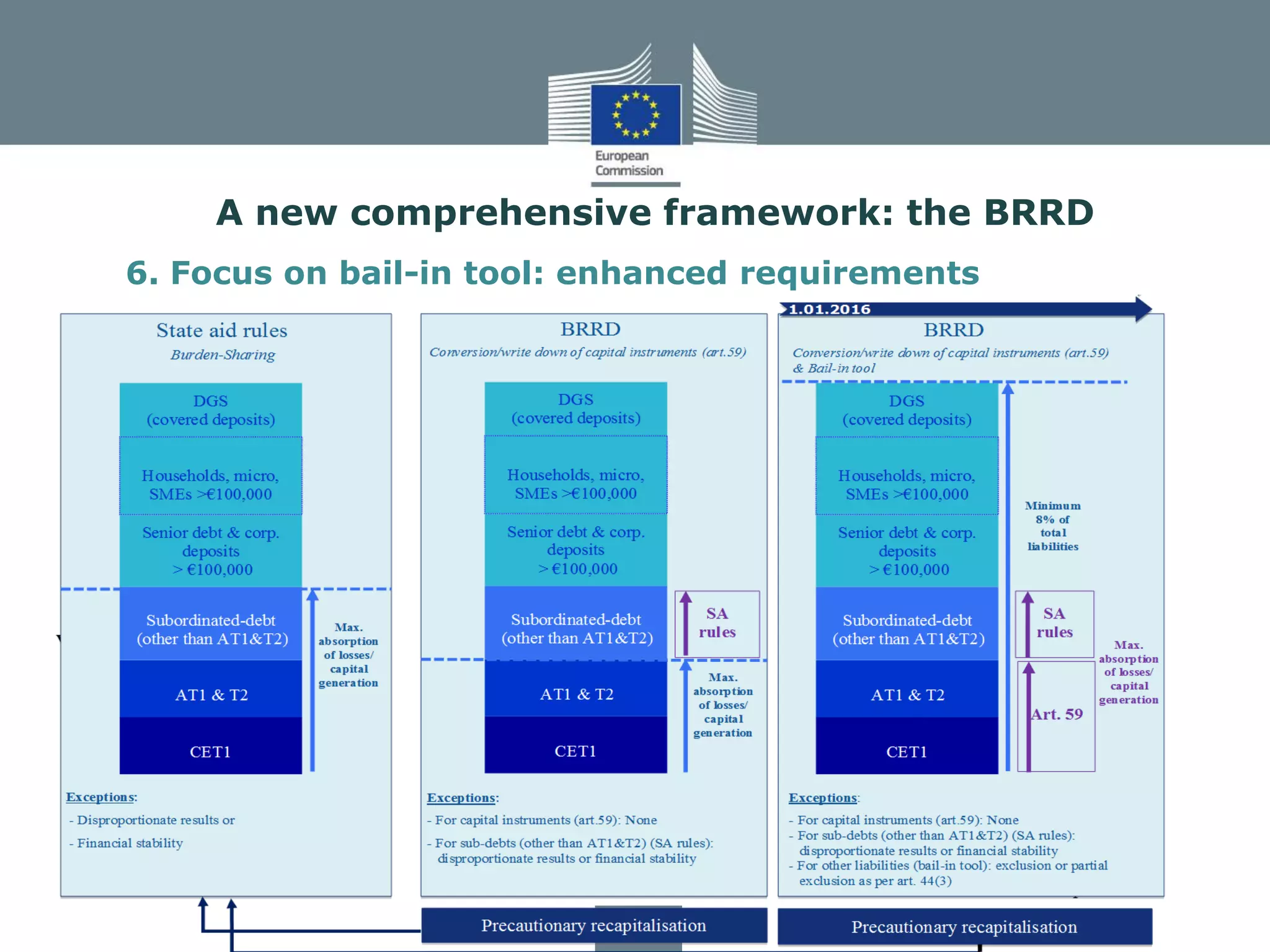

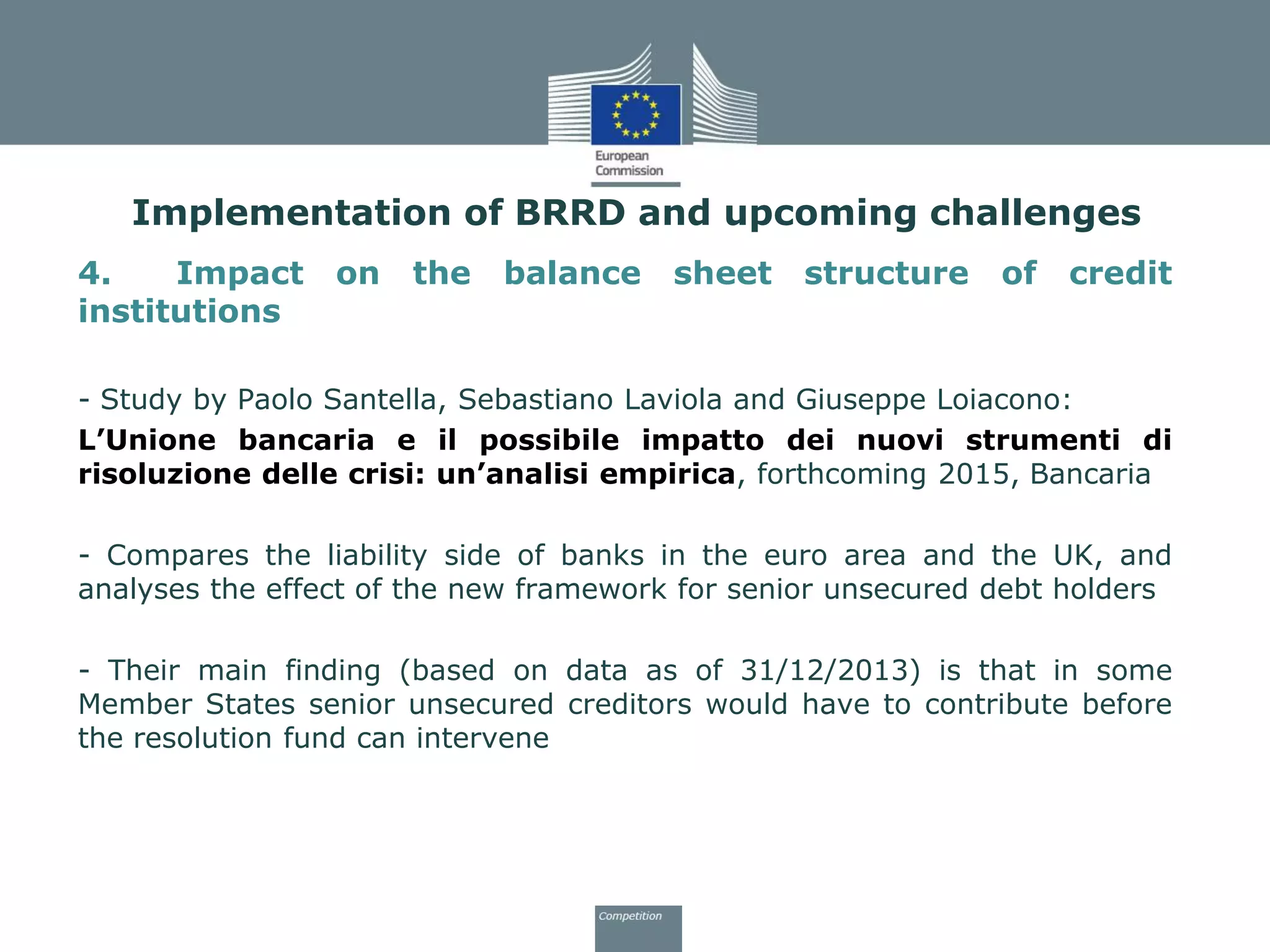

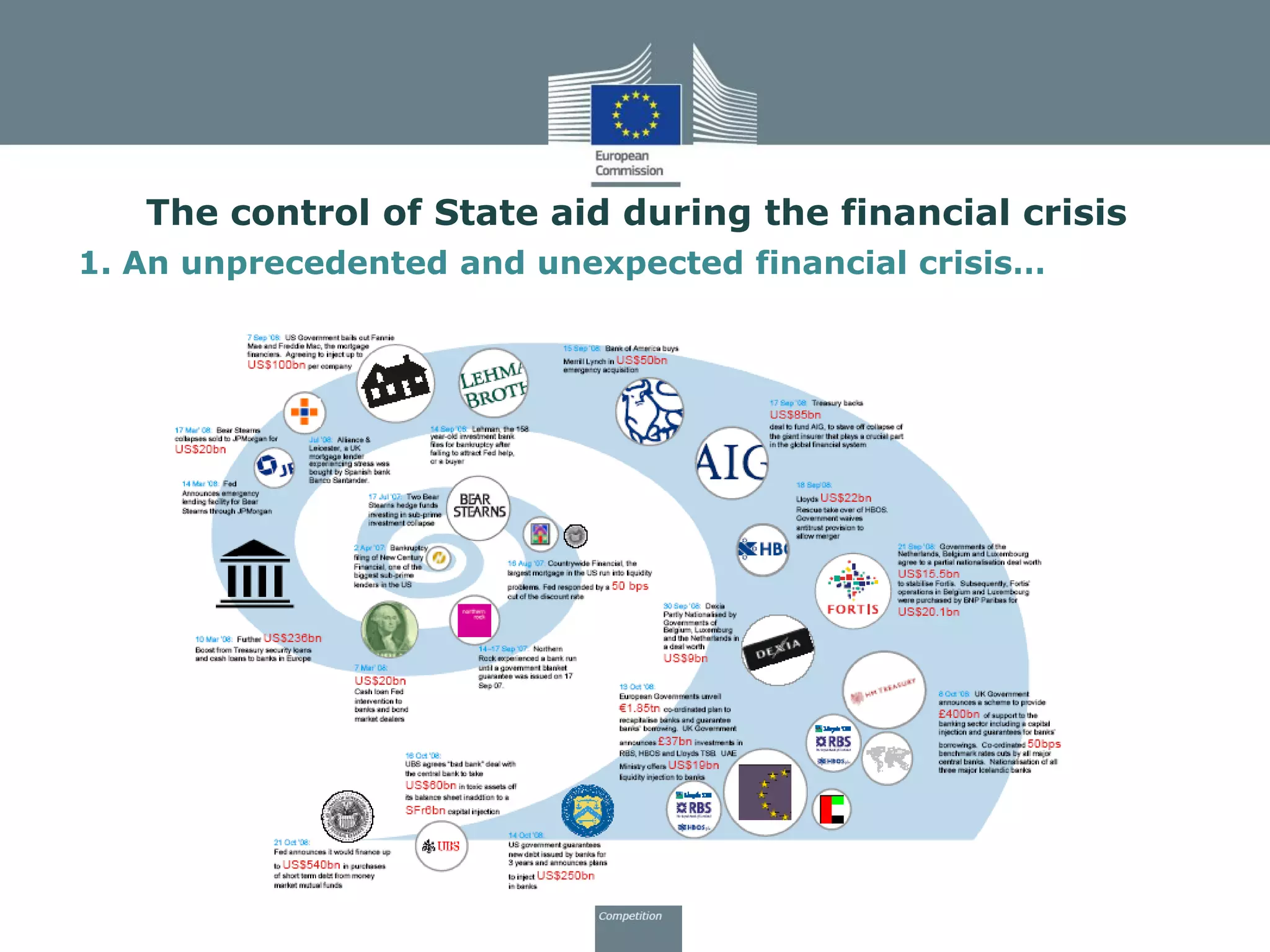

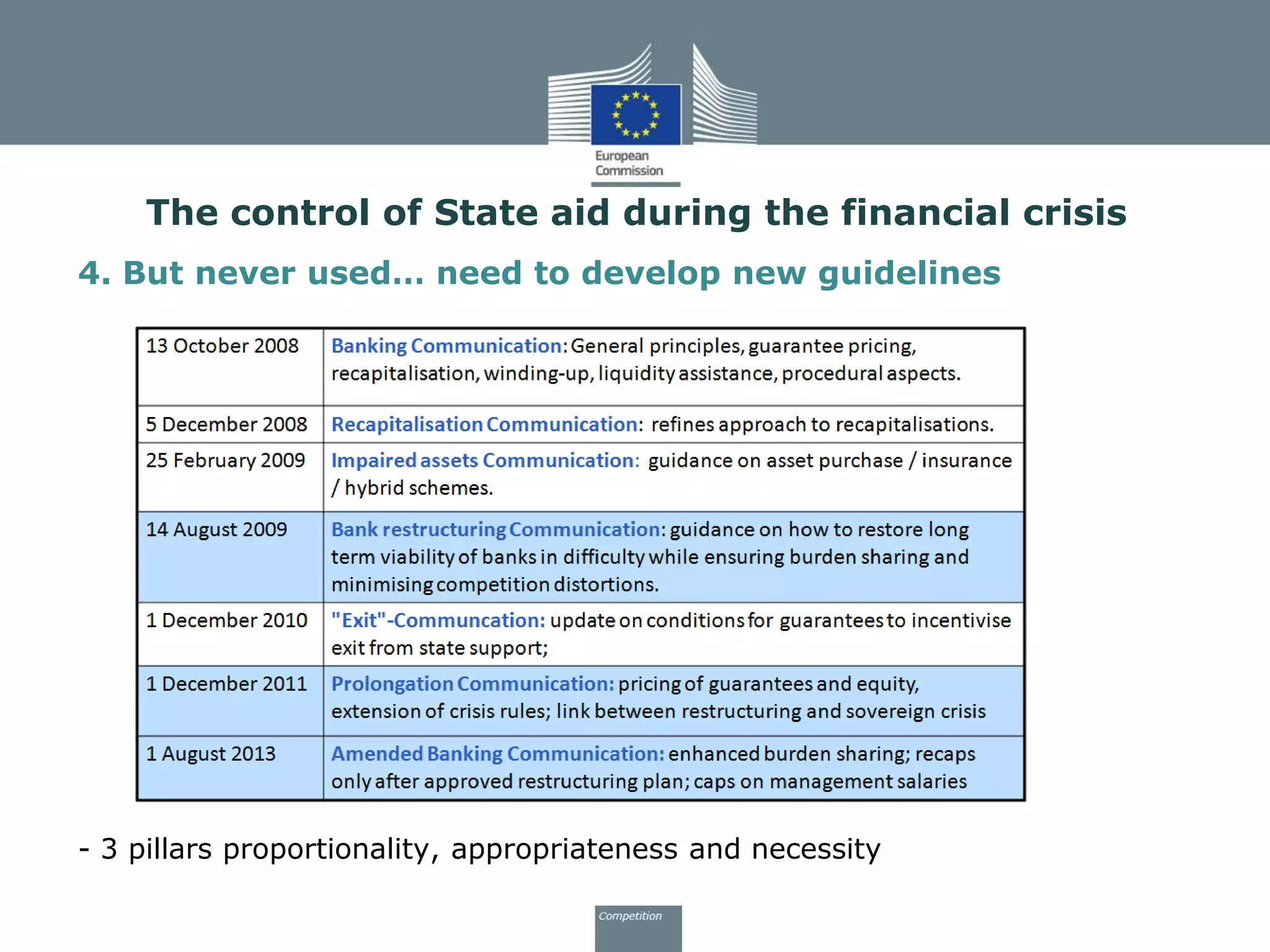

This document summarizes the key points of a presentation on the new European framework for bank resolution cases established by the Bank Recovery and Resolution Directive (BRRD). It discusses the financial crisis and state aid rules, the goals and principles of the BRRD in establishing a single rulebook and resolution mechanism, and upcoming challenges in implementing the new framework, including using the bail-in tool and ensuring adequate loss-absorbing capacity.

![3. Principles of the BRRD art 34(1)

- Shareholders bear first losses;

- Creditors bear losses in order of priority of their claims under normal

insolvency proceedings (NCWOP);

- Management to be replaced (unless needed for resolution);

- Management to assist in resolution;

- Those responsible for bank’s failure made liable;

- Creditors of same class treated equitably;

- No creditor worse off [than under insolvency] principle’;

- Covered deposits are fully protected;

- Resolution action taken in accordance with BRRD’s safeguards.

A new comprehensive framework: the BRRD](https://image.slidesharecdn.com/d21050pierre-arnaudproux-150929121446-lva1-app6892/75/A-new-European-framework-for-resolution-cases-the-BRRD-12-2048.jpg)