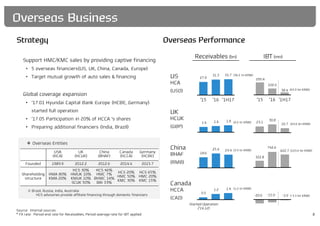

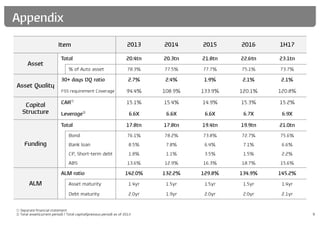

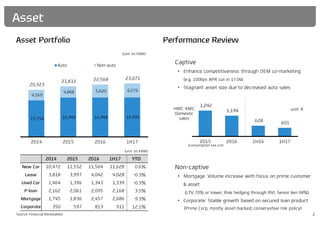

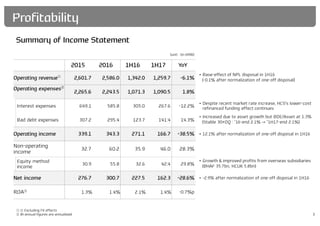

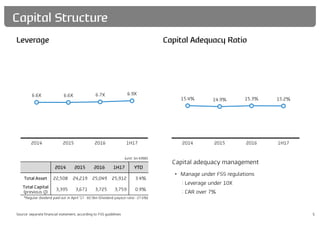

Hyundai Capital Services reported financial results for the first half of 2017. While total assets grew 3.4% to 25.9 trillion won, net income decreased 28.6% to 162.3 billion won due to one-time gains in the prior year period. Asset quality remained stable with the 30+ day delinquency ratio unchanged at 2.1% and the FSS requirement coverage ratio slightly decreased to 120.8%. Overseas subsidiaries continued growing, contributing 42.4 billion won in equity method income. Going forward, Hyundai Capital will focus on expanding its global operations and diversifying its funding sources.

![440 465 529 531

334 254 208 198

774 719 737 729

110.6%

124.0% 124.0%

120.8%

2014 2015 2016 1H17

Allowance Reserve FSS reruirement coverage

2.4%

1.9%

2.1% 2.1%

1.0%

0.7% 0.7% 0.7%

2014 2015 2016 1H17

30+ days DQ ratio New car 30+ days DQ ratio

②

4

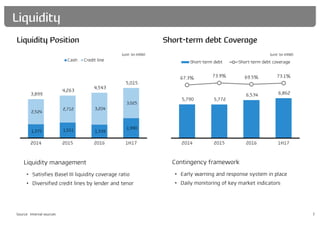

Delinquency Reserves

Asset Quality

① Assets written off at 7th time overdue → 8th time overdue

② (Allowance + Reserves) / FSS requirement

Asset quality management

• Reinforced U/W led to asset quality improvement

Reserve policy

• Max of expected loss, incurred loss or FSS requirement

• [1H17] Slight decease of FSS requirement coverage

- Reinforced FSS required allowance amount

①

(unit: bn KRW)](https://image.slidesharecdn.com/hcse-170920003631/85/Hcs-e-5-320.jpg)

![53.5%

22.1%

9.6%

6.0%

6.6%

2.2%

Domestic Bond Overseas Bond Domestic ABS

Overseas ABS Bank Loan CP & ST debt

1.9yr 2.0yr 2.0yr

2.1yr

132.2% 129.8%

134.9%

145.2%

2014 2015 2016 1H17

Debt maturity ALM ratio

21.0tn

KRW

6

Funding Position Maturity

Funding

Source: Internal sources

Portfolio diversification

• Stable portfolio through product, maturity, currency

diversification

• [1H17]Overseas Bond: USD 600mn, AUD 400mn, EUR 400mn

Funding guidelines

• By product: ABS <20%, Short-term funding <10%

• ALM ratio: 100% or higher](https://image.slidesharecdn.com/hcse-170920003631/85/Hcs-e-7-320.jpg)