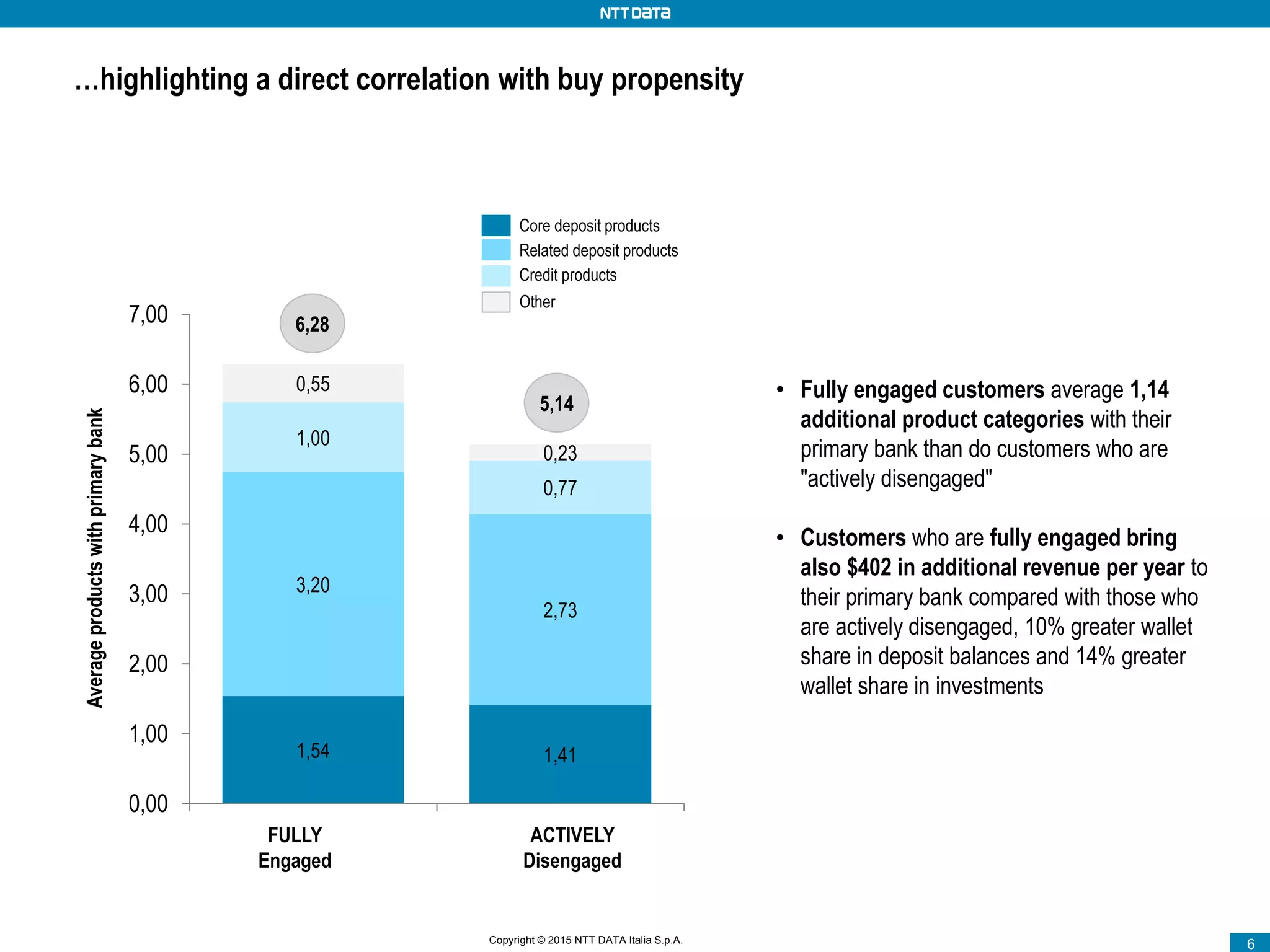

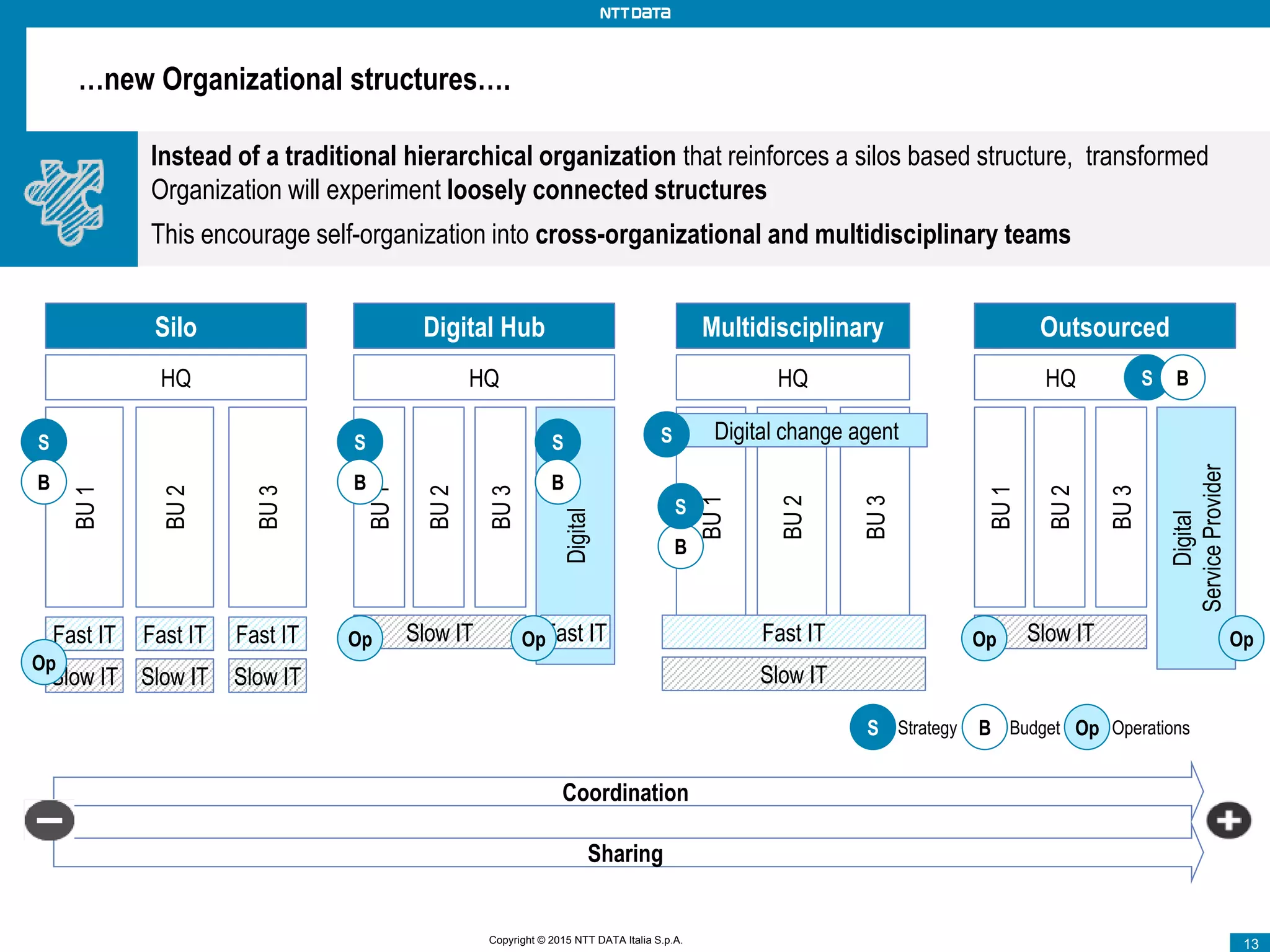

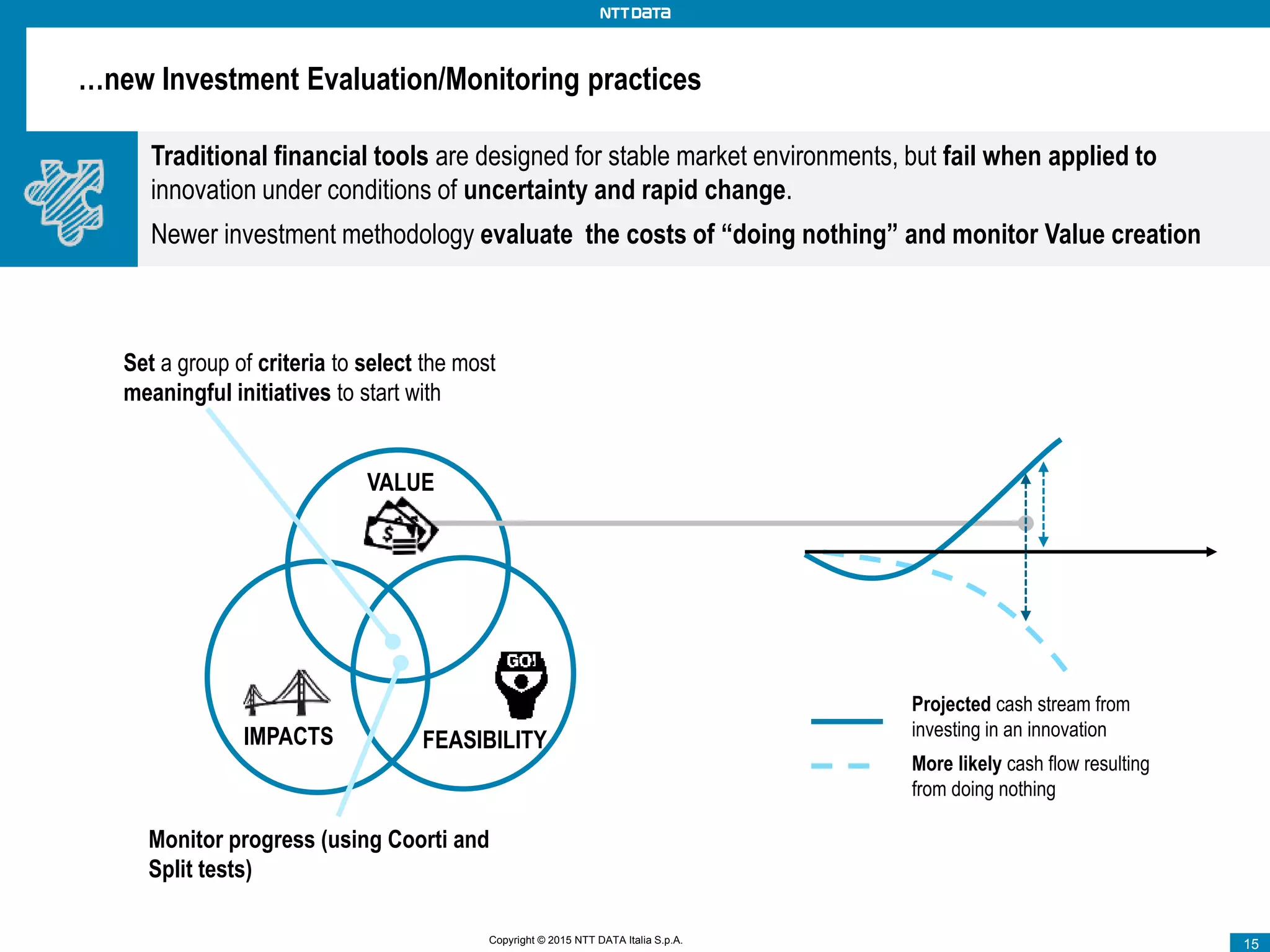

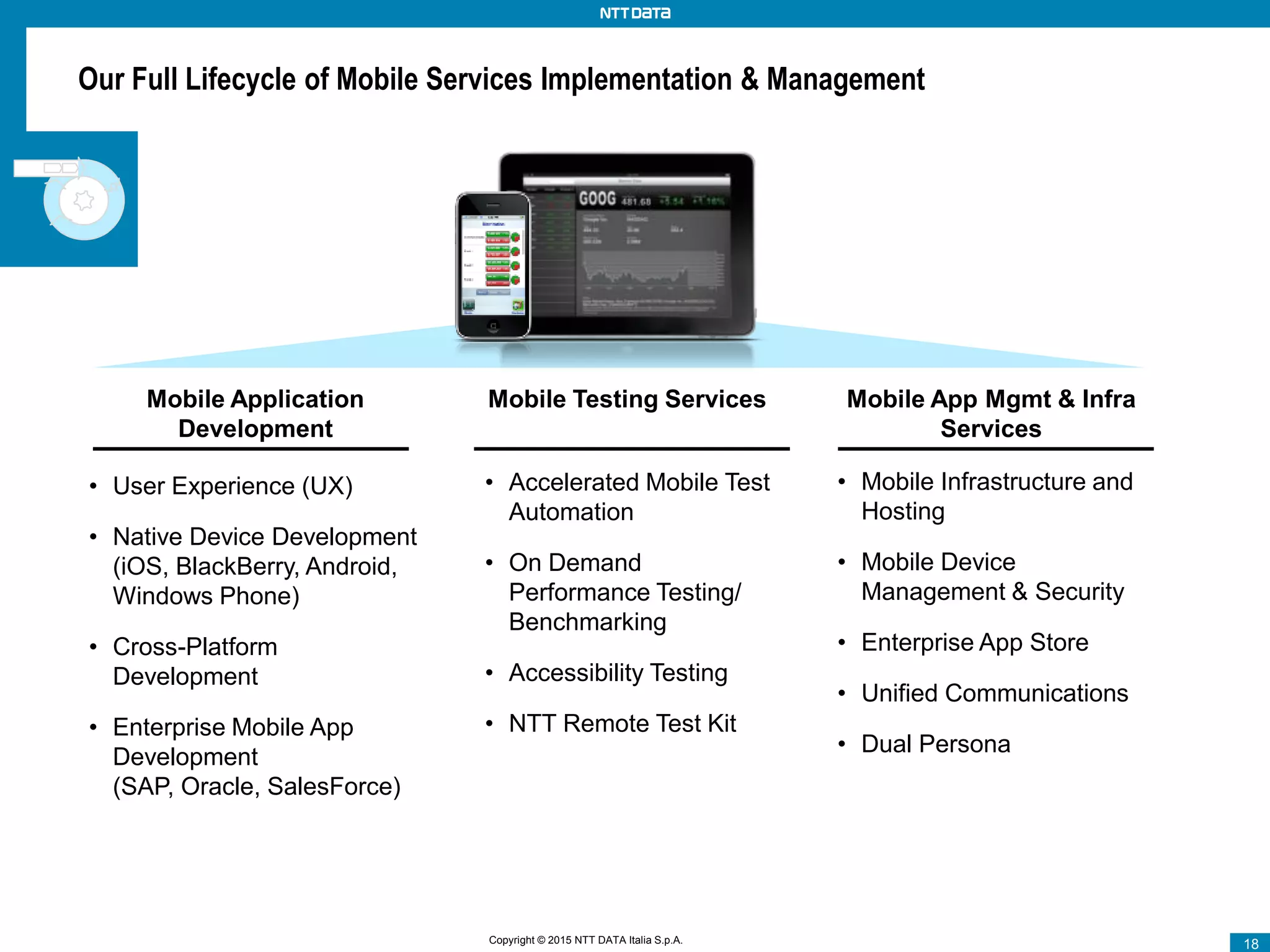

The document discusses how banks can reshape themselves around pervasive service design and embrace mobile technology. It notes that customer behaviors have changed, with customers wanting constant connectivity, customization, and freedom of choice. New technology trends are enabling greater adoption of mobile channels. The document outlines how banks can leverage their assets like technology investments and customer data to expand their footprint across the entire customer journey. This requires new operating models, organizational structures, partnership models, and service creation processes. A case study of Hello Bank is presented as an example of a digital-focused bank.