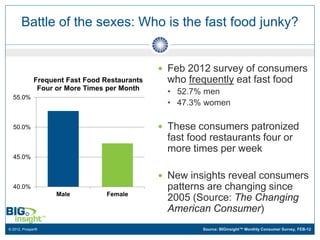

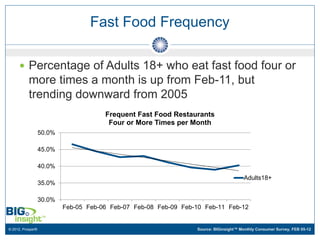

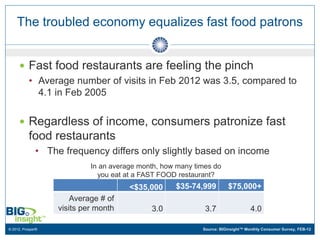

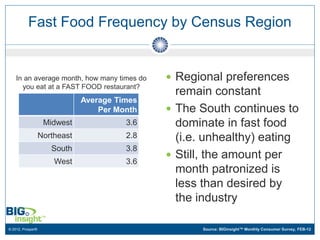

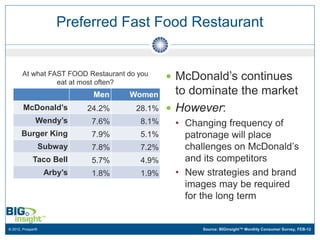

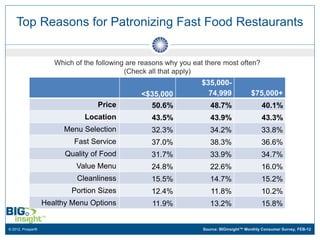

This document discusses a consumer survey on fast food trends. It finds that while the percentage of adults eating fast food four or more times a month is decreasing from 2005 levels, fast food remains popular due to low prices and convenience. McDonald's continues to be the most frequented chain but changing consumption patterns may challenge fast food companies. Reasons for patronage focus more on price and speed than food quality or healthfulness.