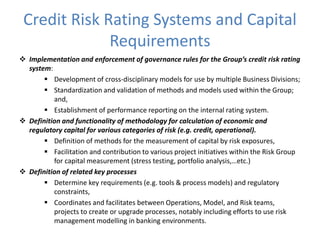

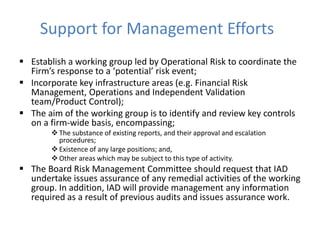

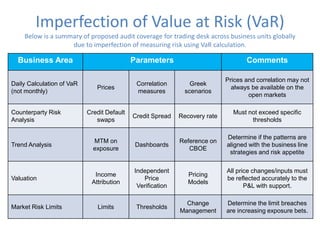

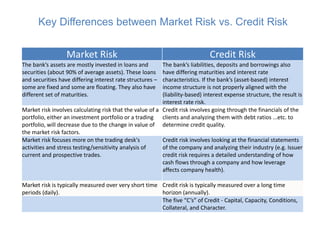

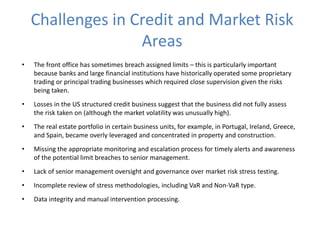

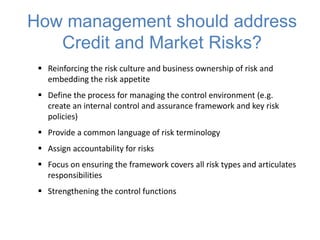

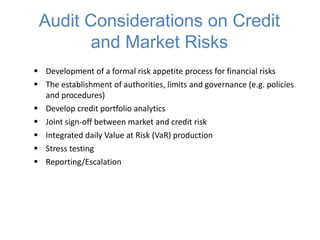

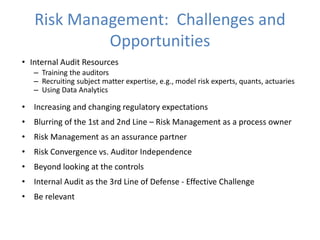

The document outlines a workshop on building a robust risk management framework focused on credit and market risks. Key topics include evaluating credit portfolios, risk reporting, and the use of credit derivatives for risk transfer, while highlighting the imperfect nature of Value-at-Risk (VaR) calculations. It emphasizes the importance of continuous monitoring and enhancing governance structures to manage credit and market risks effectively.