This document provides an overview of treasury management in banks. It discusses key topics such as:

- The role and objectives of the treasury department in managing a bank's funds, liquidity, investments, and risks.

- The organizational structure of treasury operations including the front, middle, and back offices.

- The functions performed by the treasury such as cash forecasting, investment management, risk management, and relations with stakeholders.

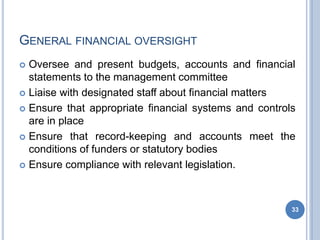

- The responsibilities of the treasurer in overseeing the financial activities and ensuring compliance.

- The importance of risk management in mitigating liquidity, price, counterparty, and other risks arising from treasury transactions.