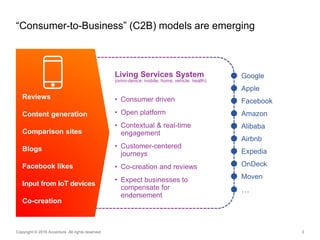

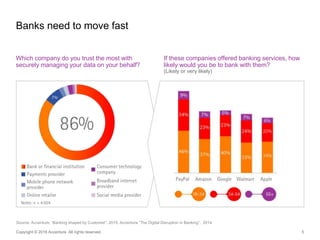

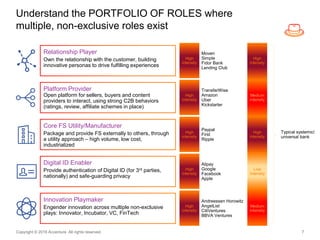

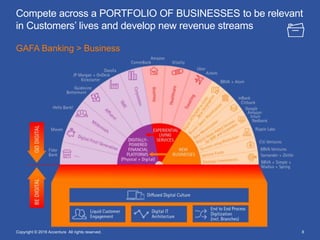

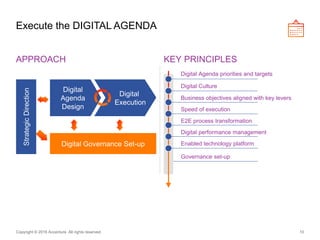

The document discusses the consumer-to-business (C2B) revolution led by major tech companies like Google, Apple, Facebook, and Amazon, emphasizing the need for businesses to adapt to the evolving consumer agenda. It highlights the importance of digital transformation in banking, calling for banks to establish strategic directions and efficiently execute digital agendas while engaging customers through innovative services. Additionally, it underscores the competitive landscape where banks must leverage technology to offer personalized financial propositions and maintain relevance in customers' lives.