This document provides an overview of the Basel III regulatory framework including its objectives, key elements, and implications. The main points are:

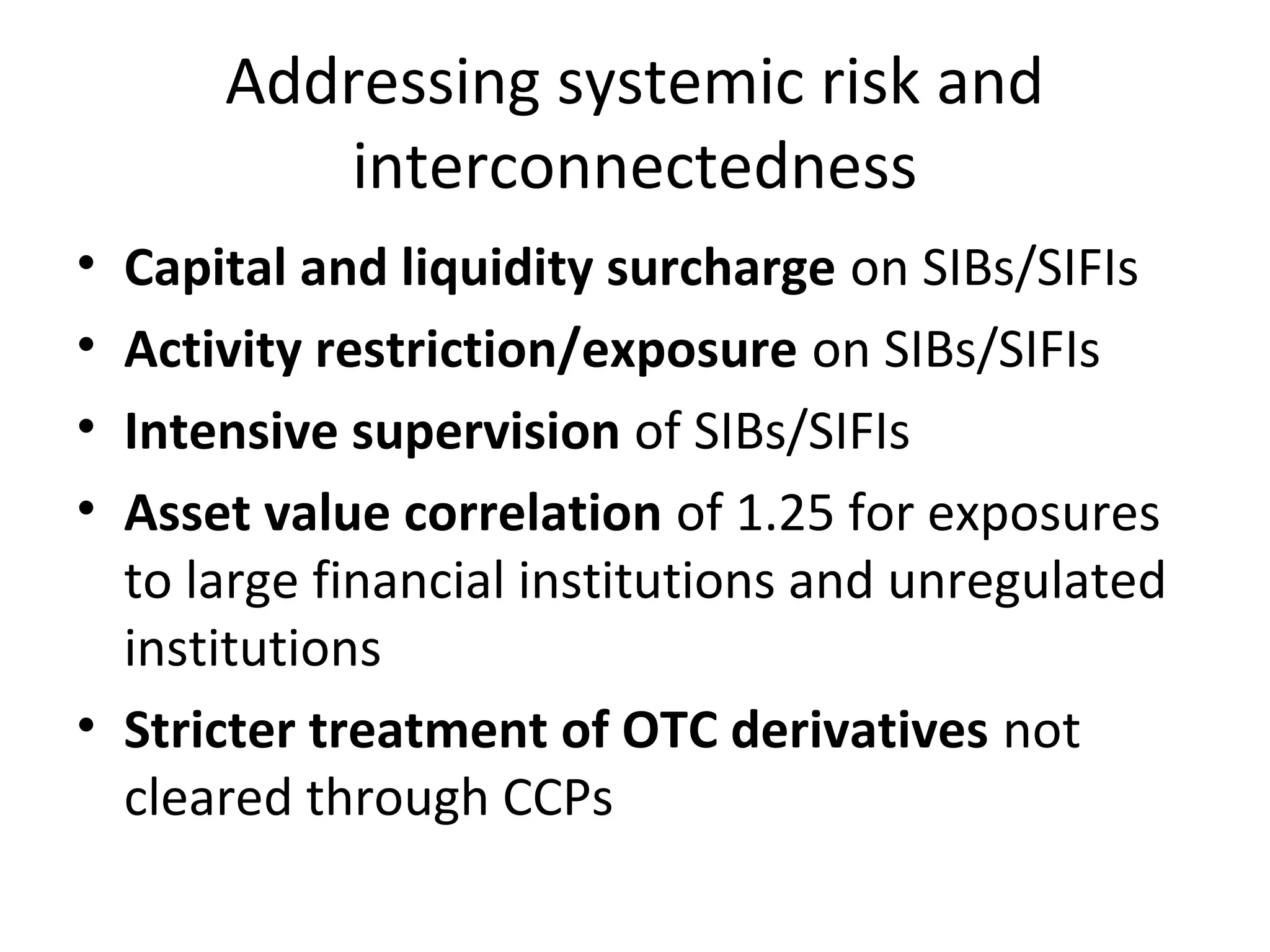

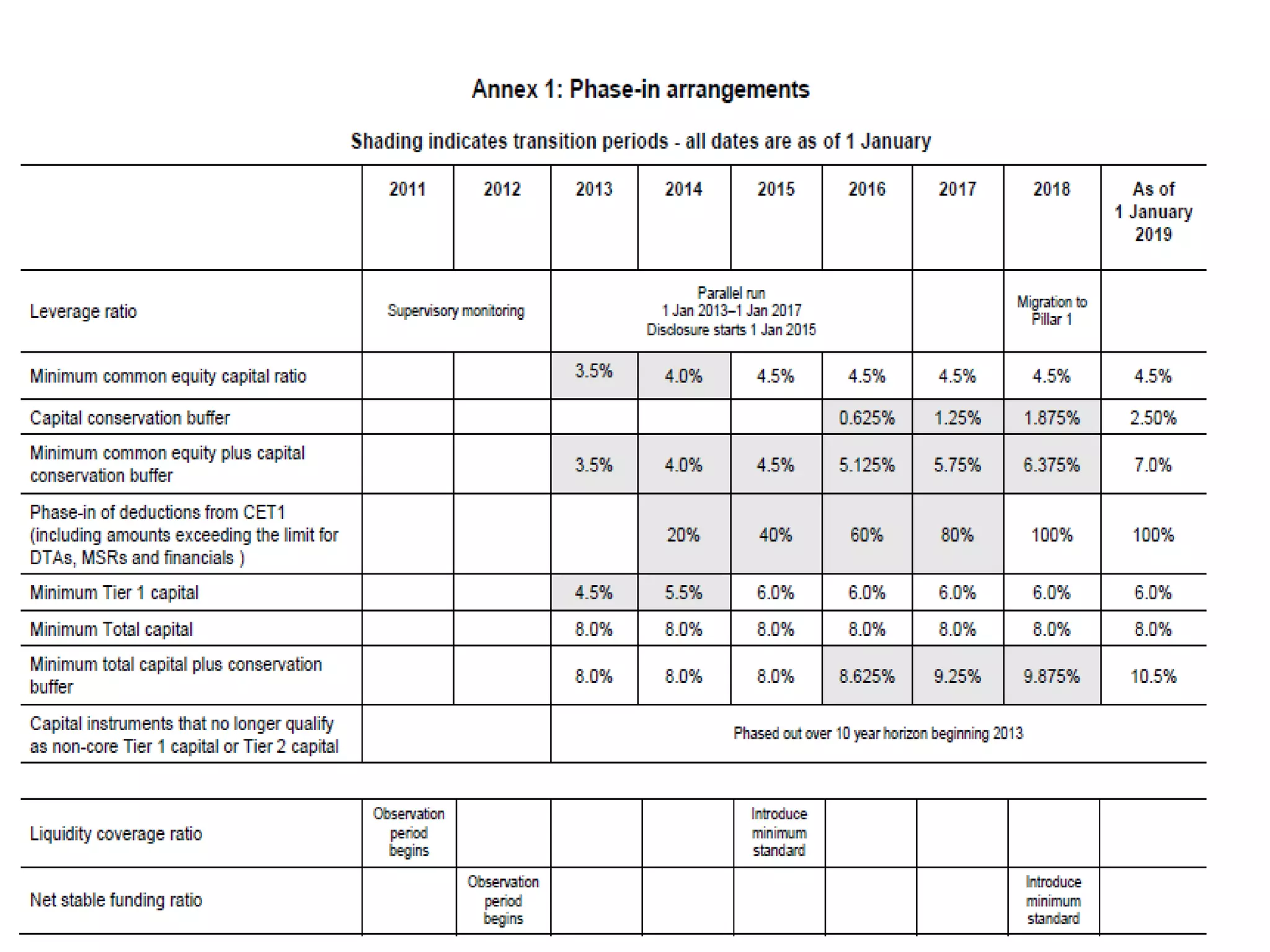

1) Basel III aims to strengthen bank capital requirements and introduce new regulatory standards on bank liquidity and leverage. It seeks to improve banks' ability to absorb shocks and reduce risk spillovers.

