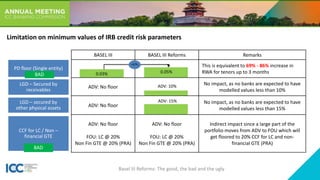

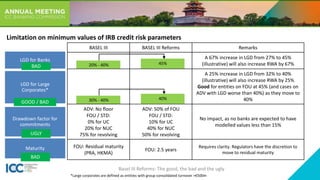

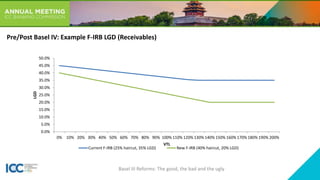

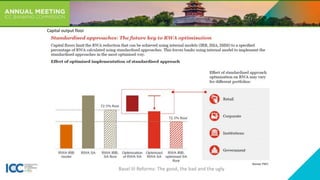

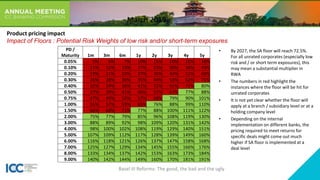

The document discusses the Basel III reforms aimed at reducing the variability of risk-weighted assets (RWAs) across banks, introducing changes in credit and operational risk approaches. Key changes include updated risk weights, liquidity ratios, and the introduction of capital output floors, which will gradually increase to 72.5% by 2027. The reforms may significantly impact the pricing and capital requirements for banks, especially concerning unrated corporates and short-term exposures.

![“A key objective of the revisions in this [Basel III: Finalising post-crisis

reforms] document is to reduce excessive variability of risk-weighted

assets (RWAs).”

Basel Committee on Banking Supervision1

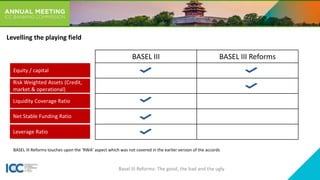

Levelling the playing field

Accord seeks to reduce variability in RWA treatments across banks

1. BCBS, Basel III: Finalising post-crisis reforms, December 2017, Bank for International Settlements

Basel III Reforms: The good, the bad and the ugly](https://image.slidesharecdn.com/14h00baseliiireforms-goodbadanduglyv4-krishnanramadurai-190429174615/85/BCMeeting2019-Basel-III-Reforms-3-320.jpg)