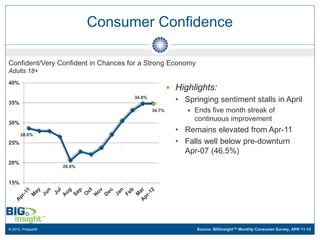

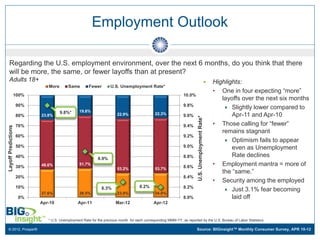

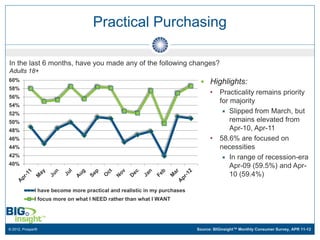

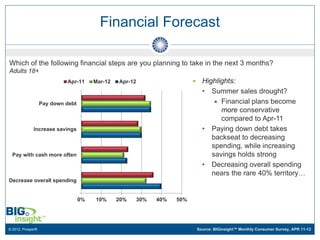

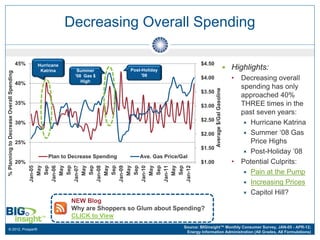

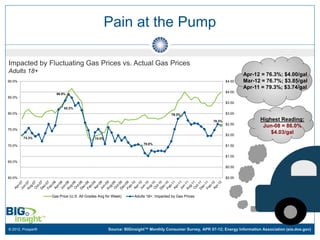

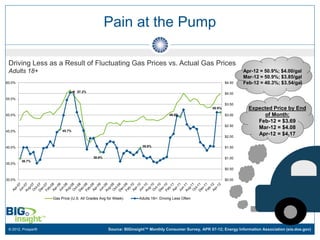

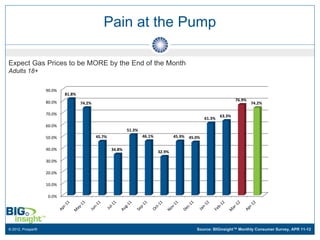

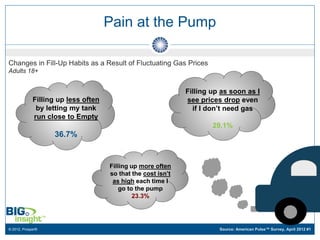

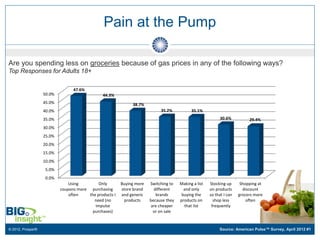

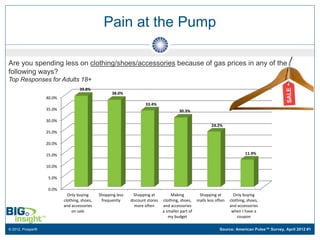

The document summarizes results from a consumer survey conducted in April 2012. It finds that consumer confidence stalled after improving for five months, employment outlook remains stagnant with over half expecting the same number of layoffs, and practical purchasing remains a priority for most consumers who are focusing on necessities over wants.