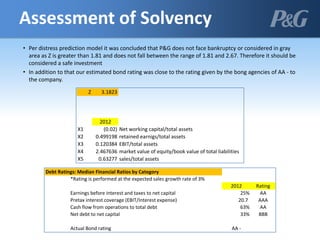

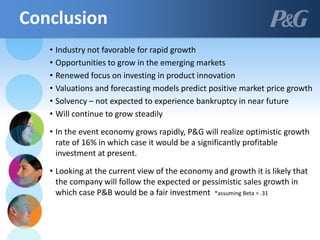

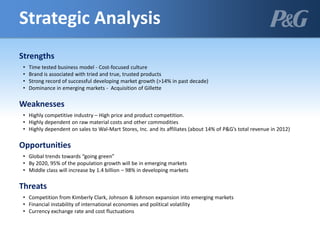

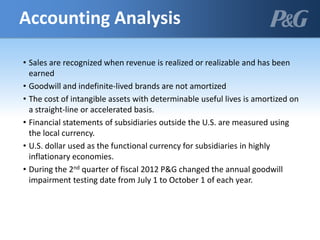

The team performed a strategic, financial, and valuation analysis of Procter & Gamble to make an investment recommendation. P&G has a long history and is a global leader in consumer goods with 300 brands. The analysis found strengths in P&G's business model and emerging market growth, but also weaknesses in high competition and commodity costs. Valuation models estimated the stock price could grow moderately assuming the economy improves slowly. The analysis concluded P&G is unlikely to face bankruptcy and would be a fair investment assuming moderate sales growth, recommending investors proceed.

![Projected Company Data Using Historical Earnings Growth Rate

Year EPS DPS

Current $4.41 2.05 5.35 Earnings after 10 years

Year 1 4.50 2.09 24.83 Sum of dividends paid over 10 years

Year 2 4.58 2.13

Year 3 4.67 2.17 $96.45 Projected price (Average P/E * EPS)

Year 4 4.76 2.21 $121.27 Total gain (Projected Price + Dividends)

Year 5 4.86 2.25

Year 6 4.95 2.30 4.1% Projected return using historical EPS growth rate

Year 7 5.05 2.34 [(Total Gain / Current Price) ^ (1/10)] - 1

Year 8 5.15 2.39

Year 9 5.25 2.43

Year 10 5.35 2.48

Projected Company Data Using Sustainable Growth Rate

Year BVPS EPS DPS

Current $23.99 3.77 1.75 8.46 Earnings after 10 years (BVPS * ROE)

Year 1 26.01 4.08 1.89 29.74 Sum of dividends paid over 10 years

Year 2 28.20 4.43 2.05

Year 3 30.58 4.80 2.23 $152.45 Projected price (Average P/E * EPS)

Year 4 33.15 5.21 2.41 $182.19 Total gain (Projected Price + Dividends)

Year 5 35.94 5.64 2.62

Year 6 38.97 6.12 2.84 8.4% Projected return using sustainable growth rate

Year 7 42.25 6.64 3.08 [(Total Gain / Current Price) ^ (1/10)] - 1

Year 8 45.81 7.19 3.34

Year 9 49.67 7.80 3.62

Year 10 53.85 8.46 3.92

Buffet Valuation](https://image.slidesharecdn.com/pgpresentation-130426173747-phpapp01/85/P-g-presentation-10-320.jpg)