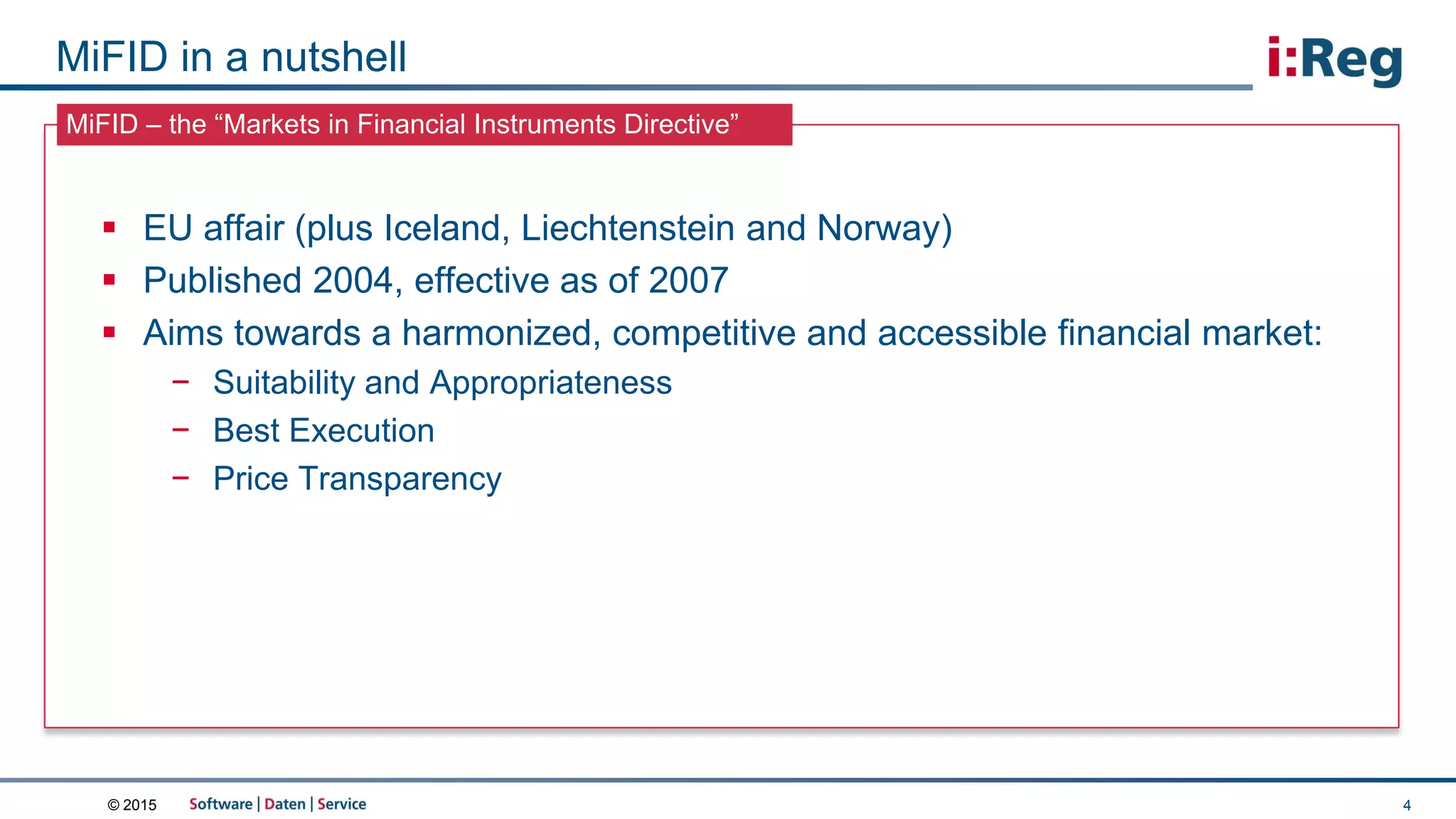

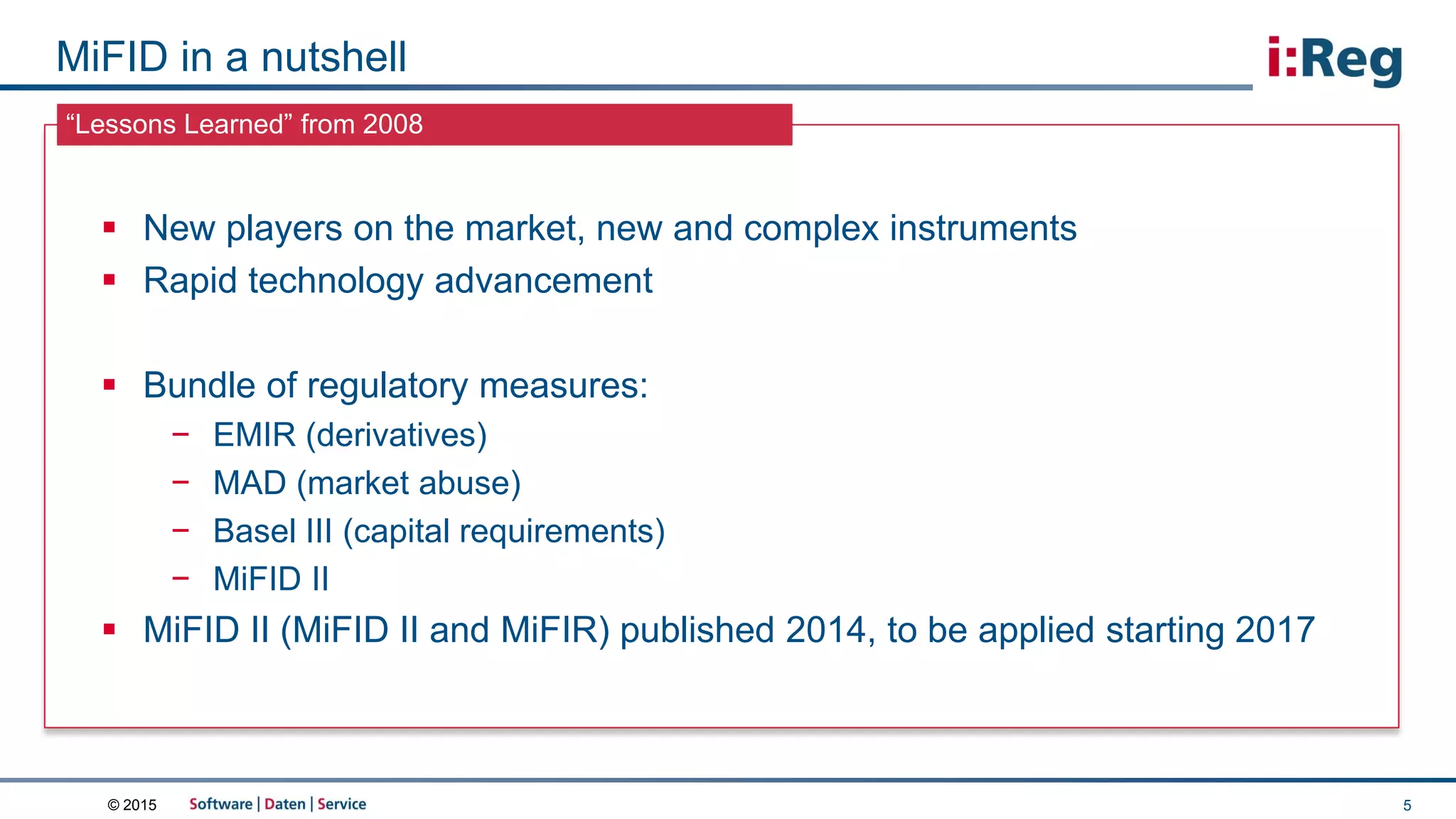

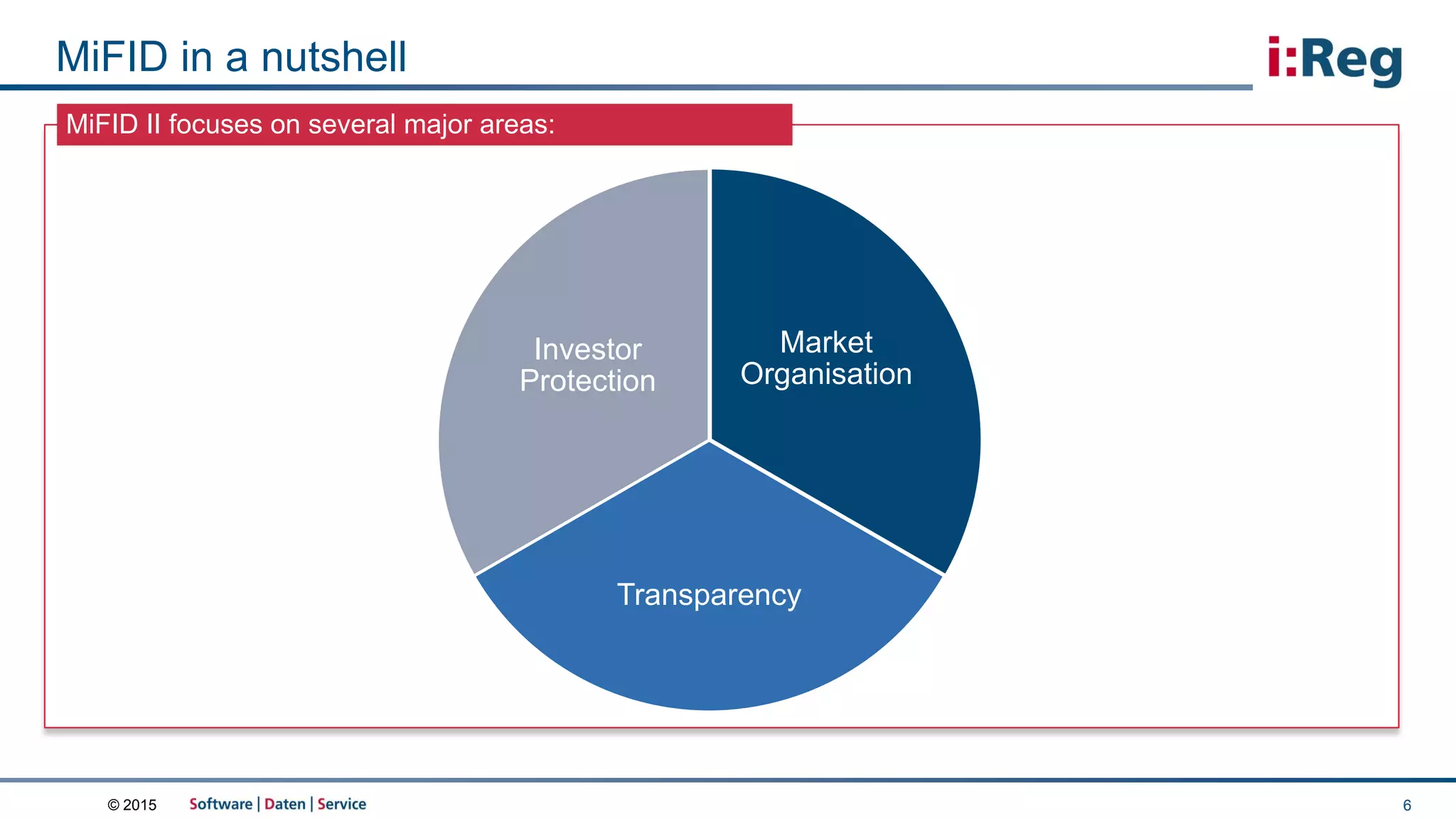

