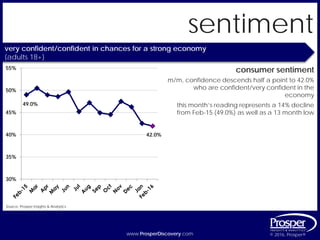

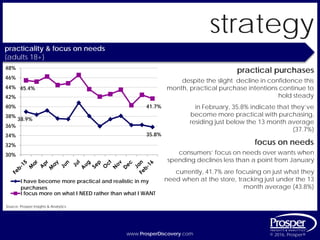

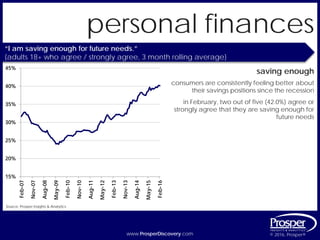

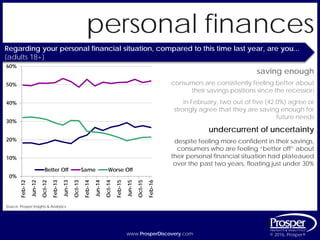

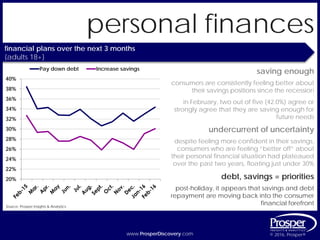

Consumer confidence declined slightly in February according to a survey by Prosper Insights & Analytics. The percentage of adults who are confident or very confident in the economy fell to 42.0%, down from 49.0% in February 2015. While consumers feel more positive about their savings than following the recession, the percentage who feel better off financially has plateaued just under 30% recently. In February, consumers indicated that paying down debt and increasing savings would be priorities over the next three months.