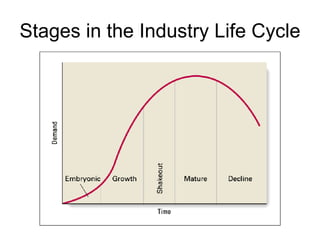

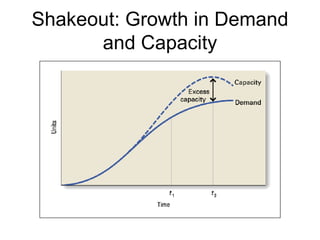

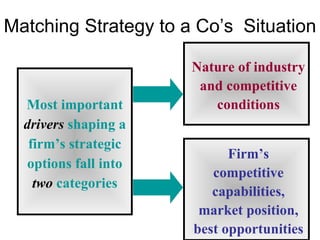

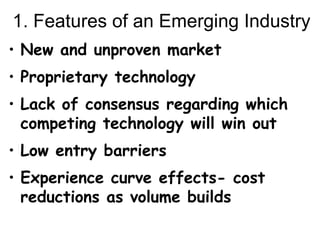

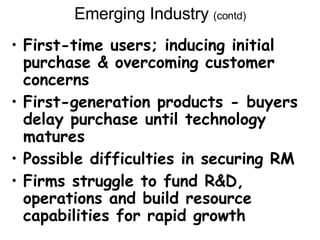

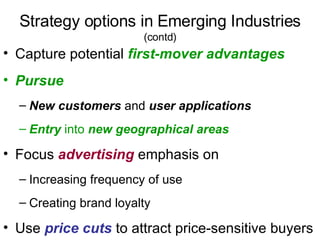

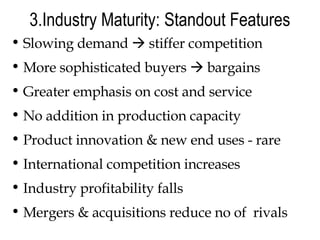

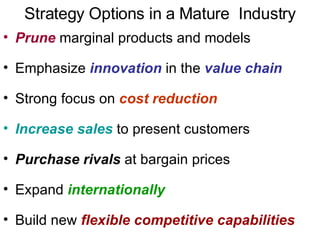

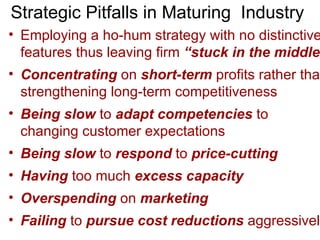

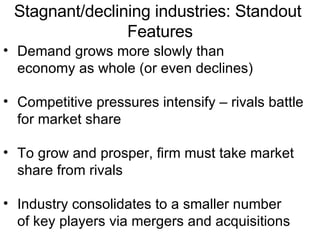

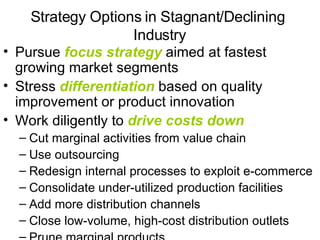

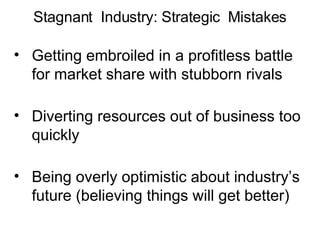

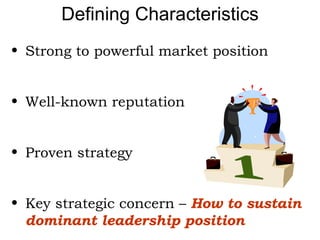

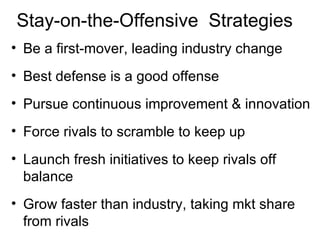

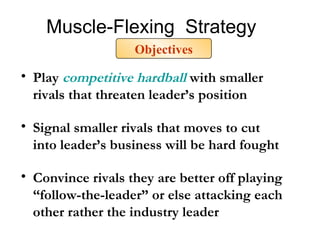

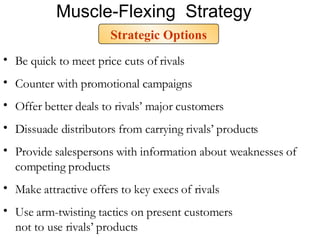

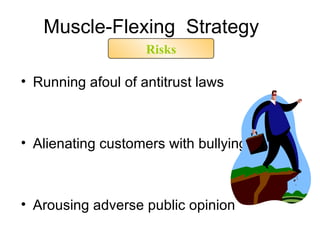

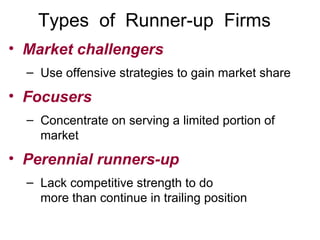

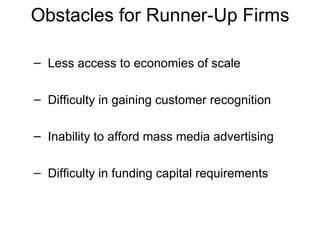

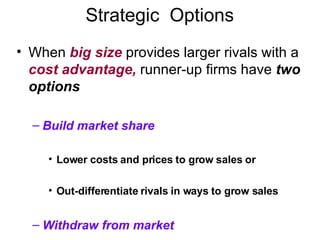

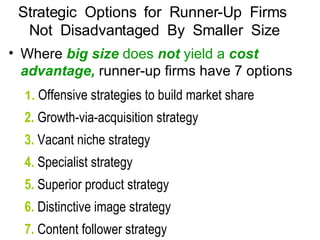

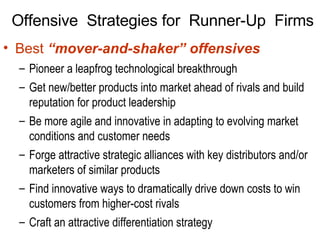