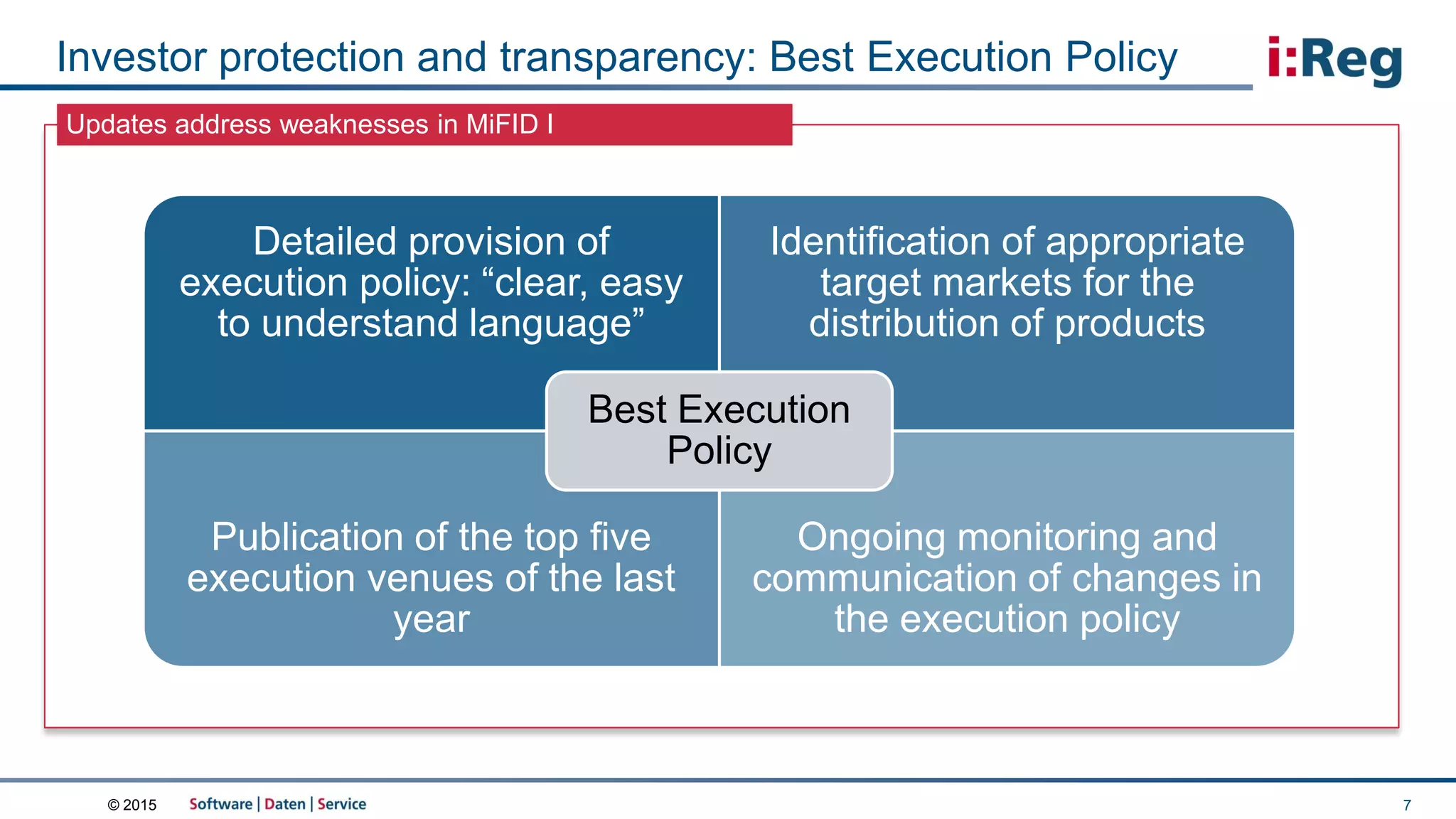

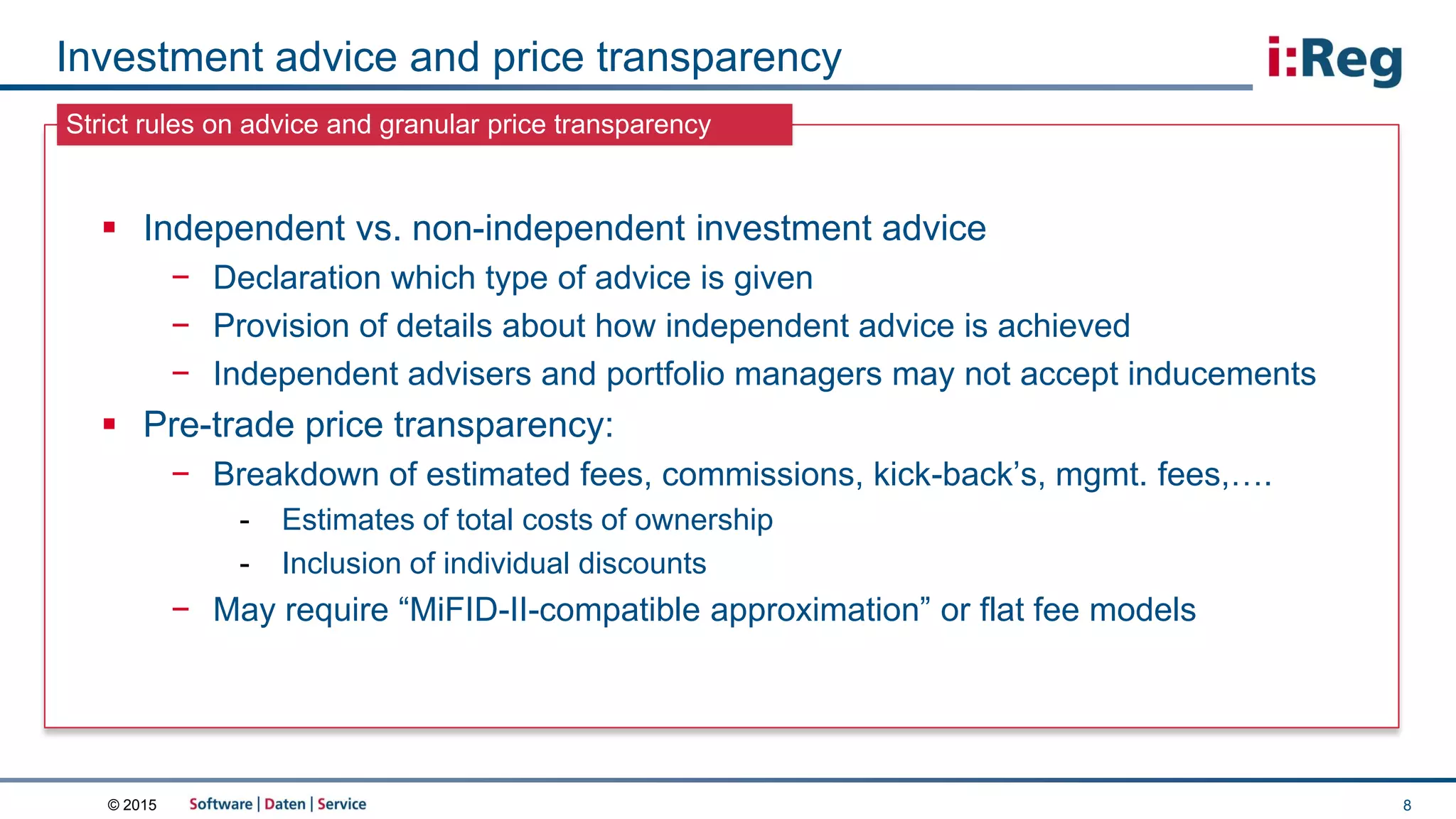

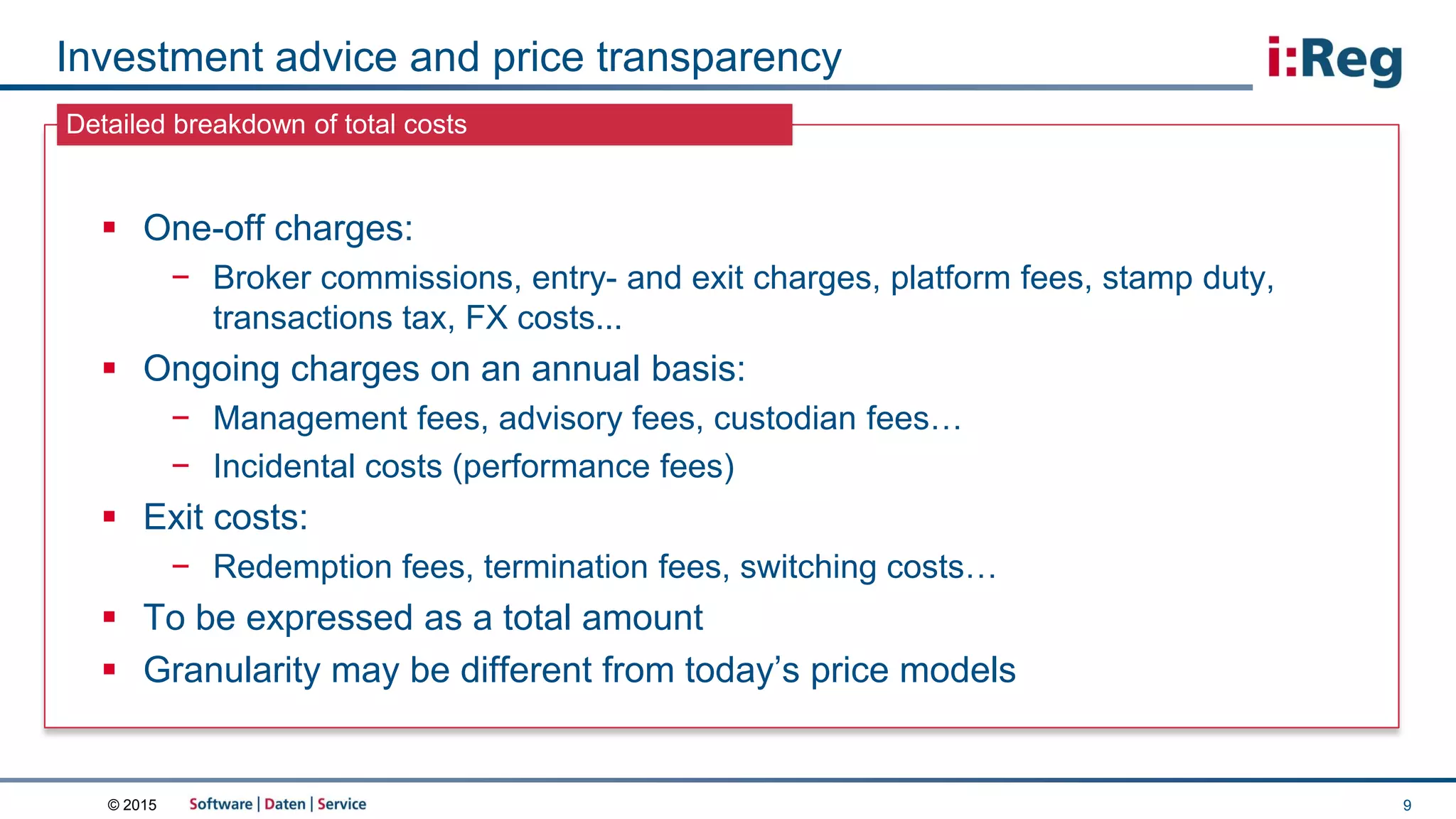

