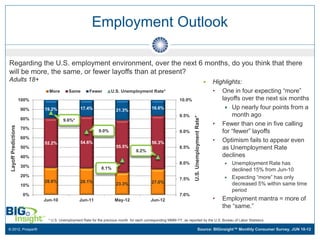

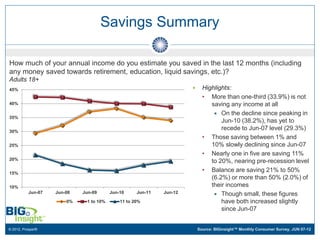

The document summarizes the results of a June 2012 consumer survey. It finds that consumer confidence in the economy is at its lowest level since 2007. One in four adults expect more layoffs over the next six months, despite declining unemployment rates. Less than one in five expect fewer layoffs. Over a third of adults did not save any of their annual income in the last year. Those saving small amounts are declining since 2007 levels.