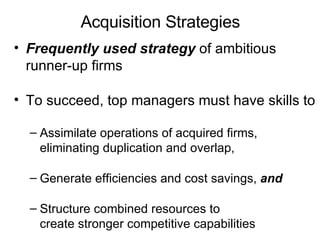

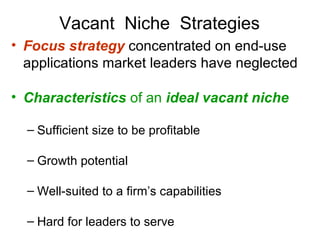

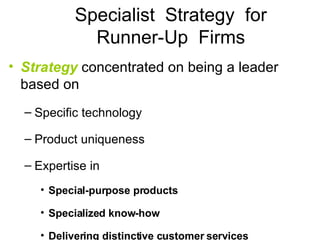

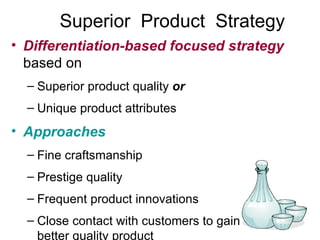

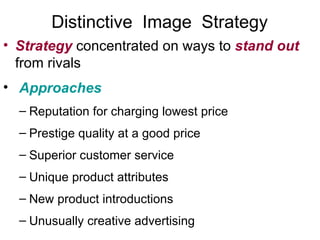

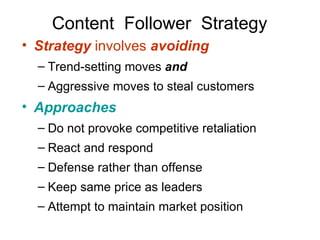

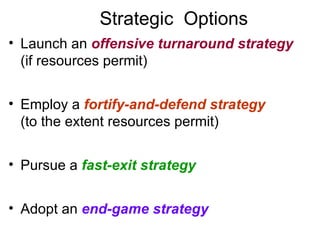

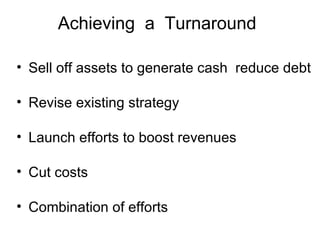

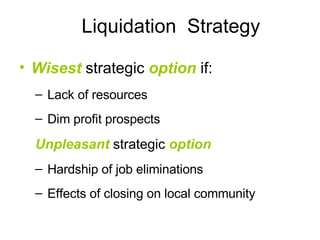

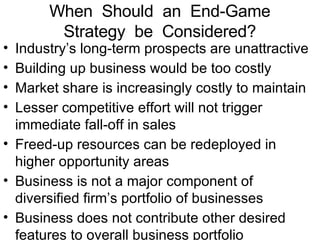

The document discusses strategies for different types of companies based on their industry and market position. It describes strategies for industry leaders to sustain their position, strategies for runner-up companies to build market share or lower costs, and strategies for weak companies in declining industries to focus on growth segments or product differentiation. The key factors discussed are the life cycle stage of the industry, the competitive dynamics, and a company's capabilities and market position.