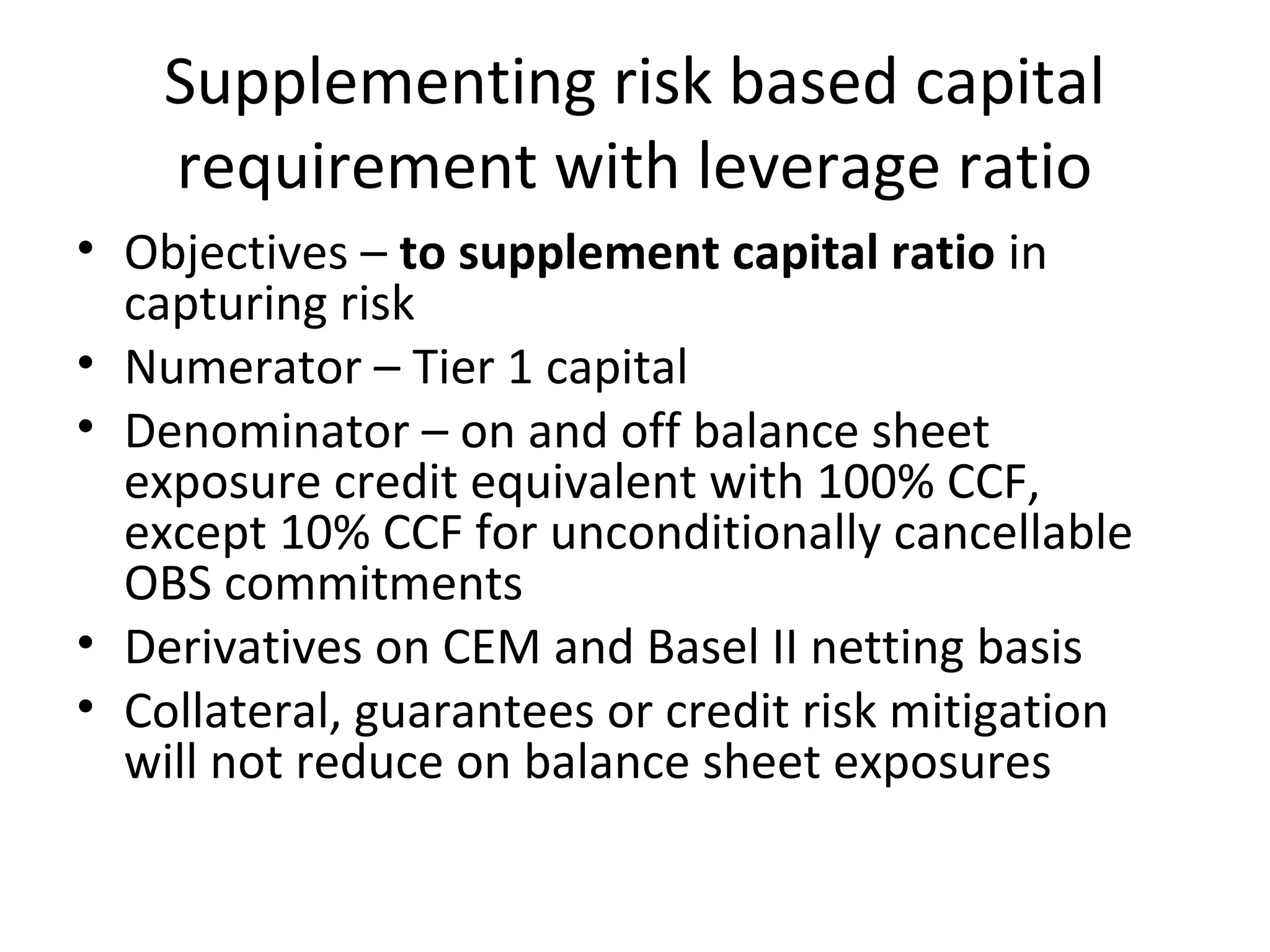

2) Key elements of Basel III include higher and better quality capital requirements, a supplementary leverage ratio, additional capital charges for counterparty credit risk, and two mandatory liquidity ratios.