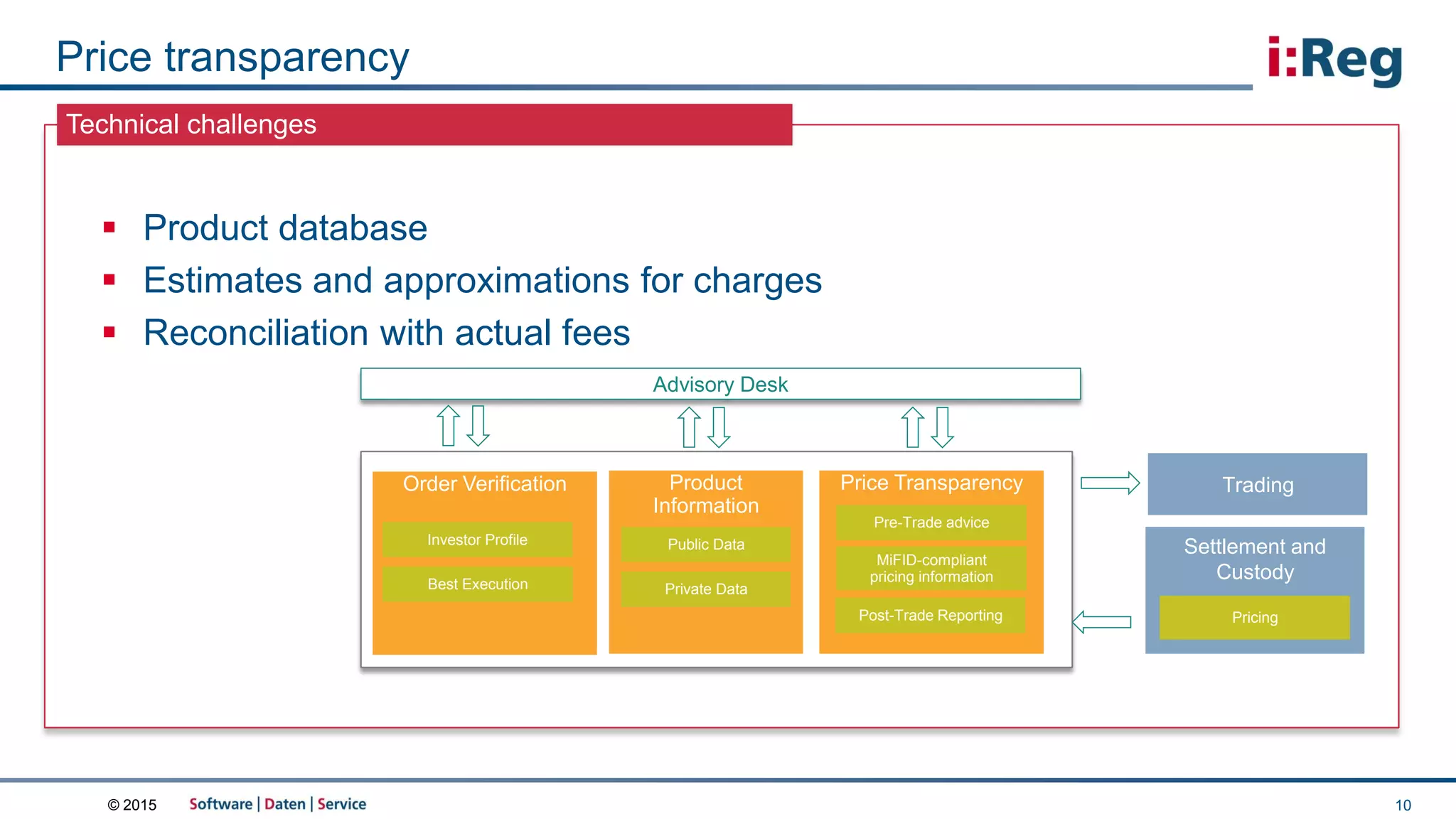

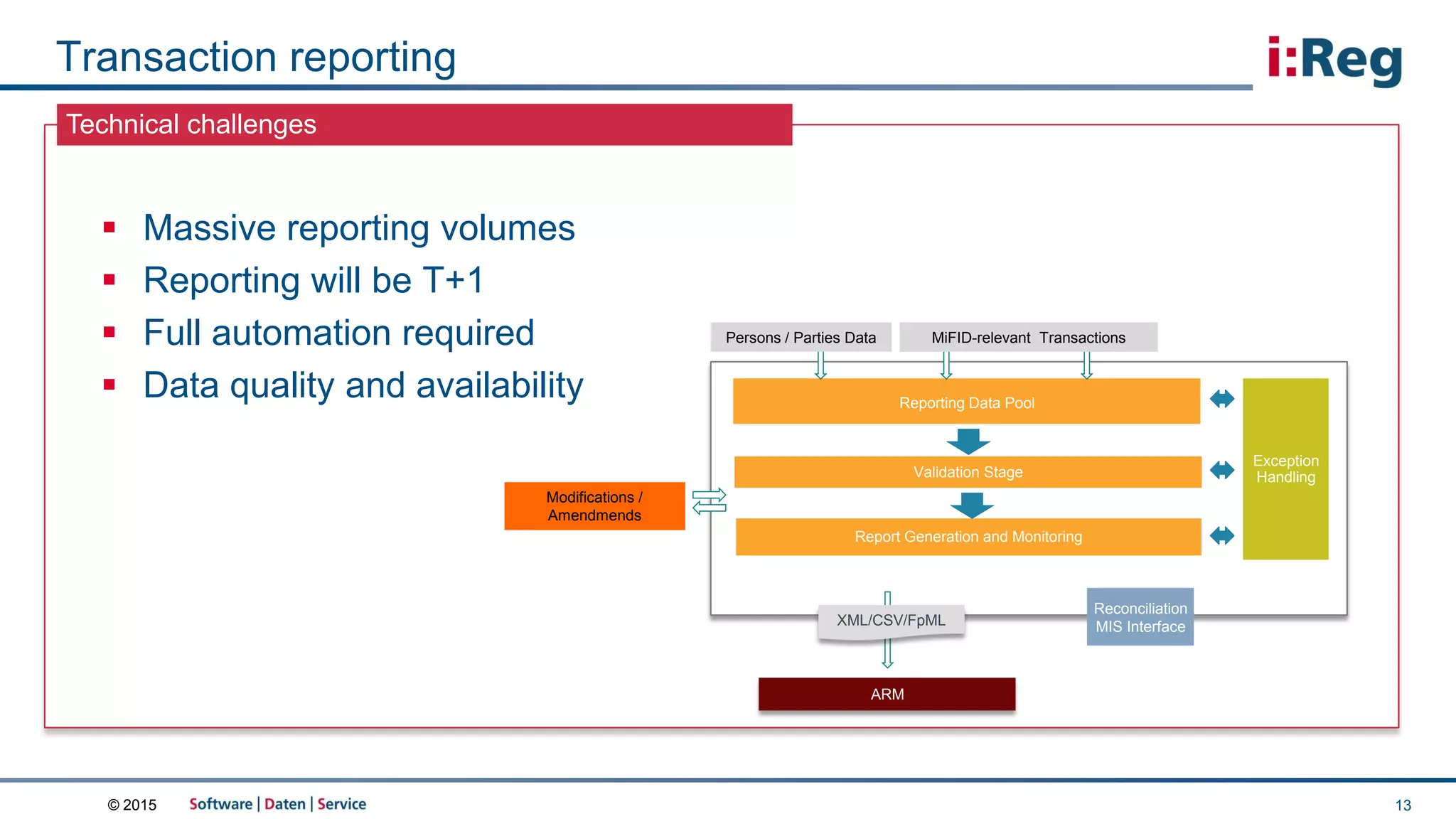

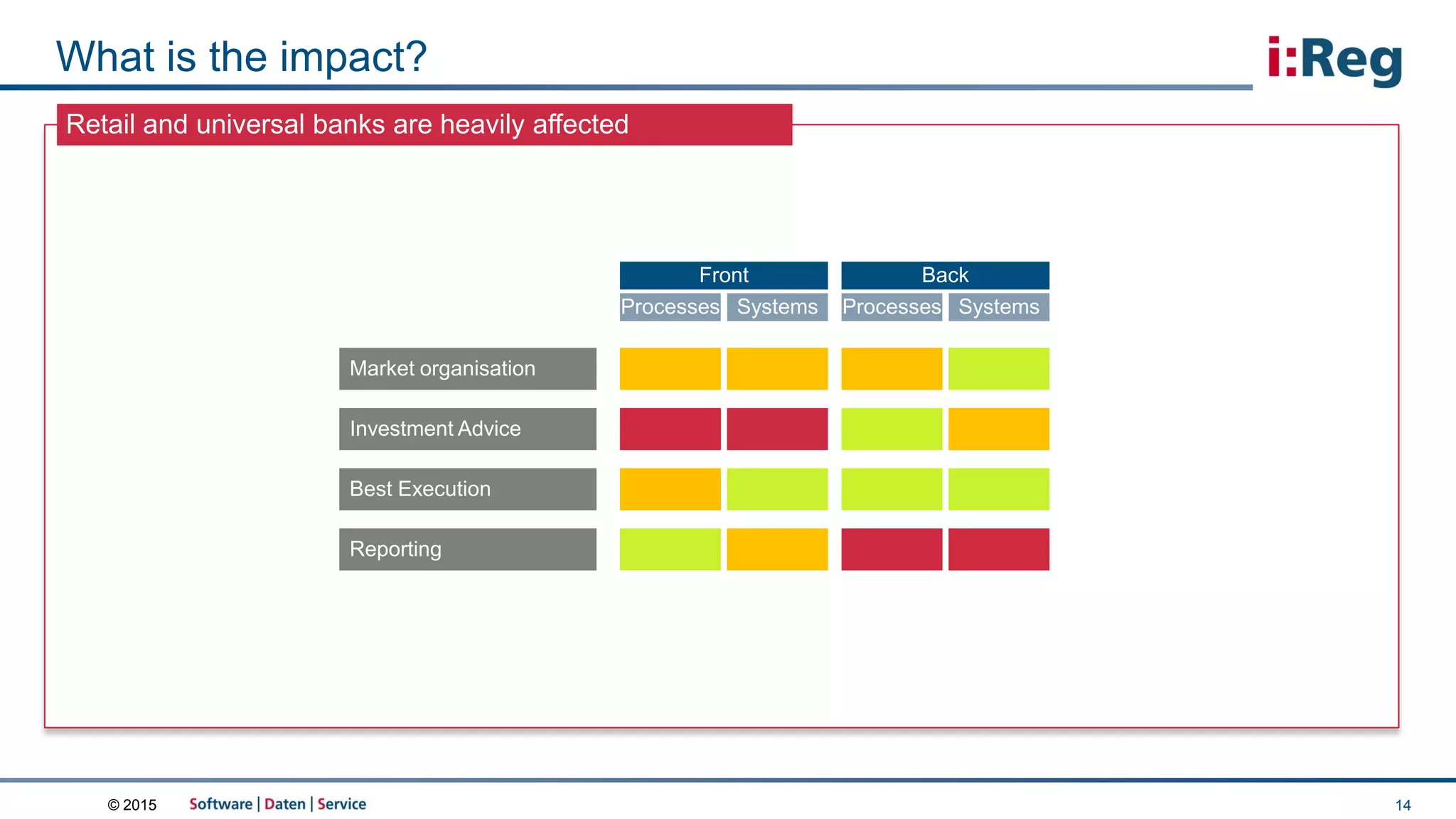

