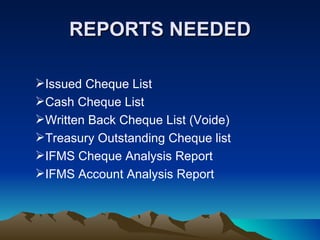

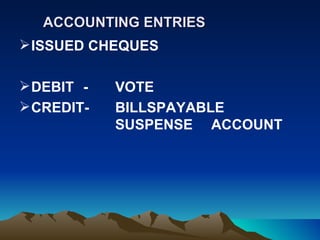

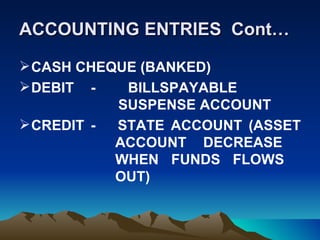

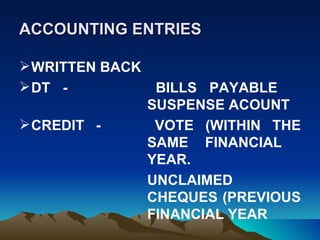

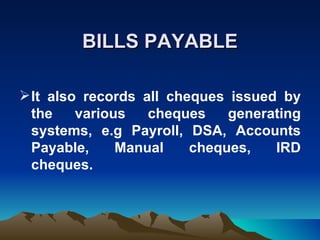

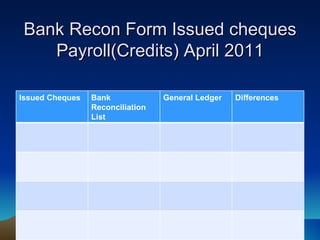

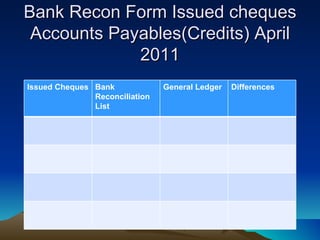

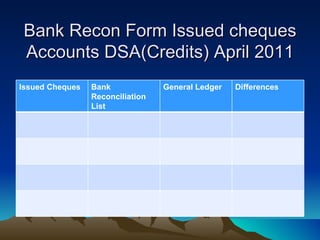

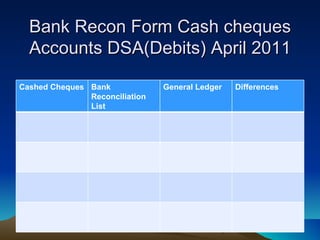

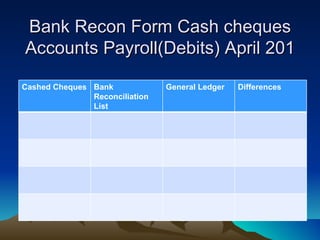

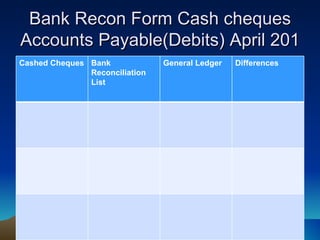

This workshop outlines how to reconcile bills payable suspense accounts. It discusses the reports needed to reconcile, including issued cheque lists and cash cheque lists. The workshop will cover accounting entries for issued and cashed cheques, as well as written back cheques. Each ministry will have a chance to reconcile their own accounts and identify any errors. The goal is to ensure the general ledger balance matches the outstanding cheque balance.