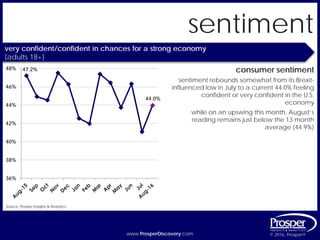

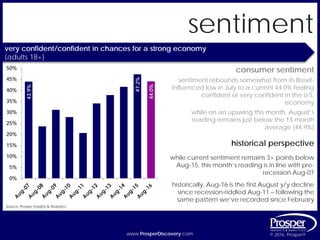

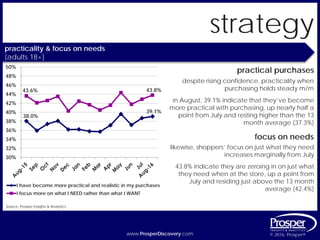

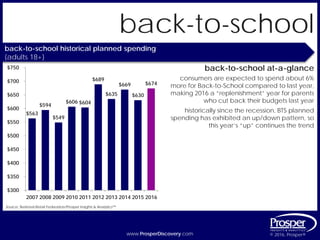

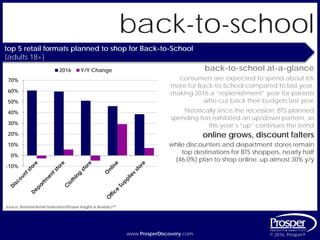

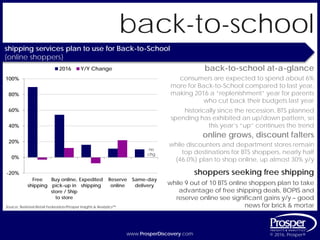

Consumer sentiment rebounded in August from its Brexit-influenced low in July, with 44.0% of Americans feeling confident in the economy. While an improvement over July, sentiment remains below its 13-month average. Practicality in purchases and focus on needs increased marginally in August compared to July. Consumers are expected to spend 6% more on back-to-school shopping this year compared to last, making it a "replenishment" year. Nearly half of shoppers plan to shop online, a nearly 30% increase year-over-year, while discount stores remain popular destinations.