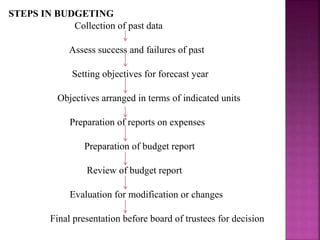

The document discusses budgeting and the budgeting process. It defines a budget as an estimation of future needs and expenditures for a given period of time. It outlines the key steps in developing a budget, including collecting past data, setting objectives, estimating income and expenditures, reviewing the budget, and getting final approval. Effective budgeting provides targets, facilitates coordination, and aids in planning and control. The roles and responsibilities of administrators in budgeting are also reviewed.