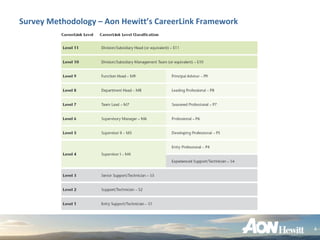

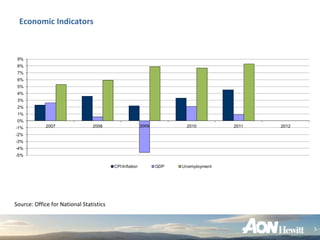

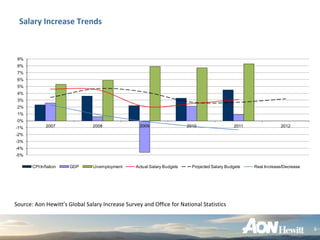

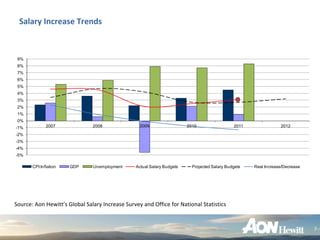

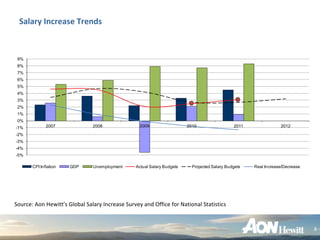

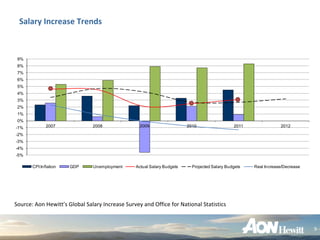

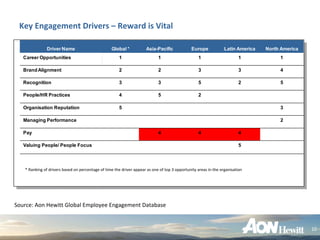

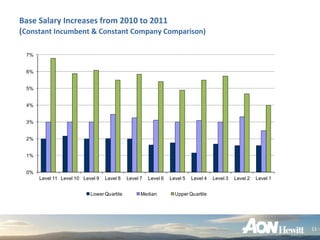

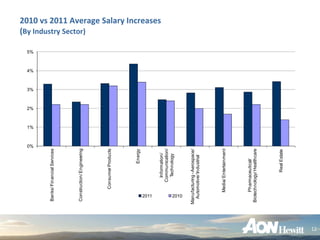

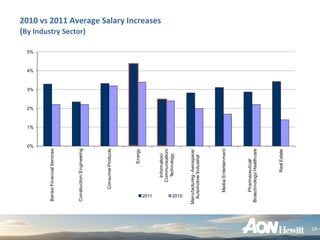

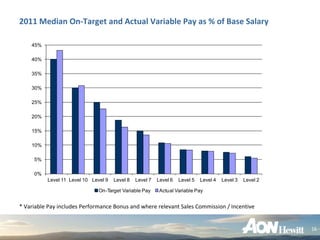

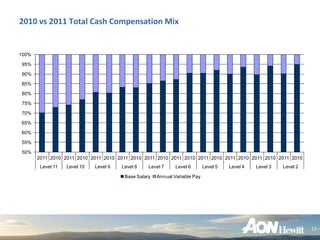

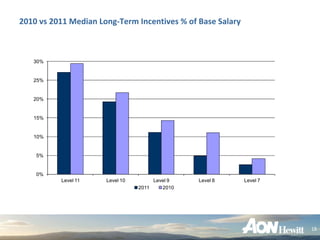

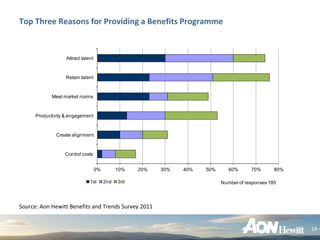

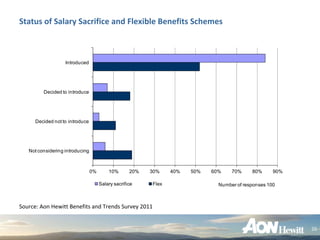

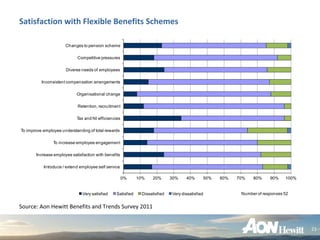

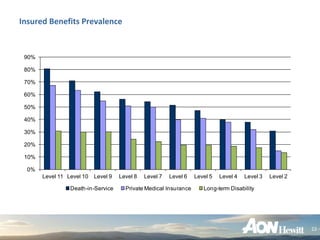

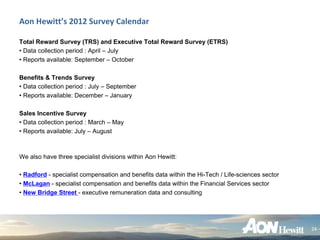

This document summarizes a presentation by Aon Hewitt on employee remuneration trends in 2011/12. It discusses Aon Hewitt's survey methodology, key economic indicators, salary increase budgets and trends across different levels and industries. It also covers bonus awards, long-term incentives, employee benefits, and the 2012 reward outlook. Slides include data on salary increases, total cash compensation mixes, long-term incentive prevalence, benefits programs, and Aon Hewitt's 2012 survey calendar.