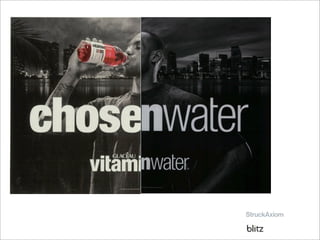

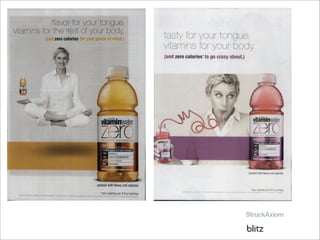

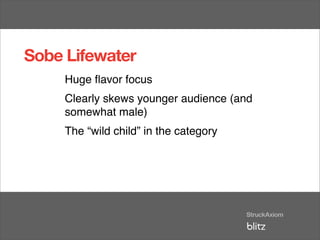

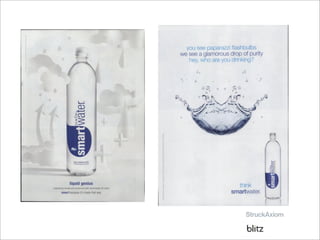

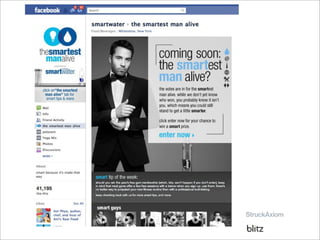

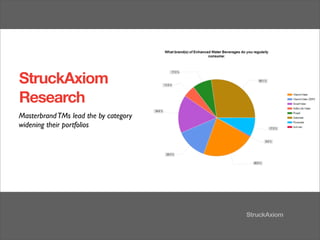

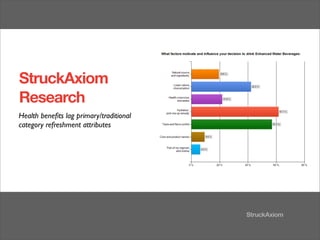

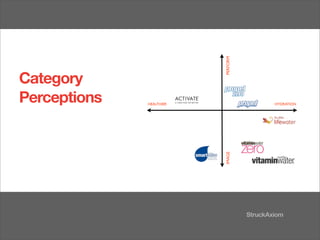

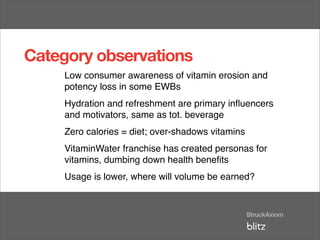

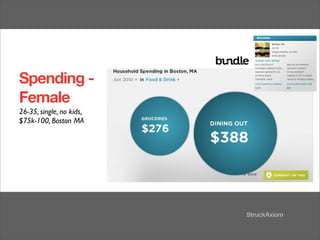

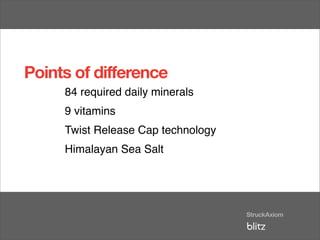

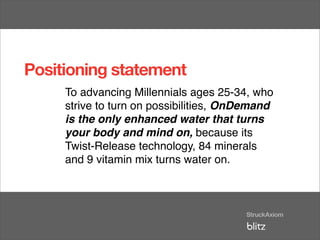

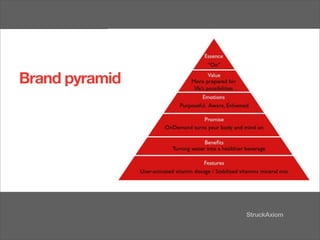

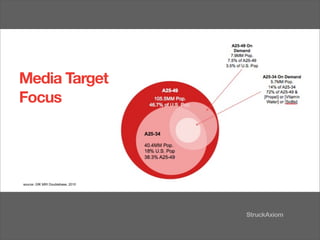

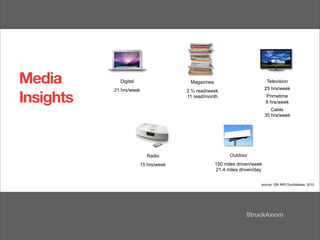

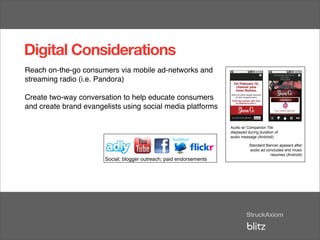

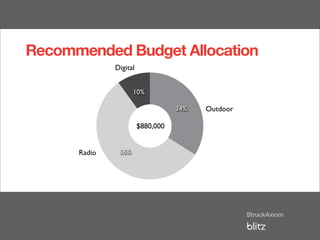

This document provides an overview and agenda for presenting OnDemand, an enhanced water beverage, to casual to heavy users of the category. The presentation will explore the competitive landscape, target consumer, brand positioning, and creative and media implications. Research on category perceptions, spending habits, and media usage of the target millennial consumer will inform the brand and positioning statement. A mix of digital, radio, and outdoor advertising is recommended to build brand recognition and drive trial among 25-34 year olds seeking healthier lifestyles.