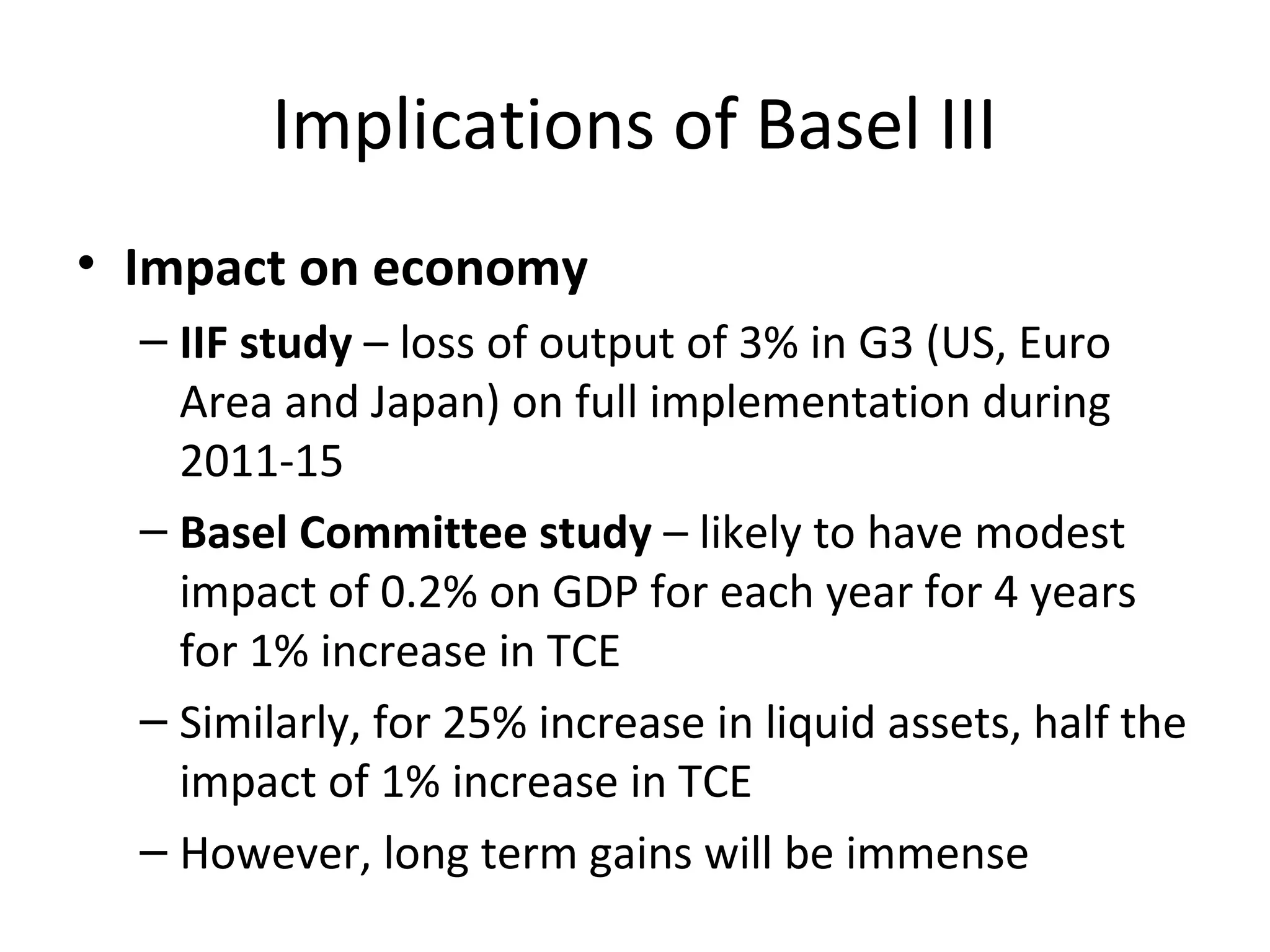

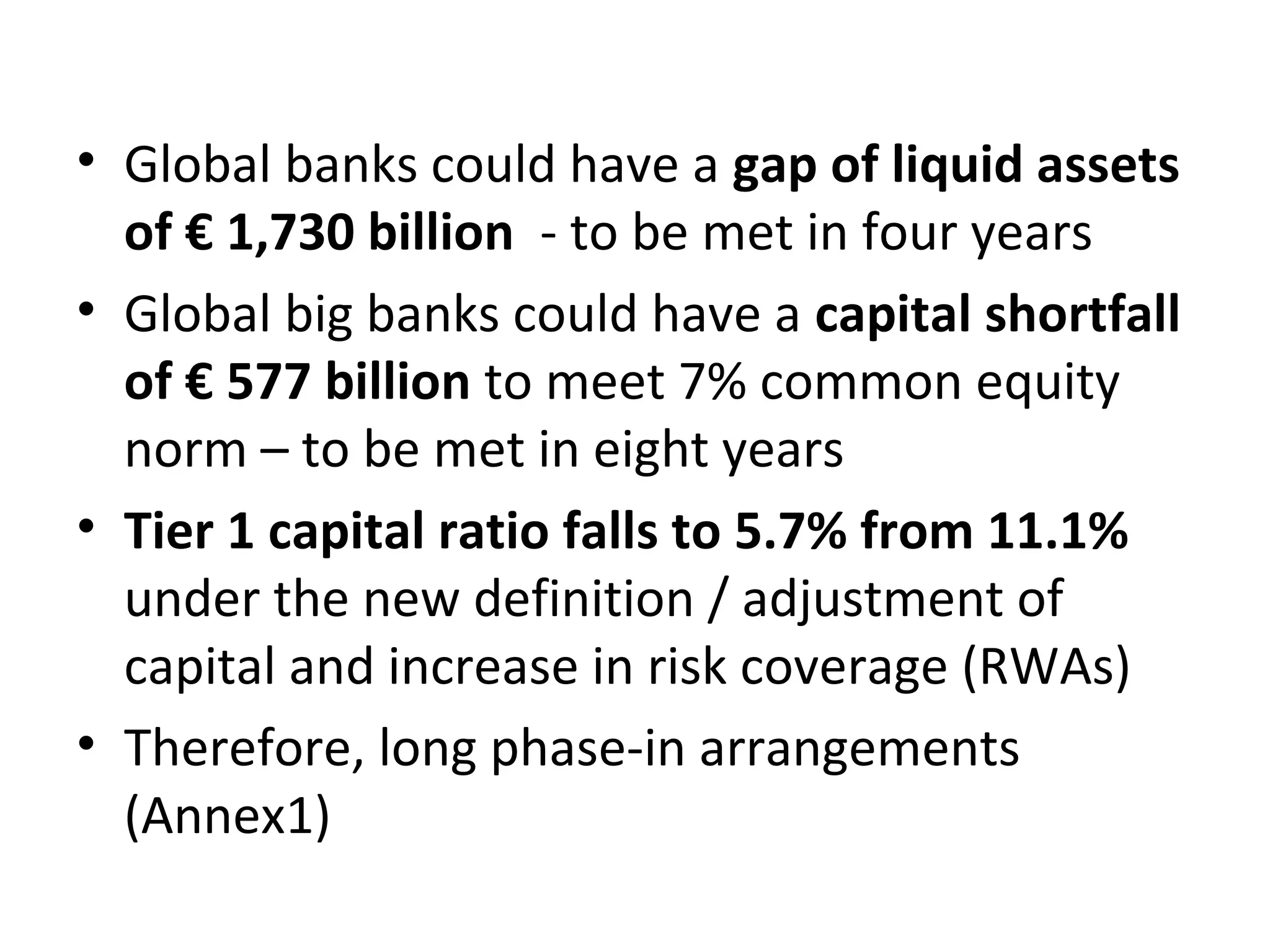

3) Implementation of Basel III is expected to narrow the capital shortfall of global banks but may reduce GDP growth slightly. Indian banks currently have high capital levels but some may face challenges meeting new