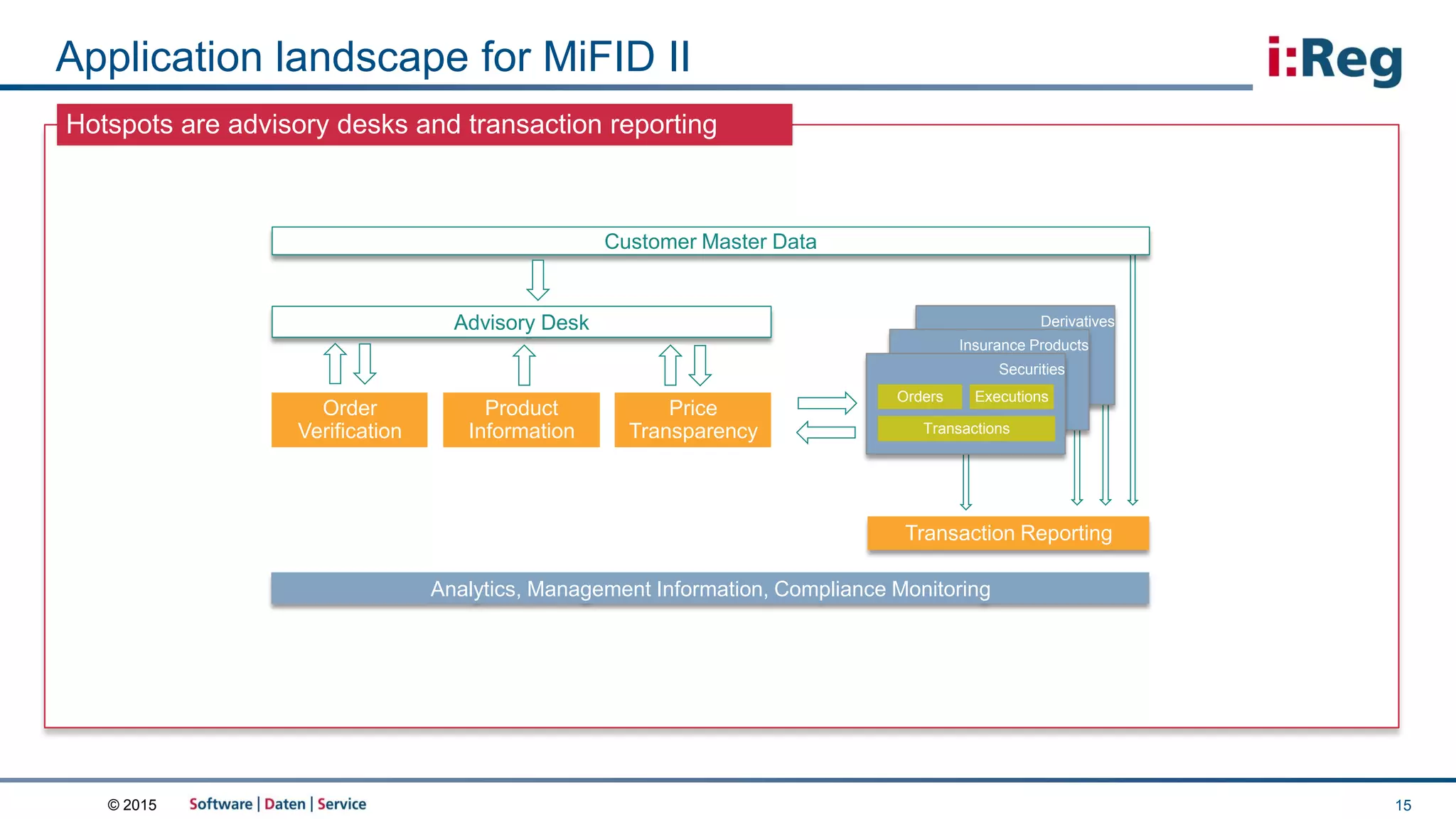

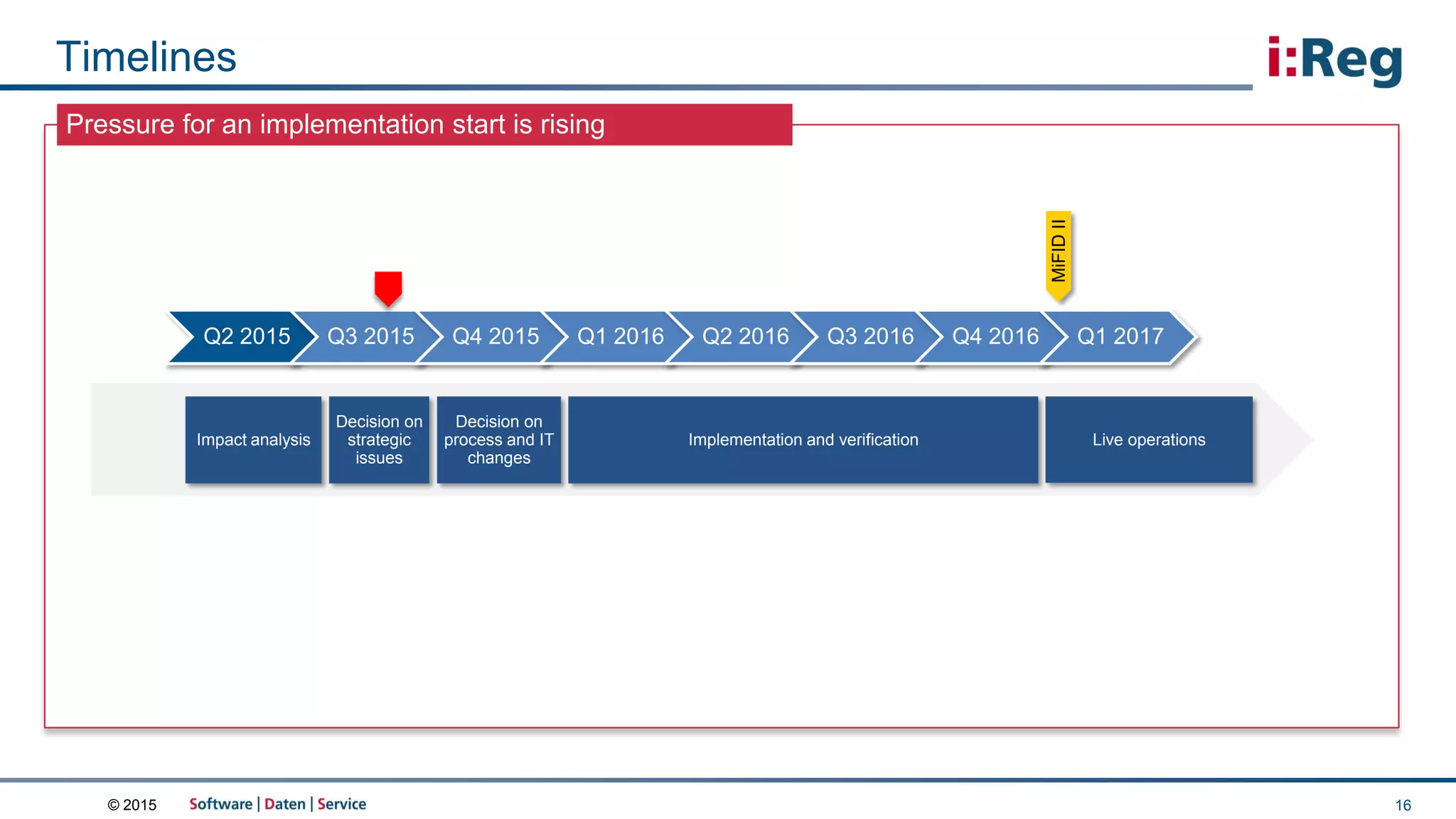

The document outlines the key aspects and implications of MiFID II, a significant update to financial market regulations in the EU aimed at enhancing investor protection, transparency, and market organization. It highlights the technical challenges that financial institutions will face in adapting to the new reporting regime and the need for compliance with stricter rules on best execution and investment advice. The document emphasizes the urgency for financial institutions to begin implementing necessary changes to meet the approaching deadlines and regulatory requirements.